CA ABC Provides Additional Coronavirus Regulatory Relief; CA ABC and TTB Postpone Due Dates for Certain Payments and Filings

Over the past forty-eight hours, the California Department of Alcoholic Beverage Control (“CA ABC”) has provided additional regulatory relief to licensees, including information relevant to industry members engaged in fundraising in connection with Coronavirus-related charities. In addition, CA ABC and the Alcohol Tobacco Tax and Trade Bureau (”TTB”) announced that industry members will be permitted to delay certain payments and filings. We have summarized each of these notices below, but the full text of these notices can be accessed through the links below:

- CA ABC Second Notice of Regulatory Relief

- CA ABC Notice re Renewal Fees

- TTB Industry Circular re Postponement of Payments and Filings

1. CA ABC Second Notice of Regulatory Relief

CA ABC issued a Second Notice of Regulatory Relief on April 1, 2020 (the “Second Notice”) temporarily loosening it’s enforcement of certain regulations during the period that shelter-in-place restrictions are in place.. CA ABC had previously announced certain regulatory relief measures in its first Notice of Regulatory Relief (“First Notice”) on March 19, 2020 and we summarized that notice in this blog post.

Below is a summary of ABC’s Second April Notice.

FREE DELIVERY OF ALCOHOLIC BEVERAGES TEMPORARILY ALLOWED: ABC has temporarily provided licensees that can ship or deliver alcoholic beverages, whether pursuant to the ABC Act or pursuant to the First Notice, the right to deliver or ship to consumers for free, without violating Business and Professions Code Section 25600, which prohibits licensees from providing any “premium, gift, or free goods” in connection with the sale or marketing of alcoholic beverages.

DELIVERY HOURS OF ALCOHOL TO RETAILERS EXTENDED TO MIDNIGHT: Licensees (including manufacturers, winegrowers, and wholesalers) may now deliver alcoholic beverages to retailers between 12 AM and 8 PM (rather than starting at 3AM). The prohibition against Sunday deliveries remains in effect. Note that if a retail licensee has a condition on its license limiting the hours during which it may allow deliveries, such condition shall remain in full effect.

CERTAIN CHARITABLE PROMOTIONS RELATED TO SALES OF ALCOHOL: The CA ABC is relaxing its enforcement of restrictions on charitable promotions during this challenging time. Manufacturers, wholesalers, or other supplier-type licensees may advertise that a portion of the purchase price of the alcoholic beverages will be donated to a specified charitable organization related to Coronavirus-related relief, subject to the following limitations:

- The donation and promotion involve a bona fide charitable organization providing relief related to the COVID-19 pandemic;

- The promotion is in connection with the sale of sealed containers and does not encourage or promote the consumption of alcoholic beverages; and

- The donation and promotion do not identify, advertise, or otherwise promote or involve any retail licensee.

Any promotions under this provision must conclude no later than June 30, 2020. ABC has stated it will reassess this measure at that time and determine if it should be extended further.

ABC previously stated in its FAQs that donations to nonprofits benefiting restaurant and hospitality workers in general are permissible, so long as it is just a donation to an organization and does not identify or involve any quid pro quo with specific retailers. In addition, gifts or donations (such as meals or gift cards) may not be made directly to retailer employees.

DISTILLED SPIRITS MANUFACTURERS PROVIDING HIGH-PROOF SPIRITS FOR DISINFECTION PURPOSES: Licensed distilled spirits manufacturers (Type 04) and craft distillers (Type 74) may produce denatured high proof spirits if such distilled spirits are produced for use in accordance with guidance from the Food and Drug Administration, which may be found in the FDA’s Policy (PDF). Undenatured distilled spirits are not included in this relief as they are considered alcoholic beverages. Licensees may provide such distilled spirits for free to any person, including retail licensees, if they are not used to promote the manufacturer’s alcoholic beverage products and are not provided in exchange for an agreement to purchase anything produced or distributed by the manufacturer.

***

Licensees should note that all of the above changes are only temporary and ABC will provide the industry 10 days’ notice before these guidelines terminate. And although these provisions relax ABC’s enforcement of certain provisions of the ABC Act, the ABC did remind industry members that “[a]ll provisions of the Alcoholic Beverage Control Act, including …tied-house and trade practice restrictions, remain in effect and subject to enforcement unless the Department has provided express notice that specific provisions will not be enforced.”

As we noted in our earlier post, local regulations and restrictions may restrict the ability of licensees to engage in these activities, so you should always confirm that any activity in which you engage is permitted by local zoning or use permits.

2. CA ABC Grants 30 Day Grace Period for License Renewal Fees and Penalties

The CA ABC is providing licensees a 30 day grace-period for paying their annual renewal fees.

For Licensees who have previously missed their license renewal deadline and owe penalties as a result of failing to pay their renewal fee in a timely manner, the ABC is also granting a 30 day grace period.

The ABC has provided helpful tables in its notice that lay out the exact deadlines that have been extended and new due dates for license renewals.

3. TTB Postpones Tax Payment and Filing Deadlines

To help ease the burden on the alcohol beverage industry dealing with the impact of COVID-19 the TTB is postponing several filing and payment due dates for 90days where the original due date falls on or after March 1, 2020, through July 1, 2020. The TTB’s relief actions include:

- Postponing tax payment due dates for wine, beer, distilled spirits, tobacco products, cigarette papers and tubes, firearms, and ammunition excise taxes.

- Postponing filing due dates for excise tax returns.

- Postponing filing due dates for submission of operational reports.

- Postponing filing due dates for claims for credit or refund by producers.

- Postponing filing due dates for claims by manufacturers of non-beverage products.

- Postponing due dates for submission of export documentation.

- Considering emergency variations from regulatory requirements for affected businesses on a case-by-case basis.

- Reviewing requests for relief from penalties based on reasonable cause.

For a list of Coronavirus related resources, please see our Resources Page.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

TTB Allows Returns of Products Purchased for Events Cancelled due to CORONAVIRUS

Today, TTB announced that it would permit returns of alcoholic beverages that were originally purchased for events that have been canceled due to Coronavirus. As TTB stated: “Given the unexpected and widespread nature of the concerns involving COVID-19, TTB will not consider returns of alcohol beverage products purchased to sell during such cancelled events to violate federal consignment sales rules provided the products were not initially purchased or sold with the privilege of return.”

Federal regulations typically prohibit consignment sales, which they interpret broadly to include the sale or purchase of alcohol beverage products with the privilege of return. (27 CFR 11.21).Typically, returns for ordinary and usual commercial reasons are not permitted, but returns because a product is overstocked or slow-moving does not constitute a return for ordinary and commercial reasons and are prohibited. (27 CFR 11.45.)

Acknowledging that wholesalers and retailers likely had already purchased product for various events such as festivals, concerts and sporting events that have seen widespread cancellations in recent days, TTB has taken the position that returns resulting from these cancellations would be permitted.

Local officials and event organizers have begun announcing cancellations of widely-attended events, such as parades, festivals, fairs, concerts, and sporting events based on concerns about COVID-19. These announcements may be made after wholesalers and retailers purchased large quantities of products to sell during.

Note that returns of alcoholic beverages to retailers would still be considered consignment sales under California law and we are working with California ABC to understand their position on such returns given the mass cancellations of events and gatherings.

For more information about how to address the return of alcoholic beverage products, please contact Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

New Wine Excise Tax Credit Raises Questions

While many in the industry have celebrated the passage of the Craft Beverage Modernization and Tax Reform components of the Tax Cuts and Jobs Act of 2017, there are a lot of lingering questions about how TTB will interpret these new laws.

Many wineries, for capacity reasons or otherwise, have wine made at a facility other than their own bonded winery. Up through December 31, 2017, such wine was eligible for a small producer tax credit because the law stated that the credit was available for wine “produced at qualified facilities in the United States” provided that other prerequisites were met. 26 U.S.C. Sec. 5041(c)(1). TTB interpreted this statute in a manner that allowed a small winery to apply a tax credit on wine produced for it at another bonded winery, so long as that wine was transferred in bond to the small producer and removed from that bonded facility.

Under the new law, wines “which are produced by the producer” and removed from bond in 2018 and 2019 are eligible for a tax credit. 26 U.S.C. Sec. 5041(c)(8)(A). It is unclear if, in drafting the law in this manner, Congress intended to prohibit a winery from claiming a tax credit on wines produced for it at another winery. To date, TTB has not issued any guidance on this front.

In short, if you are a winery that has some wine made at a winery other than your bonded premise, that wine may not be eligible for a tax credit under the new law, though further action from TTB is needed to say so conclusively. We’ll be sure to keep our readers informed of any developments.

NOTE – Hat tip goes to Liz Holtzclaw of Holtzclaw Compliance, who raised this issue in a comment on the WineBusiness.com website!

TTB and County of Napa Info for Businesses Affected by Wildfires

Our hearts go out to our friends and neighbors who are dealing with damage and destruction caused by the California fires. Although there are certainly more pressing concerns, we wanted to provide some information that may prove useful in the days and weeks ahead.

TTB Information

The U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) announced that it will waive late filing, payment, or deposit penalties for those impacted by the California wildfires on a case-by-case basis. This waiver is available to taxpayers with businesses located in, or whose records are stored in, areas declared as Major Disaster areas, which includes Mendocino, Napa, and Sonoma Counties. Please go to the TTB website for additional information: https://www.ttb.gov/announcements/waiver-excise-tax-penalties-businesses-affected-california-wildfires.shtml

Also, in 2015, TTB issued guidance for wineries impacted by wildfires which has helpful information on (1) reporting losses at bonded premises, (2) filing claims for refund or credit of federal excise tax on wine lost in a wildfire; (3) handling untaxpaid wine damaged during a wildfire; and (4) moving wine in bond to another bonded wine facility for temporary storage. We have been in touch with TTB, and the Bureau may be issuing an updated version of this prior guidance in response to the current wildfires. We will be sure to let you know if so.

Napa County Agricultural Commissioner Office

For those of you in Napa County that are looking to conduct harvest or other agricultural activities in areas that have been evacuated or wherein access is restricted, please be advised that the County has established a protocol for approving requests for access to engage in such activities. That protocol can be found through the Ag Commissioner’s website and Facebook page. The initial protocol was issued on Saturday evening, and revised on Sunday evening, so we encourage you to revisit the Commissioner’s Facebook page for any updates.

Also, the Ag Commissioner’s notice states: “According to CalFire officials, grapes that have been contacted by flame retardant are not safe for humans and should not be harvested.” We asked the Ag Commissioner’s office how growers are supposed to determine that their grapes have been in contact with fire retardants. They responded that the retardants are a very noticeable bright pink / red color, and that it should be evident even after flaking off of the grapes.

Other Resources

Finally, the Napa Valley Vintners, Sonoma Valley Vintners and Growers, and the Wine Institute have created pages with some very helpful information for wineries in wildfire affected areas. Those links are below.

- Napa Valley Vintners 2017 Fires Resources

- Sonoma Valley Vintners and Growers 2017 Fire Resources

- Wine Institute Wildfire Resources

If you have any questions regarding the above topics, please contact John Trinidad at [email protected].

TTB Issues Guidance for Cider Producers

On May 17, 2017, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) issued additional guidance for cider producers on federal excise tax, labeling and formula requirements through Industry Circular 2017-2 (“Amendments to the Criteria for the Hard Cider Tax Rate and Information on Other Requirements that Apply to Wine that is Eligible for the Hard Cider Tax Rate”).

This guidance explains in detail the modified criteria for the hard cider tax rate described in our previous blog post, “Federal Rule Changes Make More Products Eligible for (Lower) Hard Cider Tax Rate.” Of particular note, the guidance makes clear that some effervescent ciders may now be eligible for the small producer tax credit even though wines classified as “champagne and sparkling wines” are not eligible.

The criteria set forth under the temporary rule have not changed; rather, TTB is providing this additional information to assist industry members in understanding how existing requirements may apply to their cider or perry products. If you have any questions about this modified definition of “hard cider” and the potential tax benefits for your business, please contact Katy Stambaugh via email or by phone at (707) 252-7122.

Federal Rule Changes Make More Products Eligible for (Lower) Hard Cider Tax Rate

The start of the New Year brought federal tax relief to certain cider producers. The PATH Act of 2015 made various changes to the Internal Revenue Code, which took effect on January 1, 2017. Included in the changes was a modification of the definition of products eligible for the “hard cider” tax rate. Under the new rule, more hard cider products can qualify for this tax rate and enjoy a much lower rate per gallon than the rates that might otherwise apply.

In order to meet the “hard cider” definition and be eligible for the lower tax rate, the product in question must meet certain criteria related to carbonation, alcohol content and contents. The modified definition of “hard cider” under the PATH Act allows for an increased carbonation level (up to 0.64 grams of carbon dioxide/100 milliliters versus the previous 0.392 grams/100 milliliters), increased alcohol by volume (up to 8.5% versus the prevision limit of 7%) and the use of pear and pear concentrates, rather than just apple and apple concentrates. Similar to the previous definition, the product may not contain any fruit product or flavoring other than apple or pear.

If a hard cider product does not meet the foregoing criteria, it will be taxed as a wine, for which there are various classifications and corresponding tax rates. For example, a hard cider that contains more than 0.64 grams of carbon dioxide/100 milliliters is considered an effervescent wine and will be taxed as either a sparkling wine or artificially carbonated wine (depending on the source of the carbon dioxide). The producer would pay $3.40/wine gallon if the product is classified as “sparkling wine” or $3.30/wine gallon if the product is classified as an “artificially carbonated wine.” If, however, the product qualified as a “hard cider,” the applicable tax rate would be only $0.226/wine gallon.

On January 23, 2017, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) published a temporary rule to implement these changes to the definition of “hard cider” under the Internal Revenue Code. TTB is also imposing a new labeling requirement which requires the statement “Tax Class 5041(b)(6)” on any container of wine for which the hard cider tax is claimed. TTB is providing a one year grace period for this rule, but products removed after January 1, 2018 must include the statement “Tax Class 5041(b)(6)” in conjunction with the designation of the product as “hard cider.” This statement may appear anywhere on the label.

TTB is currently soliciting comments on the temporary rule within Docket No. TTB– 2016–0014 on the regulations.gov website. If you have any questions about this modified definition of “hard cider” and the potential tax benefits for your business, please contact Katy Stambaugh via email or (707) 261-700.

TTB ISSUES GUIDANCE ON ELIMINATION OF BOND REQUIREMENTS FOR SMALL PRODUCERS

As we discussed in our earlier blog post, as of January 1, 2017, TTB-licensed breweries, distilled spirits plants and wineries that owed less than $50,000 in excise taxes in 2016, and expect to owe less than $50,000 in 2017, will no longer be required to hold a bond. TTB started off the new year by issuing some additional guidance regarding the elimination of the bonding requirement for such producers. You can find the industry circular at this link.

Please note: if you are an existing, licensed, and bonded producer and you feel you are eligible for the bond exemption, TTB will not begin processing your request until it has received your final tax payments for 2016 excise taxes.

Don’t Forget – Starting January 1, Eligible Licensees Can Amend TTB Permits To Eliminate Bonds

As of January 1, 2017, if you are currently licensed with TTB as a brewery, distilled spirits plant or winery and owed less than $50,000 in excise taxes in 2016, and expect to owe less than $50,000 in 2017, you will no longer be required to hold a bond. This is great news for all the small producers out there!

This change, however, does not take place automatically and requires an amendment to your existing TTB permits. As such, after January 1, 2017, if you owed less than $50,000 in excise taxes in 2016 and expect to owe less than $50,000 in excise taxes, you will be able to amend your TTB permits to request exemption from the bond requirements. This amendment can be done online for any licensees that obtained their permits through Permits Online or on paper for any licensees that originally obtained their permits with paper applications.

Note that the bond exemption is applied a bit differently with respect to new permit applicants. Any new applications to operate breweries/brewpubs, distilled spirits plants, or wineries submitted to TTB before January 1, 2017 are still required to include a bond, even if the applicant expects to be eligible for the bond exemption. TTB will review the application and return any bond-related materials if they grant the bond exemption.

Applications submitted after January 1, 2017 for eligible small producers (i.e., those who do not expect to owe less than $50,000 in excise taxes in 2017) will not require a bond.

For further information or for assistance amending your TTB permits, please contact Bahaneh Hobel.

Protecting Wine Origins is Pro-Consumer and Pro-Industry

TTB’s attempt to put an end to an inherently misleading labeling practice and protect the AVA wine origin labeling rules has garnered significant reaction from certain commentators and some in the industry. In order to shed some light on the proposed amendments to federal labeling rules and why Napa Valley Vintners, the Wine Institute, over 50 members of Congress and others have supported TTB’s Notice of Proposed Rulemaking 160, we have prepared the following summary.

I. Current regulations allow certain wineries to employ misleading labeling practices.

Producers selling wine in interstate commerce must obtain a Certificate of Label Approval (“COLA”) and comply with federal regulations aimed at protecting consumers from misleading labeling practices. This includes federal standards for using vintage date, grape variety designations, and wine origin designations such as county, state, and country appellations and American Viticultural Areas (“AVAs”).

Wineries wishing to avoid enforcement of these federal truth-in-labeling standards can do so simply by filing for a COLA exemption and noting on the wine bottle that the wine is “For Sale Only” in the state in which the producing winery is located. This leads to the potential for misleading wine labeling practices. For example, federal regulations require that an AVA wine sold in interstate commerce with a 2015 vintage date must be made from at least 95% grapes grown in that vintage. But those regulations do not apply, and therefore would not prevent, a wine with a certificate of label approval exemption from using a lower percentage of 2015 harvested grapes and still being labeled as “2015.” Wines with certificates of label approval can be labeled with a varietal name, such as Pinot Noir, if it is made from at least 75% of grapes of that variety, but get an exemption and slap on a “For Sale Only” sticker, and then there is no obligation under federal regulations that the wine meet that 75% requirement.

Certain wineries have taken advantage of this COLA exemption loophole to designate their wine with an AVA while not complying with federal standards governing wine origin labeling, specifically, 27 C.F.R. Sec. 4.25 which requires that wine labeled with an AVA (a) be derived 85 percent or more from grapes grown within the boundaries of that AVA, and (b) be fully finished within the state in which the AVA is located. This “fully finished” federal requirement ensures that California wine production and labeling laws apply to wines that are identified with a California appellation or AVA.

These federal appellation labeling rules assure consumers that when they buy an appellation-designated wine, they are buying a product wherein both the grape source and the place of production are closely tied to the named place. Absent such rules, retail shelves could be stocked with wine labeled as “Burgundy” that was made in Sweden, “Barolo” that was actually produced in Slovenia, or “Sonoma Coast” made in Alaska.

II. TTB’s Notice 160 Proposes to Close the Loophole By Requiring All Wines to Follow the Same Vintage, Variety, and Appellation Labeling Standards.

In September 2015, 51 members of Congress wrote to TTB with a fairly simple request: “ensure that all wines bearing AVA terms—regardless of where they are sold—meet the clear and understandable American Viticultural Area rules.”

On June 22, 2016, the U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) responded by issuing Notice of Proposed Rulemaking 160, in which the agency proposed eliminating the COLA-exemption loophole by requiring COLA-exempt wines to comply with federal standards for vintage, varietal, and wine origin designations and to keep records to support such labeling claims. TTB subsequently granted a 90-day extension on September 8, 2016 and, in so doing, requested “comments regarding whether any geographic reference to the source of the grapes used in the wine could be included on a wine label in a way that would not be misleading with regard to the source of the wine” (emphasis added).

III. NVV and Wine Institute Support Notice 160 to Put an End to Misleading Labeling Practices.

Napa Valley Vintners (NVV), a non-profit trade association with over 500 members and our client, issued a comment letter supporting Notice 160, pointing out that the COLA exemption loophole was being used to mislead consumers and allow COLA-exempt wines to “unfairly benefit from the goodwill and brand recognition of appellation names without having to comply with the appellation regulations.”

NVV also pointed out that out-of-state wineries passing off their products as California wines by using the names of California appellations on their wine labels were able to avoid compliance with state laws regarding wine production and labeling. For example, wines produced outside of California but labeled with the name of a California AVA have no obligation to follow the state’s conjunctive labeling, wine composition and production, or misleading brand name statutes.

Similarly, wines produced outside of Oregon but using the name of an Oregon AVA, would have no requirement to follow the much stricter Oregon varietal composition (requiring at least 90% for most varieties) and appellation of origin (requiring 100% from Oregon and 95% for all other appellations). As David Adelsheim, founder of Oregon’s Adelsheim Vineyard, pointed out in his support of Notice 160, “the reputation of Oregon’s AVAs, hard won through years of experimentation and work” would suffer as a result of allowing COLA exempt wines to avoid enforcement of state wine-related laws.

After significant consultation, Napa Valley Vintners (NVV) and Wine Institute, a public policy advocacy association representing over a thousand California wineries and affiliated businesses responsible for 85 percent of the nation’s wine production and more than 90 percent of U.S. wine exports, issued a joint letter in further support of Notice 160, noting that the proposed amendments “put an end to the inherently misleading practice of using a Certificate of Label Approval … exemption to avoid compliance with federal labeling laws.” Sonoma County Vintners also issued a letter in full support of the NVV and Wine Institute position.

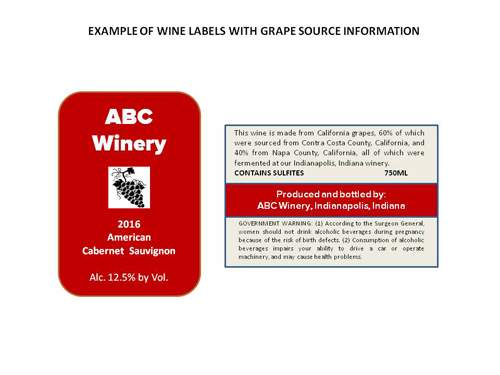

IV. NVV and Wine Institute Put Forward a Proposal that Allows For Optional Grape Source Information for COLA Exempt Wines.

In their joint letter, NVV and Wine Institute directly respond to TTB’s request for information as to whether grape source information could be included on COLA-exempt wines in a manner that was not misleading as to wine origin designations. The joint proposal directly addresses concerns that Notice 160 would prevent producers from providing consumers with truthful information regarding where the grapes used to make the wine came from, and at the same time protects AVA names as designators of wine origin. It also addresses concerns raised by wineries that had previously used COLA exemptions suggesting that they could continue to label their wine with truthful vintage and variety designations..

The NVV / Wine Institute proposal permits wineries to provide the following “Grape Source Information” on their wine: (a) the name of the county(-ies) and state(s), or just the state(s), where all of the grapes are grown; (b) the percentage of the wine derived from grapes grown in each county or state shown on the label; and (c) the city and state, or just the state, where the wine was fully finished. In order to avoid any confusion with wine origin designations, no name of an AVA (other than a county or a state) could be used as part of the Grape Source Information, and the wine itself would have to be designated using the “American” appellation. By using the American Appellation, (under current Federal regulations), the wine could also be designated with the vintage and grape varietal.

In short, NVV and Wine Institute are in favor of truthful labeling practices that protect the integrity of the AVA system. The goal of the joint proposal is simple: when consumers come across a wine labeled with an AVA name, they should be assured that the wine actually meets the legal standards for AVA labeling.

V. Support for Notice 160 comes from Industry Members That Believe Protecting Wine Origin Labeling is both Pro-Consumer, Pro-Grower, and Pro-Vintner.

Notice 160 is supported by a broad swath of industry members that believe the integrity of wine origin labeling regulations is essential to the U.S. wine industry. Regional associations (including the New York Wine Industry Association and Washington Wine Institute) and industry members from well-established as well as up-and-coming wine growing regions have written to TTB to note their support for the proposed amendments.

For example, Andy Beckstoffer, a noted grape grower with vineyards in Napa Valley as well as the Red Hills Lake County AVA wrote TTB to voice approval of Notice 160, stating:

It is vitally important to grape growers that the integrity of the AVA system be maintained, and I applaud TTB’s efforts in ensuring that all wine labeled with the name of an AVA meet the well-established federal wine labeling requirements. Grape growers, whether they farm vineyards in well established AVAs or in newer AVAs, benefit greatly from regulatory efforts to protect those place names.

This sentiment was shared by the High Plains Winegrowers Association, a group of winegrowers and vintners from the Texas High Plains AVA. They feared that the current COLA exemption loophole “is detrimental to Texas wineries that support locally grown wine grapes,” and further concluded that “[f]ailing to uniformly treat the labeling of all wine—whether distributed in-state or in interstate commerce—results in inequitable treatment within the same industry.” Douglas Lewis, a Texas Winemaker, also supports Notice 160 because it “helps consumers get more accurate information [about wine origin] by closing the loop hole.” And Andrew Chalk, a Dallas based wine writer, noted that by eliminating the COLA exemption loophole, TTB would be “remov[ing] the biggest impediment to the Texas wine industry’s growth.”

***

Notice 160 has caught the attention of industry members since it was first issued back in June, over 170 days ago, as more than 100 comments have been submitted to TTB on this matter. TTB will consider those comments as it comes to a decision on whether: (a) the COLA exemption loophole should continue to exist; and, (b) additional and truthful grape source information can be included on such wines in a way that does not undermine the AVA system for wine origin designation.

Wine industry members and consumers who believe that wine is a product of place and that place names are worthy of protection should support Notice 160. Although certain individuals may benefit financially from the COLA-exemption loophole, that is no reason for the federal government to allow an inherently misleading labeling practice to continue unabated. Moreover, elimination of the COLA-exemption loophole does not necessarily prohibit wineries from providing additional truthful, non-misleading information about grape sourcing. Any regulation that allows for such information, however, must also be crafted in a manner that maintains the integrity of the AVA regulatory system. The joint NVV / Wine Institute proposal does just that.

Furthermore, if the U.S. allows U.S. wineries to skirt the rules for proper use of American appellations and American Viticultural Areas, then the U.S. will be in no position to insist that other countries require that their wineries also follow the rules in respect of American appellations and American Viticultural Areas. Undoubtedly wine production is less costly in countries outside the U.S., and if wine grapes from Napa Valley can be shipped to Texas and the wine produced in Texas is allowed to use the “Napa Valley” AVA on the label, there is no basis to object to a Chinese or Canadian winery producing a “Napa Valley” wine from Napa Valley grapes shipped to those countries. Not only is that bad for the U.S. industry, but it diminishes the value of the AVA and harms all consumers.

NOTE – DP&F serves as outside counsel to several regional wine trade associations including Napa Valley Vintners with interests in protecting the integrity of regional appellations.

TTB Proposes to Shut Down COLA Exemption Appellation Labeling Loophole

The U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) has proposed amendments to federal wine labeling laws that protect the integrity of the appellation of origin labeling system in its Notice of Proposed Rulemaking No. 160 (NPRM 160). If adopted, the proposed amendments would close off a loophole that allows certain wines to be labeled with the name of an appellation of origin, including the name of an American Viticultural Area (AVA), even though those wines do not meet the strict legal requirements for appellation labeling.

A winery wishing to sell AVA-labeled wines in interstate commerce must meet strict criteria. Specifically, not less than 85 percent of the wine must be derived from grapes grown in the AVA and the wine needs to be fully finished in the state (or in the case of a multi-state AVA, in one of the states) in which the AVA is located. 27 C.F.R. §4.25(e)(3)(iv). The second prong of this test ensures that wines that carry an AVA name also comply with the laws of the state in which the AVA is located regarding wine production, composition and labeling – laws that state legislatures adopted in order to protect and promote their local wine growing regions.

However, under the current system, wineries that choose to sell wine solely within their home state can apply for a Certificate of Label Approval (COLA) exemption for that wine, and benefits from the use of an appellation name to market their wine without having to comply with the federal and state requirements mentioned above. TTB’s proposed rule would eliminate this loophole and thereby create a uniform system for the use of appellations of origin and AVAs on wine labels.

By creating one set of rules that all wineries must follow in labeling wines with appellation names, the proposed amendment not only prevents unfair competition among wineries, but also protects against consumer confusion. Let’s say an Indiana consumer comes across a wine labeled with the Napa Valley AVA, produced and by an Indiana winery and sold in Indiana pursuant to a COLA exemption. Because the wine is marketed and sold under the Napa Valley AVA, the consumer is led to believe that the wine meets all the criteria necessary for the use of the Napa Valley AVA. But that’s not the case. That wine, even if made from 85% Napa Valley grapes, was not fully finished in California, which is a requirement for use of the Napa Valley AVA, and it was not subject to California’s production, composition, and labeling laws. TTB’s proposed amendments would ensure that when consumers are evaluating wines carrying a certain AVA name, they are assured that those wines have all met the same standard.

Furthermore, the proposed rule protects the significant investment states have made in promoting and regulating the use of their regional wine appellations which provide significant financial contributions to their state economies. If the TTB were to continue to allow wineries in other states to use appellations in disregard of the TTB rules and flout the rules of the states in which the appellations are located, the U.S. would have very little recourse in objecting to the foreign use of those same appellations if the grapes were shipped to other countries and the wine produced overseas. Surely the U.S. wine industry does not wish to see a wine labeled with the name of a U.S. AVA or appellation produced in China or Australia and shipped throughout the world in direct competition with such same domestically produced wines. Such a result would severely undermine the integrity and “brand value” of U.S. AVAs and appellations of origin around the world and impair the ability of U.S. wineries to compete in the global wine market.

The adoption of regulations aimed at closing off a loophole will invariably have an impact on those that have relied on the existence of that loophole as part of their business plan. But that alone is not sufficient to reject reforms needed to create a uniform standard and protect against potential consumer confusion. The AVA system has been a fundamental component of the growth of the U.S. wine industry, and TTB’s proposed amendments are necessary to protect the integrity of that system.

NOTE – DP&F serves as outside counsel to several regional wine trade associations with interests in protecting the integrity of regional appellations

TTB Provides Guidance on Category Management Practices

On February 11th, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) issued a new ruling regarding the extent to which “category management” practices are permissible under federal tied-house laws.

The “tied-house” laws promulgated under the Federal Alcohol Administration Act (the “FAA Act”) generally prohibit industry members from giving “things of value” such as supplies, money, or services to a retailer to induce the retailer to purchase their products to the exclusion of others. In 1995, TTB adopted an exception to these tied house prohibitions (27 CFR Sec. 6.99(b)) allowing industry members to stock, rotate and affix prices to their products at a retail account, provided that the products of other industry members are not altered or disturbed. The exception also states that the provision of a shelf schematic or plan by the supplier to the retailer does not constitute “a means to induce” within the meaning of the FAA Act.

Over the past few years, suppliers and retailers have engaged in certain practices commonly referred to as “category management” which are aimed at optimizing the assortment, price, shelf presentation and promotion of particular “category” of products found at a retail location. Recently, industry members asked TTB to clarify its position with respect to the scope of the Sec. 6.99(b) exception to federal tied house laws to determine if such category management practices by alcohol beverage industry members fall under the exception.

In its ruling, the TTB took a very narrow reading of that exception. Unsurprisingly, TTB held that furnishing retailers with a shelf plan or shelf schematic, as stated unambiguously in the exception, is permissible and in and of itself not an inducement. However, additional services provided by suppliers to retailers beyond the mere provision of the shelf plan or schematic exceed the bounds of the exception and may constitute a tied house violation if the practice results in the exclusion of competitor products. Practices that may result in TTB scrutiny include, but are not limited to:

- Assuming, in whole or in part, a retailer’s purchasing or pricing decisions, or shelf stocking decisions involving a competitor’s products;

- Receiving and analyzing, on behalf of a retailer, confidential and/or proprietary competitor information;

- Furnishing to the retailer items of value, including market data from third party vendors;

- Providing follow-up services to monitor and revise a shelf schematic where such activity involves an agent or representative of the industry member communicating (on behalf of the retailer) with the retailer’s stores, vendors, representatives, wholesalers, and suppliers concerning daily operational matters (such as store resets, add and delete item lists, advertisements and provisions);

- Furnishing a retailer with human resources to perform merchandising or other functions, with the exception of stocking, rotation or pricing services of the industry member’s own product.

As noted above, in order to find that a federal tied house violation had occurred with respect to such “category management” practices, the agency would have to find that the practice in question had the effect of excluding a competitor’s product.

For more information, see TTB’s ruling here or contact one of the attorneys in our alcohol beverage department: Bahaneh Hobel, John Trinidad, and Katy Barfield.

Small Producer Tax Credit Pitfalls: The K Vintners Case

When is a small producer not a small producer? That was the question answered by a federal district court in a case that centered on a winery’s ability to claim a small producer tax credit for wine produced at another winery (K Vintners v. U.S., Case No. 12-cv-05128-TOR (E.D. Wa. Jan 21, 2015)).

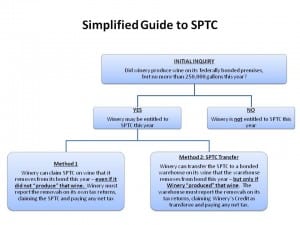

Background on the Small Producer Tax Credit.

Under federal law, domestic wineries producing 250,000 gallons of wine or less per year (“small producers”) are entitled to a tax credit of up to $0.90 per gallon for the first 100,000 gallons of non-sparkling wine removed from bond and “produced at qualified facilities” and a reduced credit thereafter (26 U.S.C. Sec. 5041(c)). This is popularly referred to as the “small producer tax credit,” what I’ll refer to as the SPTC.

There are two methods by which a small producer can take advantage of the SPTC for wine that was produced at its own facility. First, the winery can claim the SPTC on wine that it removes from its own bond by reporting the removal on its tax return, claiming the SPTC, and paying the net tax. Alternatively, the producer can transfer wine it produced at its own facility in bond to a bonded warehouse, and transfer the SPTC to the bonded warehouse for eligible wine. In this scenario, the warehouse reports the removal on its tax return, claims the winery’s SPTC as transferee, and pays the net tax.

The SPTC can also apply to wines that were not made at small producer’s bonded winery, but only if that wine is transferred in bond from the producing winery to the small producer’s facility and removed from bond by the small producer so long as the small producer actually produces some wine at its facility that year.

The K Vintners Case: SPTC does not apply to wine produced at another winery on behalf of a small producer and transferred directly to a bonded cellar is not eligible for SPTC.

But what happens when the small producer has wine made at a different facility, and instead of transferring that wine to its own bonded premises, decides to have the wine transferred directly to a bonded warehouse? Is that wine eligible for the SPTC?

That was the issue that one Washington winery, K Vintners, faced a few years back. From 2005-2008, K Vintners produced wine each year at its bonded facility and also purchased bulk wine from two other wineries, Hogue Cellars and Wahluke Slope Vineyards. Hogue and Wahluke fermented, blended, and bottled wine for K Vintners (referred to hereafter as the “Hogue/Wahluke Wine”), then transferred the bottled wine directly to Tiger Mountain, a bonded cellar contracted by K Vintners. K Vintners then sold the wine its own tradenames. Pursuant to the K Vintners-Tiger Mountain contract, Tiger Mountain paid claimed K-Vintners’ SPTC on the wine transferred from Hogue/Wahluke and paid the net excise taxes on those wines when removed from bond, and K Vintners reimbursed the bonded cellar for any excise taxes it incurred.

TTB conducted an audit in 2007 and determined that the SPTC could not apply to the Hogue/Wahluke Wine because the wine in question was not produced at K Vintner’s bonded facility. TTB ordered Tiger Mountain to pay $327,496.83 in unpaid taxes and an additional $126,580.05 in late-payment penalties. TTB acknowledged that if the Hogue/Wahluke Wines had been shipped in bond from the producing wineries to K Vintner’s bonded premises, and then removed from bond by K Vintners, then K Vintners could have claimed the credit on its own behalf (provided that K Vintners produced some wine at its own facility in each of those years).

K Vintners and Tiger Mountain paid the amount under protest, raised administrative claims that were subsequently denied by TTB, and eventually filed suit to seek a refund of these tax payments. K Vintners argued, in part, that the wine was eligible for the SPTC because even though it was made at the Hogue/Wahluke facilities, K Vintners had significant control and oversight through its contractual arrangement with those wineries that in essence, K Vintners “produced” the wine, and therefore the wine was eligible for the SPTC.

The federal district court in the Eastern District of Washington sided with TTB, concluded that such wines were produced at the winery where they went through fermentation (Hogue/Wahluke) and therefore were not eligible for the SPTC when removed from Tiger Mountain’s bond. The end result: K Vintners would not see any refund of the nearly half million dollars worth of unexpected taxes and penalties it incurred as a result of its misapplication of the small producer tax credit.

Can a small producer claim the SPTC for wine produced at a winery that produces more than 250K gallons of wine?

One curious comment in the court’s decision (mere dicta, for those of you with legal experience) is worth exploring in more detail. The court took a close look at the regulatory language authorizing the SPTC, and noted that the SPTC was only available for “wine produced at qualified facilities in the United States.” Under the court’s interpretation, this means that a small producer could only claim the SPTC on wine it purchased from another winery if that winery was also “qualified” as a small producer. This directly contradicted statements in TTB’s court filings in which TTB stated that K Vintners could have applied the small producer tax credit to the Hogue/Wahluke Wine if the wine had been directly transferred in bond to, and subsequently removed from bond by, K Vintners.

We reached out to TTB to determine if, in light of this language in the court’s decision, TTB would be making any changes to its interpretation or enforcement of the small producer tax credit. TTB affirmed that it still interprets 26 USC Sec 5041(c)(1) to allow an eligible small producer to purchase wine from another winery — whether or not that selling winery is itself eligible as a “small producer” — and that wine may still be eligible for the SPTC, so long as the small producer meets all other conditions for eligibility. Note , however, that one of those conditions is that allowance of the SPTC would not “benefit a person who would otherwise fail to qualify for use of the SPTC.…”

This article does not constitute legal advice. Please contact an attorney if you have any questions about the application of the small producer tax credit.

TTB Announces Expansion of List of Changes for Prior Approved Labels

Today, the Alcohol Tobacco Tax and Trade Bureau (“TTB”) announced that it has further expanded the list of changes that may be made to approved labels (or COLAs) without requiring those labels to be resubmitted to TTB for review. Currently, industry members are permitted to make certain changes to approved alcohol beverage labels without applying for a new COLA under TTB guidelines entitled “Allowable Revisions to Approved Labels.” As of today, the following additional changes may be made to labels without re-submittal of previously approved labels: 1) Delete or change promotional sponsorship-themed graphics, logos, artwork, dates, event locations and/or other sponsorship-related information; 2) Add, delete, or change a label or sticker that provides information about a rating or recognition provided by an organization (e.g., “Recognized as one of the top values in vodka by x Magazine” or “Rated as the best 2012 wine by x Association”), as long as the rating or recognition reflects simply the opinion of the organization and does not make a specific substantive claim about the product or its competitors; 3) Delete all organic references from the label; 4) Change an approved sulfite statement to certain approved options included on TTB guidance; 5) Add, delete, or change information about the number of bottles that were “made,” “produced,” “brewed,” or “distilled” in a batch; respectively; 6) Add certain instructional statements to the label(s) about how best to consume or serve the product (only approved statements listed within the TTB guidance may be included).

For more information or for assistance with labeling or COLAs questions, please contact Bahaneh Hobel at here.

Earthquake-Related Info from ABC & TTB

Both the California Department of Alcoholic Beverage Control (“ABC”) and the Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (“TTB”) have made information available on their websites for alcohol beverage businesses (including producers, wholesalers, and retailers) seeking earthquake related information. Here are links to those bulletins:

ABC’s Earthquake-Related Information for ABC Licensees

TTB’s Napa Earthquake Frequently Asked Questions

Some of the highlights:

CALIFORNIA ABC

- Under the ABC Act, any producer or wholesaler whose premises have been destroyed by an “act of God” may carry on its business for up to six months at a location within 500 feet of the licensed premises. A representative from the Governor’s office has stated that if a demand is identified, the 500-foot limitation may also be waived.

- There is no fee for transferring a license from one premise to another if the originally licensed premise was destroyed by an“act of God” and the new premise is located in the same county. Cal. Bus. & Prof. Code Sec. 24082.

- Over the next three months, alcohol beverage suppliers (producers and wholesalers, or any officer or agent of such businesses) may give, lend, or sell equipment, fixtures, or supplies other than alcohol beverages to any retailer that has suffered losses or damages as a result of the earthquake. This exception to tied house law is found in Cal. Bus. & Prof. Code Sec. 25511

TTB

- Although typically businesses must report any casualty loss immediately to TTB, TTB has relaxed that rule, but is encouraging business to report losses “as soon as they are able to determine the extent of the damage to their inventories.”

- Alcohol Beverage retailers, wholesalers, importers and producers may eligible for a refund of the federal excise taxes paid on lost alcohol beverage products. For more information go to When Disaster Strikes. http://www.ttb.gov/public_info/120068_disaster2005.shtml

- TTB will consider waiving late filing, payment or deposit penalties for those that have been directly affected by the earthquake.

Loeffelholz / Trinidad on Wine Labeling Legal and IP Issues

Wine Business Monthly recently published an article by DP&F attorneys Katja Loeffelholz and John Trinidad on wine labeling legal and intellectual property issues. You can access the article using the following link:

“Avoiding Label Approval Issues”

(Published with the permission of Wine Business Monthly).

(Published with the permission of Wine Business Monthly).

TTB Ruling on Voluntary Serving Facts Statements for Alcohol Beverage Labels and Advertising

|

| Exemplar from TTB of Serving Facts Statement for 750ML bottle of wine (NOTE: ABV and fl. oz of alcohol are optional) |

- Serving Facts statements include the following information: serving size, the number of servings per container; and the number of calories, grams of carbohydrates, protein, and fat per serving size.

- For wine of 7-16% ABV, the average serving size is 5 fluid ounces; for wine over 16% ABV but less than 24% ABV, the average serving size is 2.5 fluid ounces.

- The Serving Facts panel may include (but does not need to include) the percentage of alcohol by volume. If the Serving Facts statement includes the ABV, then it may also include a statement of the number of ounces of alcohol per serving. However, the inclusion of ounces of alcohol per serving does not relieve an industry member from their obligation to comply with other regulations regarding the disclosure of alcohol by volume.

- The tolerances and lab procedures for testing calorie, carbohydrate, protein, and fat content is laid out in TTB Procedure 2004-1.

- No new COLA is required for simply adding a Serving Fact panel to your already approved label. In other words, you can simply add a neck or strip label to your already approved wine bottle label without submitting a new COLA application.

- The rulemaking process regarding the use of Serving Fact statements is still ongoing and producers should keep in mind that the TTB ruling is simply a temporary policy until the rulemaking process is completed.

New TTB Guidelines on Social Media and Alcohol Beverage Advertising

|

Social Networks (incl. Facebook)

|

Applies to “fan pages for alcohol beverage products or companies and any content regarding alcohol beverage products posted to the pages by the industry member.”

Mandatory statements must be included on any “member fan page,” and should not be “hidden or buried.” TTB “strongly recommends” these statements be included in a conspicuous location, such as the profile section of the fan page (such as the “About” section on a Facebook fan page).

|

|

Video Sharing Sites

|

Applies to “[v]ideos about alcohol beverages that are posted to video sharing sites by industry members.”

Mandatory statements should be included in “profile” section of individual videos or on the “channel” information if the industry member maintains a channel.

|

|

Blogs

|

Applies to any blog maintained by an industry member that “discusses issues related to the company, its products, or the industry in general….” Also applies to “anything posted by the industry member on the blog”

Mandatory statements must be included.

|

|

Microblogs (incl. Tumblr, Twitter)

|

Applies to any written statement “calculated to induce sales in interstate or foreign commerce.”

Mandatory statements must be included and TTB recommends including these statements on the profile page.

|

|

Mobile Applications

|

Applies to apps for mobile or other handheld devices “related to alcohol beverages.” Such apps are considered “consumer specialty advertisement,” similar to ash trays, matches, cork screws, etc. Thus, only mandatory statement is the company name or brand name of the product.

|

TTB Issues Ruling re COLAs for Beer

This rule only applies to malt beverages. Wineries must still apply for a COLA or a certificate of exemption even if their wine is sold solely instate.

The TTBs ruling is available at: http://ttb.gov/rulings/2013-1.pdf