California Tied House Laws and Social Media

According to a recent article in the Sacramento Bee, the California Department of Alcoholic Beverage Control (“ABC”) recently accused a California winery of violating tied house laws by sending the following tweet: “Two days till @SaveMart Grape Escape in Downtown #Sacramento!” SaveMart Supermarkets holds a California alcohol beverage retailer license, and the ABC considered the tweet free advertisement given by a supplier to a retailer in violation of California tied house laws.

Tied-house laws are federal and state laws that attempt to prohibit brewers, distillers, winegrowers and other alcohol beverage suppliers from exerting undue influence over retailers. In theory, such laws minimize the potential for unfair business practices in the industry and protect against social ills such as over-consumption. Certain tied house laws bar suppliers from providing anything of value (such as a free advertisements) to alcohol beverage retailers. Both federal and state regulators have treated winery websites and social media pages and accounts as advertising platforms, so mentioning retailers on such channels can give rise to tied-house claims.

Federal and state tied-house regulations share the same intent, but their provisions differ greatly.

A. Federal Tied-house Laws

Under federal tied-house law, it is unlawful for an alcohol beverage manufacturer or supplier to “induce” directly or indirectly, any alcohol beverage retailer (such as a bottle store, bar or restaurant) to purchase any products from that supplier to the “exclusion,” in whole or in part, of other suppliers’ products. Inducements include, but are not limited to, furnishing, giving, renting, lending, or selling to the retailer anything of value (subject to various exceptions).

A violation of federal law only occurs if the inducement leads to “exclusion.” Exclusion occurs when a supplier directly or indirectly places retailer independence at risk because of a connection between the supplier and retailer or by any other means of control over the retailer; and where such practice by the supplier-side licensee results in the retailer purchasing less than it would have of a competitor’s product.

B. California State Tied-house Laws

Under California law, no alcohol beverage manufacturer or supplier may “[f]urnish, give, or lend any money or other thing of value, directly or indirectly, to” an on- or off-premise alcohol beverage retailer. Unlike federal law, there is no need for there to be actual exclusion for a violation to arise. Nor does the supplier’s intent play any role in evaluating if a tied house violation has occurred.

Although an advertisement placed by a supplier for a retailer is a “thing of value,” there are certain exceptions to California tied house laws. For example, supplier advertisements of instructional tasting events held on a retailer’s premise do not violate state tied house law, so long as they adhere to certain restrictions. See ABC Ac Sec. 25503.4. Such ads cannot contain the retail price of the wines, any “laudatory references” to the retailer, or any picture or illustrations of the retailer’s premises, and any mention of the retailer must be “relatively inconspicuous in relation to the advertisement as a whole.”

It should be noted, however, that not all states have tied house exception, and before posting information related to a retailer outside of California, wineries should review the tied house provisions of the retailer’s home state.

Groupon to Launch Wine Brand?

During a review of wine labels on ShipCompliant’s LabelVision database, we came across several new COLAs issued to Top it Off Bottling, LLC and Appellation Trading Company, LLC (Type 02 licensed winegrower based in Napa) listing the fictitious business name “Groupon Wines” and bearing a GROUPON WINES word mark on the front label. The wines include:

- Chatty Cat Cabernet Sauvignon;

- Jazzy Cat Pinot Noir;

- Snazzy Cat Chardonnay; and

- Top Cat Merlot.

A search of the USPTO’s trademark database shows that Groupon, Inc. has applied for trademark registration for the GROUPON WINES, CHATTY CAT, JAZZY CAT, SNAZZY CAT, and TOP CAT marks in Class 33 (alcoholic beverages other than beer).

It is unclear from these documents what Groupon’s plan is for these wine brands (i.e., whether Groupon will be acting as a third party marketer or has entered into a licensing arrangement with the licensed winegrowers), but it is interesting to see an Internet discount marketplace get involved in the supply-side of the wine market.

For more information on wine and internet regulations, contact John Trinidad at [email protected].

New Paso AVAs Available for Use in November

In early 2006, the Paso Robles AVA Committee (PRAVAC) began an organized outreach effort to growers and vintners across the Paso Robles wine country and kicked off the formal process of gathering historical and scientific evidence that would support the further definition of the distinctive wine regions within the Paso Robles AVA. For many PRAVAC members, the desire arose much earlier to educate the public about the unique areas within the Paso Robles AVA and how these distinctive qualities in each area impact the wine produced in the region. In May 2007, the PRAVAC filed eleven petitions with the TTB to establish eleven separate AVAs within the approximately 612,000 acre Paso Robles AVA.

On Thursday, October 9, 2014, the TTB will publish the Final Rule establishing the 11 new AVAs within the Paso Robles AVA. These new viticultural areas include Adelaida District, Creston District, El Pomar District, Paso Robles Estrella District, Paso Robles Geneseo District, Paso Robles Highlands District, Paso Robles Willow Creek District, San Juan Creek, San Miguel District, Santa Margarita Ranch, and Templeton Gap District.

The effective date for all 11 AVAs will be November 10, 2014 at which time producers of qualifying Paso Robles wine can apply to TTB for COLAs with one of the new AVA names. The new AVAs can be used on wine of any vintage as long as it is not already bottled and labeled.

DPF has been proud to represent the PRAVAC through this process and sends its congratulations to all of the PRAVAC members and supporters.

http://www.ttb.gov/press/fy14/press-release-fy-15-02.pdf

For additional information regarding AVA petitions, please contact Carol Ritter at [email protected]

Diageo and Major Brands Settle Franchise Law Dispute

This is the way most franchise law litigation ends: not with a bang, but with a whimper. After over a year of legal jostling, Diageo and Major Brands have apparently reached settlement, according to Missouri news outlets.

Suppliers trying to terminate their relationship with a Missouri distributor should closely review a state court opinion issued in the same case in response to Major Brands’ preliminary injunction motion. In that opinion, the court found that Missouri’s franchise law does not necessarily apply to all alcohol beverage distribution agreements. Instead, the court concluded that, “A liquor distributor who seeks to invoke the protections of [Missouri’s Franchise Law] must show (1) an arrangement, (2) in which a person grants to another a license to use a trade name, trademark, service mark, ‘or related characteristic,’ (3) in which there is a community of interest in the marketing of goods, and (4) which involves a relationship of liquor wholesaler and liquor supplier.” See also Missouri Beverage Co. v. Shelton Bros., Inc., 669 F.3d 873 (8th Cir. 2012).

Smaller producers trying to get out of a franchise relationship may be able to argue that no “community of interest” exists, so long as they make up only a small portion of the distributor’s portfolio. Major Brands successfully argued (in the preliminary injunction stage) that because Diageo brands accounted for 23% of Major Brand’s total revenue, a community of interest existed, and Missouri’s franchise law applied. There is, however, no clear minimum threshold that would consider sufficient to prove the existence of a community of interest.

For more information on distribution agreements and franchise laws, please contact John Trinidad at [email protected].

21st Amendment Litigation: NY Wine Retailer Sues NYSLA

Nine years ago, the U.S. Supreme Court held that a New York law that discriminated against out of state wineries violated the Commerce Clause, and rejected arguments that the 21st Amendment protected such laws from constitutional scrutiny.

New York now finds itself at the center of yet another Commerce Clause/ 21st Amendment controversy pitting Empire Wine & Spirits LLC, a New York-based alcohol beverage retailer, against the New York State Liquor Authority (SLA).

The dispute began in August, when the SLA commenced disciplinary proceedings against Empire under 9 NYCRR 53.1(n), a code provision that gives the SLA the ability to suspend, cancel or revoke a license for “improper conduct by the licensee or permittee….” The SLA has previously used its authority under Sec. 53.1(n) in cases where the owners, officers, or directors of a licensee were charged with either a drug-related felony (Miracle Pub v. New York State Liquor Auth.,210 A.D.2d 229 (N.Y. App. Div. 2d Dep’t 1994); see also Edto Foods, Ltd. v. New York State Liquor Authority,113 A.D.2d 787 (N.Y. App. Div. 2d Dep’t 1985)) or serious misdemeanors, such as reckless endangerment and obstruction (See Order of Suspension of New Rat LLC). Here, however, the alleged “improper conduct” is Empire’s shipment of wine to consumers in the following states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Illinois, Maine, Massachusetts, Mississippi, Ohio, Louisiana, Pennsylvania, Vermont, Virginia, and Washington. Some of those states prohibit out of state retailers from ship to in-state consumers; others allow such shipments so long as the retailer obtains a permit; and others have “reciprocal” privileges (i.e., if retailer’s home state allows direct to consumer shipping from state x, then state x will allow such shipments).

On September 23, Empire filed suit in state court in Albany County. In its complaint, Empire notes that there is no New York statute or regulation that expressly prohibits a licensed retailer from shipping wine to customers in other states. The SLA apparently concedes this point, as it failed to cite 9 NYCRR 53.1(a) in its Notice of Pleading. 53.1(a) gives the SLA the ability to cancel, revoke, or suspend a licensee when the licensee has violated any provision of the New York State Alcoholic Beverage Control Law or of any SLA rule or regulation.

Empire seeks a court order declaring that the SLA’s disciplinary action attempts to regulate the sale and distribution of alcohol beyond New York’s borders, violates the 21st Amendment, and constitutes an impermissible interference with interstate commerce in violation of the Commerce Clause. Empire further claims that the SLA does not have the statutory authority to regulate such shipments since, under ABC Law Sec. 2, SLA’s sole function is “to regulate and control the manufacture, sale and distribution within the state of alcoholic beverages for the purpose of fostering and promoting temperance in their consumption and respect for and obedience to law” (emphasis added). Finally, Empire claims that 9 NYCRR 53.1(n) is unconstitutionally vague, as it fails to provide licensees with any warning that out of state shipments could be deemed “improper conduct” such as to warrant suspension, cancellation, or revocation of their alcoholic beverage license.

The case is Empire Wine & Spirits LLC v. New York State Liquor Authority (Case No 004915/2014). Click on the link below for a PDF of the complaint.

Empire Wine v NYSLA 2014 Complaint

For more information related to direct to consumer shipping laws, please contact John Trinidad at [email protected]

Franchise Law Trial Begins in Missouri

After 18 months of discovery and motion practice, Diageo and Missouri distributor Major Brands will have their day in court to determine if state franchise law prevents Diageo from terminating its Missouri distribution agreement.

In March 2013, Major Brands brought suit in Missouri state court against Diageo and its new Missouri distributor, Glazer’s, claiming that the alcohol beverage producer’s attempt to terminate the distribution agreement violated state’s franchise law. At the time of the attempted termination, according to Major Brands, Diageo products accounted for 23% of the distributor’s gross revenues.

Jury selection began on Monday, September 15. We will continue to provide updates as the case unfolds.

Earthquake-Related Info from ABC & TTB

Both the California Department of Alcoholic Beverage Control (“ABC”) and the Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (“TTB”) have made information available on their websites for alcohol beverage businesses (including producers, wholesalers, and retailers) seeking earthquake related information. Here are links to those bulletins:

ABC’s Earthquake-Related Information for ABC Licensees

TTB’s Napa Earthquake Frequently Asked Questions

Some of the highlights:

CALIFORNIA ABC

- Under the ABC Act, any producer or wholesaler whose premises have been destroyed by an “act of God” may carry on its business for up to six months at a location within 500 feet of the licensed premises. A representative from the Governor’s office has stated that if a demand is identified, the 500-foot limitation may also be waived.

- There is no fee for transferring a license from one premise to another if the originally licensed premise was destroyed by an“act of God” and the new premise is located in the same county. Cal. Bus. & Prof. Code Sec. 24082.

- Over the next three months, alcohol beverage suppliers (producers and wholesalers, or any officer or agent of such businesses) may give, lend, or sell equipment, fixtures, or supplies other than alcohol beverages to any retailer that has suffered losses or damages as a result of the earthquake. This exception to tied house law is found in Cal. Bus. & Prof. Code Sec. 25511

TTB

- Although typically businesses must report any casualty loss immediately to TTB, TTB has relaxed that rule, but is encouraging business to report losses “as soon as they are able to determine the extent of the damage to their inventories.”

- Alcohol Beverage retailers, wholesalers, importers and producers may eligible for a refund of the federal excise taxes paid on lost alcohol beverage products. For more information go to When Disaster Strikes. http://www.ttb.gov/public_info/120068_disaster2005.shtml

- TTB will consider waiving late filing, payment or deposit penalties for those that have been directly affected by the earthquake.

Impact-Napa Conference Focuses on Past, Present and Future of Napa Valley

With Sunday’s earthquake still fresh on people’s mind, members of the wine growing community gathered at Napa’s Meritage Resort & Spa for the North Bay Business Journal’s annual “Impact: Napa” conference. DP&F’s Richard Mendelson served as the moderator and DP&F was one of the two underwriters for the conference.

Napa County Board of Supervisors Chairman Marc Luce started the conference with an update on the earthquake damage and the County’s response.

Mendelson then interviewed Margrit Mondavi, Vice President for Cultural Affairs for Robert Mondavi Winery. Mondavi shared many details of her long history in the Valley, starting from her time as a tour guide at Charles Krug Winery. Mondavi highlighted the influence of food, art, and international travel in the growth of Robert Mondavi Winery, founded by her late husband Robert Mondavi. She also noted the strong sense of community that has continued to be a hallmark of the Valley, recalling how Robert Mondavi and others would readily share equipment and lend advice to fellow winegrowers.

Next, Mendelson led a panel discussion on the Winery Definition Ordinance. Panelists included Clay Gregory, president of Visit Napa Valley; Alex Ryan, President of Duckhorn Wine Company; and Dennis Groth, president of Groth Vineyards & Winery. Panelists shared their views on the WDO’s impact on valley winegrowers and potential changes to county regulations. Mendelson closed the panel by reminding attendees that there will be a community forum this November to discuss the future of the WDO. We will announce more details regarding that forum in future blog posts.

The conference closed with a discussion featuring the “next generation” of leaders in the vineyard, winery, and restaurant worlds. Panelists included Caleb Mosey, vineyard manager at Quintessa Winery; Vanessa Robledo, president of Black Coyote Winery; and Perry Hoffman, chief at Etoile Restaurant. Both Robledo and Hoffman grew up in Napa, and talked about how their local upbringing continues to influence them today. Hoffman learned to cook at his grandparents’ restaurant in Yountville, the French Laundry, while Robledo learned how to tend to vines directly from her grandfather. All panelists emphasized the importance of continued innovation in their respective fields as key to the continued growth and development of Napa Valley.

Wine and Spirits Law Academy (Sept. 8-10, 2014)

DP&F attorneys Scott Gerien, Jim Terry, and John Trinidad will be panelists at the Wine and Spirits Law Academy. The conference, co-sponsored by UC-Davis and the Wine & Law Program from the Université de Reims (Champagne, France), brings together an international group of practitioners and academics to discuss some of the key legal and regulatory issues facing the wine and spirits industries. Of particular note: Judge Ken Starr, who was part of the legal team that argued the landmark case of Granholm v. Heald, will address conference participants on September 9.

Mr. Gerien will discuss comparative aspects of trademark law with panelists from France and Australia. Mr. Terry will be on a panel with the founding CEO of Lot 18, Phillip James, on “Global Issues Facing Wine Entrepreneurs,” and Mr. Trinidad will be on a panel titled, “Social Media and Its Impact on the Global Wine Market.” Click the following link for the complete Wine and Spirits Law Academy Agenda.

You can register here.

Cava Considers Adoption of Single Estate Classification

In an effort to raise the Cava brand image, the Cava Regulatory Board (Consejo Regulador del Cava) has announced plans for the establishment of a “Single Estate” classification — Cava del Paraje Calificado – for use on wines sourced from single, estate owned vineyards and allow DO Cava wines to compete in a premium price category. The Ministry of Agriculture will need to authorize any such classification, but according to this article, it appears that the Ministry would likely support this proposed classificaton.

Currently, Cava producers can label their wines using a “control mark” based largely on how long the wine has spent aging before disgorgement: DO Cava, Cava Reserva, or Cava Gran Reserva. According to this article from The Drinks Report, the exact qualifications for use of the Single Estate classification are still being ironed out, but “the yield and ageing restrictions will be in line with, or most probably higher than those used for Gran Reserva Cavas.”

Over the past few years, a number of Spanish producers have expressed their willingness to leave the Cava DO and announced plans for a DO with stricter production regulations, criticizing Cava for becoming “a solely volume-oriented DO….”

The current President of the Cava Regulatory Board, Pere Bonet, has voiced similar concerns in announcing the launch of the new classification system. According to news reports, Mr. Bonet is quoted as saying: “It’s very bad for Cava’s brand image for it to be on sale at Tesco for £5. We’re seeking more distribution in high-end restaurants and specialist retailers in order to get the top Cavas into the UK to change people’s perceptions.”

For more information regarding geographical indications, please contact John Trinidad ([email protected])

New California Law Allows Wine Tastings at Farmers’ Markets

On July 8, 2014, Governor Jerry Brown signed a bill allowing state licensed winegrowers (Type 02 license holders) to host “instructional tasting events” at certified state farmers’ markets. The bill (AB 2488) passed the Senate last month and had the support of the Wine Institute and Family Winemakers of California.

Prior to the law’s passage, a Type 02 licensed winegrower could apply for a “Certified Farmers’ Market Sales Permit” (Type 79) which would allow the winegrower to sell wine at farmers’ markets, so long as the wine was (a) produced entirely from grapes grown by the licensee and (b) bottled by the licensee.

Under the new law, Certified Farmers’ Market Sales Permit holders may host an “instructional tasting event” under certain circumstances.

- The operator of the certified farmers’ market must approve the event;

- The event must be conducted by either the licensee, a member of licensee’s family, or an employee of licensee;

- The area for the event must be separated from the remainder of the market by some permanent or temporary barrier (wall, rope, cable, etc.);

- Tasting is limited to three ounces of wine per person per day; and

- No open container of wine may leave the instructional tasting area.

For more information on California state alcohol beverage privileges, please contact John Trinidad ([email protected]).

A Closer Look at BCG’s Franchise Law Study

The Boston Consulting Group (BCG) recently released a study finding that the U.S. beer market is “open, freely competitive and driven by consumer choice.” BCG concludes its study by imploring lawmakers to be “skeptical of complaints (legal or otherwise) that the marketplace favors only large players.” In other words, BCG appears to argue that regulators should maintain the status quo and uphold state franchise laws.

For the reasons outlined below, regulators should be wary of any overreaching claims of the BCG study and closely examine the anti-competitive effects of franchise laws.

CELEBRATES COMPETITION AT SUPPLIER TIER; IGNORES LACK OF COMPETITON IN WHOLESALE TIER

BCG cites the tremendous growth in the number of craft breweries in the U.S. over the past twenty-odd years as proof that the U.S. beer market is open and competitive. BCG attributes this success to what it touts as the “open U.S. beer-distribution system.”

But the presence of a high-level of competition in the supplier tier does not necessarily mean there is sufficient competition in the distributor tier. By all accounts, the number of wholesalers continues to shrink. Moreover, many states have imposed franchise laws that insulate wholesalers from competition by making it exceedingly difficult for alcohol beverage producers to sever ties with underperforming wholesalers.

Any assessment of competition in the alcohol beverage industry must assess competition at each tier: producers, wholesaler, and retailer. By focusing solely on competition amongst producers and avoiding an assessment of the wholesale tier, BCG’s study falls short.

RELIES ON HYPOTHETICAL “CLOSED” SYSTEM; FAILS TO ANALYZE IMPACT OF DIFFERENT FRANCHISE LAW REGIMES

BCG’s study centers on a comparison of the average delivery and sales costs under two different types of distribution systems that BCG identifies as the “open” and “closed” systems. Under the “open” system, wholesalers are independent from suppliers and are free to carry both large and small producers in their portfolio. In comparison, in a “closed” network, only products produced or sanctioned by a major brewer could be part of a wholesaler’s network.

BCG calculates that the average delivery and sales cost for craft beer distribution to large grocery stores in a closed network is three-times more than in an open network. Accordingly, craft brewers benefit from franchise laws, since such laws maintain wholesaler “independence” and prevent large suppliers from extracting advantages from distributors at the expense of craft brewers.

The problem with the open vs. closed dichotomy is that it gives the impression that there is no other alternative. But not all states impose franchise laws, and some states have much less restrictive forms of franchise laws. Given the great degree of variation among state alcohol beverage regimes, BCG could have conducted a comparison of distribution costs in states that have varying sorts of franchise law regulations. Instead, however, BCG’s study rests on a hypothetical and fictitious “closed” distribution.

ENTIRELY SILENT ON IMPACT OF FRANCHISE LAWS ON CONSUMERS.

BCG’s study also falls short in that it fails to take into consideration the impact of franchise laws on consumer choice and retail prices. Although BCG states that “consumer preferences have been the main engine” driving growth of craft beers, it makes no effort to determine if strict franchise law states offer more choice and cheaper prices for consumers.

CONCLUSION

The debate over franchise laws in the alcohol beverage industry continues to grab headlines in a number of states. In March, the New York Times published an anti-franchise law op-ed authored by the co-founder and President of Brooklyn Brewery and a member of the board of directors of the Brewers Association. This summer, the South Dakota’s legislature is conducting a review of alcohol distribution systems.

BCG’s study helps highlight some of the arguments wholesalers will rely on in claiming that states should not repeal or alter alcohol beverage franchise laws. But the study has many shortcomings, and regulators should be skeptical of any arguments that suggest that this report conclusively finds that franchise laws benefit small producers.

For more information on franchise laws or wine law in general, please contact John Trinidad at [email protected].

Trademark Protection for Vineyard Brands

The June 2014 issue of Practical Winery & Vineyard features an article by DP&F’s Katja Loeffelholz titled “Branding Agricultural Commodities.” The articles provides growers with a detailed summary of the importance of protecting their vineyard’s brand.

You can access the article by clicking on the image below.

For more information on how you can secure trademark rights, please contact Katja Loeffelholz at [email protected].

Wine Law Refresher for Napa Valley Vintners Members

Friday, June 27, 2014

Dickenson, Peatman & Fogarty’s Of Counsel Richard Mendelson and Senior Alcohol Beverage Attorney Bahaneh Hobel will be presenting a wine law refresher course to members of the Napa Valley Vintners.

This presentation will include an overview of federal, state and local licensing issues including sponsorships, private and charity events, contests and sweepstakes and third party retailers, as well as a discussion of Napa County’s Winery Definition Ordinance and an overview of the different regulations that apply in Napa’s “Ag Preserve.”

Members of the Napa Valley Vintners can RSVP and register for the presentation on the NVV Members website.

Loeffelholz / Trinidad on Wine Labeling Legal and IP Issues

Wine Business Monthly recently published an article by DP&F attorneys Katja Loeffelholz and John Trinidad on wine labeling legal and intellectual property issues. You can access the article using the following link:

“Avoiding Label Approval Issues”

(Published with the permission of Wine Business Monthly).

(Published with the permission of Wine Business Monthly).

FTC Criticizes Franchise Laws…in Automobile Industry

“Regulators should differentiate between regulations that truly protect consumers and those that protect the regulated.”

So concluded the Federal Trade Commission in a recent blog post criticizing franchise laws in the automobile industry. Tesla Motors, a leading manufacturer of high-end electric cars, implemented a sales model to allow it to sell cars direct to consumers. This has upset auto dealerships who have complained that Tesla’s efforts violated state franchise laws that require automobile manufacturers to sell their cars through local, independent auto dealerships.

Last week, the FTC weighed in, and criticized such laws as “bad policy” that protects middlemen and harms consumers. “We hope lawmakers will recognize efforts by auto dealers and others to bar new sources of competition for what they are — expressions of a lack of confidence in the competitive process that can only make consumers worse off.”

Numerous states have protectionist franchise laws that govern supplier-distributor relationships in the alcohol beverage industry. Such franchise laws vary in their scope from state to state, but generally restrict producers from terminating distributors absent “good cause.” In practice, “good cause” has been narrowly defined by state regulatory agencies and courts, making it difficult for producers to terminate even for well-founded business reasons. Some states impose severe penalties for terminating or restructuring distribution arrangements absent “good cause,” including significant fines and potential suspension or revocation of the wineries’ state permits.

One has to wonder if the FTC’s recent statement on automobile dealership franchise laws could have any repercussions in the alcohol beverage industry.

For more information on franchise laws or wine law in general, please contact John Trinidad at [email protected].

Tied House Laws: Alive and Kicking

The New York State Liquor Authority issued a stern reminder that tied house laws are not only still on the books, but will be strictly enforced. On Tuesday, March 25, the NYSLA accepted a plea offer from the numerous entities associated with restaurateur Joe Bastianich to pay $500,000 penalty, close down Manhattan-based wine store Eataly Wines for six month, and remove Lidia Bastianich (Joe’s mother) as an owner of that store due to tied house violations.

Tied house laws are aimed at prohibiting alcohol beverage suppliers (manufacturers, wholesalers, importers) from exerting control over retailers (including restaurants, bars, and liquor stores). To that end, state laws typically prevent an owner of a licensed supplier from holding an ownership interest, direct or indirect, in a licensed retailer. In this case, Bastianich and a number of his partners apparently held ownership interests in a number of New York retail licenses while also holding ownership interests in wineries in Italy.

In a sign that not all publicity is good publicity, counsel for the NYSLA stated that their investigation started as a result of a cover story on Eataly owner Oscar Farinetti in Wine Spectator. The article reported that “Eataly now owns stakes in six wine estates across northern Italy” and that Joe Bastianich was the “owner of several Italian wineries….” NYSLA reviewed the various alcohol beverage retail licenses held by Bastianich-related entities and discovered that these various winery interests were never disclosed in the initial or renewal license applications.

The NYSLA’s enforcement of tied house laws is not surprising given past precedent. In 2011, the Authority issued two separate declaratory rulings stating that an applicant holding an interest in a foreign-based alcohol beverage manufacturer could not hold a New York retail liquor license under New York tied house laws. In fact, one of those rulings applied to an Italian wine producer seeking a New York restaurant license.

California also has tied house laws, but provides exceptions allowing winegrowers (i.e., Type 02 license holders) to own an interest in an alcohol beverage retail license so long as they disclose their ownership interests and accept certain restrictions. For example, under certain circumstances, a licensed California winegrower may own interests in multiple restaurants holding California alcohol beverage licenses so long as they do not sell their wine at more than two of those establishments and their wines do not constitute more than 15% of all brands offered for sale at those restaurants. (This exception does not apply to custom crush clients / “virtual wineries” that operate under a Type 17/20 license.). As the Eataly matter demonstrates, however, that winegrower would be barred from obtaining a New York alcohol beverage retail license.

For more information on wine law or tied house issues, please contact John Trinidad at [email protected]. Mr. Trinidad was interviewed by Levi Dalton of Eater NY in an earlier article on this same matter.

Federal Court Dismisses Diageo’s Complaint in Franchise Law Case

Earlier this week, Missouri distributor Major Brands, Inc. won the most recent round in its year-long franchise law litigation with Diageo Americas, Inc. The federal district court in Connecticut has dismissed Diageo’s complaint, and the parties dispute appears to be gearing up for a trial in Missouri state court this summer.

Last March, Diageo brought suit in federal district court in Connecticut seeking declaratory relief to allow Diageo to terminate its relationship with Major Brands. In its complaint, Diageo argued that the parties’ contract included a clause that stated that their agreement would be construed under Connecticut law. Enforcement of such a clause would avoid the application of Missouri franchise law. Even though Connecticut also has a franchise law, Diageo argued that it only applied to franchise agreements that would require the distributor to maintain a place of business in that state. Since Major Brands was not required to establish a business in Connecticut, then the Diageo-Major Brands agreement falls outside the scope of Connecticut’s franchise laws, according to Diageo’s complaint.

Major Brands brought its own suit in Missouri state court against Diageo and its new Missouri distributor, Glazer’s, and filed a motion to dismiss in Diageo’s federal court case. In that motion, Major Brands argued that the forum selection clause did not apply and also argued that the federal court should abstain given the parallel state court litigation and Missouri’s strong interest in regulating and enforcing its own alcohol beverage laws:

“The heart of this suit is the applicability of Missouri’s Franchise Act to the relationship between Plaintiff, a supplier of liquor in Missouri, and Defendant, a licensed liquor distributor and wholesaler doing business in Missouri. The Twenty-first Amendment recognizes each State’s sovereign interest in regulating and enforcing its own liquor distribution laws….”

On March 19, 2014, the federal court granted Major Brands’ motion, finding that the forum selection clause that Diageo relied on did not apply to the products at issue in the immediate case. The court did not address Major Brands’ abstention argument.

But this does not bring an end to the Diageo-Major Brands battle. Major Brands’ state court suit in Missouri continues, and the parties have engaged in extensive discovery in that forum. A trial date is set for July 21, 2014.

For more information on distributor termination or franchise law issues, please contact John Trinidad at [email protected].

Branding Strategies in Agricultural Commodities: Vineyard & Block Designates

By Katja Loeffelholz, Dickenson, Peatman & Fogarty

The prominence of vineyard-designated wines is another lesson in value-added agricultural branding which presents both the winery and the vineyard owner or lessee with a number of marketing and legal issues. Recognizing the value of vineyard designated names, vineyards have long been designating blocks within their vineyards with proprietary names.

In this way, even though multiple wineries are purchasing grapes from the same vineyard property, each winery can have a distinct name to refer to the vineyard block where the grapes were grown, also known as the “block designate.” If a vineyard owner sells wine grapes to a winery under a vineyard designate or block designate, the winery may use that vineyard or block name on wine produced from those grapes to designate origin so long as such use complies with the vineyard designation labeling requirements of the Alcohol and Tobacco Tax and Trade Bureau (TTB). Accordingly, the vineyard owner — not the winery – theoretically owns rights in the name.

Wineries may consequently find their vineyard-designated wines embroiled in a trademark dispute between different winery owners. One of the most well-publicized vineyard name trademark disputes involved the famed To Kalon Vineyard. Originally planted in 1868, To Kalon was eventually divided up and by the 1990s, both the Robert Mondavi Winery and Andy Beckstoffer owned portions of the vineyard. Mondavi secured federal trademark registrations for both the TO KALON and TO KALON VINEYARD marks. Schrader Cellars had entered into an agreement to purchase grapes from Beckstoffer, and Schrader planned to use the “Beckstoffer Original To Kalon Vineyard” designation on its wine label. In 2002, Mondavi sued Schrader Cellars, and sought an injunction to bar Schrader’s sale of “To Kalon Vineyard” designated wine. The parties eventually settled their dispute, and Beckstoffer was granted a royalty free license to continue to use the To Kalon name.

Thus, when the vineyard is owned by another party, the risk to the winery in marketing vineyard and block designated wines made from contract grapes is that once the contract ends, so can the rights to continue use of the vineyard and/or block designation. A winery must accept that by producing and marketing vineyard-designated wine made from grapes grown in a vineyard that the winery does not own, the winery is potentially spending time and money building brand equity for someone else. When the grape contract ends, there is considerable risk that the “brand” of the vineyard owner may be used by the vineyard owner itself, or potentially by other wineries that contract with the vineyard owner.

Wineries are often unaware that the vineyard designation or block designation actually belongs to the vineyard owner. Many wineries feel that if they are using the vineyard designation on wine and popularizing the vineyard name, they should own the rights in the vineyard or block designate as a trademark. While this may be a questionable legal position, this attitude among some wineries may nevertheless be problematic from a practical perspective. Should a winery successfully register rights in a mark which is used as a vineyard or block designate, the vineyard owner will need to spend considerable time and money in a potentially unsuccessful effort to regain clear rights in the name. The best way a vineyard owner can protect itself is to register its brands and properly license them to a winery.

To maintain trademark rights, an owner must control the quality of goods sold under the mark. For a vineyard owner, this can be accomplished through specific provisions in a grape contract or through a related trademark license agreement which is separate from the grape contract. A license will clearly establish that, as between the vineyard and the winery, the vineyard is the owner of the mark and that the winery (and its use of the designate) is subject to the terms of the license, as well as, the vineyard owner’s control of the quality of wine provided under the mark. In practice, such quality control can often be administered in a non-disruptive, nonintrusive manner (e.g., sufficient quality may be presumed based on maintenance of quality heretofore maintained by the winery operation).

The strategy of enhancing the value of grapes by naming the grapes from a certain vineyard is also widely used to enhance the value of other agricultural commodities, such as cattle from a certain ranch, or spinach from a particular farm. As the commodity producer, it is important to register the trademarks for the brands used with these agricultural products so that the commodities themselves (as well as the land from which they come) can accrue value, prestige and reputation which inures to the brand assets.

Are you adequately protecting your vineyard designate or agricultural commodity?

For inquiries, please contact Katja Loeffelholz, a registered attorney with the United States Patent and Trademark Office and Of Counsel to Dickenson, Peatman & Fogarty at [email protected].

TTB Proposes New Oregon AVA, Cites Wine Blogs as Support

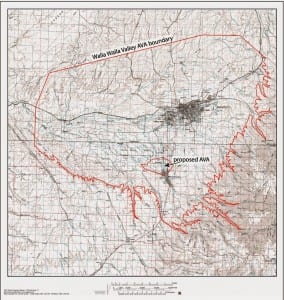

Winegrowers vying to become the 18th American Viticultural Area in Oregon have reached an important milestone. On February 26, 2014, a new notice of proposed rulemaking was published in the Federal Register, soliciting comments regarding the proposed “The Rocks District of Milton-Freewater” AVA. The comment period is open until April 28, 2014, and comments can be submitted online.

The proposed 4.9 square mile AVA is located just south of the Oregon/Washington border, in the southern part of the Walla Walla AVA, which in turn is nested in the Columbia Valley AVA. If TTB approves the new AVA, Washington wineries sourcing grapes from there will have to have their wines “finished” in Oregon in order to use the AVA name on their label pursuant to 27 CFR 4.25(e).

Wine blogs may end up playing a role in petitioner’s efforts to secure an AVA. Petitioners must submit evidence that the proposed AVA name is “currently and directly associated with an area in which viticulture exists.” The notice of proposed rulemaking cited two wine blogs (Washington Wine Report and Wine Peeps) that have referred to the area as “the rocks” in the section discussing “Name Evidence.” The petition submitted in support of the new AVA can be found through this link.

Dickenson, Peatman & Fogarty has represented a number of AVA petitioners before the TTB. For more information on AVA petitions, please contact Carol Kingery Ritter at [email protected] or John Trinidad at [email protected].