Canadian Court Gives 👍 to Contract Accepted by Emoji

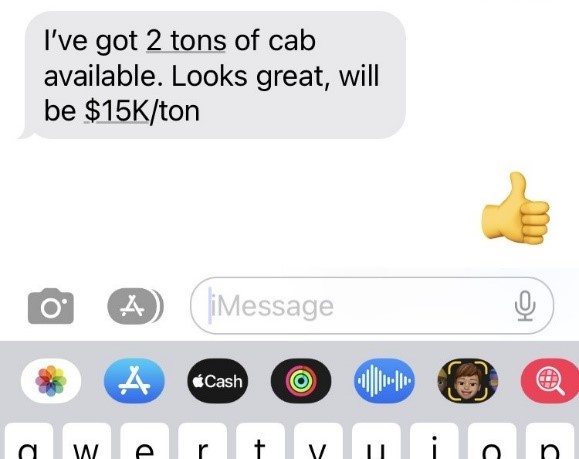

Harvest is underway in wine country. During this season there is increased demand for skilled labor, transportation, and crush facilities. Buyers and sellers of fruit have a short window to make deals. A busy harvest season also lends itself to casual communication about crops, like this:

Now, did you just tell your friend you are happy for him, or did you just commit to buying $30K worth of fruit?

According to at least one Canadian court, the thumbs-up 👍 emoji could qualify as acceptance of a contract. A recent decision from the Court of King’s Bench in Canada discussed the “new reality in Canadian society” facing courts as the forms of communication broaden.

The Canadian court examined a dispute between a farmer and grain buyer over an alleged contract for 87 metric tons of flax, to be delivered in November 2021. The grain buyer and farmer spoke by phone, and the buyer texted the farmer a photo of the contract signed by buyer for November delivery. The text message said “please confirm flax contract.” The farmer texted back a “thumbs-up” emoji.

Later, when November rolled around, the price of flax had gone up, and the farmer attempted to say that his “thumbs-up” in response to the buyer only signaled that he had received the contract, not that he had accepted it. The court also looked at the prior dealings between the farmer and buyer, noting that in prior contracts for durum wheat, the farmer had various formed agreements with the buyer employing similarly concise responses, including “looks good,” “ok,” or “yup.”

Here, the court ultimately found that yes, the “thumbs-up” was sufficient acceptance, and the farmer was ordered to pay C$82,000 for the unfulfilled contract.

Canadian law is not controlling in the United States. However, this case reminds us that as forms and methods of communication grow, U.S. courts may eventually find that an emoji can qualify as acceptance of an agreement.

So, during important business negotiations, consider the potential consequences of casually firing off that “thumbs-up” emoji to the other side. Finally, when in doubt, seek the advice of an attorney.

COLA’s Provide Scant Protection from Class Action Lawsuits

ShipCompliant recently published a guest blog post by DP&F Wine Law attorney John Trinidad on the class action lawsuits claiming that the use of the term “handmade” on vodka bottles constituted false or misleading information under state consumer protection laws.

Over the past year, a slew of class action lawsuits have been filed claiming that certain alcohol beverage product labels are false or misleading under state consumer protection laws. Tito’s Vodka, owned by a company called Fifth Generation, Inc., faces numerous actions claiming that the company’s use of the term “handmade” deceived consumers by leading them to believe that they were buying high quality, non-massed produced products.

Fifth Generation has fought these allegations, arguing that that TTB’s approval of their label as evidenced by the issuance of a certificate of label approval (“COLA”) protects against liability under state consumer protection laws. The company’s argument relies on “safe harbor” provisions provided for under state law, which in general make certain actions authorized by laws administered by state or federal regulatory authorities immune from liability. Unfortunately for the alcohol beverage industry, this argument has had mixed success.

To read the full blog post, please go to the ShipCompliant website.

Always Read The Contract – They Wrecked Your Wine, But Now Won’t Pay

You send your Chardonnay to a custom crush facility for bottling. A month later the wine in one out of about every ten bottles is brown. It oxidized in the bottle. You are forced to pull all your Chardonnay from the market at significant expense, and you fear your brand has suffered. The evidence suggests that the wine oxidized during bottling. Surely, the custom crush facility will step up and compensate you for your damages? To the surprise of many vintners, the custom crush facility may escape much or all liability based upon language in its contract.

In California, as in most states, companies can dramatically limit their liability to commercial customers. Companies do this by including clauses in their contracts with customers that exclude liability for negligence, for lost profits, or for consequential damages, among other things. These clauses are powerful – if something goes wrong – like oxidized wine – these clauses can shift liability from the company to the customer, or in our example, from the custom crush facility to the vintner. These clauses, if drafted properly, could prevent the custom crush facility from liability for lost profits, any damage to the vintner’s wine brand, consequential damages, and might even limit damages to the value of the wine if sold as bulk wine.

California courts will enforce contractual limitations of liability, but courts interpret those clauses very strictly. Consequently, those clauses should be well written and clear. There are, however, exceptions to the enforceability of these clauses. Parties cannot limit liability for fraud, willful injury to persons or property, or for violations of the law, even if those violations are negligent. While parties can limit liability for negligence, parties cannot limit liability for gross negligence. Courts explain that gross negligence is the “lack of any care or an extreme departure from what a reasonably careful person would do in the same situation to prevent harm to oneself or to others.” (See CACI 425.)

Additionally, contracts can further attempt to limit the amount of damages. For example, the custom crush facility in the above example might include a clause valuing the wine at $5 a gallon. If the wine is then destroyed in the bottling process because of the custom crush facility’s negligence, damages may be limited to $5 a gallon, even if the wine might retail for $25 a bottle.

If you are a winery or a winemaker in California, you need to understand these contractual limitations of liability before signing any contract with a custom crush facility, an alternative proprietor, bottler, or other service provider. You need to read the contract, and you further should understand that you could object to these limitations or negotiate less onerous clauses.

If you provide services to winemakers or wineries, you should also understand the need for contractual limitations of liability. Accidents happen, and they should not cost you your business. These limitations of liability, however, must be carefully drafted, and you should obtain an attorney with knowledge of the wine business to draft these limitations.

Additionally, all parties should understand the need for the right insurance to cover situations when things do go badly. Typically, commercial general liability policies will not cover damage to wine that occurs during the “wine making process,” which may include bottling. Both the vintner and the custom crush facility would do well to have an errors and omission policy.

Sellers Beware: Disclosure Requirements Expanded

In March 2014 we provided warning that new seller disclosure requirements would become effective July 1, 2014. These expanded disclosure obligations are now in effect. Sellers of single family residential property must now disclose certain construction defect claims. A new Transfer Disclosure Statement expanding the disclosure obligation of sellers of single family residences, defined as one to four units, requires sellers to disclose if they are aware of any of the following claims threatening to or impacting the property:

1. claims for damages by the seller based on construction defects;

2. claims for breach of warranty; or

3. claims for breach of an enhanced protection agreement, including any lawsuits or claims for damages under Civil Code Sections 910 or 914 alleging a defect or a deficiency in property or common areas.

If you are a seller of property in a mass-produced housing development, you are now obligated to disclose any known, threatened or impending claims by homeowners for defects affecting the community and potentially your home.

These changes relate to construction defect claims arising out of what is commonly referred to as SB800, which is codified at California Civil Code Section 895 through 945.5.

Prop 65 Lawsuit – Where Are We, How Did We Get Here And Where To Now?

You have seen the signs all over California; they exist on parking garages, gas stations, office buildings and convenience stores: “Warning, this area contains a chemical known to cause cancer or birth defects.” These signs exist because of Prop 65, which California voters enacted in 1986. It was originally presented as a way to prevent contamination of drinking water, but Prop 65 warnings have come to apply to thousands of products throughout the state, including alcoholic beverages.

The settlement of a recent Prop 65 lawsuit in Southern California has raised significant attention among the alcoholic beverage industry. The Wine Institute worked in tandem with the named defendants in that action to help settle the suit in such a way that producers not named in the suit can benefit from the settlement at a modest, albeit distasteful, cost. The Wine Institute recently notified its members about that suit and the settlement, and that notification has sparked considerable on line debate.

How did we get here?

The Wine Institute bulletin letter to its members describes the background of this issue as follows:

“Background: Proposition 65 is a California law that requires companies producing designated products containing chemicals that the State believes cause cancer, birth defects or other reproductive harm, to inform California citizens about exposure to such chemicals. Alcohol is one of the designated products, which means you may not sell alcohol in California without providing this warning to customers before they make a purchase:

‘WARNING: Drinking Distilled Spirits, Beer, Coolers, Wine and Other Alcoholic Beverages May Increase Cancer Risk, and, During Pregnancy, Can Cause Birth Defects.’

Many companies that are subject to Prop 65 warning requirements put the requisite warning on their product, but alcohol warnings are different. When Prop 65 first went into effect, the State agreed that in lieu of putting that warning on bottles, cans or packaging, the beverage alcohol industry could provide free Prop 65 signs for California retailers to post. For the last 29 years, the beverage alcohol industry has spent considerable sums providing Prop 65 alcohol warning signs to retailers, and many of you have contributed to Sign Management Company to pay for your fair share of the program costs. Unfortunately, the law as written says that the producer, not the retailer, has the legal responsibility to make sure there is a warning sign actually posted for customers to see, and some retailers do not like posting the signs.”

(A full copy of the Wine Institute member bulletin can be found on line here.)

Are wine producers really responsible for retailer signage?

We have heard that some winery owners—who are understandably reluctant to pay the fees and annual contributions required to opt in to the settlement—are under the belief that if they place a Prop 65 warning label on their bottles, they will avoid liability if a retailer fails or refuses to post the required warning signs. Unfortunately, even if producers place warning labels on their bottles, they may still be liable, particularly in cases where retailers are selling wine for on premises consumption (which was the case in the recently settled lawsuit).

The statute and regulations require that Prop 65 warnings must be “clear and reasonable” and “likely to be read and understood by an ordinary individual under customary conditions of purchase or use.” (Cal. Health & Saf. Code § 25249.6; Cal. Code Regs. tit. 27, § 25603.1.) The regulations implementing the Prop 65 statutory scheme require that where alcoholic beverages are sold by retailers for consumption on or off premises, signage, not bottle labels, of a specific size and type must be posted in one or another described location at the retail outlet, such as on tables, menus, or at the retail entrance. (Cal. Code Regs. Tit. 27, § 25603.3(e).) The responsibility for ensuring compliance with this signage requirement rests with the producer or its distributor, not the retailer:

“7. For alcoholic beverages, the placement and maintenance of the warning shall be the responsibility of the manufacturer or its distributor at no cost to the retailer, and any consequences for failure to do the same shall rest solely with the manufacturer or its distributor, provided that the retailer does not remove, deface, or obscure the requisite signs or notices, or obstruct, interfere with, or otherwise frustrate the manufacturer’s reasonable efforts to post, maintain, or periodically replace said materials.” (Cal. Code Regs. Tit. 27, § 25603.3(e)(7).)

The lawsuit

In 2012, two plaintiff’s attorneys in Southern California (often referred to as “Bounty Hunters”) located restaurants in Southern California that did not have Prop 65 signs posted, so those attorneys pursued Prop 65 actions against them.

As a result of the outcry resulting from those actions, last October, the Governor signed AB 227 to protect certain businesses, like restaurants, that had not complied with Prop. 65. Under the new amendment to the Prop 65 laws, restaurants can protect themselves from lawsuits if they take corrective action within 14 days from receiving a notice of violation (i.e. post an appropriate warning sign), pay a $500 fine, and notify the complaining party that they fixed the problem. This was much better than in the past in where restaurants that received a Prop 65 notice were faced with the Hobson’s choice of either going to court or settling the case.

AB 227 was the first legislative effort to amend Prop 65 in 15 years and the second time since its inception 25 years ago. However, in enacting this reform, the legislature overlooked the need to protect producers and the corrective safe harbor provisions were not extended for the benefit of producers. As a result, plaintiffs’ attorneys commenced a new enforcement action against producers earlier this year.

Where do we go from here?

As noted above, the Wine Institute helped negotiate a settlement agreement that allows producers to “opt-in” to a consent judgment entered into by the parties and approved by the court. By doing so, producers would not need to ensure that every retailer, who provides that producer’s wines, posts and maintains their Prop 65 signs at their retail establishment.

While we certainly understand and appreciate the reluctance most producers will have to succumb to the demands of the plaintiff’s attorneys and a state bureaucracy that requires these signs, each producer ultimately has to decide whether he or she wants to run the risk that they might in the future be subjected to enforcement actions by enterprising plaintiff’s attorneys or whether they want protection from that risk by opting in to the pending settlement and thus avoid incurring unknown defense expenses and potential liabilities that can be as high as $2,500 per day. To opt in, contact Wine Institute VP & General Counsel Wendell Lee.

It should be noted, however, that producers that operate with less than 10 employees are exempt from the requirements of Prop 65. As a result, these smaller producers (who intend to stay small producers) should not have to worry about whether or not to opt-in to the consent judgment.

Drafting Easements Agreements – Practical Considerations and Potential Pitfalls

Paul Carey, a partner in the Litigation department presented on the practical considerations and potential pitfalls of drafting easements in an online webinar designed to educate the legal community.

Eighth Circuit Rejects Southern Wine and Spirits Appeal, Says States May Discriminate Against Out of State Wholesalers.

Harvest Time and Grape Growers’ Liens – Custom Crushers Beware

A few years ago, we wrote about the producer’s lien. As I explained in my prior post, the law provides a grape grower with an automatic lien against any wine made from the grower’s grapes. This lien, called a “producer’s lien,” means that the winery cannot lawfully sell the wine without paying the grower. It gives a grower great legal protection.

While the concept behind the producer’s lien is simple, it can get complicated in practice. For example, a recent situation involved a grower who sold grapes to a winery, but delivered the grapes to a custom crush facility for crushing and fermentation. The winery then failed to pay both the grower and the custom crush facility. Does the grower still have a producer’s lien? Does the custom crush facility have a producer’s lien?

In this situation, the custom crush facility claimed it was a “producer” and consequently entitled to a lien against the wine it had now made for the winery. The custom crush facility would not, therefore, release the wine to the grower or the winery until it was paid. The grower, however, also claimed a lien against the wine, and demanded that the custom crush facility give the wine to the grower, even though the grower had not been paid. The winery also demanded the wine, because it needed to sell the wine to pay both the custom crush facility and the grower.

Unfortunately for the custom crush facility, only the grower can claim a producer’s lien. While the custom crush facility might argue it is a “producer”, the producer’s lien applies only to a producer who “sells any product which is grown by him. . .” (See CaliforniaFood and Agricultural Code § 55631.) The custom crush facility didn’t grow anything; it couldn’t, therefore, obtain a producer’s lien.

This means that the grower can force the custom crush facility to return the wine to the grower so the grower can sell the wine to recover what it is owed. The grower obtains the lien automatically (and this lien takes priority over all other liens), but the grower may need to take legal action to force the custom crush facility to cooperate and turn over the wine to the grower.

But what is the custom crush facility to do? In this situation, the custom crush facility will need to take action to obtain a junior lien against the wine. It will want to make sure that, if the grower sells the wine, it can still get whatever money is left after the grower’s bills are paid. It does not automatically obtain the benefit of a lien, as the grower does. It has to go out and get its lien.

Happily in this situation, the grower, the custom crush facility, and the winery were all able and willing (with the assistance of counsel) to cooperate without legal action. The grower sold the wine and took a portion of the proceeds to satisfy its bills. The custom crush facility then took some of the proceeds left over to satisfy its bills. And, there was still a little left over for the winery.

If you have any questions about contract disputes or producer’s liens, please contact us.

Charlie Trotter Files Answer in Wine Fraud Lawsuit

In June 2013, Plaintiffs Ilir and Bekim Frrokaj filed a lawsuit claiming that celebrated chef Charlie Trotter sold them a counterfeit magnum of 1945 Domaine de la Romanee-Conti in June 2012.

Trotter filed his answer yesterday, in which he denies that the wine sold to Plaintiffs is counterfeit or fraudulent.

Trotter’s answer can be found via the link below:

Southern Awarded Over $1.25 Million in Nevada Suit Against Small Competitors

If you are importing and selling wine in Nevada, make sure you aren’t violating someone else’s exclusivity. Even in Sin City, exclusivity can matter.

Update on The Battle of Missouri and Franchise Distribution Law

In its June 20, 2013 ruling on Major Brands’ request for a preliminary injunction, the Missouri Circuit Court, to the chagrin of the large producers, affirmedMissouri’s franchise law. The Court further held that there was no good cause for Diageo’s termination of its distribution agreement with Major Brands. However, in a partial victory for Diageo, the Court declined to issue a preliminary injunction forcing Diageo to continue working with Major Brands – Major Brands would be entitled to money damages only.

The battle in Missouri is far from over. Bacardi is also seeking to terminate its relationship with Major Brands, and litigation is pending in both Federal and State Courts. And certainly, the lobbying efforts of both distributors and producers will continue in earnest.

For more information or assistance on distribution litigation contact us.

Diageo Americas v. Major Brands: Franchise Law Litigation and Forum Selection

Franchise Laws and Diageo’s Recent Distributor Termination Action in Missouri

We usually see this alleged “breach of franchise agreement” used as the basis for a counter-claim by the purchaser of our client’s wine. Typically, XYZ Winery sells its wine to a retail establishment in a franchise state, which then doesn’t pay for the wine. When our client sues the purchaser in California state court, the purchaser counter sues for breach of the alleged franchise agreement, and will sometimes remove the case to federal court. The purchaser will then use the cost of litigation of its counter-claim to negotiate a discount on the amount owed, or a complete “walk-away” settlement.

In a recent Missouri case, however, Diageo sued its distributor in the state to terminate its distribution agreement. Diageo argues thatMissouri state law should not apply to the two distribution contracts in question. Diageo relies on language in its distribution contract with Major Brands that states that the contract’s terms are to be governed by Connecticut law for certain products, and New York law for certain other products. In the alternative, Diageo argues that it has good cause to terminate the agreement should Missouri law apply, claiming that Major Brands failed to devote sufficient resources to the promotion of Diageo’s products, among other things.

We will be watching this case and will report on its outcome.

TROs and Preliminary Injunctions: The Wine Advocate, Inc. v. Antonio Galloni

Preliminary injunctions are considered an “extraordinary remedy,” and accordingly, moving parties must meet a high standard in order to prevail. A party seeking injunctive relief must show likelihood of success on the merits of its claim and irreparable harm in the absence of a preliminary injunction. The court will also take into consideration the hardship on defendants should an injunction be granted

TWA may not only seek an injunction to prevent Galloni from publishing the tasting notes, but may also demand a court order “forcing” him to produce those notes to TWA. This constitutes a request for “mandatory injunctive relief” – i.e., a court order directing specific conduct by the non-moving party. Courts exercise heightened scrutiny in such situations.

The complaint suggests that TWA will seek a TRO and preliminary injunction in the near future. Indeed, TWA is free to move the court for a TRO at anytime, even before the 21-day time period for defendants to file a formal answer to the complaint has expired. And given the need to show likelihood of success on the merits, TWA will need to provide evidence to support its allegations of wrongdoing and harm. In short, should TWA follow through with its stated plan to seek a TRO and preliminary injunction, it will need to present a preview of its case-in-chief.

Alcohol Beverage Licenses as Assets in Debt Collection

Plaintiff creditor had sold his interest in the bar, the real property it was located on and its liquor license to the debtor and carried back a note, which was alleged to have been secured by the real property and the liquor license. Debtor’s self-valuation of the bar, the real property and liquor license improperly deducted the value of various liens and other encumbrances, which plaintiff claimed established fraudulent intent barring discharge. The Bankruptcy Court disagreed, finding that while debtor’s self-valuation was incorrect, it resulted from an honest mistake and thus fraudulent intent was not present. The debtor’s discharge was ultimately approved, likely after amended bankruptcy schedules were filed. Apparently, given the lack of bankruptcy court objection, a liquor license can properly be used as collateral for a secured transaction in Florida, as opposed to California where such use is statutorily prohibited.

For further assistance or questions on debt collection matters contact David Balter at [email protected]

Wine Industry Lawsuits: How to Avoid Them

Winery Exchange v. 7-Eleven – $2 million Supplier Dispute

For more information or assistance on litigation matters in the alcohol beverage industry contact Dave Balter at [email protected]

Seminar on How to Collect on Deadbeat Accounts

Stopping Gray Market Wine Imports

On October 1, 2011, Scott Gerien, head of Dickenson, Peatman & Fogarty’s intellectual property practice group made a presentation at the annual meeting of the International Wine Law Association in Logrono, Spain on the issue of stopping gray market wine imports in the U.S.

The ability to prevent gray market imports, especially as to wine, has always been difficult under U.S. law. However, a recent case out of the Second Circuit of the U.S. federal courts has provided foreign wine producers and their U.S. agents with a new weapon to potentially prevent the import of their wines through unauthorized importers. In Wiley & Sons, Inc. v. Kirtsaeng, 2011 U.S. App. LEXIS 16830 (2d Cir. August 15, 2011), the Second Circuit held that foreign copyright owners may prevent the unauthorized import into the U.S. of copies of their works not intended for sale in the U.S., thus changing the direction of prior decisions which had generally held that once a copyright owner sells a copy of its work, the buyer of such copy is free to dispose of such copy as the buyer sees fit.

So one may ask, what does copyright have to do with wine? Well, the overwhelming majority of wine is sold with a wine label that is usually a creative work subject to the protection of copyright law. Therefore, even though most consumers are buying the wine to own the content of the bottle, not the label on the bottle, the copyright law still gives the owner of the copyright in the wine label the ability to control how copies of such label are distributed. See Quality King Dist. Inc. v. L’Anza Research Int’l, Inc., 523 U.S. 135 (1998) (recognizing use of copyright law to prevent gray market import of shampoo based on copyright in packaging). Thus, the Wiley decision has the effect of allowing foreign wine producers who own copyright in their label designs to prevent the unauthorized import into the U.S. of authentic, gray market wine obtained in foreign markets.

It should be noted that the Wiley decision is based on a very specific interpretation of the copyright law and only applies to foreign copyrights and copies produced outside the U.S. and then imported here. The Wiley decision also only applies in the Second Circuit (New York, Connecticut and Vermont) and is actually contradictory to an opinion of the Ninth Circuit (California, Arizona, Nevada, Oregon, Washington, Idaho, Montana, Alaska and Hawaii) meaning the issue could actually reach the Supreme Court on appeal.

However, until then, gray market importers selling wine in New York, Connecticut and Vermont (as well as in states in circuits other than the Ninth Circuit which choose to follow the Second Circuit) should beware as foreign producers and their U.S. agents appear to now have a very strong tool to stop such gray market imports.

For a full copy of Gerien’s presentation, click HERE.

For more information or assistance on intellectual property matters contact Scott Gerien at [email protected].