New Alcohol Beverage Regulations Give Licensees Expanded Rights and Privileges in the New Year

Beginning on January 1, 2016, new provisions of the California ABC Act will go into effect that will, among other things, provide industry members with additional rights and privileges related to marketing, events and promotions, and will also create a new Craft Distiller License. A summary of a few of these important new statutory provisions is included below.

Retailer and Non-Retailer Sponsorships of Non-Profit Events (Section 23355.3):

Overview:

- This new statutory section was largely drafted in response to accusations filed by the ABC against certain wineries related to their participation in a nonprofit event, the “Save Mart Grape Escape”. As the name suggests, although this was a nonprofit event, Save Mart, a licensed retailer, was also a sponsor of the nonprofit event. The ABC had alleged in its accusations that participating supplier-side licensees that referenced the event by name on their websites or social media feeds were giving a thing of value to Save Mart in violation of California’s tied house rules. Section 23355.3 resolves this issue by providing an exception to the tied house rules that not only allows both retail and nonretail licensees to sponsor non-profit events but allows participating nonretail licensees to reference retail licensees, subject to the restrictions contained in the statute.

Details:

- Section 23355.3 permits sponsorships of nonprofit organizations (not other organizations) that are conducting and receiving benefit from the subject event. Note that nonprofits are still required to obtain any required temporary licenses from ABC to conduct their event.

- A nonretail/supplier side licensee may advertise or communicate its sponsorship of or participation in the nonprofit event in social media and elsewhere, which advertising can include identification of both retail and nonretail licensees that are sponsoring or participating in the event and can include posting, re-posting, forwarding or sharing social media and/or other advertisements or communications made by other nonretail or retail licensees (subject to the restrictions below) . For purposes of this provision “social media” is specifically defined as “a service, platform, application, or site where users communicate and share media, such as pictures, videos, music, and blogs, with other users.” Note that Section 23355.3 does not usurp other applicable industry or legal standards that govern when and where the advertisement of alcohol is acceptable and typical precautions to ensure responsible advertising practices should be taken.

- Any advertisement or communication by a nonretail licensee that includes identifying a retail licensee (including reposting, forwarding, sharing social media posts by others) cannot include the retail price of any alcoholic beverage or otherwise promote the retail licensee beyond its sponsorship or participation in the event.

- It should be noted that donations of alcoholic beverages to nonprofits by supplier side licensees are only permitted to the extent they are otherwise allowed under Section 25503.9, which only permits certain supplier side licensees to make certain types of donations to nonprofits. And except as otherwise may be permitted in specific circumstances under the ABC Act, retailers are not permitted to give or sell alcoholic beverages to the nonprofit.

- Nonretail/supplier-side licensees should be careful not to provide other things of value to retail licensees, except as permitted above. Specifically, nonretail licensees should not pay or reimburse any retail licensee, directly or indirectly, for any advertising services (whether by social media or otherwise) or cover any costs of a retail licensee sponsoring or participating in the event.

- Retail licensees are also subject to rules and restriction under the new statute and should not accept any payment or reimbursement, directly or indirectly, for any advertising services offered by a nonretail licensee and should not offer or provide nonretail licensees any advertising, sale, or promotional benefit in connection with the sponsorship or participation.

Sponsorships of Certain Live Entertainment Marketing Companies in Napa (Section 25503.40)

Overview

- Section 25503.40 creates a new exception to the tied-house rules that allows certain alcohol beverage licensees to purchase sponsorships and advertising time and space from certain live entertainment marketing companies related to live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events promoted by a live entertainment company in Napa County, such as Bottlerock. The events are to be held at entertainment facilities, parks, fairgrounds, auditoriums, arenas, or other areas or venues that are designed for, or set up to be, and lawfully permitted to be used for live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events. The conditions and restrictions related to such sponsorships are set forth below.

Details:

- Only the following types of licensees are permitted to sponsor events under 25503.40: Beer Manufacturer (Type 01 or Type 23), Out-of-State Beer Manufacturer’s Certificate (Type 26), Winegrower (Type 02), Winegrower’s Agent (Type 27) , Distilled Spirits Manufacturer (Type 04 and likely new Type 74 craft distilled spirits manufacturer), Distilled Spirits Manufacturer’s Agent (Type 05), Rectifier (Type 07, 08 or 24) or Importer that does not hold a wholesale or retail license (Type 09 (but only if hold one of the other licenses listed), 10, 11, 12 (but only if hold one of other licenses listed) or 13).

- The above licensees may sponsor events promoted by a live entertainment company and may purchase advertising space and time from or on behalf of a live entertainment marketing company. For purposes of Section 25503.40, a live entertainment marketing company must be a entertainment marketing company that is a) a wholly owned subsidiary of a live entertainment company b) not publicly traded, c) has its principal place of business in the County of Napa, and d) which may own interests, directly or indirectly, in retail licenses or winegrower licenses.

- Sponsorships must be pursuant to a written contract and may only be purchased by permitted licensees in connection with live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events that take place at entertainment facilities, parks, fairgrounds, auditoriums, arenas, or other areas or venues that are designed for, or set up to be, and lawfully permitted to be used for live artistic, musical, sports, food, beverage, culinary, lifestyle, or other cultural entertainment events located within the County of Napa. Expected attendance of the event must be at least 5,000 people per day and the live entertainment company promoting the event is required to represent to the retail licensee that will hold the license for the event, such as the concessionaire, that the live entertainment company promoting the event, including the subject event, has not exceeded the permissible limit of three events in the County of Napa for the year in which the event is being held.

- An on-sale licensee (such as a concessionaire) selling alcoholic beverages at the event must serve at least one other brand of beer, distilled spirits, and wine (one per category) distributed by a competing wholesaler in addition to any brand manufactured or distributed by the sponsoring or advertising licensees.

- Participating licensees are not permitted to give, or lend anything of value to an on-sale retail licensee, except as expressly authorized by 25503.40 or any other provision of the ABC Act.

- Note that while Section 25503.40 does not itself provide licensees the right to be present at the events (either pouring their products and/or educating the consumers in their tents), because the premises will be licensed as an on-sale retail premises, Sections 25503.4, 25503.55 and 25503.57 of the ABC Act would allow limited education and tastings by certain wine, beer and spirits licensees at the event, subject to the terms and conditions of those sections and approval by the event organizers.

Listing of Retailers in Supplier Advertising and Marketing (Section 25500.1)

Overview:

- The recent revisions to Section 25500.1 of the ABC Act have revised the tied-house exception in that section to provide supplier side licensees with new ways to refer to retailers in their advertising and marketing. These changes were driven by new marketing and advertising practices on the internet and social media but apply to all marketing and advertising practices. Previously, listings of retailers were only permitted in response to consumer inquiries and were further limited by statute.

Details:

- Supplier-side industry members (such as manufacturers or wholesalers) may list the following information in their advertising or marketing (include social media posts), so long as the remaining requirements listed below are also satisfied: Names, addresses, telephone numbers, email addresses, or Internet Web site addresses, or other electronic media, of two or more unaffiliated on-sale or off-sale retailers selling the beer, wine, or distilled spirits produced, distributed, or imported by the supplier-side industry member. The listing must include information about two or more unaffiliated retailers and must be the only reference to the on-sale or off-sale retailers in the direct communication with the consumer.

- The listing cannot contain the retail price of the product.

- The listing is made, or produced, or paid for, exclusively by supplier-side industry member.

- For more information about the changes to Section 25500.1, refer to our prior blog post on this issue.

New Craft Distiller License & Expanded Tasting Privileges for Distilled Spirits Manufacturers

Overview:

- Various provisions of the ABC Act have been amended to create the new Type 74 craft distiller license for distillers that manufacture up to 100,000 gallons of distilled spirits per fiscal year (July 1 through June 30). The new legislation has also provided Type 04 distilled spirits manufacturers, and craft distillers, expanded rights and privileges with respect to consumer tastings.

Details:

- The new Type 74 craft distiller license may be issued to a person who has facilities and equipment for, and is engaged in, the commercial manufacture of distilled spirits. The fees for the craft distiller shall be the same as those of a Type 04 distilled spirits manufacturer. It should be noted that the craft distiller will be required to report its production to the ABC on an annual basis, and if the production amounts go above the maximum requirements described below such that the craft distiller no longer qualifies to hold a craft distiller’s license, the ABC will automatically renew the license as a Type 04 distilled spirits manufacturer’s license (Type-04).

- The production, sale, distribution and tasting privileges of the new Type 74 Craft Distiller’s license include the right to:

- Manufacture up to 100,000 gallons of distilled spirits per fiscal year (July 1 through June 30) (excluding brandy that the craft distiller manufactures or has manufactured for them). In its advisory, ABC noted that “gallon” is defined in Section 23031 as “that liquid measure containing 231 cubic inches” and that the amount to be reported is the actual liquid volume manufactured not proof gallons. ABC also clarified that measurement of gallons for this purposes is the volume of distilled spirits (excluding waste product) drawn off the still.

- Package, rectify, mix, flavor, color, label, and export only those distilled spirits manufactured by the licensee. This means that the holder of a craft distiller license is not permitted to package, rectify, mix, label, flavor, color or export any spirits manufactured by any other licensees. However, ABC has confirmed that this provision does not prohibit the use of grain neutral spirits manufactured by another distiller in the manufacture of distilled spirits by a craft distiller licensee, since that requires actual re-distillation of grain neutral spirits. ABC has also noted that this prohibition against rectification of other products also means that the holder of a rectifier’s license (Type 07 or Type 24) cannot also hold a craft distiller’s license.

- Only sell distilled spirits that are manufactured and packaged by the craft distiller solely to a wholesaler, manufacturer, winegrowers, manufacturer’s agent, or rectifier that holds a license authorizing the sale of distilled spirits or to persons that take delivery of those distilled spirits within this state for delivery or use without the state.

- Sell up to 2.25 liters (in any combination of prepackaged containers) per day per consumer of distilled spirits manufactured by the craft distiller at its premises to a consumer attending an instructional tasting on the licensed premises pursuant to Section 23363.1.

- Sell all beers, wines, brandies, or distilled spirits to consumers for consumption on the premises in a bona fide eating place as defined in Section 23038, which is located on the licensed premises or on premises owned by the licensee that are contiguous to the licensed premises and which is operated by and for the licensee, provided that any alcoholic beverages not manufactured or produced by the licensee must be purchased from a licensed wholesaler.

- During private events only, sell or serve beer, wines, and distilled spirits, regardless of source, to guests during private events or private functions not open to the general public. All alcoholic beverages sold at the premises that are not manufactured or produced and bottled by or for the licensed craft distiller must be purchased only from a licensed wholesaler. ABC has noted that “private events” and “private functions” do not include events, activities, or functions that are open to the public, whether by purchase of a ticket or otherwise. As an example, the ABC has stated that it would not consider a cocktail-making class that anyone could attend to be a “private event or private function”.

- Craft distillers (unlike type 04 distilled spirits manufacturers) have also been provided with a tied house exception that allows a craft distiller to hold ownership interests in up to two (2) on-sale licenses (such as restaurants, hotels or bars). Other than the products made by or for the craft distiller, all other alcoholic beverages at such on-sale retailers must be purchased from a California wholesaler. Further, the interested craft distiller’s products cannot exceed more than 15% of the total distilled spirits by brand offered for sale by the on-sale licensee. This exception shall continue to apply, even if the distiller no longer qualifies as a craft distiller, so long as the distiller qualified as a craft distiller at the time it first obtained the interest in the on-sale retailers.

- As noted above, the recently enacted legislation amending Section 23363.1 provided both craft distillers and distilled spirits manufacturers expanded privileges with regard to direct to consumer tastings from their licenses premises. Type 04 and Type 74 licensees may now provide one and one-half ounces tastings of distilled spirits per individual per day from their premises with or without charge and can also serve these tastes in the form of a cocktail or mixed drink.

Beer Tastings at Farmers Markets

Overview:

- Previously, under Section 23399.45, beer manufacturers were permitted to sell limited amounts of bottled beer at certified farmers markets so long as they held a Type 84 certified farmers market beer sales permit. An amendment to Section 23399.45 will now the holder of a type 84 certified farmers’ market beer sales permit to conduct instructional tasting events for consumers at certified farmers markets as well. These privileges are automatically extended to Type 84 permit holders as of January 1, 2016 so no additional permit is required for existing permit holders.

Details:

- The holder of a certified farmers market beer sales permit is authorized to conduct an instructional tasting event for consumers at locations specified in Section 23399.45 at a certified farmers market.

- The tasting is limited to 8 ounces per person per day and may be provided as provided as one 8 ounce tasting or various smaller tastings.

- The instructional tasting event area must be separated from the remainder of the market by a wall, rope, cable, cord, chain, fence, or other permanent or temporary barrier.

- Only one Type 84 license holder may conduct an instructional tasting event during the a farmers market.

- The licensee shall not permit any consumer to leave the instructional tasting area with an open container of beer.

Please note that the information provided above is just an overview of the requirements of the new legislation. Careful review of each statute in its entirety should be undertaken before any actions are taken in reliance on these new provisions.

We will be posting details on other new legislation in the coming days and weeks, but for questions on any of the new legislation discussed above and how it may affect your business, please contact Bahaneh Hobel.

COLA’s Provide Scant Protection from Class Action Lawsuits

ShipCompliant recently published a guest blog post by DP&F Wine Law attorney John Trinidad on the class action lawsuits claiming that the use of the term “handmade” on vodka bottles constituted false or misleading information under state consumer protection laws.

Over the past year, a slew of class action lawsuits have been filed claiming that certain alcohol beverage product labels are false or misleading under state consumer protection laws. Tito’s Vodka, owned by a company called Fifth Generation, Inc., faces numerous actions claiming that the company’s use of the term “handmade” deceived consumers by leading them to believe that they were buying high quality, non-massed produced products.

Fifth Generation has fought these allegations, arguing that that TTB’s approval of their label as evidenced by the issuance of a certificate of label approval (“COLA”) protects against liability under state consumer protection laws. The company’s argument relies on “safe harbor” provisions provided for under state law, which in general make certain actions authorized by laws administered by state or federal regulatory authorities immune from liability. Unfortunately for the alcohol beverage industry, this argument has had mixed success.

To read the full blog post, please go to the ShipCompliant website.

New York Aims to Modernize State Alcohol Beverage Laws

New York alcohol beverage producers, wholesalers and retailers take note: there may be some changes coming your way. Governor Andrew Cuomo has announced the creation of an industry working group to recommend revisions to the state’s Alcoholic Beverage Control Laws. The group, to be headed up by NY State Liquor Authority Chairman Vincent Bradley, is scheduled to look into “reorganizing or replacing the current alcohol beverage control law” as well as the following issues:

- Removing outdated and redundant provisions;

- Modernizing statutory language for clarity;

- Improving and consolidating various licensing provisions;

- Clarifying the types of licenses available;

- Reducing mandatory paperwork; and

- Eliminating unnecessary restrictions imposed on manufacturers.

The working group’s first meeting is scheduled to take place on November 12, 2015 at 1pm at the NYSLA’s Harlem Office (317 Lenox Avenue). Video conferencing will be available in the NYSLA’s Albany and Buffalo office locations. Seating is limited, and parties interested in attending should RSVP by sending an email to [email protected] no later than noon on Wednesday, November 11.

Clock is Ticking for Trademark Owners for .wine Generic Top-Level Domain

As we’ve previously reported, the Internet Corporation for Assigned Names and Numbers (ICANN) has been selling hundreds of generic top-level domains (gTLDs) to domain name registries for $185,000 each. These registries then authorize domain name registrars to sell domain names to the public under the gTLDs that the registries have purchased. The registry called Donuts has purchased many of these gTLDs, including two of particular interest to members of the wine industry — <.wine> and <.vin>. The <.wine> and <.vin> gTLDs have been in limbo since they were awarded to Donuts due to issues raised by the EU and several regional wine associations concerning the protection of appellations of origin within the <.wine> and <.vin> gTLDs. However, those issues have since been resolved and the <.wine> and <.vin> gTLDs are now moving forward.

This means that trademark owners that wish to secure domain names encompassing their trademarks under the <.wine> and <.vin> gTLDs must now do so within the sunrise periods that have been established by Donuts for the <.wine> and <.vin> gTLDs. If they fail to secure their domain names within the sunrise periods, those domain names under the <.wine> and <.vin> gTLDs can then be purchased by members of the general public and the only recourse available to the trademark owners will be through costly dispute resolution procedures.

The Sunrise periods for the <.wine> and <.vin> gTLDs open on November 17, 2015 and close on January 16, 2016. In order for a trademark owner to obtain its trademarks within domain names for the <.wine> and <.vin> gTLDs, the trademark owner must first register its trademarks with the Trademark Clearinghouse. We have previously blogged about the process for registering a trademark in the Trademark Clearinghouse here. Once a trademark owner has obtained registration in the Trademark Clearinghouse, it may then pay to register its trademarks as domain names under the <.wine> and/or <.vin> gTLDs with recognized domain name registrars during the November 17, 2015 – January 16, 2016 sunrise periods.

So, for all of you wineries wishing to take part in the new <.wine> and <.vin> gTLDs, now is the time to make sure that your trademarks are registered with the Trademark Clearinghouse. For additional information or any other questions contact Scott Gerien at his email.

CEB Wine Law Forum (Nov. 5-6 in Paso Robles)

Thursday and Friday, November 5th & 6th

Paso Robles, California

Three DP&F attorneys will be speaking at the annual CEB Wine Law Forum,™ taking place on November 5th and 6th in Paso Robles, California. The Forum, sponsored by the International Wine Law Association and moderated by DPF’s Richard Mendelson, will address Water Regulation, the AVA System, and Employment Law. Mr. Mendelson will speak on the history and future of the U.S. AVA system, and DPF Director Carol Ritter will lead a panel on protecting and promoting AVAs. DPF co-managing partner Greg Walsh will lead a panel discussion on employment law issues faced by winery and vineyard owners.

The event is sponsored by the International Wine Law Association and Napa Valley Vintners.

Additional information and on-line registration can be found on the CEB website.

AGENDA

Water and Wine—Thursday Morning

Water and Wine—California

Water and Wine—Paso Robles

Appellation Designations—Thursday Afternoon

35 Years Later—An Examination of the AVA System

Promoting and Protecting AVAs

Employment Law Matters—Friday Morning

Challenges of a Seasonal Workforce

Top 5 Wage & Hour Issues Facing Winery and Vineyard Owners

9 hours MCLE Credit

New Law Amends California Tied-House Law

Governor Jerry Brown has signed AB 780, a law which helps clarify the rules that permit an alcohol beverage producer, importer, or wholesaler (collectively, a “supplier”) to list or mention on- and off- premise retailers in supplier-sponsored advertising, including supplier websites and social media channels. As described in more detail below, the new law is fairly limited, and does not give suppliers carte blanche to begin mentioning retailers in their social media posts.

State alcohol beverage law prohibits suppliers from providing retailers with “things of value.” These “tied-house” restrictions are generally aimed at preventing undue influence by suppliers over retailers. The ABC Act, however, also contains numerous exceptions to tied-house laws. For example, ABC Act Sections 25500.1 and 25502.1 allow suppliers to list certain information such as the address, phone number, email address and website address of two or more unaffiliated retailers so long as the listing (1) is made in response to a direct consumer inquiry, (2) does not contain the product’s retail price, and (3) is made by, produced by, or paid for exclusively by the supplier.

AB 780 amends these tied-house exceptions that pertain to on- and off-premise retailer listings. Here are a few key things that AB 780 will do when it goes into effect on January 1, 2016.

- Creates one set of rules for producer’s listing of on- and off- premise retailers . Previously, the ABC Act had two different rules that governed supplier listings of retailers: on-premise retailer listings were governed by ABC Act Sec. 25500.1, and off-premise retailer listings were governed by Sec 25502.1. AB 780 repeals 25502.1 and consolidates rules governing on- and off- premise retailer listings into Section 25500.1, meaning that there is now one set of rules that governs retailer listings.

- Impact. Under current law, a supplier listing of on-premise retailers could include the “names, addresses, telephone numbers, email addresses, or Internet Web site addresses, or other electronic media” of those retailers. The law governing listings of off-premise retailers did not include the “other electronic media” language. Thus, current law could be interpreted to prohibit a supplier from including the Twitter handle of an off-premise retailer in a listing because the handle may be considered “other electronic media” of the retailer. Once AB 780 goes into effect, the listing of on- and off-premise retailers’ “other electronic media” is allowed so long as the other requirements of Sec 25500.1 are met.

- Deletes language requiring customer inquiry for retailer listing. Under the ABC Act, any listing of a retailer could only be made “in response to a direct inquiry from a consumer.” AB 780 eliminates this requirement.

- Impact. The current law could be interpreted as prohibiting a producer from issuing a social media post (such as a tweet) listing two or more twitter handles of on-premise retailers unless it was in direct response (and potentially in a direct message not viewable by the general public) to a consumer inquiry. AB 780 would allow such a post, whether or not it was in direct response to a consumer, provided that all other requirements are met.

- Continues to restrict the type of listing allowed. Once amended. Section 25500.1 will continue to prohibit any supplier sponsored listing from referring to only one retailer or listing the retail price of the product. In addition, the listings must be made, produced, or paid for exclusively by the supplier.

- Impact. Suppliers should familiarize themselves with the limitations contained in Section 25500.1.

- Does not change rules governing events at retailer locations. AB 780 does not alter the sections of the ABC Act that govern the promotion of producer events at retailer locations, such as ABC Act Sec. 25503.4 (regarding winegrower instructional events).

- Impact. Suppliers wishing to promote upcoming events at on-premise retailer must continue to follow the applicable rules for events, which may be more restrictive than the amended Sec. 25500.1. For example, under ABC Act 25503.4, a winemaker instructional event held at a retailer cannot include laudatory statements about the retailer, nor can they include pictures of the retailer.

Finally, suppliers should keep in mind that the adoption of AB 780 does not repeal state tied-house laws and that it is still generally impermissible for a producer to provide a “thing of value” (such as free advertising) to a retailer, absent an explicit exception in the ABC Act. AB 780 simply clarifies one exception to the state’s tied-house laws by declaring that certain listings of retailers are not considered “things of value.”

For more information or assistance on alcohol beverage advertising, social media, and tied house laws, contact John Trinidad ([email protected]).

This post is made available for general informational purposes only and none of the information provided should be considered to constitute legal advice.

NYSLA Proposes Advisory for Trademark Licensing Agreements

The New York State Liquor Authority is considering adopting an advisory regarding trademark licensing agreements between retailers and alcohol beverage producers. If adopted, the advisory would prohibit certain trademark licensing agreements between retailers and suppliers (i.e., producers and wholesaler) that involve a licensing fee based upon a percentage of sales or that otherwise “correlate[s] with sales.” According to the NYSLA, such arrangements violate state tied house law because they are indicia of a retailer having a direct or indirect interest in a supplier.

The draft advisory will be discussed at the June 30, 2015 NYSLA Board Meeting. Interested parties can submit comments to NYSLA Secretary Jacqueline Held at [email protected] by June 29, 2015.

6/30/2015 UPDATE – According to the NYSLA website, the hearing has been postponed until July 14, 2015.

Proposed Expansion of Oregon’s Willamette Valley AVA

Willamette Valley, one of the most well regarded American Viticultural Areas, may be getting a wee bit bigger. Last week, the Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) published a notice of proposed rulemaking detailing the proposed addition of approximately 29 square miles (which constitutes less than 1% of the existing AVA) to the southwestern edge of the Willamette Valley, as shown in the following map:

King Estate Winery, which is located in the proposed expansion area and Oregon’s largest wine producer, submitted the petition, and both the Willamette Valley Wineries Association and the Oregon Winegrowers Association have voiced their support. The petition is available online at http://www.regulations.gov/#!documentDetail;D=TTB-2015-0008-0002

As evidence that the expansion area is associated with the established Willamette Valley AVA, the petitioners included excerpts from restaurant wine lists that identify certain King Estate wines as coming from “Willamette,” “Willamette Valley,” or “Willamette, Oregon,” even though the wines are not labeled as Willamette Valley AVA, nor could they be under TTB regulations. Query as to whether this demonstrates true association with the expansion area and the existing Willamette Valley AVA or simply sommelier error.

Members of the public can submit comments through August 17, 2015. For more information, go to http://www.regulations.gov/#!docketDetail;D=TTB-2015-0008

For more information regarding AVA formation and expansion, please contact John Trinidad ([email protected])

Napa County to Consider Minimum Parcel Size for Winery Development

Napa County’s Agricultural Protection Advisory Committee will be holding a hearing on Monday, April 27, 2015 at 9:00 am to discuss (1) the minimum parcel size for establishing new wineries in the agricultural preserve, (2) the net loss of vineyards associated with winery development and/or expansion; and (3) the role of estate grapes in winery production. The hearing takes place at 2741 Napa Valley Corporate Drive, Building 2, and public comment is welcome.

The full agenda for Monday’s meeting and other material for that meeting can be found at: http://services.countyofnapa.org/agendanet/MeetingDocuments.aspx?ID=4410

Small Producer Tax Credit Pitfalls: The K Vintners Case

When is a small producer not a small producer? That was the question answered by a federal district court in a case that centered on a winery’s ability to claim a small producer tax credit for wine produced at another winery (K Vintners v. U.S., Case No. 12-cv-05128-TOR (E.D. Wa. Jan 21, 2015)).

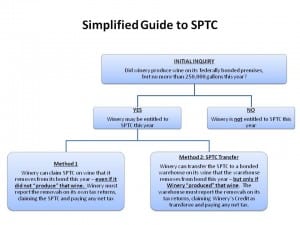

Background on the Small Producer Tax Credit.

Under federal law, domestic wineries producing 250,000 gallons of wine or less per year (“small producers”) are entitled to a tax credit of up to $0.90 per gallon for the first 100,000 gallons of non-sparkling wine removed from bond and “produced at qualified facilities” and a reduced credit thereafter (26 U.S.C. Sec. 5041(c)). This is popularly referred to as the “small producer tax credit,” what I’ll refer to as the SPTC.

There are two methods by which a small producer can take advantage of the SPTC for wine that was produced at its own facility. First, the winery can claim the SPTC on wine that it removes from its own bond by reporting the removal on its tax return, claiming the SPTC, and paying the net tax. Alternatively, the producer can transfer wine it produced at its own facility in bond to a bonded warehouse, and transfer the SPTC to the bonded warehouse for eligible wine. In this scenario, the warehouse reports the removal on its tax return, claims the winery’s SPTC as transferee, and pays the net tax.

The SPTC can also apply to wines that were not made at small producer’s bonded winery, but only if that wine is transferred in bond from the producing winery to the small producer’s facility and removed from bond by the small producer so long as the small producer actually produces some wine at its facility that year.

The K Vintners Case: SPTC does not apply to wine produced at another winery on behalf of a small producer and transferred directly to a bonded cellar is not eligible for SPTC.

But what happens when the small producer has wine made at a different facility, and instead of transferring that wine to its own bonded premises, decides to have the wine transferred directly to a bonded warehouse? Is that wine eligible for the SPTC?

That was the issue that one Washington winery, K Vintners, faced a few years back. From 2005-2008, K Vintners produced wine each year at its bonded facility and also purchased bulk wine from two other wineries, Hogue Cellars and Wahluke Slope Vineyards. Hogue and Wahluke fermented, blended, and bottled wine for K Vintners (referred to hereafter as the “Hogue/Wahluke Wine”), then transferred the bottled wine directly to Tiger Mountain, a bonded cellar contracted by K Vintners. K Vintners then sold the wine its own tradenames. Pursuant to the K Vintners-Tiger Mountain contract, Tiger Mountain paid claimed K-Vintners’ SPTC on the wine transferred from Hogue/Wahluke and paid the net excise taxes on those wines when removed from bond, and K Vintners reimbursed the bonded cellar for any excise taxes it incurred.

TTB conducted an audit in 2007 and determined that the SPTC could not apply to the Hogue/Wahluke Wine because the wine in question was not produced at K Vintner’s bonded facility. TTB ordered Tiger Mountain to pay $327,496.83 in unpaid taxes and an additional $126,580.05 in late-payment penalties. TTB acknowledged that if the Hogue/Wahluke Wines had been shipped in bond from the producing wineries to K Vintner’s bonded premises, and then removed from bond by K Vintners, then K Vintners could have claimed the credit on its own behalf (provided that K Vintners produced some wine at its own facility in each of those years).

K Vintners and Tiger Mountain paid the amount under protest, raised administrative claims that were subsequently denied by TTB, and eventually filed suit to seek a refund of these tax payments. K Vintners argued, in part, that the wine was eligible for the SPTC because even though it was made at the Hogue/Wahluke facilities, K Vintners had significant control and oversight through its contractual arrangement with those wineries that in essence, K Vintners “produced” the wine, and therefore the wine was eligible for the SPTC.

The federal district court in the Eastern District of Washington sided with TTB, concluded that such wines were produced at the winery where they went through fermentation (Hogue/Wahluke) and therefore were not eligible for the SPTC when removed from Tiger Mountain’s bond. The end result: K Vintners would not see any refund of the nearly half million dollars worth of unexpected taxes and penalties it incurred as a result of its misapplication of the small producer tax credit.

Can a small producer claim the SPTC for wine produced at a winery that produces more than 250K gallons of wine?

One curious comment in the court’s decision (mere dicta, for those of you with legal experience) is worth exploring in more detail. The court took a close look at the regulatory language authorizing the SPTC, and noted that the SPTC was only available for “wine produced at qualified facilities in the United States.” Under the court’s interpretation, this means that a small producer could only claim the SPTC on wine it purchased from another winery if that winery was also “qualified” as a small producer. This directly contradicted statements in TTB’s court filings in which TTB stated that K Vintners could have applied the small producer tax credit to the Hogue/Wahluke Wine if the wine had been directly transferred in bond to, and subsequently removed from bond by, K Vintners.

We reached out to TTB to determine if, in light of this language in the court’s decision, TTB would be making any changes to its interpretation or enforcement of the small producer tax credit. TTB affirmed that it still interprets 26 USC Sec 5041(c)(1) to allow an eligible small producer to purchase wine from another winery — whether or not that selling winery is itself eligible as a “small producer” — and that wine may still be eligible for the SPTC, so long as the small producer meets all other conditions for eligibility. Note , however, that one of those conditions is that allowance of the SPTC would not “benefit a person who would otherwise fail to qualify for use of the SPTC.…”

This article does not constitute legal advice. Please contact an attorney if you have any questions about the application of the small producer tax credit.

Considerations in Structuring Alternating Proprietorship Agreements

In 2008, TTB published an Industry Circular- Alternating Proprietors at Bonded Wine Premises (http://www.ttb.gov/industry_circulars/archives/2008/08-04.html). The Circular sets the parameters for establishing an alternating proprietor (AP) relationship that will satisfy TTB regulations. The structure, although called an alternating proprietorship, is fundamentally a lease arrangement involving two parties: the AP and the “host” winery. The AP is a fully licensed and bonded wine producer (at both the federal and state levels) who produces wine at facilities of another fully licensed and bonded wine producer (the “host” winery) holding a Federal Basic Permit, on an alternating basis. The AP, as result of its permit status, is responsible for its winemaking activities and all associated reporting and tax obligations. For the AP to control its permitted and licensed activities, it must control the facilities at the host winery in the alternating premises (when the AP is alternating into the alternating premises) and, if applicable, at its designated premises.

From the perspective of the host winery, an AP Agreement that allocates risk and liability similar to a landlord/tenant relationship can offer many benefits. In exchange for offering the host winery’s premises, on an alternating basis, to the AP, the host winery can take a triple-net lease approach that limits the host winery’s potential liabilities and expenses associated with the winery premises. In the event of, let’s say, an earthquake, the AP Agreement could expressly disclaim all warranties with respect to the structure and equipment. The host winery can disclaim responsibility for maintaining insurance that covers damage and destruction and limit the availability of insurance proceeds to the AP.

On January 21, 2015, host wineries got an additional incentive to clearly structure their APs as leases. The Board of Equalization found in favor of an appeal by Terravant Wines reversing a $416,457 tax bill. See http://www.pacbiztimes.com/2015/01/30/wine-firm-wins-crushing-victory-in-tax-case/.

The Board of Equalization originally ruled that the host winery owed a one-time sales tax payment on the purchase of equipment used at the winery. The Board did not accept the argument that the equipment was leased and, therefore, subject to a use tax instead of a sales tax. The Board found that the host winery was performing a service for the AP rather than providing a leased premises for the AP’s independent winemaking operations. In the January 21 ruling, the Board reversed its decision and accepted the argument that the AP structure gave the AP “constructive possession and actual control.” In short, the Board was ultimately persuaded that the AP relationship was a lease relationship.

The takeaway is that an AP Agreement structured in a manner that explicitly and clearly reflects the leasehold nature of the relationship and also takes into account TTB’s concerns set forth in the 2008 industry circular can have regulatory, liability and tax benefits all of which should be considered by parties involved in AP relationships.

New Bill to Aid Private Equity Firms Applying for ABC License

The California Senate Committee on Governmental Organization is considering a bill to streamline the process for qualification of private equity firms seeking to hold an interest in a state alcohol beverage license. SB 796 would add Section 23405.4 to the California Business and Professions Code, which would allow a private equity fund to hold a license and avoid having each and every investor of that fund qualified so long as certain conditions are met. Those conditions are:

- The fund holds a passive interest, meaning that neither the fund nor any manager, employee or agent of the fund has any management, control, or involvement in the licensed business;

- The fund advisors are registered under the federal Investment Advisors Act, and the fund advisors are subject to Section 275.204(b)-1 of Title 17 of the Code of Federal Regulations;

- No investor holds more than 10% interest — directly or indirectly — in the fund; and

- No investor has direct or indirect control over the investment decisions of the fund.

Although the investors of the fund need not be qualified under the new regulation, the Department of Alcoholic Beverage Control (“ABC”) may require the fund manager to execute an affidavit to confirm compliance with these requirements.

The proposed regulation does not apply to hedge funds, liquidity funds, real estate funds, secured asset funds, and venture capital funds.

Although the fund investors need not each individually submit detailed material and fingerprints in order for the fund to qualify for a license, the regulation specifically states:

“This section is not intended to allow a person, by reason of his or her investment in a private equity fund, to hold an interest in a license issued by the department if that interest is not otherwise permitted under this division.”

In other words, it appears that proposed legislation would bar a private equity fund from qualifying for an alcohol beverage license if any of its investors, for example, holds a disqualifying tied-house interest in another alcohol beverage license.

The full text of SB 796 as introduced on March 12, 2015 can be found here.

Best Practices in Winery Operations Conference (Napa, 3/19 – 3/20)

James W. Terry Director at Dickenson, Peatman & Fogarty and chair of the firm’s business practice group, will serve as as program co-chair at the annual “Best Practices in Winery Operations” conference hosted by The Seminar Group, to be held on March 19 and 20, 2015 at The River Terrace Inn in Napa, California. The conference touches on many key issues facing the wine industry today including:

- The history and future of Napa’s Winery Definition Ordinance.

- Employment law issues surrounding winery volunteers, interns, and immigration.

- Applying for, and creating value in, an AVA

- Issues facing next generation winemakers.

In addition to the usual group of legal experts leading the panels, this year’s seminar features many noted voices from the wine industry, including Andy Beckstoffer, Cathy Corison, Genevieve Janssens, Tegan Passalacqua, Matthew Rorick, and Richard Sanford. A full program schedule can be downloaded here, and you can register here.

Richard P. Mendelson Of Counsel at DP&F will moderate a session on Napa’s Winery Definition Ordinance which will include panelists Andy Beckstoffer (Owner, Beckstoffer Vineyards).

Gregory J. Walsh, Director at DP&F, will co-present a session on Volunteers, Interns, and Immigration.

Carol Ritter, Director at DP&F, will provide a presentation on the AVA application Process, and then lead a panel discussion on “Creating and Maintaining AVA Value,” with panelists Richard Sanford (Alma Rosa Winery & Vineyards) and Rex Stults (Government Relations Director, Napa Valley Vintners).

Katja Loeffelholz, Of Counsel at DP&F, will moderate a panel discussing on diversity in teh Vineyard and the Cellar, featuring leading women in the wine industry, including Cathy Corison (Corison Winery), Genevieve Janssens (Robert Mondavi Winery), Vanessa Robledo (Black Coyote Winery), Coral Brown (Brown Estate Vineyards, LLC) and Remi Coehn (Lede Family Wines/ Cliff Lede Vineyards).

John Trinidad, an attorney with DP&F’s Wine Law practice group, will lead a discuss about the opportunities and challenges facing young winemakers as they try to establish their own brands and locate vineyard sources. Panelists include Tegan Passalacquia (Head winemaker and Vineyard Manger for Turley Wine Cellars and Proprietor of Sandlands Wines), and Matthew Rorick (Winemaker and Proprietor, Forlorn Hope Wines).

Regulatory Hurdles for DTC, Social Media, and Third Party Sales Channels

During last week’s Unified Wine & Grape Symposium, DP&F attorney John Trinidad moderated a panel discussion titled, “Regulatory Hurdles for DTC, Social Media, and Third Party Sales Channels.” Trinidad led off the session with a presentation describing how the Internet has “disrupted” the wine industry’s traditional sales and marketing models. You can access Trinidad’s PowerPoint presentation by clicking on the image below:

Trinidad noted that the promise of e-commerce has become significantly more important for small wineries given the increase in the number of suppliers and continued consolidation of the wholesale tier. As noted by a respondent to a Gomberg, Fredrikson & Associates study:

“It is tougher than ever int he 3-tier channel. We have a hard time getting distributor attention as tehy have way too many brands, not enough people and we are just too small to matter.”

While wineries now have a significantly increased opportunity to reach consumers directly without having to find national distribution or share their revenues with intermediary tiers, a number of hurdles still remain. These include production caps, on site requirements, and other impediments to direct-to-consumer shipping. Additional issues arise due to regulatory uncertainty regarding how state alcohol beverage agencies will treat “new players” in the wine sales model, including third party providers. In short, e-commerce and the increased ability to ship directly to consumers offers a number of opportunities for wineries, but also raises a number of unresolved regulatory questions.

Similarly, social media provides wineries with the opportunity to interact and build relationships with consumers, but may still wonder how federal and state regulations apply to “new media.” Government agencies concerned with transparency and consumer have, by in large, ported their advertising restriction and applied it broadly to social media. This includes tied house laws, which prevent wineries from providing things of value (including free advertising) to retailers. Trinidad noted that regulatory uncertainty is likely to continue as new Internet-based business models appear and blur the line between e-commerce and social media.

Finally, Trinidad provided attendees with an update on the Empire Wine / NYSLA dispute. As noted in prior blog posts, NYSLA has accused Empire Wine, a New York based retailer, of shipping wine to states where retail direct to consumer shipping is prohibited, even though those states have not pursued any disciplinary action against Empire. NYSLA believes this action is grounds for suspension, revocation, or cancellation of Empire’s New York State License. If NYSLA prevails, a California winery that illegally ships wine to a consumer in, say, Utah, may be putting their NY Direct Shipper’s license at risk.

Updates to Massachusetts Direct to Consumer Shipper License Application

As most wine industry members are aware, licensed wineries now have the option to ship directly to consumers in Massachusetts if they obtain a Direct Wine Shipper License from the Massachusetts Alcoholic Beverages Control Commission (the “ABCC”).

The ABCC has recently revised the application for the Direct Wine Shipper License. The revised application allows wineries to list a mailing address (in addition to their facility address), no longer requires a copy of a vote by the Board of Directors LLC Managers appointing a manager or principal representative, and only ask applicants to disclose interests in other Massachusetts alcohol beverage licenses (as opposed to licenses out of the state).

The revised application is available online here.

For more information on direct to consumer shipping, please contact Bahaneh Hobel via email.

NYSLA, Empire Wine and Due Process

On January 23, the New York State Liquor Authority is scheduled to hold a hearing to determine if retailer Empire Wine & Spirits (“Empire”) engaged in “improper conduct” that warrants the suspension, cancellation or revocation of the retailer’s New York liquor license. According to the SLA’s Notice of Pleading, Empire allegedly shipped wine to consumers in other states, including states that do not allow for retailer direct-to-consumer alcohol shipping, and this amounts to “improper conduct’ that warrants a disciplinary penalty. (For a summary of the issues involved, including some of Empire’s legal arguments to date, please see https://www.dpf-law.com/blogs/lex-vini/empire-wine-nysla-lawsuit/).

Under New York law, after the SLA has served a notice of pleading, and if the licensee pleads not guilty, the licensee is entitled to a hearing before an impartial decision maker – a basic tenetant of due process rights. Those same due process rights also prohibit the SLA from prejudging specific facts or laws that will be at issue in a hearing. For example, New York courts previously held that public statements by the Chairman or a commissioner of the SLA indicated prejudgment of facts at issue in a pending proceeding. Because the chairman / commissioner that made the statement had not disqualified themselves from the proceeding, licensee’s due process rights had been violated. If a “disinterested observer may conclude that [the administrative official] has in some measure adjudge the facts as well as the law of a particular case in advance of hearing it,” then that official is disqualified on the ground of prejudgment. Woodlawn Heights Taxpayers & Cmty. Ass’n v. N.Y. State Liquor Auth., 307 A.D.2d 826, 827 (N.Y. App. Div. 1st Dep’t 2003).

Recently, the SLA used its official Twitter and Facebook accounts to publish a link to an op-ed written by Craig Wolf, president of the Wine & Spirits Wholesalers of America, in which Mr. Wolf states that Empire “has for years shipped alcohol across state lines in violation of recipient states’ tax and licensing laws.” Mr. Wolf goes on to state that, “The SLA is doing what is right” by going after Empire, and argues that the SLA’s enforcement actions is supported by the 21st Amendment.

By promoting Mr. Wolf’s article, one could argue that the SLA has already decided the facts before Empire has had any chance to present evidence at the hearing. Moreover, the SLA has conclusively weighed in on a key legal questions at issue in this hearing: does the SLA’s disciplinary action attempt to regulate interstate sale and distribution of alcohol in violation of the Commerce Clause, or is the SLA’s action permissible under the 21st Amendment? (For a review of some of Empire’s other legal arguments, please see

The SLA’s adoption and public promotion of Mr. Wolf’s views and statements may provide the basis for an appeal by Empire (if needed).

John Trinidad is an attorney at DPF and also serves as pro-bono General Counsel to the American Wine Consumers Coalition, an advocacy organization seeking to protect consumer rights and lower barriers to wine access. His full bio is available here.

Updated 1/25/2015

Wine Law Basics

DP&F Senior Alcohol Beverage Counsel Bahaneh Hobel gave a presentation on Wine Law Basics at the CalCPA Wine Industry Conference which took place in the Napa Valley on December 8, 2014.

Always Read The Contract – They Wrecked Your Wine, But Now Won’t Pay

You send your Chardonnay to a custom crush facility for bottling. A month later the wine in one out of about every ten bottles is brown. It oxidized in the bottle. You are forced to pull all your Chardonnay from the market at significant expense, and you fear your brand has suffered. The evidence suggests that the wine oxidized during bottling. Surely, the custom crush facility will step up and compensate you for your damages? To the surprise of many vintners, the custom crush facility may escape much or all liability based upon language in its contract.

In California, as in most states, companies can dramatically limit their liability to commercial customers. Companies do this by including clauses in their contracts with customers that exclude liability for negligence, for lost profits, or for consequential damages, among other things. These clauses are powerful – if something goes wrong – like oxidized wine – these clauses can shift liability from the company to the customer, or in our example, from the custom crush facility to the vintner. These clauses, if drafted properly, could prevent the custom crush facility from liability for lost profits, any damage to the vintner’s wine brand, consequential damages, and might even limit damages to the value of the wine if sold as bulk wine.

California courts will enforce contractual limitations of liability, but courts interpret those clauses very strictly. Consequently, those clauses should be well written and clear. There are, however, exceptions to the enforceability of these clauses. Parties cannot limit liability for fraud, willful injury to persons or property, or for violations of the law, even if those violations are negligent. While parties can limit liability for negligence, parties cannot limit liability for gross negligence. Courts explain that gross negligence is the “lack of any care or an extreme departure from what a reasonably careful person would do in the same situation to prevent harm to oneself or to others.” (See CACI 425.)

Additionally, contracts can further attempt to limit the amount of damages. For example, the custom crush facility in the above example might include a clause valuing the wine at $5 a gallon. If the wine is then destroyed in the bottling process because of the custom crush facility’s negligence, damages may be limited to $5 a gallon, even if the wine might retail for $25 a bottle.

If you are a winery or a winemaker in California, you need to understand these contractual limitations of liability before signing any contract with a custom crush facility, an alternative proprietor, bottler, or other service provider. You need to read the contract, and you further should understand that you could object to these limitations or negotiate less onerous clauses.

If you provide services to winemakers or wineries, you should also understand the need for contractual limitations of liability. Accidents happen, and they should not cost you your business. These limitations of liability, however, must be carefully drafted, and you should obtain an attorney with knowledge of the wine business to draft these limitations.

Additionally, all parties should understand the need for the right insurance to cover situations when things do go badly. Typically, commercial general liability policies will not cover damage to wine that occurs during the “wine making process,” which may include bottling. Both the vintner and the custom crush facility would do well to have an errors and omission policy.

Launching New Wine Brand Without a Winery

Beverage Trade Network recently published an article “Launching New Wine Brand Without a Winery” by DP&F attorneys John Trinidad and Katja Loeffelholz on insights on how to navigate legal hurdles when entering the wine industry. The article explores some of the key legal and regulatory issues facing “virtual wineries,” including securing the right licenses and permits, and protecting intellectual property. You can access the article using the following link.

USPTO Recognizes Exclusivity in Surname Trademark for Wine

On November 7, 2014, the Trademark Trial and Appeal Board of the U.S. Patent and Trademark Office issued an opinion upholding the refusal to register the trademark BARTON FAMILY WINERY for wine based on a prior trademark registration for THOMAS BARTON, also for wine. A copy of the opinion may be found here. While this is a non-precedential case, it does reflect fairly well-settled law concerning surnames and similarity between marks and is worth reviewing for members of an industry where surname trademarks are prevalent. Essentially, the Board found that “BARTON” was the dominant portion of the mark BARTON FAMILY WINES as “BARTON” is the first term in the mark and the terms “FAMILY WINERY” are merely descriptive of applicant’s business operations. In comparing this to THOMAS BARTON, the Board held that consumers would view BARTON FAMILY WINES as a line extension from THOMAS BARTON of wines only bearing the BARTON surname. Thus, the Board held the marks to be similar and given the identical nature of the goods found there to be a likelihood of consumer confusion.

What is perhaps more interesting about this case is that there are apparently six other third-party registrations for “BARTON” marks for alcohol beverages. This usually suggests that a term is weak and not entitled to much protection. However, the Board discounted these registrations on the basis that there was no evidence of whether these other marks were even used as four of the registrations were not based on use of the mark in commerce and for the two registrations that were based on use, there was no proof of use entered in the record. It is also notable that the two “BARTON” registrations that were based on use were for trademarks for whiskey. While the Board did not expressly state that the marks for whiskey were discounted because the marks in dispute were for wine, this seems to have impacted the Board’s view on the matter. Hindsight is always 20/20, but if the applicant had perhaps put in evidence of third-party use of the term “BARTON” on wine, there may have been a different result as there may have been a different conclusion by the Board as to the strength of the term “BARTON” in the likelihood of confusion analysis. A search of the COLA database using the ShipCompliant Label Vision program discloses several “BARTON” marks for wine including BARTON & GUESTIER, CHATEAU LEOVILLE BARTON, CHATEAU LANGOA BARTON, CHATEAU MAUVESIN BARTON and LA CROIX BARTON.

However, even with this additional evidence, the applicant still may not have prevailed given the fact that its mark is essentially BARTON and the only other points of distinction are descriptive terms. Had applicant’s mark been JAMES BARTON or JONES & BARTON, it may never have even been initially refused by the trademark examiner, and this is perhaps the best take away from this case. If you are the first to register a surname by itself, e.g., SBRAGIA, the USPTO will likely refuse registration to second-comers that include that surname as part of their mark. If you are a second-comer and a surname is already registered as part of composite trademark, e.g., THOMAS BARTON, you will be unlikely to obtain registration of the surname by itself or in combination with other descriptive terms and your better course of action would be to adopt a distinctive composite if you want to register the surname, e.g., JAMES BARTON. These are important considerations when deciding what mark to adopt.

Another interesting side note: the Board repeatedly referred to the “distillation” of wine at a winery facility. Honest mistake given the range of industries with which the USPTO interacts, but entertaining nonetheless.