TTB Pumps the Brakes on CBD Infused Alcohol

Despite a slew of news reports on Cannabis-wine/beer/spirits over the past year, recent actions by the Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) have brought into question whether CBD-infused alcoholic beverages can be legally produced in the United States, even in states that have legalized cannabis for adult use.

Last fall, a Colorado brewery, Dad & Dudes Breweria, announced that it had secured TTB formula approval for a CBD-infused beer to be marketed as General Washington’s Secret Stash, and that it planned to distribute the beer nationwide. But in December, after the Drug Enforcement Agency concluded that marijuana extracts that contain cannabinoids are considered a Schedule I drug, TTB asked the Breweria to surrender the formula. The parties have since entered into negotiations as to next steps and the Breweria has agreed to (at least temporarily) stop producing the CBD-infused beer.

California newspapers have recently reported on in-state breweries and wineries that are making CBD-infused products. Given TTB’s treatment of Dad & Dudes Breweria, however, it is clear that the federal government believes that any such product requires a TTB-approved formula. Moreover, given recent statements by the U.S. Attorney General, it seems unlikely that the current administration would permit TTB to grant formulas for the production of a product that involves the infusion of a Schedule I drug. Producers engaged in making CBD-infused alcohol products absent a formula may be putting their federal licensing at risk until such time, at least, as the DEA changes its mind about the classification of marijuana extracts.

We reported on Oregon Liquor Control Commission’s guidance on marijuana-infused alcohol earlier this year. For more information regarding alcohol beverage production and ABC/TTB issues, please contact John Trinidad at [email protected].

Recent Uptick in Tied House Enforcement Actions by State and Federal Agencies

Clients often ask us about enforcement of the various alcohol beverage regulations and tied house laws that apply to industry members. “Tied-house” laws generally prohibit supplier-side licensees (including producers and wholesalers) from giving, directly or indirectly, any premium, gift, or “thing of value” to retail licensees, unless a specific exception applies.

Over the past year, we have seen an increase in enforcement actions by the California Department of Alcoholic Beverage Control (“ABC”) and the federal Alcohol and Tobacco Tax and Trade Bureau (“TTB”) in connection with state and federal tied house laws. These actions serve as important reminders that the agencies are both monitoring the activities of industry members and taking action to ensure that the rules and regulations are complied with.

Last month, ABC announced a $400,000 settlement with Anheuser-Busch, LLC wholesalers for the wholesaler’s engagement in marketing practices prohibited under California’s tied house laws. Approximately 34 retail licensees were also sanctioned. The settlement and related sanctions arise from an investigation by ABC’s Trade Enforcement Unit that found that the wholesaler paid for, or at least partially financed, refrigeration units, television sets and draught systems on behalf of various Southern California retailers. ABC’s settlement with Anheuser-Busch, LLC is the largest monetary penalty in ABC history.

As we highlighted in a blog post last year, TTB has issued guidance regarding the extent to which “category management” practices by wholesalers are permissible under federal tied house laws. In that ruling, TTB stated unequivocally that any “category management” services provided by wholesalers to retailers beyond the development of a shelf plan or schematic constitute tied house violations if the services result in the exclusion of competitor products. While this ruling was not surprising considering the language of the regulation that allows wholesalers to provide retailers with shelf plans, suppliers and retailers had long been engaging in practices aimed at optimizing the promotion of a particular “category” of products for years that exceeded the scope of this regulation. Read more about TTB’s ruling here.

We have also seen an increase in ABC’s investigation of supplier-side events occurring at retail premises.

Considering this increase in focus and enforcement of trade practice issues by both ABC and TTB, supplier-side licensees should seek legal counsel prior to planning events at retail premises or engaging in any other marketing activities that involve a retail licensee.

For more information, contact one of the attorneys in our alcohol beverage department: Bahaneh Hobel, John Trinidad, and Katy Stambaugh

Cannabis Wine? Not so fast, says Oregon Liquor Control Commission

With the legalization of marijuana spreading across major wine producing states, including Washington, Oregon and (most recently) California, many believed that it was only a matter of time before licensed cannabis retailers would stock their shelves with marijuana-infused wines.

But earlier this month, the Oregon agency in charge of regulating the sale of alcohol and recreational marijuana in the state, the Oregon Liquor Control (OLCC), issued guidance that prohibits the sale of marijuana-infused alcohol beverage products. Under Oregon Rev. Statute 471.446(2), OLCC may “prohibit any licensee from selling, any brand of alcoholic liquor which in its judgment …contains injurious or adulterated ingredients.” OLCC concluded that any alcohol beverage that contains “marijuana or marijuana items” (including extracts) should be deemed adulterated and, therefore, prohibited the sale of such products. OLCC, however, created an exception for alcoholic beverages produced using industrial hemp (as that term is defined under ORS 571.300) so long as the U.S Alcohol and Tobacco Tax and Trade Bureau has issued a formula for that product and the product’s label complies with TTB requirements.

California may adopt a similar view of the sale of marijuana-infused alcohol beverage products. Under California law adopted pursuant to Prop 64, a licensed marijuana retailer will be the only entity that could sell products infused with marijuana for recreational use (such as marijuana-infused wine). However, in order to do so, that retailer would also have to hold an alcohol beverage retail license issued by the Department of Alcoholic Beverage Control, and laws adopted under Prop 64 specifically prohibit a party from holding both licenses. Thus, unless new rules are enacted that allow either an alcohol beverage retailer or a licensed marijuana retailer to sell marijuana infused alcoholic beverages, there is no legal sales outlet for such products in California.

There is also a serious question as to whether such products could be legally produced by a state licensed and federally bonded winery. Those concerns are entirely separate from, and in addition to, concerns as to whether the current administration will impede state-sponsored efforts to legalize adult-use marijuana.

In short, cannabis wine entrepreneurs should proceed cautiously.

Federal Rule Changes Make More Products Eligible for (Lower) Hard Cider Tax Rate

The start of the New Year brought federal tax relief to certain cider producers. The PATH Act of 2015 made various changes to the Internal Revenue Code, which took effect on January 1, 2017. Included in the changes was a modification of the definition of products eligible for the “hard cider” tax rate. Under the new rule, more hard cider products can qualify for this tax rate and enjoy a much lower rate per gallon than the rates that might otherwise apply.

In order to meet the “hard cider” definition and be eligible for the lower tax rate, the product in question must meet certain criteria related to carbonation, alcohol content and contents. The modified definition of “hard cider” under the PATH Act allows for an increased carbonation level (up to 0.64 grams of carbon dioxide/100 milliliters versus the previous 0.392 grams/100 milliliters), increased alcohol by volume (up to 8.5% versus the prevision limit of 7%) and the use of pear and pear concentrates, rather than just apple and apple concentrates. Similar to the previous definition, the product may not contain any fruit product or flavoring other than apple or pear.

If a hard cider product does not meet the foregoing criteria, it will be taxed as a wine, for which there are various classifications and corresponding tax rates. For example, a hard cider that contains more than 0.64 grams of carbon dioxide/100 milliliters is considered an effervescent wine and will be taxed as either a sparkling wine or artificially carbonated wine (depending on the source of the carbon dioxide). The producer would pay $3.40/wine gallon if the product is classified as “sparkling wine” or $3.30/wine gallon if the product is classified as an “artificially carbonated wine.” If, however, the product qualified as a “hard cider,” the applicable tax rate would be only $0.226/wine gallon.

On January 23, 2017, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) published a temporary rule to implement these changes to the definition of “hard cider” under the Internal Revenue Code. TTB is also imposing a new labeling requirement which requires the statement “Tax Class 5041(b)(6)” on any container of wine for which the hard cider tax is claimed. TTB is providing a one year grace period for this rule, but products removed after January 1, 2018 must include the statement “Tax Class 5041(b)(6)” in conjunction with the designation of the product as “hard cider.” This statement may appear anywhere on the label.

TTB is currently soliciting comments on the temporary rule within Docket No. TTB– 2016–0014 on the regulations.gov website. If you have any questions about this modified definition of “hard cider” and the potential tax benefits for your business, please contact Katy Stambaugh via email or (707) 261-700.

Taking Advantage of the New Law Allowing Service of Beer and Wine by Salons & Barbershops

As of January 1, 2017, California beauty salons and barber shops in good standing with the State Board of Barbering and Cosmetology are permitted to serve their customers, where local zoning permits, no more than 12 ounces of beer or 6 ounces of wine by the glass for no charge.

Many of our winery, brewery and retail clients have asked whether they are permitted to sell wines and beer directly to salons and barber shops under this new rule. Because salons and barber shops do not hold alcohol beverage licenses, they are treated like consumers under the California ABC Act and are only permitted to purchase wine and beer directly from persons who can legally sell to consumers, such as licensed retailers or licensees with retail privileges.

Licensed wineries and breweries in California luckily do have retail privileges, and thus they have the right to sell their products directly to consumers in California. As such, they can sell wine and beer directly to salons and barbershops in the state, just as they would to a consumer. Similarly, retail licensees with off-sale privileges may sell wine and beer to qualified salons or barbershops. Note, however, that licensees holding a type 17/20 license combination may only sell wine (and not beer) to consumers, including salons and barbershops.

For all such sales to salons and barbershops, licensees must ensure that they charge and collect sales tax and report such sales and taxes to the California State Board of Equalization.

For any questions, please contact Bahaneh Hobel.

Supporting Non-Profits through Cause-Related Marketing

The start of 2017 has seen an outpouring of support from the business community for non-profit groups, including marketing campaigns that promise a certain percentage of sales or profits will be donated to particular charities. Such practices are often referred to as “cause-related marketing.” Here’s an example: ABC Winery wants to support a national nonprofit organization, and decides to launch a marketing campaign saying that 50% of profits will be donated to that cause.

While ABC Winery should be applauded for their efforts, they will also need to comply with state laws and regulations aimed at protecting consumers, promote transparency, and ensuring that charities are indeed receiving the funds that are being promised in the cause-related marketing campaign. These laws vary state by state, but typically include reporting, contracting, disclosure, and/or registration requirements for the commercial entity promising to donate a portion of sales (a “commercial co-venturer”).

In California, a commercial co-venturer must (a) have a written contract with a charity prior to making any cause marketing representation, (b) transfer any funds received as a result of the representations every 90 days, and (c) provide a written accounting to the charitable organization sufficient to determine that any cause-related representations made by the co-venturer have been “adhered to accurately and completely” and said accounting must also be sufficient for the charity to prepare its periodic charitable solicitations reports filed with the California Attorney General. Alternatively, if the co-venturer decides not to follow these steps, it must register annually with the California Attorney General’s office, pay an annual fee, and submit annual reports.

In addition, cause-related marketing claims are considered “sales solicitations for charitable purposes” under California law, and are subject to the disclosure requirements under Cal. Bus & Prof. Code Sec. 17510 et. seq. This law requires disclosure of the following information:

- Name and address of the combined campaign, each organization, or fund on behalf of which all or any part of the money collected will be utilized for charitable purposes;

- If there is no organization or fund, the manner in which the money collected will be utilized for charitable purposes;

- The non-tax-exempt status of the organization or fund, if the organization or fund for which the money or funds are being solicited does not have a charitable tax exemption under both federal and state law; and

- The percentage of the total gift or purchase price which may be deducted as a charitable contribution under both federal and state law.

If sales and marketing efforts are made outside of California, then those state laws and regulations regarding cause-based marketing may also apply.

TTB ISSUES GUIDANCE ON ELIMINATION OF BOND REQUIREMENTS FOR SMALL PRODUCERS

As we discussed in our earlier blog post, as of January 1, 2017, TTB-licensed breweries, distilled spirits plants and wineries that owed less than $50,000 in excise taxes in 2016, and expect to owe less than $50,000 in 2017, will no longer be required to hold a bond. TTB started off the new year by issuing some additional guidance regarding the elimination of the bonding requirement for such producers. You can find the industry circular at this link.

Please note: if you are an existing, licensed, and bonded producer and you feel you are eligible for the bond exemption, TTB will not begin processing your request until it has received your final tax payments for 2016 excise taxes.

Don’t Forget – Starting January 1, Eligible Licensees Can Amend TTB Permits To Eliminate Bonds

As of January 1, 2017, if you are currently licensed with TTB as a brewery, distilled spirits plant or winery and owed less than $50,000 in excise taxes in 2016, and expect to owe less than $50,000 in 2017, you will no longer be required to hold a bond. This is great news for all the small producers out there!

This change, however, does not take place automatically and requires an amendment to your existing TTB permits. As such, after January 1, 2017, if you owed less than $50,000 in excise taxes in 2016 and expect to owe less than $50,000 in excise taxes, you will be able to amend your TTB permits to request exemption from the bond requirements. This amendment can be done online for any licensees that obtained their permits through Permits Online or on paper for any licensees that originally obtained their permits with paper applications.

Note that the bond exemption is applied a bit differently with respect to new permit applicants. Any new applications to operate breweries/brewpubs, distilled spirits plants, or wineries submitted to TTB before January 1, 2017 are still required to include a bond, even if the applicant expects to be eligible for the bond exemption. TTB will review the application and return any bond-related materials if they grant the bond exemption.

Applications submitted after January 1, 2017 for eligible small producers (i.e., those who do not expect to owe less than $50,000 in excise taxes in 2017) will not require a bond.

For further information or for assistance amending your TTB permits, please contact Bahaneh Hobel.

Protecting Wine Origins is Pro-Consumer and Pro-Industry

TTB’s attempt to put an end to an inherently misleading labeling practice and protect the AVA wine origin labeling rules has garnered significant reaction from certain commentators and some in the industry. In order to shed some light on the proposed amendments to federal labeling rules and why Napa Valley Vintners, the Wine Institute, over 50 members of Congress and others have supported TTB’s Notice of Proposed Rulemaking 160, we have prepared the following summary.

I. Current regulations allow certain wineries to employ misleading labeling practices.

Producers selling wine in interstate commerce must obtain a Certificate of Label Approval (“COLA”) and comply with federal regulations aimed at protecting consumers from misleading labeling practices. This includes federal standards for using vintage date, grape variety designations, and wine origin designations such as county, state, and country appellations and American Viticultural Areas (“AVAs”).

Wineries wishing to avoid enforcement of these federal truth-in-labeling standards can do so simply by filing for a COLA exemption and noting on the wine bottle that the wine is “For Sale Only” in the state in which the producing winery is located. This leads to the potential for misleading wine labeling practices. For example, federal regulations require that an AVA wine sold in interstate commerce with a 2015 vintage date must be made from at least 95% grapes grown in that vintage. But those regulations do not apply, and therefore would not prevent, a wine with a certificate of label approval exemption from using a lower percentage of 2015 harvested grapes and still being labeled as “2015.” Wines with certificates of label approval can be labeled with a varietal name, such as Pinot Noir, if it is made from at least 75% of grapes of that variety, but get an exemption and slap on a “For Sale Only” sticker, and then there is no obligation under federal regulations that the wine meet that 75% requirement.

Certain wineries have taken advantage of this COLA exemption loophole to designate their wine with an AVA while not complying with federal standards governing wine origin labeling, specifically, 27 C.F.R. Sec. 4.25 which requires that wine labeled with an AVA (a) be derived 85 percent or more from grapes grown within the boundaries of that AVA, and (b) be fully finished within the state in which the AVA is located. This “fully finished” federal requirement ensures that California wine production and labeling laws apply to wines that are identified with a California appellation or AVA.

These federal appellation labeling rules assure consumers that when they buy an appellation-designated wine, they are buying a product wherein both the grape source and the place of production are closely tied to the named place. Absent such rules, retail shelves could be stocked with wine labeled as “Burgundy” that was made in Sweden, “Barolo” that was actually produced in Slovenia, or “Sonoma Coast” made in Alaska.

II. TTB’s Notice 160 Proposes to Close the Loophole By Requiring All Wines to Follow the Same Vintage, Variety, and Appellation Labeling Standards.

In September 2015, 51 members of Congress wrote to TTB with a fairly simple request: “ensure that all wines bearing AVA terms—regardless of where they are sold—meet the clear and understandable American Viticultural Area rules.”

On June 22, 2016, the U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) responded by issuing Notice of Proposed Rulemaking 160, in which the agency proposed eliminating the COLA-exemption loophole by requiring COLA-exempt wines to comply with federal standards for vintage, varietal, and wine origin designations and to keep records to support such labeling claims. TTB subsequently granted a 90-day extension on September 8, 2016 and, in so doing, requested “comments regarding whether any geographic reference to the source of the grapes used in the wine could be included on a wine label in a way that would not be misleading with regard to the source of the wine” (emphasis added).

III. NVV and Wine Institute Support Notice 160 to Put an End to Misleading Labeling Practices.

Napa Valley Vintners (NVV), a non-profit trade association with over 500 members and our client, issued a comment letter supporting Notice 160, pointing out that the COLA exemption loophole was being used to mislead consumers and allow COLA-exempt wines to “unfairly benefit from the goodwill and brand recognition of appellation names without having to comply with the appellation regulations.”

NVV also pointed out that out-of-state wineries passing off their products as California wines by using the names of California appellations on their wine labels were able to avoid compliance with state laws regarding wine production and labeling. For example, wines produced outside of California but labeled with the name of a California AVA have no obligation to follow the state’s conjunctive labeling, wine composition and production, or misleading brand name statutes.

Similarly, wines produced outside of Oregon but using the name of an Oregon AVA, would have no requirement to follow the much stricter Oregon varietal composition (requiring at least 90% for most varieties) and appellation of origin (requiring 100% from Oregon and 95% for all other appellations). As David Adelsheim, founder of Oregon’s Adelsheim Vineyard, pointed out in his support of Notice 160, “the reputation of Oregon’s AVAs, hard won through years of experimentation and work” would suffer as a result of allowing COLA exempt wines to avoid enforcement of state wine-related laws.

After significant consultation, Napa Valley Vintners (NVV) and Wine Institute, a public policy advocacy association representing over a thousand California wineries and affiliated businesses responsible for 85 percent of the nation’s wine production and more than 90 percent of U.S. wine exports, issued a joint letter in further support of Notice 160, noting that the proposed amendments “put an end to the inherently misleading practice of using a Certificate of Label Approval … exemption to avoid compliance with federal labeling laws.” Sonoma County Vintners also issued a letter in full support of the NVV and Wine Institute position.

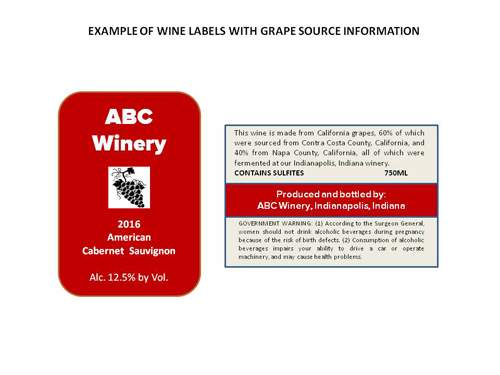

IV. NVV and Wine Institute Put Forward a Proposal that Allows For Optional Grape Source Information for COLA Exempt Wines.

In their joint letter, NVV and Wine Institute directly respond to TTB’s request for information as to whether grape source information could be included on COLA-exempt wines in a manner that was not misleading as to wine origin designations. The joint proposal directly addresses concerns that Notice 160 would prevent producers from providing consumers with truthful information regarding where the grapes used to make the wine came from, and at the same time protects AVA names as designators of wine origin. It also addresses concerns raised by wineries that had previously used COLA exemptions suggesting that they could continue to label their wine with truthful vintage and variety designations..

The NVV / Wine Institute proposal permits wineries to provide the following “Grape Source Information” on their wine: (a) the name of the county(-ies) and state(s), or just the state(s), where all of the grapes are grown; (b) the percentage of the wine derived from grapes grown in each county or state shown on the label; and (c) the city and state, or just the state, where the wine was fully finished. In order to avoid any confusion with wine origin designations, no name of an AVA (other than a county or a state) could be used as part of the Grape Source Information, and the wine itself would have to be designated using the “American” appellation. By using the American Appellation, (under current Federal regulations), the wine could also be designated with the vintage and grape varietal.

In short, NVV and Wine Institute are in favor of truthful labeling practices that protect the integrity of the AVA system. The goal of the joint proposal is simple: when consumers come across a wine labeled with an AVA name, they should be assured that the wine actually meets the legal standards for AVA labeling.

V. Support for Notice 160 comes from Industry Members That Believe Protecting Wine Origin Labeling is both Pro-Consumer, Pro-Grower, and Pro-Vintner.

Notice 160 is supported by a broad swath of industry members that believe the integrity of wine origin labeling regulations is essential to the U.S. wine industry. Regional associations (including the New York Wine Industry Association and Washington Wine Institute) and industry members from well-established as well as up-and-coming wine growing regions have written to TTB to note their support for the proposed amendments.

For example, Andy Beckstoffer, a noted grape grower with vineyards in Napa Valley as well as the Red Hills Lake County AVA wrote TTB to voice approval of Notice 160, stating:

It is vitally important to grape growers that the integrity of the AVA system be maintained, and I applaud TTB’s efforts in ensuring that all wine labeled with the name of an AVA meet the well-established federal wine labeling requirements. Grape growers, whether they farm vineyards in well established AVAs or in newer AVAs, benefit greatly from regulatory efforts to protect those place names.

This sentiment was shared by the High Plains Winegrowers Association, a group of winegrowers and vintners from the Texas High Plains AVA. They feared that the current COLA exemption loophole “is detrimental to Texas wineries that support locally grown wine grapes,” and further concluded that “[f]ailing to uniformly treat the labeling of all wine—whether distributed in-state or in interstate commerce—results in inequitable treatment within the same industry.” Douglas Lewis, a Texas Winemaker, also supports Notice 160 because it “helps consumers get more accurate information [about wine origin] by closing the loop hole.” And Andrew Chalk, a Dallas based wine writer, noted that by eliminating the COLA exemption loophole, TTB would be “remov[ing] the biggest impediment to the Texas wine industry’s growth.”

***

Notice 160 has caught the attention of industry members since it was first issued back in June, over 170 days ago, as more than 100 comments have been submitted to TTB on this matter. TTB will consider those comments as it comes to a decision on whether: (a) the COLA exemption loophole should continue to exist; and, (b) additional and truthful grape source information can be included on such wines in a way that does not undermine the AVA system for wine origin designation.

Wine industry members and consumers who believe that wine is a product of place and that place names are worthy of protection should support Notice 160. Although certain individuals may benefit financially from the COLA-exemption loophole, that is no reason for the federal government to allow an inherently misleading labeling practice to continue unabated. Moreover, elimination of the COLA-exemption loophole does not necessarily prohibit wineries from providing additional truthful, non-misleading information about grape sourcing. Any regulation that allows for such information, however, must also be crafted in a manner that maintains the integrity of the AVA regulatory system. The joint NVV / Wine Institute proposal does just that.

Furthermore, if the U.S. allows U.S. wineries to skirt the rules for proper use of American appellations and American Viticultural Areas, then the U.S. will be in no position to insist that other countries require that their wineries also follow the rules in respect of American appellations and American Viticultural Areas. Undoubtedly wine production is less costly in countries outside the U.S., and if wine grapes from Napa Valley can be shipped to Texas and the wine produced in Texas is allowed to use the “Napa Valley” AVA on the label, there is no basis to object to a Chinese or Canadian winery producing a “Napa Valley” wine from Napa Valley grapes shipped to those countries. Not only is that bad for the U.S. industry, but it diminishes the value of the AVA and harms all consumers.

NOTE – DP&F serves as outside counsel to several regional wine trade associations including Napa Valley Vintners with interests in protecting the integrity of regional appellations.

CA ABC Issues Warning About Potential Scam

The California Department of Alcoholic Beverage Control has issued a warning that licensees are being targeted by a possible scam. Apparently, licensees have been receiving calls from someone claiming that, as a result of an ABC violation, the licensee must pay a fine. In short, the ABC does not operate in this manner, and if you receive such a call, check in with your local ABC office before submitting any payment or credit card information. Also, the ABC is asking licensees to help uncover these fraudsters. If you are contacted by these scammers, asking for their name and contact information, and pass that information on to the ABC.

If you need to find the contact number for your closest ABC office, it is available at this link.

TTB Proposes to Shut Down COLA Exemption Appellation Labeling Loophole

The U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) has proposed amendments to federal wine labeling laws that protect the integrity of the appellation of origin labeling system in its Notice of Proposed Rulemaking No. 160 (NPRM 160). If adopted, the proposed amendments would close off a loophole that allows certain wines to be labeled with the name of an appellation of origin, including the name of an American Viticultural Area (AVA), even though those wines do not meet the strict legal requirements for appellation labeling.

A winery wishing to sell AVA-labeled wines in interstate commerce must meet strict criteria. Specifically, not less than 85 percent of the wine must be derived from grapes grown in the AVA and the wine needs to be fully finished in the state (or in the case of a multi-state AVA, in one of the states) in which the AVA is located. 27 C.F.R. §4.25(e)(3)(iv). The second prong of this test ensures that wines that carry an AVA name also comply with the laws of the state in which the AVA is located regarding wine production, composition and labeling – laws that state legislatures adopted in order to protect and promote their local wine growing regions.

However, under the current system, wineries that choose to sell wine solely within their home state can apply for a Certificate of Label Approval (COLA) exemption for that wine, and benefits from the use of an appellation name to market their wine without having to comply with the federal and state requirements mentioned above. TTB’s proposed rule would eliminate this loophole and thereby create a uniform system for the use of appellations of origin and AVAs on wine labels.

By creating one set of rules that all wineries must follow in labeling wines with appellation names, the proposed amendment not only prevents unfair competition among wineries, but also protects against consumer confusion. Let’s say an Indiana consumer comes across a wine labeled with the Napa Valley AVA, produced and by an Indiana winery and sold in Indiana pursuant to a COLA exemption. Because the wine is marketed and sold under the Napa Valley AVA, the consumer is led to believe that the wine meets all the criteria necessary for the use of the Napa Valley AVA. But that’s not the case. That wine, even if made from 85% Napa Valley grapes, was not fully finished in California, which is a requirement for use of the Napa Valley AVA, and it was not subject to California’s production, composition, and labeling laws. TTB’s proposed amendments would ensure that when consumers are evaluating wines carrying a certain AVA name, they are assured that those wines have all met the same standard.

Furthermore, the proposed rule protects the significant investment states have made in promoting and regulating the use of their regional wine appellations which provide significant financial contributions to their state economies. If the TTB were to continue to allow wineries in other states to use appellations in disregard of the TTB rules and flout the rules of the states in which the appellations are located, the U.S. would have very little recourse in objecting to the foreign use of those same appellations if the grapes were shipped to other countries and the wine produced overseas. Surely the U.S. wine industry does not wish to see a wine labeled with the name of a U.S. AVA or appellation produced in China or Australia and shipped throughout the world in direct competition with such same domestically produced wines. Such a result would severely undermine the integrity and “brand value” of U.S. AVAs and appellations of origin around the world and impair the ability of U.S. wineries to compete in the global wine market.

The adoption of regulations aimed at closing off a loophole will invariably have an impact on those that have relied on the existence of that loophole as part of their business plan. But that alone is not sufficient to reject reforms needed to create a uniform standard and protect against potential consumer confusion. The AVA system has been a fundamental component of the growth of the U.S. wine industry, and TTB’s proposed amendments are necessary to protect the integrity of that system.

NOTE – DP&F serves as outside counsel to several regional wine trade associations with interests in protecting the integrity of regional appellations

Napa’s New Winery Compliance Rules Preceding Strict Enforcement

Earlier this month, the Napa County Board of Supervisors completed their review of the Agricultural Protection Advisory Committee’s (APAC) recommendations to improve agricultural protection, primarily by imposing new restrictions and limitations on wineries (See approved list of Board actions on APAC recommendations). One of the recommendations approved by the Board was to implement a phased, self-certification compliance program in order to assure wineries are complying with the terms of their use permits and provide greater consistency in how the County enforces code compliance. The Board still needs to formally approve the specifics, but staff anticipates the new three-phase program would go into effect in early 2018.

Phase One: This phase will require all wineries to report their annual production and grape sourcing data to the County. To properly ascertain this data the County will evaluate a winery’s production reports to the Alcohol and Tobacco Tax and Trade Bureau and California Department of Food and Agriculture. The County has taken the position that production related information is confidential and not subject to Public Records Act requests; however, it is likely that certain members of the public will continue their cries for greater code compliance and transparency and seek access to any available data.

In preparation for Phase One, wineries should review the County’s definition of “Production” and its own operations to determine whether they are in compliance with their use permit production limits (See Napa County worksheet regarding interpretation of winery production) and, if applicable, the 75% grape sourcing rule (See Napa County Code § 18.104.250 [“at least 75% of the grapes used to make the winery’s wine . . . shall be grown in Napa County”]). It is important to note that these production calculations are not based on maximum allowed production, but rather on the actual amount of wine made.

Phase Two: The second phase would encourage wineries to meet with County officials for a voluntary review of their use permit. According to the County, the purported purpose of the review is to: “(1) streamline existing use permit conditions of approval; (2) determine existing vested rights; (3) clarify the scope of permitted activities; and (4) consider alternative measures to accommodate marketing activities.” The exact meanings of the stated purposes are difficult to understand right now and the County has not defined any of the terms. However, officials have stated that the reviews would not involve any change to a winery’s legally established vested rights.

How one defines “vested right” could potentially result in disagreement between winery owners and County staff. For example, staff could take the position that if a winery has not fully utilized its permitted production the winery would have vested rights only to that amount actually produced. Determinations of vested rights is highly fact-specific so it is difficult to make any general conclusions, but this could be a significant issue for some wineries that currently feel they are not at risk because they have not reached their visitation or production limits. We also anticipate other issues will arise related to interpreting a winery’s historic use permits as the County’s forms and standards have changed over time.

During Phases One and Two, the County will continue to its current practice of randomly auditing 20 wineries per year. Each year the County audits wineries and reports the results of those audits to the Board of Supervisors at the end of each year. Again, it is unclear how the County the audit may evolve based on the new compliance process.

Phase Three: County officials plan to transition to a practice of strict code enforcement whereby the County will require violators to immediately comply with all applicable requirements. In the past, the County has allowed wineries not operating within the conditions of their use permit to continue such activities if that winery seeks a use permit modification to come into compliance. But now some decision makers have stated that those days “of forgiveness” are over.

While the proposed self-certification program may not go into effect until 2018, Napa County’s wineries should understand the terms of their use permit and any applicable vested rights.

For more information about this and other land use issues, please contact Tom Adams or Jeff Dodd from DP&F’s Land Use Group.

ABC Provides Guidance on Passport Events

On March 4, 2016, the California Department of Alcoholic Beverage Control (“ABC”) published an Industry Advisory providing guidance to licensees, marketing companies and winegrower associations participating in “passport” marketing events.

Most passport events have the same format – consumers purchase an identifiable event glass, wrist band, passport or punch card from a marketing company or winegrower association organizing the event, which provides the consumers access to various experiences and tastings at the premises of participating manufacturer licensees (beer, wine or spirits). The experiences and tastings are then provided to the consumers by the participating manufacturer licensees at their licensed premises to the extent such experiences and tastings are permitted under their existing licenses. So, for example, tastings by wineries, breweries and distilleries as part of such passport events are permissible, since such licensees have the right to conduct such tastings under their licenses (subject to restrictions set forth in the ABC Act). However, Type 17/20 licensees would not be able to provide tastings as part of any such passport event, since such licensees are not permitted to conduct consumer tastings.

While these events have been occurring for many years throughout California, ABC district offices throughout the state were dealing with licensing for these events in different and inconsistent ways (i.e., if a license was required at all, if one license could cover the whole event at all locations, if a separate license was required at each location, etc.). As such, ABC provided the Passport Event Guidelines which set forth the conditions under which these events can be held without a license.

In order for a marketing agency or a winegrower association to organize a Passport Event without obtaining its own ABC license(s) for the event, the Passport Event has to satisfy all of the following requirements:

- The marketing organization or winegrower association is only marketing the event which is actually put on by the participating manufacturers.

- The organization sells only access to the experiences or activities that the manufacturer licensee may lawfully provide free of charge to consumers (such as tastings).

- The manufacturer licensees involved are doing no more than providing tastes of wine, beer, or distilled spirits to participating consumers under the authority of their license (which allows such manufacturer licensee to give or sell such tastes).

- There is no commingling of funds or sharing of revenue between the marketing organization and manufacturer licensee (i.e., all proceeds for the sale of the passport go to the organization, and revenue from sales of alcoholic beverages to consumers separate and apart from the tastes given during the marketing event are not shared with the marketing organization).

Events that fall outside of these parameters will require a license for the marketing company (if a license is even possible under the ABC Act), or the nonprofit winegrower association. Thus, for example, Passport Events that include a gala dinner or tasting event where wines from multiple wineries are being poured at one location will require a temporary daily license held by the event organizer. Or, where the tickets being sold by the organization include alcohol (in excess of the “tastings” permitted at a licensed manufacturer’s premises under the ABC Act), a temporary daily license will be required. Note that because not all organizations are eligible for temporary daily licenses under the ABC Act (as such licenses are typically limited to nonprofit or other charitable organizations), event organizers should contact counsel or the ABC while organizing their event to determine if a license, if required, is even available to the event organizer.

For more information on licensing and other questions related to passport or other events at licensed premises, please contact Bahaneh Hobel, Partner in DP&F’s alcohol beverage law group, or Katy Barfield, Associate in DP&F’s alcohol beverage law group.

TTB Provides Guidance on Category Management Practices

On February 11th, the Alcohol and Tobacco Tax and Trade Bureau (“TTB”) issued a new ruling regarding the extent to which “category management” practices are permissible under federal tied-house laws.

The “tied-house” laws promulgated under the Federal Alcohol Administration Act (the “FAA Act”) generally prohibit industry members from giving “things of value” such as supplies, money, or services to a retailer to induce the retailer to purchase their products to the exclusion of others. In 1995, TTB adopted an exception to these tied house prohibitions (27 CFR Sec. 6.99(b)) allowing industry members to stock, rotate and affix prices to their products at a retail account, provided that the products of other industry members are not altered or disturbed. The exception also states that the provision of a shelf schematic or plan by the supplier to the retailer does not constitute “a means to induce” within the meaning of the FAA Act.

Over the past few years, suppliers and retailers have engaged in certain practices commonly referred to as “category management” which are aimed at optimizing the assortment, price, shelf presentation and promotion of particular “category” of products found at a retail location. Recently, industry members asked TTB to clarify its position with respect to the scope of the Sec. 6.99(b) exception to federal tied house laws to determine if such category management practices by alcohol beverage industry members fall under the exception.

In its ruling, the TTB took a very narrow reading of that exception. Unsurprisingly, TTB held that furnishing retailers with a shelf plan or shelf schematic, as stated unambiguously in the exception, is permissible and in and of itself not an inducement. However, additional services provided by suppliers to retailers beyond the mere provision of the shelf plan or schematic exceed the bounds of the exception and may constitute a tied house violation if the practice results in the exclusion of competitor products. Practices that may result in TTB scrutiny include, but are not limited to:

- Assuming, in whole or in part, a retailer’s purchasing or pricing decisions, or shelf stocking decisions involving a competitor’s products;

- Receiving and analyzing, on behalf of a retailer, confidential and/or proprietary competitor information;

- Furnishing to the retailer items of value, including market data from third party vendors;

- Providing follow-up services to monitor and revise a shelf schematic where such activity involves an agent or representative of the industry member communicating (on behalf of the retailer) with the retailer’s stores, vendors, representatives, wholesalers, and suppliers concerning daily operational matters (such as store resets, add and delete item lists, advertisements and provisions);

- Furnishing a retailer with human resources to perform merchandising or other functions, with the exception of stocking, rotation or pricing services of the industry member’s own product.

As noted above, in order to find that a federal tied house violation had occurred with respect to such “category management” practices, the agency would have to find that the practice in question had the effect of excluding a competitor’s product.

For more information, see TTB’s ruling here or contact one of the attorneys in our alcohol beverage department: Bahaneh Hobel, John Trinidad, and Katy Barfield.

California Court Issues Trademark Injunction Against Fresno’s Black Ops Brewery

New York based Brooklyn Brewery brought an action to enjoin the Fresno County Black Ops Brewery from any continued use of “Black Ops” on or related to beer products. The Court granted the injunction January 6, 2016. Brooklyn Brewery produces a single bottle Russian Stout (with a champagne cork) under the name “Brooklyn Black Ops,” which was issued as a federal trademark registration in 2009, and the brewery has since successfully sold tens of thousands of cases of the beer in 27 states in the past 8 years. Brooklyn Brewery is currently in negotiation to expand distribution to California. Case No. 1:15-cv-01656-JAM-EPG (E.D. Cal.) Click here for opinion.

Black Ops Brewery, Inc. in Fresno County, CA produces blondes and IPAs with specific identifying names, including “the Blonde Bomber” and “Shrapnel.” Each 22 ounce single bottle retails for less than $7.00, compared to Brooklyn Black Ops’ 22 ounce single bottle retail price of $29.99. In March 2015 Black Ops Brewery applied to the Patent and Trademark Office, and was subsequently denied, federal registration for “Black Ops Brewing” for beer and taproom services. Nonetheless, Black Ops Brewery continued its use of the name.

Brooklyn Brewery notified Black Ops Brewery of its infringement and demanded immediate cessation of use of the name; not only was Brooklyn Brewery issued federal registration for the mark, but Brooklyn Brewery’s Black Ops mark is also an incontestable mark because it has been in continuous use for 5 years since trademark issue. Brooklyn Brewery argued that continued infringing use of the name was in bad faith. Black Ops Brewery claimed it had adopted the name in good faith in memory of friends and family in military service and continued use of the term despite being on notice of Brooklyn Brewery’s alleged superior rights in the mark.

The Court found that Black Ops was a strong arbitrary mark (i.e., does not describe the product’s characteristics), and that despite some differences in beer quality, packaging and pricing of the goods, the two breweries had an identical product. These factors weighed heavily in favor of the Court’s finding that there existed a high likelihood of confusion by consumers between the two brands.

The Court determined that the two breweries shared similar marketing channels. While Black Ops Brewery does not have the same marketing teams or distributors as Brooklyn Brewery, Black Ops Brewery did use the same social media channels to promote itself as Brooklyn Brewery. The Court further found that Brooklyn Brewery would likely expand sales to Fresno County where consumer confusion would increase if both brands were available at the same location. As the Court noted, the purchasing environment of alcoholic beverages like beer is often “chaotic and impulsive,” such as when purchased at bars, thus further increasing the likelihood of confusion of the consumer when purchasing a “Black Ops” beer.

Finally, the Court held that Brooklyn Brewery would face irreparable harm if the injunction were not granted. Brooklyn Brewery has spent years of effort and financial investment to establish the goodwill of its brand. Brooklyn Brewery was concerned that if consumers drank a Black Ops Brewery beer they would be unlikely to ever purchase a Brooklyn Black Ops Beer “thinking it is connected with the “Black Ops” beer that they did not enjoy.” The Court agreed with this likelihood of consumer confusion and harm to Brooklyn Brewery, and concluded that the injunction would be effective immediately to enjoin and restrain Black Ops Brewing Inc. from using the marks “Black Ops” or “Black Ops Brewing” or any other infringing or unfairly competing mark with Brooklyn Black Ops.

This case is especially interesting because the Court issued the preliminary injunctive relief even though Brooklyn Brewery is not yet selling its Brooklyn Black Ops beer in California. Thus, the immediacy of the harm to Brooklyn Brewery could be questionable. However, the fact that Black Ops Brewery was on notice of Brooklyn Brewery’s rights and disregarded them no doubt had equitable impact on the Court’s decision.

Avoid Penalty Flags from the ABC During Super Bowl 50

In anticipation of Super Bowl 50 on Sunday, February 7 in the Bay Area, and given the large number of both retail and supplier-side licensees that are participating at the Super Bowl, and in events and promotions in the week leading up to the game, the California Department of Alcoholic Beverage Control has issued an advisory providing guidance to licensees participating, selling and/or serving alcoholic beverages at Super Bowl related events.

The takeaway from ABC’s advisory? All the same rules apply. If you were not permitted to do something before, you are not permitted to do it now just because it’s Super Bowl.

However, a little reminder from the ABC about the rules never hurts, so here is a brief summary of their do’s and don’ts to help you avoid penalty flags during Super Bowl week.

- The Super Bowl is not a “time out” for licensees. All current laws and regulations remain in effect during Super Bowl and no new laws have been passed regarding the sale, service, consumption, or marketing of alcoholic beverages for Super Bowl.

- Just because it’s the Super Bowl doesn’t mean after parties are allowed at licensed locations. It is still illegal (a misdemeanor) to sell or serve alcohol between the hours of 2 a.m. and 6 a.m. ABC guidelines also specifically say that purchasing alcohol ahead of time or in bulk to be served after 2 a.m. on a licensed premises is not permitted.

- In case you forgot, it is unlawful to serve alcoholic beverages to minors under the age of 21 (even if they look like football players) and it is unlawful to serve alcoholic beverages to obviously intoxicated persons (even if they look like football players that just won the Super Bowl). Make sure to keep checking IDs and monitor your customer’s behavior before selling or serving them any drinks.

- All of your sales and service activities, and your location, need to be licensed, even though it might be a lot more fun to do something different “because its Super Bowl.” You can only sell and serve alcoholic beverages in the areas covered by your existing licenses. And you can only sell alcoholic beverages if you are licensed to do so. This includes charging admission fees or pre-selling tickets that include alcohol in the admission or ticket price.

- You can only sell what you are normally allowed to sell. You are not permitted to sell an amazing Super Bowl inspired Vodka cocktail at your licensed premises if your license only permits you to sell wine or beer.

ABC is out and about, especially during big events like the Super Bowl, so just operate in accordance with the rules and regulations that are normally applicable to your license to ensure that you and your employees don’t fumble.

Super Bowl will bring a lot of business and potential new customers to industry members. Keeping the above tips in mind will help ensure a winning Super Bowl for all involved (except maybe the losing team).

For more information on the rules and regulations governing the sales, service and distribution of alcoholic beverages, please contact Bahaneh Hobel via email.

New Alcohol Beverage Regulations Give Licensees Expanded Rights and Privileges in the New Year

Beginning on January 1, 2016, new provisions of the California ABC Act will go into effect that will, among other things, provide industry members with additional rights and privileges related to marketing, events and promotions, and will also create a new Craft Distiller License. A summary of a few of these important new statutory provisions is included below.

Retailer and Non-Retailer Sponsorships of Non-Profit Events (Section 23355.3):

Overview:

- This new statutory section was largely drafted in response to accusations filed by the ABC against certain wineries related to their participation in a nonprofit event, the “Save Mart Grape Escape”. As the name suggests, although this was a nonprofit event, Save Mart, a licensed retailer, was also a sponsor of the nonprofit event. The ABC had alleged in its accusations that participating supplier-side licensees that referenced the event by name on their websites or social media feeds were giving a thing of value to Save Mart in violation of California’s tied house rules. Section 23355.3 resolves this issue by providing an exception to the tied house rules that not only allows both retail and nonretail licensees to sponsor non-profit events but allows participating nonretail licensees to reference retail licensees, subject to the restrictions contained in the statute.

Details:

- Section 23355.3 permits sponsorships of nonprofit organizations (not other organizations) that are conducting and receiving benefit from the subject event. Note that nonprofits are still required to obtain any required temporary licenses from ABC to conduct their event.

- A nonretail/supplier side licensee may advertise or communicate its sponsorship of or participation in the nonprofit event in social media and elsewhere, which advertising can include identification of both retail and nonretail licensees that are sponsoring or participating in the event and can include posting, re-posting, forwarding or sharing social media and/or other advertisements or communications made by other nonretail or retail licensees (subject to the restrictions below) . For purposes of this provision “social media” is specifically defined as “a service, platform, application, or site where users communicate and share media, such as pictures, videos, music, and blogs, with other users.” Note that Section 23355.3 does not usurp other applicable industry or legal standards that govern when and where the advertisement of alcohol is acceptable and typical precautions to ensure responsible advertising practices should be taken.

- Any advertisement or communication by a nonretail licensee that includes identifying a retail licensee (including reposting, forwarding, sharing social media posts by others) cannot include the retail price of any alcoholic beverage or otherwise promote the retail licensee beyond its sponsorship or participation in the event.

- It should be noted that donations of alcoholic beverages to nonprofits by supplier side licensees are only permitted to the extent they are otherwise allowed under Section 25503.9, which only permits certain supplier side licensees to make certain types of donations to nonprofits. And except as otherwise may be permitted in specific circumstances under the ABC Act, retailers are not permitted to give or sell alcoholic beverages to the nonprofit.

- Nonretail/supplier-side licensees should be careful not to provide other things of value to retail licensees, except as permitted above. Specifically, nonretail licensees should not pay or reimburse any retail licensee, directly or indirectly, for any advertising services (whether by social media or otherwise) or cover any costs of a retail licensee sponsoring or participating in the event.

- Retail licensees are also subject to rules and restriction under the new statute and should not accept any payment or reimbursement, directly or indirectly, for any advertising services offered by a nonretail licensee and should not offer or provide nonretail licensees any advertising, sale, or promotional benefit in connection with the sponsorship or participation.

Sponsorships of Certain Live Entertainment Marketing Companies in Napa (Section 25503.40)

Overview

- Section 25503.40 creates a new exception to the tied-house rules that allows certain alcohol beverage licensees to purchase sponsorships and advertising time and space from certain live entertainment marketing companies related to live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events promoted by a live entertainment company in Napa County, such as Bottlerock. The events are to be held at entertainment facilities, parks, fairgrounds, auditoriums, arenas, or other areas or venues that are designed for, or set up to be, and lawfully permitted to be used for live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events. The conditions and restrictions related to such sponsorships are set forth below.

Details:

- Only the following types of licensees are permitted to sponsor events under 25503.40: Beer Manufacturer (Type 01 or Type 23), Out-of-State Beer Manufacturer’s Certificate (Type 26), Winegrower (Type 02), Winegrower’s Agent (Type 27) , Distilled Spirits Manufacturer (Type 04 and likely new Type 74 craft distilled spirits manufacturer), Distilled Spirits Manufacturer’s Agent (Type 05), Rectifier (Type 07, 08 or 24) or Importer that does not hold a wholesale or retail license (Type 09 (but only if hold one of the other licenses listed), 10, 11, 12 (but only if hold one of other licenses listed) or 13).

- The above licensees may sponsor events promoted by a live entertainment company and may purchase advertising space and time from or on behalf of a live entertainment marketing company. For purposes of Section 25503.40, a live entertainment marketing company must be a entertainment marketing company that is a) a wholly owned subsidiary of a live entertainment company b) not publicly traded, c) has its principal place of business in the County of Napa, and d) which may own interests, directly or indirectly, in retail licenses or winegrower licenses.

- Sponsorships must be pursuant to a written contract and may only be purchased by permitted licensees in connection with live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events that take place at entertainment facilities, parks, fairgrounds, auditoriums, arenas, or other areas or venues that are designed for, or set up to be, and lawfully permitted to be used for live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events located within the County of Napa. Expected attendance of the event must be at least 5,000 people per day and the live entertainment company promoting the event is required to represent to the retail licensee that will hold the license for the event, such as the concessionaire, that the live entertainment company promoting the event, including the subject event, has not exceeded the permissible limit of three events in the County of Napa for the year in which the event is being held.

- An on-sale licensee (such as a concessionaire) selling alcoholic beverages at the event must serve at least one other brand of beer, distilled spirits, and wine (one per category) distributed by a competing wholesaler in addition to any brand manufactured or distributed by the sponsoring or advertising licensees.

- Participating licensees are not permitted to give, or lend anything of value to an on-sale retail licensee, except as expressly authorized by 25503.40 or any other provision of the ABC Act.

- Note that while Section 25503.40 does not itself provide licensees the right to be present at the events (either pouring their products and/or educating the consumers in their tents), because the premises will be licensed as an on-sale retail premises, Sections 25503.4, 25503.55 and 25503.57 of the ABC Act would allow limited education and tastings by certain wine, beer and spirits licensees at the event, subject to the terms and conditions of those sections and approval by the event organizers.

Listing of Retailers in Supplier Advertising and Marketing (Section 25500.1)

Overview:

- The recent revisions to Section 25500.1 of the ABC Act have revised the tied-house exception in that section to provide supplier side licensees with new ways to refer to retailers in their advertising and marketing. These changes were driven by new marketing and advertising practices on the internet and social media but apply to all marketing and advertising practices. Previously, listings of retailers were only permitted in response to consumer inquiries and were further limited by statute.

Details:

- Supplier-side industry members (such as manufacturers or wholesalers) may list the following information in their advertising or marketing (include social media posts), so long as the remaining requirements listed below are also satisfied: Names, addresses, telephone numbers, email addresses, or Internet Web site addresses, or other electronic media, of two or more unaffiliated on-sale or off-sale retailers selling the beer, wine, or distilled spirits produced, distributed, or imported by the supplier-side industry member. The listing must include information about two or more unaffiliated retailers and must be the only reference to the on-sale or off-sale retailers in the direct communication with the consumer.

- The listing cannot contain the retail price of the product.

- The listing is made, or produced, or paid for, exclusively by supplier-side industry member.

- For more information about the changes to Section 25500.1, refer to our prior blog post on this issue.

New Craft Distiller License & Expanded Tasting Privileges for Distilled Spirits Manufacturers

Overview:

- Various provisions of the ABC Act have been amended to create the new Type 74 craft distiller license for distillers that manufacture up to 100,000 gallons of distilled spirits per fiscal year (July 1 through June 30). The new legislation has also provided Type 04 distilled spirits manufacturers, and craft distillers, expanded rights and privileges with respect to consumer tastings.

Details:

- The new Type 74 craft distiller license may be issued to a person who has facilities and equipment for, and is engaged in, the commercial manufacture of distilled spirits. The fees for the craft distiller shall be the same as those of a Type 04 distilled spirits manufacturer. It should be noted that the craft distiller will be required to report its production to the ABC on an annual basis, and if the production amounts go above the maximum requirements described below such that the craft distiller no longer qualifies to hold a craft distiller’s license, the ABC will automatically renew the license as a Type 04 distilled spirits manufacturer’s license (Type-04).

- The production, sale, distribution and tasting privileges of the new Type 74 Craft Distiller’s license include the right to:

- Manufacture up to 100,000 gallons of distilled spirits per fiscal year (July 1 through June 30) (excluding brandy that the craft distiller manufactures or has manufactured for them). In its advisory, ABC noted that “gallon” is defined in Section 23031 as “that liquid measure containing 231 cubic inches” and that the amount to be reported is the actual liquid volume manufactured not proof gallons. ABC also clarified that measurement of gallons for this purposes is the volume of distilled spirits (excluding waste product) drawn off the still.

- Package, rectify, mix, flavor, color, label, and export only those distilled spirits manufactured by the licensee. This means that the holder of a craft distiller license is not permitted to package, rectify, mix, label, flavor, color or export any spirits manufactured by any other licensees. However, ABC has confirmed that this provision does not prohibit the use of grain neutral spirits manufactured by another distiller in the manufacture of distilled spirits by a craft distiller licensee, since that requires actual re-distillation of grain neutral spirits. ABC has also noted that this prohibition against rectification of other products also means that the holder of a rectifier’s license (Type 07 or Type 24) cannot also hold a craft distiller’s license.

- Only sell distilled spirits that are manufactured and packaged by the craft distiller solely to a wholesaler, manufacturer, winegrowers, manufacturer’s agent, or rectifier that holds a license authorizing the sale of distilled spirits or to persons that take delivery of those distilled spirits within this state for delivery or use without the state.

- Sell up to 2.25 liters (in any combination of prepackaged containers) per day per consumer of distilled spirits manufactured by the craft distiller at its premises to a consumer attending an instructional tasting on the licensed premises pursuant to Section 23363.1.

- Sell all beers, wines, brandies, or distilled spirits to consumers for consumption on the premises in a bona fide eating place as defined in Section 23038, which is located on the licensed premises or on premises owned by the licensee that are contiguous to the licensed premises and which is operated by and for the licensee, provided that any alcoholic beverages not manufactured or produced by the licensee must be purchased from a licensed wholesaler.

- During private events only, sell or serve beer, wines, and distilled spirits, regardless of source, to guests during private events or private functions not open to the general public. All alcoholic beverages sold at the premises that are not manufactured or produced and bottled by or for the licensed craft distiller must be purchased only from a licensed wholesaler. ABC has noted that “private events” and “private functions” do not include events, activities, or functions that are open to the public, whether by purchase of a ticket or otherwise. As an example, the ABC has stated that it would not consider a cocktail-making class that anyone could attend to be a “private event or private function”.

- Craft distillers (unlike type 04 distilled spirits manufacturers) have also been provided with a tied house exception that allows a craft distiller to hold ownership interests in up to two (2) on-sale licenses (such as restaurants, hotels or bars). Other than the products made by or for the craft distiller, all other alcoholic beverages at such on-sale retailers must be purchased from a California wholesaler. Further, the interested craft distiller’s products cannot exceed more than 15% of the total distilled spirits by brand offered for sale by the on-sale licensee. This exception shall continue to apply, even if the distiller no longer qualifies as a craft distiller, so long as the distiller qualified as a craft distiller at the time it first obtained the interest in the on-sale retailers.

- As noted above, the recently enacted legislation amending Section 23363.1 provided both craft distillers and distilled spirits manufacturers expanded privileges with regard to direct to consumer tastings from their licenses premises. Type 04 and Type 74 licensees may now provide one and one-half ounces tastings of distilled spirits per individual per day from their premises with or without charge and can also serve these tastes in the form of a cocktail or mixed drink.

Beer Tastings at Farmers Markets

Overview:

- Previously, under Section 23399.45, beer manufacturers were permitted to sell limited amounts of bottled beer at certified farmers markets so long as they held a Type 84 certified farmers market beer sales permit. An amendment to Section 23399.45 will now the holder of a type 84 certified farmers’ market beer sales permit to conduct instructional tasting events for consumers at certified farmers markets as well. These privileges are automatically extended to Type 84 permit holders as of January 1, 2016 so no additional permit is required for existing permit holders.

Details:

- The holder of a certified farmers market beer sales permit is authorized to conduct an instructional tasting event for consumers at locations specified in Section 23399.45 at a certified farmers market.

- The tasting is limited to 8 ounces per person per day and may be provided as provided as one 8 ounce tasting or various smaller tastings.

- The instructional tasting event area must be separated from the remainder of the market by a wall, rope, cable, cord, chain, fence, or other permanent or temporary barrier.

- Only one Type 84 license holder may conduct an instructional tasting event during the a farmers market.

- The licensee shall not permit any consumer to leave the instructional tasting area with an open container of beer.

Please note that the information provided above is just an overview of the requirements of the new legislation. Careful review of each statute in its entirety should be undertaken before any actions are taken in reliance on these new provisions.

We will be posting details on other new legislation in the coming days and weeks, but for questions on any of the new legislation discussed above and how it may affect your business, please contact Bahaneh Hobel.

COLA’s Provide Scant Protection from Class Action Lawsuits

ShipCompliant recently published a guest blog post by DP&F Wine Law attorney John Trinidad on the class action lawsuits claiming that the use of the term “handmade” on vodka bottles constituted false or misleading information under state consumer protection laws.

Over the past year, a slew of class action lawsuits have been filed claiming that certain alcohol beverage product labels are false or misleading under state consumer protection laws. Tito’s Vodka, owned by a company called Fifth Generation, Inc., faces numerous actions claiming that the company’s use of the term “handmade” deceived consumers by leading them to believe that they were buying high quality, non-massed produced products.

Fifth Generation has fought these allegations, arguing that that TTB’s approval of their label as evidenced by the issuance of a certificate of label approval (“COLA”) protects against liability under state consumer protection laws. The company’s argument relies on “safe harbor” provisions provided for under state law, which in general make certain actions authorized by laws administered by state or federal regulatory authorities immune from liability. Unfortunately for the alcohol beverage industry, this argument has had mixed success.

To read the full blog post, please go to the ShipCompliant website.

New York Aims to Modernize State Alcohol Beverage Laws

New York alcohol beverage producers, wholesalers and retailers take note: there may be some changes coming your way. Governor Andrew Cuomo has announced the creation of an industry working group to recommend revisions to the state’s Alcoholic Beverage Control Laws. The group, to be headed up by NY State Liquor Authority Chairman Vincent Bradley, is scheduled to look into “reorganizing or replacing the current alcohol beverage control law” as well as the following issues:

- Removing outdated and redundant provisions;

- Modernizing statutory language for clarity;

- Improving and consolidating various licensing provisions;

- Clarifying the types of licenses available;

- Reducing mandatory paperwork; and

- Eliminating unnecessary restrictions imposed on manufacturers.

The working group’s first meeting is scheduled to take place on November 12, 2015 at 1pm at the NYSLA’s Harlem Office (317 Lenox Avenue). Video conferencing will be available in the NYSLA’s Albany and Buffalo office locations. Seating is limited, and parties interested in attending should RSVP by sending an email to [email protected] no later than noon on Wednesday, November 11.

CEB Wine Law Forum (Nov. 5-6 in Paso Robles)

Thursday and Friday, November 5th & 6th

Paso Robles, California

Three DP&F attorneys will be speaking at the annual CEB Wine Law Forum,™ taking place on November 5th and 6th in Paso Robles, California. The Forum, sponsored by the International Wine Law Association and moderated by DPF’s Richard Mendelson, will address Water Regulation, the AVA System, and Employment Law. Mr. Mendelson will speak on the history and future of the U.S. AVA system, and DPF Director Carol Ritter will lead a panel on protecting and promoting AVAs. DPF co-managing partner Greg Walsh will lead a panel discussion on employment law issues faced by winery and vineyard owners.

The event is sponsored by the International Wine Law Association and Napa Valley Vintners.

Additional information and on-line registration can be found on the CEB website.

AGENDA

Water and Wine—Thursday Morning

Water and Wine—California

Water and Wine—Paso Robles

Appellation Designations—Thursday Afternoon

35 Years Later—An Examination of the AVA System

Promoting and Protecting AVAs

Employment Law Matters—Friday Morning

Challenges of a Seasonal Workforce

Top 5 Wage & Hour Issues Facing Winery and Vineyard Owners

9 hours MCLE Credit