Southern Glazer’s Class Action Settlement a Reminder to Comply with Maximum Late Payment Penalties on Retailers

A recent $5.5 million settlement payment from one of the country’s largest alcoholic beverage wholesalers serves as a good reminder that California law restricts the amount of late fees and interest that can be charged in connection with the purchase and sale of alcoholic beverages to retailers.

Cal. Bus. & Prof. Code § 25509 provides that various alcoholic beverage manufacturers and wholesalers who sell and deliver alcoholic beverages to a retailer and who did not receive payment for such alcoholic beverages within 42 days of delivery shall charge the retailer 1% of the unpaid balance on the 43rd day and an additional 1% for each 30 days thereafter.

In 2014, a Los Angeles-based retailer, Wiseman Park, LLC (“Wiseman”), brought an action against Southern Glazer’s Wine and Spirits, LLC (“Southern”) in connection with Southern’s attempt to collect not only the Section 25509 statutory late payment penalty, but also a 1% per month “carrying charge” included in the parties’ written agreement. Wiseman alleged that Southern’s imposition of the separate carrying charge violated Cal. Bus. & Prof. Code § 17200.

In 2021, the action was changed to a class action lawsuit so that other retailers subject to Southern’s carrying charge could join the lawsuit. In early 2024, the court preliminarily approved the parties’ proposed settlement agreement whereby Southern would make a $5.5 million payment to resolve the class action lawsuit, write off $44.1 million carrying charges yet to be paid by the retailers, and agree not to impose the carrying charge going forward. The deadline for retailers to opt out of, or object to, the class action was March 1, 2024. The final approval hearing for the settlement is scheduled for April 16, 2024.

Industry members should take this opportunity to review their agreements with retailers, and ensure any interest or penalties imposed on retailers do not exceed the statutory limits imposed by the ABC Act.

For assistance with this or any other Alcohol Beverage Law & Compliance or Wine Law matters, email Bahaneh Hobel, John Trinidad, or Alexander Mau.

Key Legal Updates All California Employers Should Know for 2024

Employment laws in California are always changing, and it is important for employers in California to keep up with these changes to ensure their policies and practices are compliant. This blog post provides key updates to the California employment laws that all employers should know for this year.

Minimum Wage Increase

Beginning January 1, 2024, the state minimum wage for all employers has been increased to $16.00 per hour. This rate reflects a 3.5% increase from this year’s minimum wage based on the law’s provision that allows this increase if the national Consumer Price Index (“CPI”) is over 7%. All employers must post the current minimum wage rate in a common area where employees can easily view it.

With this new rate of $16.00/hour, the minimum salary for exempt employees in 2024 has also increased to $66,560.00/year. Note that the minimum salary is tied to the state minimum wage rate, not individual municipalities.

Employers should also check if there is a higher minimum wage in any city or municipality where they have employees working (typically 2 hours/week is the minimum). For example, the minimum wage in Santa Rosa has increased to $17.45/hour.

Increase in Paid Sick Leave Amount to 5 Days

As of January 1, 2024, the amount of paid sick leave that must be provided to employees under the Healthy Workplaces, Healthy Families Act increased to five (5) days, or 40 hours, per year. Employers can still choose to either provide paid sick leave in a lump sum each year or allow employees to accrue paid sick leave based on hours worked.

The minimum accrual rate is still one (1) hour for every 30 hours worked. If paid sick leave is accrued, employees must now be allowed to accrue up to a cap of at least ten (10) days, or 80 hours. However, employers can limit employees’ actual use of accrued sick leave to five (5) days, or 40 hours per year.

Reproductive Loss Leave Required for All Employers with 5 or More Employees

Beginning January 1, 2024, private employers with five (5) or more employees are required to provide all employees who have worked for the employer for at least 30 days with five (5) days of unpaid, protected leave following a reproductive loss event, which includes a failed adoption, failed surrogacy, miscarriage, stillbirth or an unsuccessful assisted reproduction.

The five days of leave do not have to be taken consecutively but must be completed within three months of the reproductive loss event. This new leave is available for each qualifying reproductive loss event; however, employers have the right to limit the maximum amount of leave under the policy to no more than 20 days in a 12-month period.

Off-Duty Cannabis Use Added as a Protected Class Under FEHA

Starting January 1, 2024, off-duty cannabis use was added as a protected class under the state’s Fair Employment and Housing Act law (“FEHA”). The law specifically prohibits any adverse employment actions taken against an employee for off-duty cannabis use and prohibits an employer from drug screening for cannabis. Employers may still prohibit on-duty possession, impairment, or use. Additionally, the law does not apply to employees in the building or construction trades, or employees that work in positions that require federal background investigations or security clearance under federal law.

Non-Compete Agreements With Employees Still Prohibited in California

Under existing law in California, non-compete agreements with employees are and have been void and unenforceable. Nonetheless, the state has passed two new laws regarding post-employment non-compete agreements that both went into effect on January 1, 2024.

The first law confirms existing case law and voids all unlawful noncompete agreements contained in employment contracts. Under this law, employers are required to individually notify all current employees, and former employees who were hired after January 1, 2022, whose employment contracts include a noncompete clause or who were required to sign a noncompete agreement that such clauses or agreements are void. The notice must be given in writing by no later than February 14, 2024. The notice can be by email, but it must be an individualized communication to each employee or former employee.

The second law confirms that all noncompete agreements are void and unenforceable regardless of where and when the contract was signed. Even if the contract was signed in another state with an employee who was working outside of California, it cannot be enforced in California. The law also makes it a civil violation for employers to enter into or try to enforce unlawful noncompete agreements. Further, the law gives employees the right to bring a civil action against an employer that attempts to enforce an unlawful noncompete agreement, which allows the employee to seek damages and attorneys’ fees and costs in addition to injunctive relief.

New Presumption of Retaliation for Adverse Actions Taken Within 90 Days of Protected Activity

Starting January 1, 2024, if an employer takes any adverse action against an employee within 90 days of the employee engaging in so called “protected activity,” it will create a rebuttable presumption of retaliation under the law. An employer who violates this provision will be liable for a civil penalty of up to $10,000 per employee to be awarded to the employee(s) that was retaliated against. “Protected activity” is defined broadly and includes, among other things, employees who make an internal complaint about working conditions, wages, harassment, etc., an employee who files a suit or complaint with an agency against the company and an employee who testifies in a proceeding against the employer.

NLRB Decision in Stericyle Requires Employers to Review Their Handbook Policies

In 2023, the National Labor Relations Board (“NLRB”) issued a decision in Stericycle, Inc. and Teamsters Local 628 regarding workplace policies and the effect they have on employee rights under the National Labor Relations Act (the “NLRA”). The decision states that workplace policies cannot infringe on employees’ rights under the NLRA, either directly or indirectly. This includes policies that could discourage employees from engaging in protected activities under the NLRA. Employees’ rights under the NLRA, which are protected, include: the right to form or join unions, the right to engage in protected, concerted activities to address or improve working conditions and the right to refrain from engaging in these activities.

Employers should review their handbook policies and make sure they are drafted so that their policies do not “chill” employees’ exercise of their rights under the NLRA.

Additional Updates and Reminders

Updated Wage Theft Notice (Required for all Non-Exempt Employees Upon Hire)

The Notice to Employee required under Labor Code Section 2810.5 – also referred to as a “Wage Theft Notice” – has been updated for 2024. All employers are required to use the new form. You can access the revised Wage Theft Notice here.

Updated Harassment Poster

The California Civil Rights Department (CRD) has updated their “California Law Prohibits Workplace Discrimination and Harassment” poster. Employers are required to display this poster in a common area where employees can easily view it. You can access the new updated poster here.

IRS Mileage Reimbursement Rate Increase

Starting January 1, 2024, the Internal Revenue Service (IRS) has increased the standard mileage rate by 1.5 cents per mile for 2024 to 67 cents per mile.

Overtime Change for Small Agricultural Employers

For employers with 25 or fewer employees, the phase in for overtime rules for agricultural workers continues in 2024 with daily overtime for any hours worked in excess of 8.5 hours in a day and 45 hours in a week.

Workplace Violence Prevention Plan Required by July 1, 2024

Starting July 1, 2024, all employers are required to establish and maintain a workplace violence prevention plan as part of their Illness Injury Prevention Plan (“IIPP”), which will include maintaining a violence incident log and providing effective training on the workplace violence prevention plan. We will be doing a more detailed blog post on the requirements for the new plan in the Spring.

Employers should reach out to their workers’ compensation carrier for assistance with updating their IIPP accordingly.

*

For more information reach out to the DP&F Employment Law partners Jennifer E. Douglas and Marissa E. Buck.

COVID-19 Updates for California Employers

On January 9, 2024, the California Department of Health (CDPH) issued an order changing COVID-19 related definitions. These revisions apply to the Cal/OSHA Non-Emergency Regulations, which are still in place until February 3, 2025 and must be followed by all employers in California.

The questions and answers below reflect the updated rules and definitions that currently apply in the workplace. You can read more about the changes on Cal/OSHA’s FAQ page here, which is updated regularly.

COVID-19 Updates for California Employers as of January 2024

What is the current definition of the “infectious period” for employees who test positive for COVID-19?

For COVID-19 cases with symptoms, the “infectious period” is a minimum of 24 hours from the day of symptom onset. Under the current regulations, there is no infectious period for COVID-19 cases with no symptoms.

If an employee tests positive, are they required to be excluded from the workplace?

If an employee tests positive for COVID-19 and has symptoms, they must be excluded from the workplace for a minimum of 24 hours from the day of symptom onset.

Symptomatic COVID-19 cases may return to work after 24 hours if:

- 24 hours have passed with no fever, without the use of fever-reducing medications and;

- Symptoms are mild and improving.

If an employee tests positive for COVID-19 and is asymptomatic, there is no infectious period for the purpose of isolation or exclusion, which means they are not required to be excluded from the workplace. If symptoms develop, the above criteria will apply.

All employees who test positive for COVID-19 must wear a mask around others for 10 days from the date of the positive test or symptom onset.

Are employees allowed to come to the workplace if they had a “close contact” with someone with COVID-19?

Yes – employees do not have to be excluded from the workplace unless they test positive.

If employees have had a “close contact,” they are no longer required to test; however, the CDPH still recommends testing for:

- All people with new COVID-19 symptoms; and

- Close contacts who are at higher risk of severe disease or who have contact with people who are at higher risk of severe disease.

Are masks still required in the workplace?

Masks are only required in the workplace in the following situations:

- Employees who test positive for COVID-19 must wear a mask while around others for 10 days from the positive test or symptom onset;

- In an outbreak or major outbreak all employees in the exposed group must wear a mask; and

- If a local ordinance requires it, such as places like healthcare facilities and skilled nursing facilities.

Close contacts are no longer required to wear masks; however, it is still recommended that close contacts wear masks around others for 10 days following the last contact.

What is a “close contact”?

The regulation defines a “close contact” as sharing the same indoor airspace as a COVID-19 case for a cumulative total of 15 minutes or more over a 24-hour period during a COVID-19 case’s infectious period. Spaces that are separated by floor-to-ceiling walls (e.g., offices, suites, rooms, waiting areas, bathrooms, or break or eating areas that are separated by floor-to-ceiling walls) are considered distinct indoor airspaces.

What is the current definition of an “outbreak”?

The new outbreak definition requires at least three COVID-19 cases within an exposed group during a 7-day period (previously it was a 14-day period).

Is an employee paid if they test positive and are unable to work?

Possibly. The COVID supplemental paid sick leave program has expired. However, an employee may be eligible for compensation if they have accrued sick time and/or vacation time, or through disability insurance.

Note that the Workers’ Compensation Presumption expired on January 1, 2024, which means the presumption that an employee’s work-related COVID-19 illness is an occupational injury and eligible for workers’ compensation is no longer available.

Does an employer still need to send a notification to employees when there is a workplace exposure?

If an employer becomes aware of a potential COVID-19 exposure in the workplace, they are still obligated to notify all employees who may have had close contact with a COVID-19 case in the workplace. The notice must be in writing and must be provided within one business day of discovering the potential exposure.

Is an Employer still required to maintain a COVID Prevention Plan (CPP)?

Yes. To comply with the Non-Emergency Regulations, an employer must either develop a written COVID-19 Prevention Program or ensure its elements are included in an existing Injury and Illness Prevention Program (IIPP).

Does an employer still need to provide COVID-19 testing to employees?

Regardless of CDPH recommendations, employers must continue to make COVID-19 testing available at no cost and during paid time to all employees who had a close contact at work with a person with COVID-19 during their infectious period, except for asymptomatic employees who recently recovered from COVID-19.

In workplace outbreaks or major outbreaks, the COVID-19 regulations still require testing of all close contacts in outbreaks, and everyone in the exposed group in major outbreaks. Employees who refuse to test and have symptoms must be excluded for at least 24 hours from symptom onset and can return to work only when they have been fever-free for at least 24 hours without the use of fever-reducing medications, and symptoms are mild and improving.

For more information reach out to the DP&F Employment Law partners Jennifer E. Douglas and Marissa E. Buck.

Deadline Is October 1, 2023 To Apply for Continuation Under Napa County’s Winery Waste Discharge Program

DEADLINE IS OCTOBER 1, 2023 TO APPLY FOR CONTINUATION UNDER NAPA COUNTY’S WINERY WASTE DISCHARGE PROGRAM

The deadline to apply for Napa County’s Winery Waste Discharge Program was recently extended. For wineries currently enrolled in Napa County’s Winery Waste Discharge Program, the deadline to apply for continuation under the program is coming up on Sunday, October 1, 2023. Below is additional information on how to apply for continuation and additional information for wineries that are not currently enrolled in the program.

As California winery operators are likely aware, the new California Statewide General Waste Discharge Requirements for Winery Process Water Order requires compliance for most existing wineries beginning January 20, 2024. However, Napa County has arranged to continue its existing Winery Waste Discharge Program for an additional three years. If you have not yet applied for continuation, you can submit the application here (the application page still references the prior August 1, 2023 deadline).

More information can be found on the County’s website here.

Wineries that do not have current enrollment in the County’s program are NOT eligible for apply for this continuation and will be required to enroll in the new Statewide General Winery Discharge Program by January 20, 2024, which can be found here.

For more information or for assistance with enrollment in either of the above, please contact Josh Devore or Elena Neigher.

Deadline to Apply for Continuation Under Napa County’s Winery Waste Discharge Program

DEADLINE IS AUGUST 1, 2023 TO APPLY FOR CONTINUATION UNDER NAPA COUNTY’S WINERY WASTE DISCHARGE PROGRAM

As California winery operators are likely aware, the new California Statewide General Waste Discharge Requirements for Winery Process Water Order requires compliance for most existing wineries beginning January 20, 2024. However, Napa County has arranged to continue its existing Winery Waste Discharge Program for an additional three years. If your winery is currently enrolled in Napa County’s Winery Waste Discharge Program, the deadline to apply for continuation under the program is coming up on Tuesday, August 1, 2023. If you have not yet applied for continuation, you can submit the application here: Napa County Winery Waste Discharge Program Application.

More information can be found on the County’s website here: Winery Waste Discharge Requirements (WDRs).

Wineries that do not have current enrollment in the County’s program are NOT eligible for apply for this continuation and will be required to enroll in the new Statewide General Winery Discharge Program by January 20, 2024, which can be found here: General Waste Discharge Requirements for Winery Process Water.

For more information or for assistance with enrollment in either of the above, please contact Josh Devore.

TTB Approves San Luis Obispo Coast (SLO Coast) Viticultural Area

Last week was an exciting week for producers and consumers of California Central Coast wine. On Wednesday, March 9, the Alcohol and Tobacco Tax and Trade Bureau (the “TTB”) published a final rule establishing a new “San Luis Obispo Coast,” or “SLO Coast,” American Viticultural Area (“AVA”).

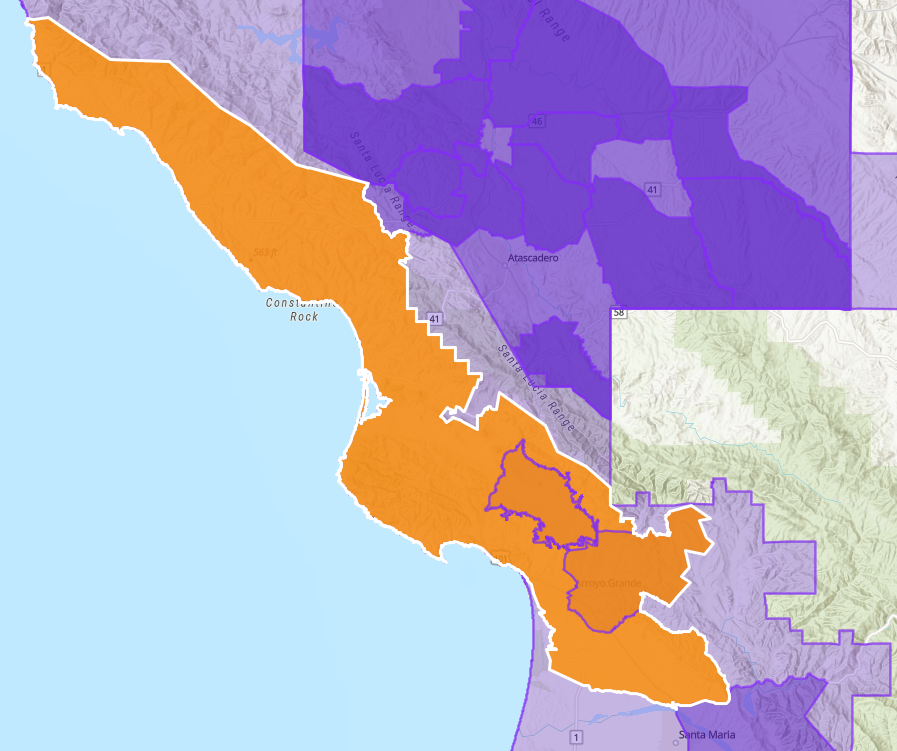

The SLO Coast AVA (identified in orange below) spans approximately 408,505 acres in San Luis Obispo County and is home to over 50 wineries and an estimated 78 commercial vineyards covering approximately 3,942 acres. It lies entirely within the multi-county Central Coast AVA and fully encompasses the established Edna Valley and Arroyo Grande Valley AVAs.

Map of “San Luis Obispo Coast” or “SLO Coast” AVA. Image: TTB.

Located along the westernmost portion of the Central Coast AVA, the SLO Coast AVA is a region of coastal terraces, foothills, and small valleys along the Pacific Coast. Its westward orientation provides more marine fog and cool marine air compared to other regions of the Central Coast AVA, using the powerhouse of the Pacific Ocean to moderate temperatures and foster optimal vineyard conditions for growing early-to-mid-season grape varietals such as Chardonnay and Pinot Noir.

Aaron Wines in Paso Robles, CA falls within the boundaries of the new SLO Coast AVA and has planted 90% of its 4,000 planted acres within 6 miles of the Pacific Ocean. Winemaker Aaron Jackson is thrilled by the important addition of the SLO Coast AVA to the “few truly coastal AVAs” in the state of California. Brian Talley of Talley Vineyards in Arroyo Grande, CA shares Mr. Jackson’s sentiments, adding that the approval of the SLO Coast AVA will “drive awareness of the coastal part of San Luis Obispo County as a world class winegrowing region.”

The establishment of the SLO Coast AVA formally recognizes the unique topography, climate, and soils of the area and offers winemakers more diversity and flexibility in marketing their wines to consumers.

Effective April 9, 2022, vintners will be able to label bottles with “San Luis Obispo Coast,” “SLO Coast,” and “Central Coast” as appellations of origin if at least 85% of the wine is derived from grapes grown within the boundaries of the SLO Coast AVA and the wine otherwise meets the statutory requirements of 27 CFR 4.25(e)(3). Vintners producing wine from grapes grown in the Edna Valley or Arroyo Grande Valley AVAs can also continue to label bottles with “Edna Valley” or “Arroyo Grande Valley” as appellations of origin for their wines.

Dickenson, Peatman & Fogarty has represented a number of AVA petitioners before the TTB, including the SLO Coast petitioners. For more information on AVA petitions and labeling compliance, please contact Carol Kingery Ritter or John Trinidad.

Regular Rate Blues: California Supreme Court’s Decision on Premium Payments and Other Pay Practice Reminders

On July 15, 2021, the California Supreme Court decided in Ferra v. Loews Hollywood Hotel, LLC that employers must pay premium payments to employees for missed meal, rest, and recovery breaks at the employee’s “regular rate of pay” instead of the employee’s base hourly rate, as many employers were doing. The ruling is retroactive, and employers should audit their practices to determine if a true-up payment is necessary.

Under California wage and hour laws, an employer must provide and permit nonexempt employees who work more than five hours in a day an unpaid duty-free meal period of at least 30 minutes in length starting no later than the end of the fifth hour of work. Employees who work no more than six hours in a day may waive the meal period upon written agreement between the company and the employee. In addition, nonexempt employees who work at least three and one-half hours in a day must be provided and permitted a paid 10-minute duty-free rest period for every four hours of work or major fraction thereof, and a second rest period if working up to six hours a day. Employees who work outdoors are entitled to cool-down recovery periods in fixed, shaded areas whenever needed to prevent heat illness.

If an employer doesn’t provide compliant meal, rest, or recovery periods, the employer must pay the employee one additional hour of pay as a “premium” for each workday that the meal, rest or recovery period was not provided. (Labor Code § 226.7.) Before the recent ruling, it was unclear whether this premium should be paid at the employee’s base hourly rate or their “regular rate of pay” which includes all nondiscretionary incentive payments such as bonuses and commissions. The Court settled this issue: the premium must be paid at the regular rate of pay, not the base rate. This is bad news for employers that acted in good faith by paying premium pay at the base hourly rate.

How To Calculate “Regular Rate of Pay”

Regular rate calculation requires employers to include all compensation for hours worked and divide that number by the total hours worked. “All compensation” includes hourly wages, nondiscretionary bonuses, shift differentials, on-call pay, and commissions. In general, most bonuses are considered nondiscretionary and include any bonus that employees know about and expect such as: production bonuses, bonuses for quality of work, bonuses to induce employees to work more efficiently, attendance bonuses, and safety bonuses. Thus, if nonexempt employees are paid a commission, non-discretionary bonus, or other incentive payment, such payment must be factored into the employees’ regular rate in order to compute any applicable overtime or break premium compensation.

Different Rule for Flat Sum Bonus: Note that California law requires the use of a different rule for calculating “regular rate of pay” when employees earn a non-discretionary, flat sum bonus. A flat sum bonus is typically a bonus paid for working a shift that is not tied to any measure of production or efficiency, for example a flat sum bonus for working on a weekend. When calculating the regular rate of pay from a flat sum bonus, the bonus is divided by only the regular, non-overtime hours worked in the workweek instead of all hours.

For examples showing regular rate calculations you can review the Labor Commissioner’s website here.

When To Use Regular Rate

The regular rate of pay is used when calculating overtime, California paid sick leave (see sick leave section below) and now meal and rest pay premiums.

Overtime “True Up” Calculations

If the employees’ bonus or commission is paid out on a weekly basis, the calculation is simple and the additional pay is added to all other wages earned in the workweek and then divided by the total hours worked in that workweek to come up with the regular rate. However, the majority of bonuses and commissions are not paid on a weekly basis and are more often earned and calculated on a monthly or quarterly basis.

If employees earn nondiscretionary bonuses or commissions on a monthly, quarterly, or other non-weekly basis, the amount of the bonus or commission earned must be spread out over the period it was earned by the employee for purposes of the overtime calculation. Employers must apportion the bonus or commission payments to each workweek during the period the amount was earned on a pro rata basis. Once that is done, employers must then recalculate any additional overtime amounts that may be owed over the period the bonus or commissions was earned, and “true up” the amount by paying the employee the difference.

The true up process for overtime or premium payments should be done whenever the bonus or commission payments are made to employees. Any additional overtime or premium amount owed to employees should be paid at the same time as the bonus or commission or in the following pay period. If you have questions regarding the method of calculating the regular rate or “truing up” payments, you should work with legal counsel to ensure employees are being compensated appropriately.

Paid Sick Leave Pay for Hourly Employees Is Also Regular Rate

An often-overlooked provision of California’s paid sick leave law is that the rate of pay for paid sick leave for hourly (non-exempt) employees is also the regular rate, not the straight hourly rate of employees. This is different than how an employer usually pays vacation or PTO time, so it can often slip by even the most seasoned of HR professionals and payroll personnel.

Nonexempt employees must be paid their regular non-overtime hourly rate for the amount of time taken as paid sick leave. To determine the rate of pay for nonexempt employees taking sick leave, the employer may either:

- Calculate the regular rate of pay for the workweek in which the employee used paid sick leave, whether or not they actually worked overtime in that workweek (see above; this is calculated like the “flat sum” bonus), or

- Divide your total compensation for the previous 90 days (excluding overtime premium pay) by the total number of non-overtime hours worked in the full pay periods of the prior 90 days of employment

For exempt employees, paid sick leave is calculated in the same manner the employer calculates wages for other forms of paid leave time (for example, vacation pay or PTO).

Take Away

This is a good time for employers to review their pay practices and contact their legal counsel to determine what, if any, corrections should be made. Because the ruling is retroactive, there may be an increase in litigation surrounding meal and rest breaks. It is important to be proactive in evaluating risk.

If you have any questions about this or any other employment related matters contact Sarah Hirschfeld-Sussman or anyone on the DP&F Employment Team.

ABC Launches New Online Portal for Mandatory Alcohol Beverage Server Training

The California Department of Alcoholic Beverage Control (ABC) has launched a new Responsible Beverage Service (RBS) portal to provide mandatory alcohol beverage service training and certification.

Under the Responsible Beverage Services Training Act, starting on July 1, 2022, all California licensees with on-premise consumption privileges (including bars, restaurants, and wineries, breweries, and distilleries with tasting rooms) must require all alcohol beverage servers and managers to attend responsible beverage service training. All servers and managers in licensees’ employment as of July 1, 2022, must attend this training and pass an online RBS exam by August 30, 2022. If any servers or managers were hired after July 1, 2022, then they must attend training and pass the RBS exam within 60 days after their hire date.

The ABC designed the RBS portal to be a one-stop shop for servers, managers, licensees, and RBS trainers and provides customized access based on user roles. Servers and managers can use the RBS portal to register as servers with the ABC, search for approved training providers, and, after completing training, take an alcohol server certification exam on the RBS portal. Licensees can soon use the RBS portal to confirm server certification and maintain online records. In addition, prospective RBS trainers who will provide training to servers on safe and responsible beverage service can submit their applications using the RBS portal.

The purpose of the mandatory training is to provide licensees, servers, and managers with tools and knowledge to promote responsible consumption and community safety and to reduce underage drinking, including by educating trainees on alcohol beverage control laws and on the impact of alcohol on the body.

All licensees with on-sale privileges should become familiar with the RBS portal and begin preparing their servers and managers to meet the training and certification deadlines above. Although the RBS training does not become mandatory until July 1, 2022, servers may use the RBS portal to search for RBS training providers and take the online certification exam now. There is no harm in fulfilling RBS training and certification requirements before July 1, 2022, so servers may want to register and complete their requirements on the RBS portal sooner rather than later. The RBS portal is available here. For any specific questions, please reach out to Bahaneh Hobel (Head of Alcohol Beverage Law) or Michael Mercurio (Law Clerk).