Updates to Products Subject To California’s Bottle Bill

On October 13, 2023, Governor Gavin Newsom signed California Senate Bill 353, which made a significant change to products that will be subject to the California Beverage Container Recycling and Litter Reduction Act (known as the Bottle Bill).

Now, only products filled and labeled after January 1, 2024 will be subject to the CRV labeling requirements of the Bottle Bill. Any products (whether domestic or imported) that were filled and labeled prior to that time will be exempt. This legislative fix did not make any changes to the change the reporting or payment requirements of the Bottle Bill.

Please see below for a full summary of the Bottle Bill and contact DP&F with any questions.

With the passage of Senate Bill No. 1013, beginning on January 1, 2024, wine and spirits will be included in California’s state container deposit system established by the California Beverage Container Recycling and Litter Reduction Act (known as the “Bottle Bill”). As such, wineries and distilleries will now be required to comply with the Bottle Bill’s CA Redemption Value (CRV) payment and reporting obligations beginning January 1, 2024, and CRV labeling requirements for all wine and spirits filled and labeled after January 1, 2024 and sold after July 1, 2025. Beer and certain other non-alcoholic beverages were already previously covered by the Bottle Bill.

Importantly, because all wines and spirits (that were not filled and labeled after January 1, 2024) sold in California after July 1, 2025 must be labeled with some type of approved CRV statement, producers should start including this information on their bottles and/or labels as soon as possible for all products to be offered for sale on or after January 1, 2025.

Below we have included a brief summary of the rules applicable to wines and spirits under Bottle Bill, the new registration and payment obligations, and labeling changes required to comply with the new laws.

TYPES OF BEVERAGES:

The Bottle Bill applies to beer, malt beverages, wine, spirits, wine and spirit coolers (regardless of ABV), and certain other non-alcoholic beverages intended for sale in California. Section 14504 and 14560.

CA REDEMPTION VALUES (CRV): Section 14560

- For bottles smaller than 750 mL (less than 24 fluid ounces), the CRV is 5 cents/bottle.

- For bottles 750 mL or larger (24 fluid ounces or more), the CRV is 10 cents/bottle.

- For boxes, bladders, pouches, or similar containers (regardless of size), the CRV is 25 cents/container.

REGISTRATION & PAYMENT OBLIGATIONS BEGINNING JANUARY 1, 2024:

- All wineries and distilleries should register with CalRecycle as soon as possible to prepare for payment and reporting requirements beginning 1/1/2024 (information regarding registration can be found here).

- All producers and importers of wine and distilled spirits should register as a Beverage Manufacturer. Brand owners that contract with producers for the manufacture of wine or distilled spirits are not considered Beverage Manufacturers.

- Any wineries and distilleries that sell wine or spirits in California Direct to Consumer or Direct to a Retailer (for wine) should also register as a Distributor.

2. Report and pay the applicable CRV to CalRecycle.

- CRV is due and payable for every beverage container (other than a refillable beverage container) sold or transferred to a dealer or consumer in CA. There is an exception for products served in a tasting rooms, discussed below. 1.5% holdback for administrative fee is permitted.

- Report due last day of month following the month of sales, even if no sales or transfers. First report for January 2024 is February 29, 2024.

- The winery or distillery may pass on the CRV cost to consumers (as the consumers can return the bottles to a recycling center for the redemption). Section 14560

3. Report and pay the applicable Processing Fee.

- The processing fee is paid on all containers a winery or distillery sells or transfers in CA, whether to wholesalers, retailers, or consumers. Section 14575(g)

- Report and payment due 10th day of 2nd month following the month of sales, even if no sales or transfers. First report and payment for January 2024 is due March 10, 2024.

- The processing fee is variable depending on container material (size does not matter) and changes each calendar year, but is currently 0.452 cents/glass bottle. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

LABELING OBLIGATIONS FOR ALL WINES AND SPIRITS SOLD AFTER JULY 1, 2025:

- All wines and distilled spirits containers sold in California that were filled and labeled before January 1, 2024 are exempt from and not subject to the labeling requirements of the Bottle Bill. No new labels or statements will have to be added to these products.

- All wines and distilled spirits containers sold in California after July 1, 2025 (except those containers filled and labeled before January 1, 2024) must be labeled with: “CA Redemption Value,” “California Redemption Value,” “CA Cash Refund,” “California Cash Refund,” or “CA CRV”.

- The CRV statement must be clearly, prominently, and indelibly marked and can be added on the actual label or by sticker (not on aluminum cans), stamp, embossment, or other similar method. Labeling size and location requirements are set forth below: CCR 2200(b).

- For glass and plastic, the CRV statement must be on the container body label or secondary label with:

- Option 1: Along the bottom edge of the container body label in minimum lettering size at least 3/16 inch in height.

- Option 2: On or in a secondary label minimum lettering size at least 3/16 inch in height.

- Option 3: On a container body label or secondary label with contrasting colors with legible lettering size at least 1/8 inch in height.

- For aluminum, the CRV statement must be on the top lid:

- for tops greater than 2 inches in diameter, the CRV statement must be 3/16” in height; and

- for tops 2 inches or less in diameter, the CRV statement must be 1/8” in height.

- Requirements for box, bladder, and pouch containers to be determined.

4. Senate Bill No. 1013 also revised Section 14561(d) of the Bottle Bill to allow for CRV labeling by the inclusion of a scan code or quick response (QR) code on the container. This new language is currently under review by CalRecycle.

EXCEPTION FOR TASTING ROOM SALES:

If any wines or spirits are sold for on-site consumption in a tasting room, then those products are exempt from the Bottle Bill’s requirements.

For more information regarding Bottle Bill compliance, please contact Bahaneh Hobel at [email protected] or Theresa Barton Cray at [email protected].

Effective January 1, 2024, CA Wineries and Distilleries Will Have Reporting and Payment Obligations to CalRecycle Under the Bottle Bill

With the passage of Senate Bill No. 1013, beginning on January 1, 2024, wine and spirits will be included in California’s state container deposit system established by the California Beverage Container Recycling and Litter Reduction Act (known as the “Bottle Bill”). As such, wineries and distilleries will now be required to comply with the Bottle Bill’s CA Redemption Value (CRV) payment and reporting obligations beginning January 1, 2024, and CRV labeling requirements for all wine and spirits sold after July 1, 2025. Beer and certain other non-alcoholic beverages were already previously covered by the Bottle Bill.

Importantly, because all wines and spirits sold in California after July 1, 2025 must be labeled with some type of approved CRV statement, producers should start including this information on their bottles and/or labels as soon as possible for all products to be offered for sale on or after January 1, 2025.

Below we have included a brief summary of the rules applicable to wines and spirits under Bottle Bill, the new registration and payment obligations, and labeling changes required to comply with the new laws.

TYPES OF BEVERAGES:

The Bottle Bill applies to beer, malt beverages, wine, spirits, wine and spirit coolers (regardless of ABV), and certain other non-alcoholic beverages intended for sale in California. Section 14504 and 14560.

CA REDEMPTION VALUES (CRV): Section 14560

- For bottles smaller than 750 mL (less than 24 fluid ounces), the CRV is 5 cents/bottle.

- For bottles 750 mL or larger (24 fluid ounces or more), the CRV is 10 cents/bottle.

- For boxes, bladders, pouches, or similar containers (regardless of size), the CRV is 25 cents/container.

REGISTRATION & PAYMENT OBLIGATIONS BEGINNING JANUARY 1, 2024:

- All wineries and distilleries should register with CalRecycle as soon as possible to prepare for payment and reporting requirements beginning 1/1/2024 (information regarding registration can be found here).

- All producers and importers of wine and distilled spirits should register as a Beverage Manufacturer. Brand owners that contract with producers for the manufacture of wine or distilled spirits are not considered Beverage Manufacturers.

- Any wineries and distilleries that sell wine or spirits in California Direct to Consumer or Direct to a Retailer (for wine) should also register as a Distributor.

2. Report and pay the applicable CRV to CalReycle.

- The winery or distillery may pass on this cost to consumers (as the consumers can return the bottles to a recycling center for the redemption). Section 14560

- The processing fee is variable depending on container material (size does not matter) and changes each calendar year, but is currently 0.452 cents/glass bottle. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

3. Report and pay the applicable Processing Fee.

- The processing fee is paid on all containers a winery or distillery sells, whether to wholesalers, retailers, or consumers. Section 14575(g)

- The processing fee is variable, but is currently 0.426 cents/glass bottle or for new containers, 0.574 cents/container. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

LABELING OBLIGATIONS FOR ALL WINES AND SPIRITS SOLD AFTER JULY 1, 2025:

- All wines and distilled spirits containers sold in California after July 1, 2025, except those containers filled and labeled before January 1, 2024, must be labeled with: “CA Redemption Value,” “California Redemption Value,” “CA Cash Refund,” “California Cash Refund,” or “CA CRV”.

- The CRV statement must be clearly, prominently, and indelibly marked and can be added on the actual label or by sticker (not on aluminum cans), stamp, embossment, or other similar method. Labeling size and location requirements are set forth below: CCR 2200(b).

- For glass and plastic, the CRV statement must be on the container body label or secondary label with:

- a text height of 3/16”, or

- a minimum text height of 1/8” and in a contrasting color to the background and nearby text.

- For aluminum, the CRV statement must be on the top lid:

- for tops greater than 2 inches in diameter, the CRV statement must be 3/16” in height; and

- for tops 2 inches or less in diameter, the CRV statement must be 1/8” in height.

- Requirements for box, bladder, and pouch containers to be determined.

3. Currently, there is no exemption for wines or spirits labeled before July 1, 2025. While the Wine Institute is working on legislation to create an exemption for wines labeled before January 1, 2024, wineries and distilleries should start including the required labeling on all applicable containers as soon as possible.

4. Senate Bill No. 1013 also revised Section 14561(d) of the Bottle Bill to allow for CRV labeling by the inclusion of a scan code or quick response (QR) code on the container. This new language is currently under review by CalRecycle.

EXCEPTION FOR TASTING ROOM SALES:

If any wines or spirits are sold for on-site consumption in a tasting room, then those products are exempt from the Bottle Bill’s requirements. Any products sold for offsite consumption are subject to the requirements of the Bottle Bill. Section 14510.

Post revised October 18, 2023 to reflect labeling exemption established under California Senate Bill 353.

For more information regarding Bottle Bill compliance, please contact Bahaneh Hobel at [email protected] or Theresa Barton Cray at [email protected].

TTB Approves San Luis Obispo Coast (SLO Coast) Viticultural Area

Last week was an exciting week for producers and consumers of California Central Coast wine. On Wednesday, March 9, the Alcohol and Tobacco Tax and Trade Bureau (the “TTB”) published a final rule establishing a new “San Luis Obispo Coast,” or “SLO Coast,” American Viticultural Area (“AVA”).

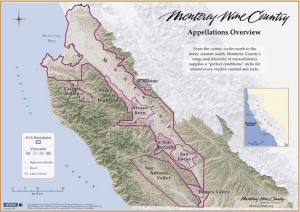

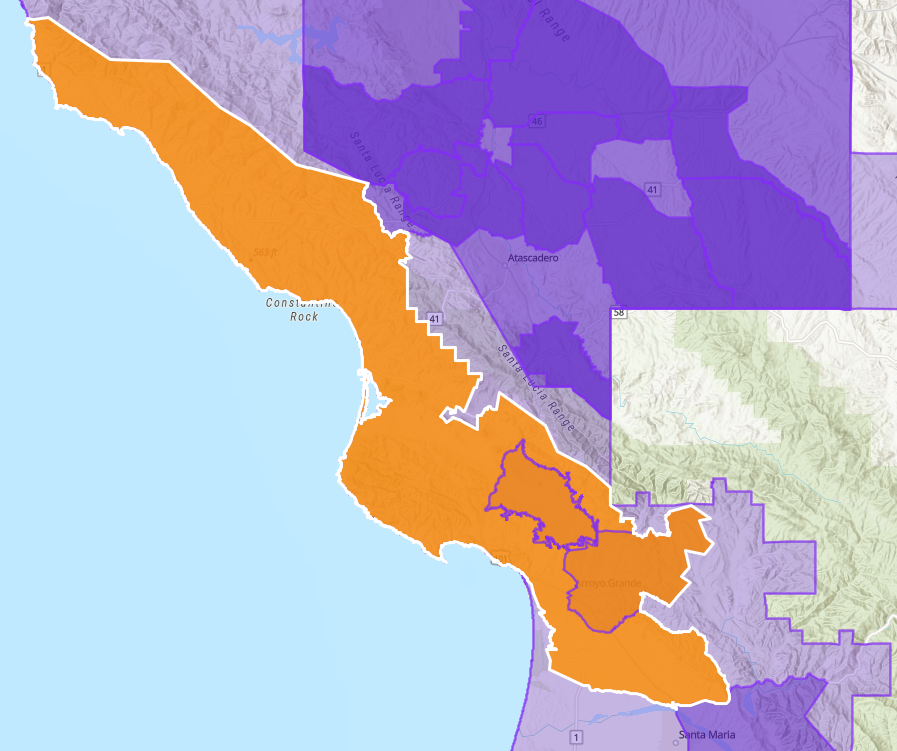

The SLO Coast AVA (identified in orange below) spans approximately 408,505 acres in San Luis Obispo County and is home to over 50 wineries and an estimated 78 commercial vineyards covering approximately 3,942 acres. It lies entirely within the multi-county Central Coast AVA and fully encompasses the established Edna Valley and Arroyo Grande Valley AVAs.

Map of “San Luis Obispo Coast” or “SLO Coast” AVA. Image: TTB.

Located along the westernmost portion of the Central Coast AVA, the SLO Coast AVA is a region of coastal terraces, foothills, and small valleys along the Pacific Coast. Its westward orientation provides more marine fog and cool marine air compared to other regions of the Central Coast AVA, using the powerhouse of the Pacific Ocean to moderate temperatures and foster optimal vineyard conditions for growing early-to-mid-season grape varietals such as Chardonnay and Pinot Noir.

Aaron Wines in Paso Robles, CA falls within the boundaries of the new SLO Coast AVA and has planted 90% of its 4,000 planted acres within 6 miles of the Pacific Ocean. Winemaker Aaron Jackson is thrilled by the important addition of the SLO Coast AVA to the “few truly coastal AVAs” in the state of California. Brian Talley of Talley Vineyards in Arroyo Grande, CA shares Mr. Jackson’s sentiments, adding that the approval of the SLO Coast AVA will “drive awareness of the coastal part of San Luis Obispo County as a world class winegrowing region.”

The establishment of the SLO Coast AVA formally recognizes the unique topography, climate, and soils of the area and offers winemakers more diversity and flexibility in marketing their wines to consumers.

Effective April 9, 2022, vintners will be able to label bottles with “San Luis Obispo Coast,” “SLO Coast,” and “Central Coast” as appellations of origin if at least 85% of the wine is derived from grapes grown within the boundaries of the SLO Coast AVA and the wine otherwise meets the statutory requirements of 27 CFR 4.25(e)(3). Vintners producing wine from grapes grown in the Edna Valley or Arroyo Grande Valley AVAs can also continue to label bottles with “Edna Valley” or “Arroyo Grande Valley” as appellations of origin for their wines.

Dickenson, Peatman & Fogarty has represented a number of AVA petitioners before the TTB, including the SLO Coast petitioners. For more information on AVA petitions and labeling compliance, please contact Carol Kingery Ritter or John Trinidad.

New Laws Expand Winery Off-Site Tasting Room Privileges and Manufacturer Charitable Donation Advertising

This week, Governor Gavin Newsom signed three bills that expand certain winery off-site tasting room privileges and grant alcohol beverage manufacturers the right to advertise and promote charitable donations in connection with the sale of alcohol. The laws will become effective on January 1, 2022. We have summarized the new bills and how they amend current law below.

Number of Winery Off-Site Tasting Rooms (SB 19)

Under current California law, Type 02 wineries are permitted to operate tasting rooms only at their licensed Type 02 premises (i.e., the same premises where the winery’s wine is crushed and fermented), and at an off-site Duplicate Type 02 premises (where crushing and fermentation of wine is not permitted). Current law permits a winery to operate only one off-site Duplicate Type 02 tasting room.

SB 19 amends Section 23390.5 of the California Alcoholic Beverage Control Act (“ABC Act”) to increase the number of Duplicate Type 02 locations that a winery can operate to two locations.

Duplicate Type 02 tasting rooms can be quite helpful for wineries to reach consumers, as they allow wineries to operate a tasting room in another location in California and sell wine to consumers there without having to maintain a production facility on the same premises.

Sale and Delivery of Consumer-Provided Containers at Duplicate Type 02 Tasting Rooms (AB 239)

Under current law, a winery may exercise all the same privileges at its Duplicate Type 02 tasting room as at its Type 02 winery premises (such as the sale and delivery of wine), with certain important exceptions. One of those exceptions is that a winery may not, at its Duplicate Type 02 premises, sell or deliver wine to consumers in containers that have been supplied, furnished, or sold by the consumer.

AB 239 amends Section 23390 of the ABC Act to delete that exception. Starting on January 1, 2022, consumers may provide their own bottles and containers to be filled at a Duplicate Type 02 tasting room premise. AB 239 provides an additional means by which wineries can provide wine to consumers that can be cost-effective for both the winery and the consumer.

Advertisements of Charitable Donations in Connection with the Sale of Alcohol (AB 1267)

Generally, California law prohibits an alcohol beverage licensee from giving a gift or “thing of value” in connection with the sale and distribution of alcoholic beverages, unless there is a statutory exception. The ABC Act permits licensees to donate to specified charities and nonprofit organizations (typically 501(c)(3)s). However, where such donations are tied to sales of alcohol beverage products and/or advertised as such – for example, when a licensee advertises that it will donate a portion or percentage of the proceeds from the sale of a product to a charity – the California Department of Alcohol Beverage Control (“ABC”) views these types of donations as “gifts” or “things of value” to consumers that “incentivize” or “entice” consumers to purchase and consume alcohol in violation of California law. During COVID-19, the CA ABC temporarily created an exception for the enforcement of this prohibition; however, this relief is limited to COVID-19 related charities only.

AB 1267 expands and codifies the CA ABC’s relief with respect to charitable donation advertising by amending Section 25600 of the ABC Act. Starting on January 1, 2022, specified manufacturers – winegrowers, beer manufacturers, distilled spirits manufacturers, craft distillers, brandy manufacturers, rectifiers, and wine rectifiers – may donate a portion of the purchase price of alcohol beverages to nonprofit charitable organizations (not limited to just COVID-19 related charities), subject to all of the following limitations:

- The donation is only in connection with the sale or distribution of alcoholic beverages in manufacturer-sealed containers.

- The promotion does not directly encourage or reference the consumption of alcoholic beverages.

- The donation does not benefit a retail licensee or a charity established for the specific purpose of benefiting the employees of retail licensees, and the advertisement for any donations does not promote or reference any retail licensee. (Note that a manufacturer may identify – but not otherwise promote – the name, address, and website of two or more unaffiliated retailers who sell the manufacturers’ product being offered in the charitable campaign, subject to the restrictions in Sec. 25500.1 of the ABC Act).

Note that this new statutory exception will sunset on January 1, 2025, so unless the exception is made permanent or extended, licensees may not advertise any donations related to the sale of alcoholic beverages at all after the date.

Further Information

The bills’ text can be found on the California Legislative Information website at the following links: SB 19 (Winegrowers: tasting rooms); AB 239 (Winegrowers and brandy manufacturers: exercise of privileges: locations); and AB 1267 (Alcoholic beverages: advertising or promoting donation to a nonprofit charitable organization).

If you have any questions, please contact John Trinidad at [email protected] or Michael Mercurio at [email protected].

CA ABC and TTB Provide Guidance to Wineries on Virtual Tastings

In light of the wide-spread shut-downs and disruptions resulting from the Covid-19 pandemic, both the California Department of Alcoholic Beverage Control and the Alcohol and Tobacco Tax and Trade Bureau have recently provided guidance to wineries that are now venturing into the new world of “virtual” wine tastings that occur online.

ABC’s latest Notice of Regulatory Relief on Virtual Wine Tastings, issued on Friday April 24, provided certain guidelines for wineries conducting such virtual tastings while their licensed wine premises or tasting rooms are closed:

- Samples or tastes for wine tastings cannot be given for free to consumers. Such samples or tastes must either be sold to the consumer, or included as part of a sale of wine or other products to the consumer.

- Any wine shipped to consumers, including small tasting samples, must be sent in a manufacturer sealed container.

- While there are no limits on the size of the tasting sample, any containers in which the tasting samples are sent must meet the federal regulatory guidelines for both labeling and standards of fill and any applicable state labeling regulations.

- Acceptable standards for fill for wine under federal law include the following: 3 Liters, 1.5 Liters, 1 Liter, 750ml, 50ml, 375ml, 187ml, 100ml (3.4 fl. oz.) and 50ml (1.7 fl. oz).

- Importantly, this means that shipping “tastes” to consumers in small vials that do not meet the above criteria would not be legal under federal or state law.

- Such shipments are subject to sales and/or other applicable taxes, just as typical direct to consumer sales would be.

- In accordance with ABC’s previous regulatory guidance, ABC is temporarily allowing the free shipment of wine to consumers, including samples for virtual wine tastings, during the Covid-19 emergency.

- Finally, it should be noted that the ABC’s latest Notice of Regulatory Relief specifically applies to the sale and shipping of wine and tasting samples within California. Any sales and shipments of wines, including tasting samples, to consumers outside of California will need to comply with the laws of the applicable state to which the wines will be shipped.

The full text of the Third Notice of Regulatory Relief can be found here.

In response to an inquiry by Wine Institute, TTB provided guidance regarding virtual tasting samples being provided by wineries to consumers. (see – https://wineinstitute.org/news-alerts/tasting-samples-for-virtual-winery-experiences-approved-by-ttb/ )

Per Wine Institute, TTB has stated that it will treat these wines just like any other taxable removals, subject to standard production and labeling requirements, payment of excise tax and applicable reporting. TTB’s guidance included the following:

- As noted above, samples must be provided in an approved standard of fill.

- Wine tasting containers must be properly labeled.

- If the tasting sample is a wine that already has an approved Certificate of Label Approval (“COLA”), the winery is permitted to change the net contents on the wine as an allowable revision without having to submit a new COLA. If no COLA was previously obtained, the winery must apply for and obtain COLA approval prior to labeling of the wine tasting sample.

- As a reminder, domestic wines must include the following information on the brand or back label as required under the regulations: Brand name, Class and type designation, Appellation of origin (if required), Alcohol content, Bottler’s name and address statement, Government health warning statement, Net contents and Sulfite declaration. Assuming that the tasting samples being sent to consumers are in containers smaller than 187ml, please note that the minimum type size for all of the foregoing under federal regulations is 1mm.

- As noted above, wines use for tasting samples are treated just like any other removals for sales or consumption – the wines must be tax paid, all required records must be kept and all required reports must be filed. Shipments of these containers must be treated the same as other types of removals from bond – for example, the wine must be tax-determined, and wineries must maintain the required removal from bond records.

For additional information on conducting virtual wine tastings, please contact Bahaneh Hobel or John Trinidad.

CA ABC Provides Additional Coronavirus Regulatory Relief; CA ABC and TTB Postpone Due Dates for Certain Payments and Filings

Over the past forty-eight hours, the California Department of Alcoholic Beverage Control (“CA ABC”) has provided additional regulatory relief to licensees, including information relevant to industry members engaged in fundraising in connection with Coronavirus-related charities. In addition, CA ABC and the Alcohol Tobacco Tax and Trade Bureau (”TTB”) announced that industry members will be permitted to delay certain payments and filings. We have summarized each of these notices below, but the full text of these notices can be accessed through the links below:

- CA ABC Second Notice of Regulatory Relief

- CA ABC Notice re Renewal Fees

- TTB Industry Circular re Postponement of Payments and Filings

1. CA ABC Second Notice of Regulatory Relief

CA ABC issued a Second Notice of Regulatory Relief on April 1, 2020 (the “Second Notice”) temporarily loosening it’s enforcement of certain regulations during the period that shelter-in-place restrictions are in place.. CA ABC had previously announced certain regulatory relief measures in its first Notice of Regulatory Relief (“First Notice”) on March 19, 2020 and we summarized that notice in this blog post.

Below is a summary of ABC’s Second April Notice.

FREE DELIVERY OF ALCOHOLIC BEVERAGES TEMPORARILY ALLOWED: ABC has temporarily provided licensees that can ship or deliver alcoholic beverages, whether pursuant to the ABC Act or pursuant to the First Notice, the right to deliver or ship to consumers for free, without violating Business and Professions Code Section 25600, which prohibits licensees from providing any “premium, gift, or free goods” in connection with the sale or marketing of alcoholic beverages.

DELIVERY HOURS OF ALCOHOL TO RETAILERS EXTENDED TO MIDNIGHT: Licensees (including manufacturers, winegrowers, and wholesalers) may now deliver alcoholic beverages to retailers between 12 AM and 8 PM (rather than starting at 3AM). The prohibition against Sunday deliveries remains in effect. Note that if a retail licensee has a condition on its license limiting the hours during which it may allow deliveries, such condition shall remain in full effect.

CERTAIN CHARITABLE PROMOTIONS RELATED TO SALES OF ALCOHOL: The CA ABC is relaxing its enforcement of restrictions on charitable promotions during this challenging time. Manufacturers, wholesalers, or other supplier-type licensees may advertise that a portion of the purchase price of the alcoholic beverages will be donated to a specified charitable organization related to Coronavirus-related relief, subject to the following limitations:

- The donation and promotion involve a bona fide charitable organization providing relief related to the COVID-19 pandemic;

- The promotion is in connection with the sale of sealed containers and does not encourage or promote the consumption of alcoholic beverages; and

- The donation and promotion do not identify, advertise, or otherwise promote or involve any retail licensee.

Any promotions under this provision must conclude no later than June 30, 2020. ABC has stated it will reassess this measure at that time and determine if it should be extended further.

ABC previously stated in its FAQs that donations to nonprofits benefiting restaurant and hospitality workers in general are permissible, so long as it is just a donation to an organization and does not identify or involve any quid pro quo with specific retailers. In addition, gifts or donations (such as meals or gift cards) may not be made directly to retailer employees.

DISTILLED SPIRITS MANUFACTURERS PROVIDING HIGH-PROOF SPIRITS FOR DISINFECTION PURPOSES: Licensed distilled spirits manufacturers (Type 04) and craft distillers (Type 74) may produce denatured high proof spirits if such distilled spirits are produced for use in accordance with guidance from the Food and Drug Administration, which may be found in the FDA’s Policy (PDF). Undenatured distilled spirits are not included in this relief as they are considered alcoholic beverages. Licensees may provide such distilled spirits for free to any person, including retail licensees, if they are not used to promote the manufacturer’s alcoholic beverage products and are not provided in exchange for an agreement to purchase anything produced or distributed by the manufacturer.

***

Licensees should note that all of the above changes are only temporary and ABC will provide the industry 10 days’ notice before these guidelines terminate. And although these provisions relax ABC’s enforcement of certain provisions of the ABC Act, the ABC did remind industry members that “[a]ll provisions of the Alcoholic Beverage Control Act, including …tied-house and trade practice restrictions, remain in effect and subject to enforcement unless the Department has provided express notice that specific provisions will not be enforced.”

As we noted in our earlier post, local regulations and restrictions may restrict the ability of licensees to engage in these activities, so you should always confirm that any activity in which you engage is permitted by local zoning or use permits.

2. CA ABC Grants 30 Day Grace Period for License Renewal Fees and Penalties

The CA ABC is providing licensees a 30 day grace-period for paying their annual renewal fees.

For Licensees who have previously missed their license renewal deadline and owe penalties as a result of failing to pay their renewal fee in a timely manner, the ABC is also granting a 30 day grace period.

The ABC has provided helpful tables in its notice that lay out the exact deadlines that have been extended and new due dates for license renewals.

3. TTB Postpones Tax Payment and Filing Deadlines

To help ease the burden on the alcohol beverage industry dealing with the impact of COVID-19 the TTB is postponing several filing and payment due dates for 90days where the original due date falls on or after March 1, 2020, through July 1, 2020. The TTB’s relief actions include:

- Postponing tax payment due dates for wine, beer, distilled spirits, tobacco products, cigarette papers and tubes, firearms, and ammunition excise taxes.

- Postponing filing due dates for excise tax returns.

- Postponing filing due dates for submission of operational reports.

- Postponing filing due dates for claims for credit or refund by producers.

- Postponing filing due dates for claims by manufacturers of non-beverage products.

- Postponing due dates for submission of export documentation.

- Considering emergency variations from regulatory requirements for affected businesses on a case-by-case basis.

- Reviewing requests for relief from penalties based on reasonable cause.

For a list of Coronavirus related resources, please see our Resources Page.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

CA ABC Loosens Regulations for Alcohol Beverage Retailers and Delivery

The California Department of Alcoholic Beverage Control issued a notice on March 19, 2020 temporarily loosening certain regulations during the current state of affairs. While primarily focused on retailers, there are some potentially helpful provisions that impact alcohol beverage producers, too.

A few things to keep in mind. First, local regulations and restrictions may also govern and restrict the ability of licensees to engage in these activities. Second, this move by the ABC is temporary. ABC plans to notify the industry 10 days before these guidelines terminate.

Below is a summary of ABC’s March 19 notice.

3/21/2020 Update: CA ABC has issued a FAQ for it’s 3/19/2020 Notice of Regulatory Relief

For a full list Coronavirus-related links and resources compiled by DPF attorneys, please click here.

ON-PREMISE RETAILERS SELLING ALCOHOL “TO GO”

ALCOHOL IN MANUFACTURER PRE-PACKAGED CONTAINERS: If you hold an on-premise retail license that allows you to sell beer and wine or beer wine and spirits, you can sell that beer and wine to go for off-premise consumption in the original container/bottle (barring any condition on your license). That was true prior to the ABC notice, and still holds. However, if you hold an on-premise retail license that allows you to sell beer, wine and spirits, you can now sell all those beverages (beer, wine and spirits) in the original container/bottle.

ALCOHOL IN RETAILER PACKAGED CONTAINER: Under ABC’s new notice, if you operate a restaurant / “bona fide eating place”, you can now package whatever alcohol your license allows you to sell (beer and wine only for a Type 41; beer, wine, and premixed cocktails/drinks if you are a Type 47) in a container with a “secure lid or cap” so long as that cap does not have a sipping hole or opening for a straw, or could otherwise be consumed without removing the lid/cap. However, that container must be sold in conjunction with a meal prepared for pick-up or delivery.

Retailers that want engage in this type of activity must have a prominent posting (either on the premise, online, or in any way possible to alert consumers or the person transporting the beverage) that states, “Alcoholic beverages that are packaged by this establishment are open containers and may not be transported in a motor vehicle except in the vehicle’s trunk; or, if there is no trunk, the container may be kept in some other area of the vehicle that is not normally occupied by the driver or passengers (which does not include a utility compartment or glove compartment (Vehicle Code section 23225)). Further, such beverages may not be consumed in public or in any other area where open containers are prohibited by law.” UPDATE 3/24/2020: ABC has created a PDF of that notice so that retailers can easily print and post.

TAKE OUT WINDOWS: Some licensees have conditions on their license that prohibit the sale / delivery of alcohol to persons in cars or to consumers outside of the licensed premises through a take-out window or slide-out tray. Those prohibitions are temporarily lifted.

DELIVERY TO CONSUMERS: Even before the emergency notice, most business that hold a license that permits them to sell alcohol to consumers for off-premise consumption can also deliver those beverages to the consumer, so long as the sales transaction (other than the delivery) takes place at the licensed premise. In other words, the order must be received at the licensed premise, and payment is processed there. You can’t just show up at someone’s door and swipe a credit card there.

The temporary notice now allows for the following:

- If you are allowed to sell to consumers for off-premise consumption, you can accept payment, including cash, at the point of delivery.

- Although the CA ABC Act is silent as to whether Craft Distillers have the right to make deliveries away from the premises, the notice now allows Type 74 craft distillers can also deliver to consumers, but must limit sales to 2.25 liters per consumer per day.

- These delivery privileges are not limited to delivery to a consumer’s residence, but also allow for curbside delivery to consumers immediately outside the licensed premises.

HOURS OF OPERATION: State law prohibits the retail sale of alcohol between 2:00am and 6:00am. Some licensees have even more restrictive hours through conditions placed on their license. However, those license conditions are now lifted for off-premise sales, though the 2am-6am state law is still in place.

RETURNS: Generally, there are restrictions on the ability of producers and wholesalers from accepting returns from retailers. Those restrictions are temporarily lifted. It doesn’t mean that wholesalers and producers are required to accept all returns from retailers, just that they can if they choose to. However, producers/wholesalers cannot condition the acceptance of a return on a requirement to purchase in the future. This is consistent with TTB latest guidance on returns as well.

RETAILER-TO-RETAILER SALES: Under California law, retailers cannot purchase alcohol from other retailers. Under the temporary guidance, an off-premise retailer (grocery store, bottle shop, etc.) can now buy inventory from on-premise retailers (such as bars and restaurants).

EXTENSION OF CREDIT: Normally, California law imposes a maximum 30 day credit on the purchase of alcohol by a retailer from a wholesaler or producer. That 30 day limit is temporarily lifted. Note, however, once the temporary guidance is revoked, the extended credit term will also terminate (i.e., the retailer will have to pay the amount due at that time).

For a list of Coronavirus related resources, please see our Resources Page.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

Additional Guidance For Wineries in Light of Recent Government Actions

Since the Governor’s announcement on Sunday recommending the temporary suspension of on-premise alcoholic beverage businesses, including winery tasting rooms, certain cities and counties have instituted “Shelter-in-Place” ordinances, and both the California ABC and the California Wine Institute have issued additional guidance on the operation of alcohol beverage licensed premises, including wineries.

Given the various orders and guidance currently in place, we have provided below a brief summary of the current state of play for wineries. Please note that things are rapidly changing and while we will do our best to issue updates, we highly recommend that all licensees sign up for the California ABC email updates, and also keep an eye on orders from their local governments.

GOVERNOR’S DIRECTIVE – Statewide Recommendations

- On Sunday, March 15, 2020, Governor Gavin Newsom announced that he was directing the closure of “all bars, nightclubs, wineries, brewpubs, and the like.”

- The California ABC has since clarified that the directive is aimed at suspending on-premise retail privileges (that is, the service of alcohol for consumption at the licensed premises). For wineries, the directive applies to their tasting room and event operations in pouring wine and serving customers for on-premise consumption. It has no impact on their production operations, and wineries can continue to have consumers purchase and pick up wine for off-premise consumption, subject to any further local restrictions such as the shelter-in-place orders discussed below.

- After discussing the directive with the Governor’s office, Wine Institute has recommended that wineries take the following steps:

- Ensure visitor and employee safety by intensify cleaning and sanitation procedures;

- Operate the facility in compliance with social distancing guidance (such as instituting procedures to keep individuals 6 feet apart);

- Implement recommendations from the CDC and California Department of Public Health re washing hands, avoiding close interpersonal contact, encouraging employees to remain at home when sick, and instituting additional precautions for older employees and customers.

For other operational recommendations, please see our Employer Guide to Navigating COVID-19 from earlier this week.

LOCAL GOVERNMENT “SHELTER-IN-PLACE” ORDERS – Enforceable Restrictions

- As of March 18, 2020, a number of counties in Northern California (including Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Santa Cruz, and Sonoma) have issued shelter-in-place orders.

- Wineries that have operations in any jurisdiction that have implemented such an order have legal obligations to alter their current operations to comply with their specific county’s order.

- In its recent guidance, issued prior to the Sonoma County order, Wine Institute concluded that winery businesses meet the definition of “essential businesses” because they constitute “businesses that supply other essential businesses (grocery stores and other food outlets) with the support or supplies necessary to operate.” According to Wine Institute, wineries can engage in the following activities in those Shelter in Place jurisdictions: “vineyard management, wine production operations, bottling, warehousing, sales, delivery and shipping.” However, this “does not include wine tasting and events ….”

- The Sonoma County order includes a provision that more directly addresses winery operations. Specifically, the following activities are deemed “essential” under the Sonoma County Ordinance: “Agriculture, food, and beverage cultivation, processing, and distribution, including but not limited to, farming, ranching, fishing, dairies, creameries, wineries and breweries in order to preserve inventory and production (not for retail business).” It is unclear whether, by excluding “retail business,” Sonoma County is restricting wineries and tasting rooms from engaging in the sale of wine in sealed containers for off-premise consumption, or whether the language is only meant to address retail sales for on-premise consumption.

- Napa County’s order goes into effect at 12:01am on Friday March 20. It includes a provision that deems the following businesses as “essential”: “Any form of cultivation of products for personal consumption or use, including farming, ranching, livestock, and fishing, and associated activities including but not limited to activities or businesses associated with planting, growing, harvesting, processing, cooling, storing, packaging, and transporting such products, or the wholesale or retail sale of such products, provided that, to the extent possible, such businesses comply with Social Distancing Requirements set forth in subsection (j) of this Section 10 and otherwise provide for the health and safety of their employees.”

Please note that this is a rapidly evolving situation, and many more cities and counties may implement Shelter-in-Place measures over the next days and weeks ahead. It is also possible that the ordinances on which this blog post, and Wine Institute’s guidance are based, may be revised.

ADDITIONAL ABC GUIDANCE

- ABC has issued additional guidance regarding the Governor’s directive on steps licensees can take to minimize risk.

- ABC has stated that retail licensees that comply with the Governor’s directive or local government restrictions will not have their licenses suspended.

- ABC offices in shelter in place jurisdictions are closed to the public. ABC Staff will be available to answer questions over the phone, and you can still mail applications to those local offices. Other ABC local office closures will be posted here.

- ABC is not currently accepting, processing, or approving special event or daily licenses in light of guidance on gatherings.

ADDITIONAL WINE INSTITUTE INFORMATION

- Wine Institute has been in direct communication with ABC and has shared the following information:

- ABC will not enforce state regulations that limit the extension of credit to 30 days.

- ABC is looking at additional relaxation of regulations in light of the current situation.

- For more information, go to https://wineinstitute.org/news-alerts/ca-abc-suspends-ca-credit-regulations-enforcement-clarifies-wine-take-out-sales-in-restaurants

- In addition, TTB has informed Wine Institute that “it does not expect any service interruptions but urges all wineries to register and utilize COLAs Online and Permits Online immediately since most of its staff is now teleworking.” For more information, go to https://wineinstitute.org/news-alerts/ttb-relaxes-consignment-sale-restrictions-urges-online-colas-and-permit-submissions

Wine Institute has a helpful resource page dedicated to Coronavirus related updates, which can be accessed here.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

TTB Allows Returns of Products Purchased for Events Cancelled due to CORONAVIRUS

Today, TTB announced that it would permit returns of alcoholic beverages that were originally purchased for events that have been canceled due to Coronavirus. As TTB stated: “Given the unexpected and widespread nature of the concerns involving COVID-19, TTB will not consider returns of alcohol beverage products purchased to sell during such cancelled events to violate federal consignment sales rules provided the products were not initially purchased or sold with the privilege of return.”

Federal regulations typically prohibit consignment sales, which they interpret broadly to include the sale or purchase of alcohol beverage products with the privilege of return. (27 CFR 11.21).Typically, returns for ordinary and usual commercial reasons are not permitted, but returns because a product is overstocked or slow-moving does not constitute a return for ordinary and commercial reasons and are prohibited. (27 CFR 11.45.)

Acknowledging that wholesalers and retailers likely had already purchased product for various events such as festivals, concerts and sporting events that have seen widespread cancellations in recent days, TTB has taken the position that returns resulting from these cancellations would be permitted.

Local officials and event organizers have begun announcing cancellations of widely-attended events, such as parades, festivals, fairs, concerts, and sporting events based on concerns about COVID-19. These announcements may be made after wholesalers and retailers purchased large quantities of products to sell during.

Note that returns of alcoholic beverages to retailers would still be considered consignment sales under California law and we are working with California ABC to understand their position on such returns given the mass cancellations of events and gatherings.

For more information about how to address the return of alcoholic beverage products, please contact Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

Governor Issues Guidance / Directive on Closure of CA Bars, Clubs, Winery Tasting Rooms, On-Premise Retailers

On Sunday, March 15, 2020, Governor Gavin Newsom announced that due to efforts to reduce the potential spread of the novel coronavirus, he was directing the closure of “all bars, nightclubs, wineries, brewpubs, and the like.” Restaurants, however, are not directed to close at this time, but are subject to reduction of occupancy and social distancing guidelines. Although the Governor did not explicitly state as much, the closure directive appears aimed at suspending on-premise retail privileges (i.e., the service of alcohol for consumption at the licensed premises), whether those privileges are exercised at stand-alone premises or at locations tied to alcohol beverage production facilities, such as tasting rooms.

The directive is not an order, but has the same force as the Governor’s guidance last week regarding non-essential social functions over 250 attendees.

While the Governor announced that the directive would apply to “wineries,” it appears that this may only apply to a winery’s tasting room operations, and does not impact production operations. A number of on-premise licensees may also have off-premise retail privileges. It is unclear whether the Governor’s directive allows these licensees to sell sealed bottles for consumption off the licensed premises during the closure period.

We have been in contact with representatives of the California Department of Alcoholic Beverage Control and expect further guidance on Monday, March 16. We will update this post with any additional information.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

Supreme Court Decision is a Victory for Alcohol Beverage Retailers

Alcohol beverage retailers won a significant victory before the U.S. Supreme Court this morning. The Court held in Tennessee Wine & Spirits Retailers Association v. Thomas that Tennessee’s two-year durational-residency requirement applicable to retail liquor store license applicants violates the Commerce Clause and is not saved by the Twenty-First Amendment. In doing so, the Court stated that the 2005 decision in Granholm vs. Heald, which prohibited discrimination against out of state alcohol beverage producers, applied with equal force to discrimination against retailers, settling a long dispute in the courts on the applicability of Granholm to retailers. The end result is that states must now defend any discriminatory or protectionist alcohol beverage laws without the luxury of relying on the Twenty-First Amendment, giving retailers wishing to ship across state lines a leg-up in future legal challenges. Today’s decision, however, does not mean that retailers can begin shipping across state boundaries legally. Additional court challenges or legislative changes are needed to fully open the door to retailer direct-to-consumer shipping.

The question of alcohol beverage retailer direct-to-consumer shipping was not directly at issue in the case. Instead, the case centered on the constitutionality of Tennessee’s residency requirements on state licensed alcohol beverage retailers. Petitioner, a Tennessee retail trade association, argued that the residency requirement must be upheld because the 21st Amendment grants states broad authority to regulate alcohol within their borders. The Court rejected that argument and concluded that:

“[Section 2 of the 21st Amendment] allows each State leeway to enact the measures that its citizens believe are appropriate to address the public health and safety effects of alcohol use and to serve other legitimate interests, but it does not license the States to adopt protectionist measures with no demonstrable connection to those interests.”

Leading up to today’s decision, many hoped the Court would issue a ruling that would not only address the residency requirement question, but also adopt a reading of the 21st Amendment that would open the door to retailer direct-to-consumer shipping. Given the Court’s reading and application of Granholm, they may have gotten their wish. States that allow in-state retailers to ship to consumers but prohibit out-of-state retailers from doing so will find such laws difficult to defend in the face of today’s decision. To avoid legal challenges, states may choose to adopt statutes that allow all retailers, regardless of where they are located, the right to ship directly to consumers, or prohibit retailers from doing so altogether.

Attention will now shift to other cases directly challenging laws that prohibit out-of-state retailers from shipping to in-state consumers, such as the appeal in Lebamoff Enterprises v. Snyder before the Sixth Circuit Court of Appeals. The federal district court in that case ruled that, under the precedent set in Granholm, a Michigan state law that permits in-state wine retailers to ship direct to consumers must also grant the same privilege to out-of-state retailers. Case No. 17-10191, (E.D. Mich. Sept. 28, 2018). The appeals court stayed the appeal pending the outcome of the Tennessee Wine & Spirits Retailers case. Retailers now will have significant support for their argument that such state laws are nothing more than protectionist measures that discriminate against out-of-state retailers. States, on the other hand, will need to defend those laws as necessary in order to protect the health and welfare of their citizens. However, given that today’s ruling strips states of any defense under the Twenty-First Amendment for any discriminatory or protectionist laws, retailers have gained a clear upper hand in the legal challenges to come.

The Court’s decision is available through the following link: https://www.supremecourt.gov/opinions/18pdf/18-96_5i36.pdf .

If you have any questions, please contact Bahaneh Hobel or John Trinidad.

A Bridge too Far for Granholm? Florida Importer Challenges California Three-Tier System

A Florida-based wine importer is hoping to shake up the California three-tier system. If successful, any importer or wholesaler in the U.S. may be permitted to sell directly to California retailers.

Earlier this year, Orion Wine Imports, LLC filed a lawsuit against the director of the California Department of Alcoholic Beverage Control arguing that licensed wine importers and wholesalers in California and in other states must be given the same right to sell and deliver wine directly to California-licensed retailers. Orion Wine Imports, LLC v. Applesmith, Case No. 2:18-cv-01721-KJM-DB (E.D. Cal.). Orion argues that, under the U.S. Supreme Court’s decision in Granholm v. Heald, state laws that discriminate against out-of-state importers and wholesalers are unconstitutional.

This argument may sound familiar. In Granholm, the Court invalidated state direct-to-consumer shipping laws that discriminated against out-of-state producers. Since then, a number of lawsuits have been filed arguing that the Granholm holding should also apply to laws that discriminate against out-of-state retailers. As we reported a few weeks ago, the Supreme Court will be hearing a case that may answer that question.

Defendant in the Orion case is likely to argue that applying Granholm to the wholesale tier is a bridge too far. Plaintiff’s are looking to invalidate long-standing provisions of the state’s three-tier licensing structure. The challenged statutes, adopted by the California legislature in 1953 as part of the state’s post-Prohibition codification of the Alcoholic Beverage Control Act, are core to the establishment of the state’s three-tier system.

Orion is also facing opposition from its fellow wholesalers. Two industry trade associations, California Beer and Beverage Distributors and the Wine and Spirits Wholesalers of California, have filed an amicus brief in support of defendant’s position.

The court has scheduled a December 21, 2018 hearing in Sacramento on defendant’s motion to dismiss.

For more information regarding the three-tier system, please contact John Trinidad.

Monterey County Wines Subject to New Conjunctive Labeling Requirements

Are you planning on bottling and labeling any wines with the name of a Monterey County AVA in the new year? Then you’ll need to comply with a new conjunctive labeling requirement. See Cal. Business and Professions Code Sec. 25247.

In 2015, the state legislature passed a law requiring wine labeled with the name of an AVA that is entirely within Monterey County to also include a “Monterey County” designation. This includes the Arroyo Seco, Carmel Valley, and Santa Lucia Highlands AVAs. The law applies to wines bottled on or after January 1, 2019.

The law does not apply to AVAs that straddle Monterey County and any other county. For example, the Chalone AVA bridges Monterey County and Benito County, so a wine labeled with the Chalone AVA is not covered by Sec. 25247.

There is one other exception to the conjunctive labeling requirement: wines labeled with the Monterey AVA. This is where things get a little confusing. Under federal law, a wine can carry the name of a county as an appellation of wine origin. AVAs are also considered appellations, but in order to carry the name of an AVA, a higher percentage of the grapes must come from that AVA. In both cases, the wine must be fully finished in the state in which the county or AVA is located (assuming the AVA is entirely within one state).

Federal regulations recognize both a “Monterey County” appellation, as well as a Monterey AVA. The Monterey AVA is located in Monterey County, but does not cover all of Monterey County (see map below). Any wine that is labeled with the Monterey AVA is exempt from the California conjunctive labeling requirement found in Cal. Business and Professions Code Sec. 25247.

For more information regarding conjunctive labeling or wine labeling regulations, please contact John Trinidad.

International Wine Law Conference Comes to Napa

DPF’s Richard Mendelson and Scott Gerien presented at the International Wine Law Association‘s annual conference held in Napa this past week. During the two day conference, wine law experts from around the world addressed key issues that impact the wine industry, including climate change, regulatory enforcement, international trade barriers, and mergers and acquisitions (click here for the full conference agenda). The event took place at CIA-Copia and drew over 110 participants.

Mr. Mendelson chaired a panel discussion titled “Climate Change Adaptation and Mitigation,” and Mr. Gerien spoke on the use of geographical indications on products other than wine.

Federal Court Rules in Favor of Wine Retailer DTC Shipments

Wine retailers received a double dose of good news last week.

As we reported earlier, on Thursday, the U.S. Supreme Court agreed to hear an appeal by the Tennessee Wine and Spirits Retailer Association in a case challenging Tennessee’s state residency requirement for persons or entities that hold a state alcohol beverage retail license. Tennessee Wine & Spirits Retailers Ass’n v. Byrd, No. 18-96 (6th Cir., 883 F. 3d 608; cert. granted Sept. 27, 2018). In determining the constitutionality of the state’s residency requirement, the Court may also weigh in on a key question that could have a big impact on direct-to-consumer shipping by wine retailers: does the Supreme Court’s 2005 decision in Granholm v. Heald, which prohibited state from discriminate against out of state wine producers, also prohibit state laws that discriminate against out-of-state retailers.

On Friday, a federal district court in Michigan answered that very question in favor of retailers, and concluded that if the state permits in-state wine retailers to ship direct to consumers, it must also grant the same privilege to out-of-state retailers. Lebamoff Enterprises v. Snyder, Case No. 17-10191, (E.D. Mich. Sept. 28, 2018). The Michigan law in question allowed in-state wine retailers that held a “specially designated merchant license” to ship to Michigan consumers, but prohibited out-of-state retailers from so doing. The court held that the law was not protected by the the 21st Amendment and unconstitutional in light of the Supreme Court’s holding in Granholm. In granting plaintiff retailer’s motion for summary judgment, the court concluded:

“Michigan is … operating an unjustifiable protectionist regime in its consumer wine market, a privilege unsanctioned by the Twenty-first Amendment and forbidden by the dormant Commerce Clause.”

As a remedy, the court opted not to nullify the offending law, but instead extended its shipping privileges to out-of-state retailers. Unless the state legislature repeals the law, then out-of-state wine retailers will be allowed to either apply for the state’s specially designated merchant license or a comparable out-of-state license.

New Bill Targets California Alcohol Delivery Services

California lawmakers are considering legislation that would regulate companies offering alcohol delivery services, such as Instacart and Drizly.

Senate Bill 254 stops short of requiring “delivery network services” from obtaining a license from the Department of Alcoholic Beverage Control (“ABC”), but does require that the ABC review and approve of their “system” before they engage in alcohol deliveries. The delivery services company’s “system” would have to meet certain criteria, including ensuring that consumers and delivery personnel were over age 21. If passed, SB 254 would also prevent delivery network services from delivering to locations on college or university campuses.

To date, many of these delivery service companies have adopted models that closely follow the third party provider guidelines issued by the ABC in 2011 and have not had to submit a summary of their system for ABC review. If passed as currently drafted, SB 254 may require these companies to suspend operations until such time as the ABC has reviewed and approved of the company’s system. Also of note, SB 254 does not appear to apply to other third party marketers that do not engage in delivery of alcoholic beverages, but instead forward orders to wineries or retailers who are ultimately responsible for delivery.

For more information on alcohol beverage laws and regulations for third party marketers and delivery services, please contact John Trinidad.

Protecting Wine Origins is Pro-Consumer and Pro-Industry

TTB’s attempt to put an end to an inherently misleading labeling practice and protect the AVA wine origin labeling rules has garnered significant reaction from certain commentators and some in the industry. In order to shed some light on the proposed amendments to federal labeling rules and why Napa Valley Vintners, the Wine Institute, over 50 members of Congress and others have supported TTB’s Notice of Proposed Rulemaking 160, we have prepared the following summary.

I. Current regulations allow certain wineries to employ misleading labeling practices.

Producers selling wine in interstate commerce must obtain a Certificate of Label Approval (“COLA”) and comply with federal regulations aimed at protecting consumers from misleading labeling practices. This includes federal standards for using vintage date, grape variety designations, and wine origin designations such as county, state, and country appellations and American Viticultural Areas (“AVAs”).

Wineries wishing to avoid enforcement of these federal truth-in-labeling standards can do so simply by filing for a COLA exemption and noting on the wine bottle that the wine is “For Sale Only” in the state in which the producing winery is located. This leads to the potential for misleading wine labeling practices. For example, federal regulations require that an AVA wine sold in interstate commerce with a 2015 vintage date must be made from at least 95% grapes grown in that vintage. But those regulations do not apply, and therefore would not prevent, a wine with a certificate of label approval exemption from using a lower percentage of 2015 harvested grapes and still being labeled as “2015.” Wines with certificates of label approval can be labeled with a varietal name, such as Pinot Noir, if it is made from at least 75% of grapes of that variety, but get an exemption and slap on a “For Sale Only” sticker, and then there is no obligation under federal regulations that the wine meet that 75% requirement.

Certain wineries have taken advantage of this COLA exemption loophole to designate their wine with an AVA while not complying with federal standards governing wine origin labeling, specifically, 27 C.F.R. Sec. 4.25 which requires that wine labeled with an AVA (a) be derived 85 percent or more from grapes grown within the boundaries of that AVA, and (b) be fully finished within the state in which the AVA is located. This “fully finished” federal requirement ensures that California wine production and labeling laws apply to wines that are identified with a California appellation or AVA.

These federal appellation labeling rules assure consumers that when they buy an appellation-designated wine, they are buying a product wherein both the grape source and the place of production are closely tied to the named place. Absent such rules, retail shelves could be stocked with wine labeled as “Burgundy” that was made in Sweden, “Barolo” that was actually produced in Slovenia, or “Sonoma Coast” made in Alaska.

II. TTB’s Notice 160 Proposes to Close the Loophole By Requiring All Wines to Follow the Same Vintage, Variety, and Appellation Labeling Standards.

In September 2015, 51 members of Congress wrote to TTB with a fairly simple request: “ensure that all wines bearing AVA terms—regardless of where they are sold—meet the clear and understandable American Viticultural Area rules.”

On June 22, 2016, the U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) responded by issuing Notice of Proposed Rulemaking 160, in which the agency proposed eliminating the COLA-exemption loophole by requiring COLA-exempt wines to comply with federal standards for vintage, varietal, and wine origin designations and to keep records to support such labeling claims. TTB subsequently granted a 90-day extension on September 8, 2016 and, in so doing, requested “comments regarding whether any geographic reference to the source of the grapes used in the wine could be included on a wine label in a way that would not be misleading with regard to the source of the wine” (emphasis added).

III. NVV and Wine Institute Support Notice 160 to Put an End to Misleading Labeling Practices.

Napa Valley Vintners (NVV), a non-profit trade association with over 500 members and our client, issued a comment letter supporting Notice 160, pointing out that the COLA exemption loophole was being used to mislead consumers and allow COLA-exempt wines to “unfairly benefit from the goodwill and brand recognition of appellation names without having to comply with the appellation regulations.”

NVV also pointed out that out-of-state wineries passing off their products as California wines by using the names of California appellations on their wine labels were able to avoid compliance with state laws regarding wine production and labeling. For example, wines produced outside of California but labeled with the name of a California AVA have no obligation to follow the state’s conjunctive labeling, wine composition and production, or misleading brand name statutes.

Similarly, wines produced outside of Oregon but using the name of an Oregon AVA, would have no requirement to follow the much stricter Oregon varietal composition (requiring at least 90% for most varieties) and appellation of origin (requiring 100% from Oregon and 95% for all other appellations). As David Adelsheim, founder of Oregon’s Adelsheim Vineyard, pointed out in his support of Notice 160, “the reputation of Oregon’s AVAs, hard won through years of experimentation and work” would suffer as a result of allowing COLA exempt wines to avoid enforcement of state wine-related laws.

After significant consultation, Napa Valley Vintners (NVV) and Wine Institute, a public policy advocacy association representing over a thousand California wineries and affiliated businesses responsible for 85 percent of the nation’s wine production and more than 90 percent of U.S. wine exports, issued a joint letter in further support of Notice 160, noting that the proposed amendments “put an end to the inherently misleading practice of using a Certificate of Label Approval … exemption to avoid compliance with federal labeling laws.” Sonoma County Vintners also issued a letter in full support of the NVV and Wine Institute position.

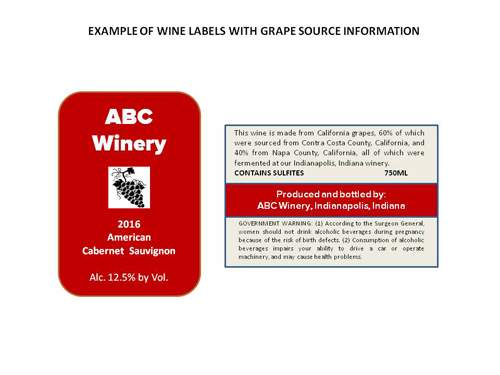

IV. NVV and Wine Institute Put Forward a Proposal that Allows For Optional Grape Source Information for COLA Exempt Wines.

In their joint letter, NVV and Wine Institute directly respond to TTB’s request for information as to whether grape source information could be included on COLA-exempt wines in a manner that was not misleading as to wine origin designations. The joint proposal directly addresses concerns that Notice 160 would prevent producers from providing consumers with truthful information regarding where the grapes used to make the wine came from, and at the same time protects AVA names as designators of wine origin. It also addresses concerns raised by wineries that had previously used COLA exemptions suggesting that they could continue to label their wine with truthful vintage and variety designations..

The NVV / Wine Institute proposal permits wineries to provide the following “Grape Source Information” on their wine: (a) the name of the county(-ies) and state(s), or just the state(s), where all of the grapes are grown; (b) the percentage of the wine derived from grapes grown in each county or state shown on the label; and (c) the city and state, or just the state, where the wine was fully finished. In order to avoid any confusion with wine origin designations, no name of an AVA (other than a county or a state) could be used as part of the Grape Source Information, and the wine itself would have to be designated using the “American” appellation. By using the American Appellation, (under current Federal regulations), the wine could also be designated with the vintage and grape varietal.

In short, NVV and Wine Institute are in favor of truthful labeling practices that protect the integrity of the AVA system. The goal of the joint proposal is simple: when consumers come across a wine labeled with an AVA name, they should be assured that the wine actually meets the legal standards for AVA labeling.

V. Support for Notice 160 comes from Industry Members That Believe Protecting Wine Origin Labeling is both Pro-Consumer, Pro-Grower, and Pro-Vintner.

Notice 160 is supported by a broad swath of industry members that believe the integrity of wine origin labeling regulations is essential to the U.S. wine industry. Regional associations (including the New York Wine Industry Association and Washington Wine Institute) and industry members from well-established as well as up-and-coming wine growing regions have written to TTB to note their support for the proposed amendments.

For example, Andy Beckstoffer, a noted grape grower with vineyards in Napa Valley as well as the Red Hills Lake County AVA wrote TTB to voice approval of Notice 160, stating:

It is vitally important to grape growers that the integrity of the AVA system be maintained, and I applaud TTB’s efforts in ensuring that all wine labeled with the name of an AVA meet the well-established federal wine labeling requirements. Grape growers, whether they farm vineyards in well established AVAs or in newer AVAs, benefit greatly from regulatory efforts to protect those place names.

This sentiment was shared by the High Plains Winegrowers Association, a group of winegrowers and vintners from the Texas High Plains AVA. They feared that the current COLA exemption loophole “is detrimental to Texas wineries that support locally grown wine grapes,” and further concluded that “[f]ailing to uniformly treat the labeling of all wine—whether distributed in-state or in interstate commerce—results in inequitable treatment within the same industry.” Douglas Lewis, a Texas Winemaker, also supports Notice 160 because it “helps consumers get more accurate information [about wine origin] by closing the loop hole.” And Andrew Chalk, a Dallas based wine writer, noted that by eliminating the COLA exemption loophole, TTB would be “remov[ing] the biggest impediment to the Texas wine industry’s growth.”

***

Notice 160 has caught the attention of industry members since it was first issued back in June, over 170 days ago, as more than 100 comments have been submitted to TTB on this matter. TTB will consider those comments as it comes to a decision on whether: (a) the COLA exemption loophole should continue to exist; and, (b) additional and truthful grape source information can be included on such wines in a way that does not undermine the AVA system for wine origin designation.

Wine industry members and consumers who believe that wine is a product of place and that place names are worthy of protection should support Notice 160. Although certain individuals may benefit financially from the COLA-exemption loophole, that is no reason for the federal government to allow an inherently misleading labeling practice to continue unabated. Moreover, elimination of the COLA-exemption loophole does not necessarily prohibit wineries from providing additional truthful, non-misleading information about grape sourcing. Any regulation that allows for such information, however, must also be crafted in a manner that maintains the integrity of the AVA regulatory system. The joint NVV / Wine Institute proposal does just that.

Furthermore, if the U.S. allows U.S. wineries to skirt the rules for proper use of American appellations and American Viticultural Areas, then the U.S. will be in no position to insist that other countries require that their wineries also follow the rules in respect of American appellations and American Viticultural Areas. Undoubtedly wine production is less costly in countries outside the U.S., and if wine grapes from Napa Valley can be shipped to Texas and the wine produced in Texas is allowed to use the “Napa Valley” AVA on the label, there is no basis to object to a Chinese or Canadian winery producing a “Napa Valley” wine from Napa Valley grapes shipped to those countries. Not only is that bad for the U.S. industry, but it diminishes the value of the AVA and harms all consumers.

NOTE – DP&F serves as outside counsel to several regional wine trade associations including Napa Valley Vintners with interests in protecting the integrity of regional appellations.

ABC Provides Guidance on Passport Events

On March 4, 2016, the California Department of Alcoholic Beverage Control (“ABC”) published an Industry Advisory providing guidance to licensees, marketing companies and winegrower associations participating in “passport” marketing events.

Most passport events have the same format – consumers purchase an identifiable event glass, wrist band, passport or punch card from a marketing company or winegrower association organizing the event, which provides the consumers access to various experiences and tastings at the premises of participating manufacturer licensees (beer, wine or spirits). The experiences and tastings are then provided to the consumers by the participating manufacturer licensees at their licensed premises to the extent such experiences and tastings are permitted under their existing licenses. So, for example, tastings by wineries, breweries and distilleries as part of such passport events are permissible, since such licensees have the right to conduct such tastings under their licenses (subject to restrictions set forth in the ABC Act). However, Type 17/20 licensees would not be able to provide tastings as part of any such passport event, since such licensees are not permitted to conduct consumer tastings.

While these events have been occurring for many years throughout California, ABC district offices throughout the state were dealing with licensing for these events in different and inconsistent ways (i.e., if a license was required at all, if one license could cover the whole event at all locations, if a separate license was required at each location, etc.). As such, ABC provided the Passport Event Guidelines which set forth the conditions under which these events can be held without a license.

In order for a marketing agency or a winegrower association to organize a Passport Event without obtaining its own ABC license(s) for the event, the Passport Event has to satisfy all of the following requirements:

- The marketing organization or winegrower association is only marketing the event which is actually put on by the participating manufacturers.

- The organization sells only access to the experiences or activities that the manufacturer licensee may lawfully provide free of charge to consumers (such as tastings).

- The manufacturer licensees involved are doing no more than providing tastes of wine, beer, or distilled spirits to participating consumers under the authority of their license (which allows such manufacturer licensee to give or sell such tastes).

- There is no commingling of funds or sharing of revenue between the marketing organization and manufacturer licensee (i.e., all proceeds for the sale of the passport go to the organization, and revenue from sales of alcoholic beverages to consumers separate and apart from the tastes given during the marketing event are not shared with the marketing organization).

Events that fall outside of these parameters will require a license for the marketing company (if a license is even possible under the ABC Act), or the nonprofit winegrower association. Thus, for example, Passport Events that include a gala dinner or tasting event where wines from multiple wineries are being poured at one location will require a temporary daily license held by the event organizer. Or, where the tickets being sold by the organization include alcohol (in excess of the “tastings” permitted at a licensed manufacturer’s premises under the ABC Act), a temporary daily license will be required. Note that because not all organizations are eligible for temporary daily licenses under the ABC Act (as such licenses are typically limited to nonprofit or other charitable organizations), event organizers should contact counsel or the ABC while organizing their event to determine if a license, if required, is even available to the event organizer.

For more information on licensing and other questions related to passport or other events at licensed premises, please contact Bahaneh Hobel, Partner in DP&F’s alcohol beverage law group, or Katy Barfield, Associate in DP&F’s alcohol beverage law group.

TTB Provides Guidance on Category Management Practices

On February 11th, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) issued a new ruling regarding the extent to which “category management” practices are permissible under federal tied-house laws.