Small Producer Tax Credit Pitfalls: The K Vintners Case

When is a small producer not a small producer? That was the question answered by a federal district court in a case that centered on a winery’s ability to claim a small producer tax credit for wine produced at another winery (K Vintners v. U.S., Case No. 12-cv-05128-TOR (E.D. Wa. Jan 21, 2015)).

Background on the Small Producer Tax Credit.

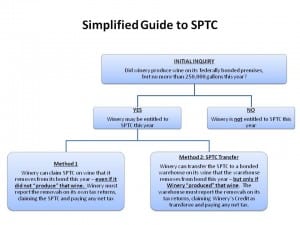

Under federal law, domestic wineries producing 250,000 gallons of wine or less per year (“small producers”) are entitled to a tax credit of up to $0.90 per gallon for the first 100,000 gallons of non-sparkling wine removed from bond and “produced at qualified facilities” and a reduced credit thereafter (26 U.S.C. Sec. 5041(c)). This is popularly referred to as the “small producer tax credit,” what I’ll refer to as the SPTC.

There are two methods by which a small producer can take advantage of the SPTC for wine that was produced at its own facility. First, the winery can claim the SPTC on wine that it removes from its own bond by reporting the removal on its tax return, claiming the SPTC, and paying the net tax. Alternatively, the producer can transfer wine it produced at its own facility in bond to a bonded warehouse, and transfer the SPTC to the bonded warehouse for eligible wine. In this scenario, the warehouse reports the removal on its tax return, claims the winery’s SPTC as transferee, and pays the net tax.

The SPTC can also apply to wines that were not made at small producer’s bonded winery, but only if that wine is transferred in bond from the producing winery to the small producer’s facility and removed from bond by the small producer so long as the small producer actually produces some wine at its facility that year.

The K Vintners Case: SPTC does not apply to wine produced at another winery on behalf of a small producer and transferred directly to a bonded cellar is not eligible for SPTC.

But what happens when the small producer has wine made at a different facility, and instead of transferring that wine to its own bonded premises, decides to have the wine transferred directly to a bonded warehouse? Is that wine eligible for the SPTC?

That was the issue that one Washington winery, K Vintners, faced a few years back. From 2005-2008, K Vintners produced wine each year at its bonded facility and also purchased bulk wine from two other wineries, Hogue Cellars and Wahluke Slope Vineyards. Hogue and Wahluke fermented, blended, and bottled wine for K Vintners (referred to hereafter as the “Hogue/Wahluke Wine”), then transferred the bottled wine directly to Tiger Mountain, a bonded cellar contracted by K Vintners. K Vintners then sold the wine its own tradenames. Pursuant to the K Vintners-Tiger Mountain contract, Tiger Mountain paid claimed K-Vintners’ SPTC on the wine transferred from Hogue/Wahluke and paid the net excise taxes on those wines when removed from bond, and K Vintners reimbursed the bonded cellar for any excise taxes it incurred.

TTB conducted an audit in 2007 and determined that the SPTC could not apply to the Hogue/Wahluke Wine because the wine in question was not produced at K Vintner’s bonded facility. TTB ordered Tiger Mountain to pay $327,496.83 in unpaid taxes and an additional $126,580.05 in late-payment penalties. TTB acknowledged that if the Hogue/Wahluke Wines had been shipped in bond from the producing wineries to K Vintner’s bonded premises, and then removed from bond by K Vintners, then K Vintners could have claimed the credit on its own behalf (provided that K Vintners produced some wine at its own facility in each of those years).

K Vintners and Tiger Mountain paid the amount under protest, raised administrative claims that were subsequently denied by TTB, and eventually filed suit to seek a refund of these tax payments. K Vintners argued, in part, that the wine was eligible for the SPTC because even though it was made at the Hogue/Wahluke facilities, K Vintners had significant control and oversight through its contractual arrangement with those wineries that in essence, K Vintners “produced” the wine, and therefore the wine was eligible for the SPTC.

The federal district court in the Eastern District of Washington sided with TTB, concluded that such wines were produced at the winery where they went through fermentation (Hogue/Wahluke) and therefore were not eligible for the SPTC when removed from Tiger Mountain’s bond. The end result: K Vintners would not see any refund of the nearly half million dollars worth of unexpected taxes and penalties it incurred as a result of its misapplication of the small producer tax credit.

Can a small producer claim the SPTC for wine produced at a winery that produces more than 250K gallons of wine?

One curious comment in the court’s decision (mere dicta, for those of you with legal experience) is worth exploring in more detail. The court took a close look at the regulatory language authorizing the SPTC, and noted that the SPTC was only available for “wine produced at qualified facilities in the United States.” Under the court’s interpretation, this means that a small producer could only claim the SPTC on wine it purchased from another winery if that winery was also “qualified” as a small producer. This directly contradicted statements in TTB’s court filings in which TTB stated that K Vintners could have applied the small producer tax credit to the Hogue/Wahluke Wine if the wine had been directly transferred in bond to, and subsequently removed from bond by, K Vintners.

We reached out to TTB to determine if, in light of this language in the court’s decision, TTB would be making any changes to its interpretation or enforcement of the small producer tax credit. TTB affirmed that it still interprets 26 USC Sec 5041(c)(1) to allow an eligible small producer to purchase wine from another winery — whether or not that selling winery is itself eligible as a “small producer” — and that wine may still be eligible for the SPTC, so long as the small producer meets all other conditions for eligibility. Note , however, that one of those conditions is that allowance of the SPTC would not “benefit a person who would otherwise fail to qualify for use of the SPTC.…”

This article does not constitute legal advice. Please contact an attorney if you have any questions about the application of the small producer tax credit.