Corporate Transparency Act: What You Need To Know To Comply

On January 1, 2024, the federal Corporate Transparency Act (CTA) took effect. This is a new law intended to combat the use of shell companies for laundering money, financing terrorism, and other bad acts by requiring that certain businesses file specific reports with the Treasury Department identifying the businesses owners and management with particularity.

Below is an overview of the requirements to comply with the CTA, including which businesses are affected and what, when, and—importantly—why to file.

Filing Requirements

All businesses that do not qualify for one of the exemptions listed below are required to file a “Beneficial Ownership Information (BOI) Report” with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) via their Beneficial Ownership Secure System (BOSS). BOI Reports are filed electronically at FinCEN’s website: https://www.fincen.gov/boi.

→ FinCEN’s Small Entity Compliance Guide outlines CTA compliance requirements in greater detail: https://www.fincen.gov/boi/small-entity-compliance-guide.

WHO: Businesses Required to File

All corporations, LLCs, and any other business entity formed by filing a document with a secretary of state or similar office (except exempt businesses) and all other business entities formed under a law of a foreign country and registered to do business in any US state (each, a “Reporting Company”), must file a BOI Report, unless they are expressly exempt from the requirement.

The following are the 23 exempt business types:

• Securities reporting issuer

• Governmental authority

• Bank

• Credit union

• Depository institution holding company

• Money services business

• Broker or dealer in securities

• Securities exchange or clearing agency

• Other Exchange Act registered entity

• Investment company or investment adviser

• Venture capital fund adviser

• Insurance company

• State-licensed insurance producer

• Commodity Exchange Act registered entity

• Accounting firm

• Public utility

• Financial market utility

• Pooled investment vehicle

• Tax-exempt entity

• Entity assisting a tax-exempt entity

• Large operating company

• Subsidiary of certain exempt entities

• Inactive entity

Each of the foregoing categories is described in more detail in the CTA: https://www.fincen.gov/boi-faqs#C_2.

Two exemptions warrant further discussion:

→ A “Large Operating Company” is an entity that employs more than twenty (20) full-time employees in the U.S. Business owners are prohibited from consolidating their employee count across multiple entities for purposes of qualifying as a Large Operating Company under the CTA. Each business entity must be evaluated separately.

→ An “Inactive Entity” is one that:

- Was in existence on or before January 1, 2020;

- Is not engaged in active business;

- Is not owned by a foreign person, whether directly or indirectly, wholly or partially;

- “Foreign person” means a person who is not a U.S. person, which is defined in section 7701(a)(30) of the Internal Revenue Code of 1986 as a citizen or resident of the U.S., domestic partnership and corporation, and other estates and trusts

- Has not experienced any change in ownership in the preceding twelve-month (12) period;

- Has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month (12) period; and

- Does not otherwise hold any kind or type of assets, whether in the U.S. or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

WHAT: Required Information for BOI Report

Each Reporting Company’s BOI Report must include the following information:

(i) Legal name and any trade or DBA name(s);

(ii) Entity address (usually the principal place of business in the US or primary location in other cases);

(iii) Jurisdiction where the Company was formed or first registered; and

(iv) Taxpayer Identification Number (TIN) and/or Employer Identification Number (EIN).

Additionally, the CTA requires that a Reporting Company’s BOI Report identify all “Beneficial Owners”—defined as any individual who, directly or indirectly, exercises substantial control over the Reporting Company or who owns or controls at least 25% of the Reporting Company – and certain other individuals.

All persons meeting the definition of a Beneficial Owner must provide the following pieces of information:

- Full name;

- Date of birth;

- Address (usually home address);

- An identifying number from a driver’s license, passport, or other approved document; and

- An image of the approved identification document for each individual.

All persons or entities filing a BOI Report or application under the CTA must certify that it is true, correct, and complete. It is estimated that the BOI Report may take three (3) hours to complete.

FinCEN enables Beneficial Owners to apply for and receive a unique identification number associated with that person or entity (“FinCEN ID”). For Beneficial Owners who receive their own FinCEN ID, it can be used in lieu of resubmitting the same information, thereby saving the applicant time when submitting future BOI Reports.

Based on the complex corporate structures involved in many businesses, many Reporting Companies will need to file a number of BOI Reports to comply with the CTA. Therefore, entities and persons are advised to apply for their own FinCEN ID if they (or a Reporting Company with which they are associated) expect to file multiple BOI Reports in the future.

WHEN: Filing Deadlines, Updates and Corrections to BOI Report

Reporting Companies are required to file their initial BOI Report according to the chart below. There is no annual requirement to file a BOI Report, only the initial BOI report. After the initial BOI Report, Reporting Companies are only required to update or correct the report, as information changes.

| Deadlines | |||

| Initial Filing | Updates | Corrections | |

| Pre-2024 Companies | 1 year | 30 days | 30 days from Reporting Company becoming aware or having reason to know of inaccuracy regarding Reporting Company or Beneficial Owner |

| Companies formed in 2024 | 90 days | ||

| Companies formed after 2024 | 30 days | ||

WHY: Penalties(!)

Civil penalties for failing to comply with the CTA are significant and can include criminal penalties. These penalties are compounded where noncompliance is willful.

Reporting Companies who fail to comply with the CTA—willfully or not—face fines of up to $500 for each day that the violation continues. Violators also face criminal penalties, including imprisonment for up to two (2) years and/or a fine of up to $10,000, where there was a willful failure to file or to provide complete or updated information, or fraudulent conveyance of false information.

… Next Steps

1. Consider whether your business may be one of the exempt business categories described above.

2. Identify and evaluate who and what needs to be reported and begin collecting the information—including images of required IDs.

3. Pay attention to the deadlines listed above and exercise diligence when and where previously reported information needs to be updated or corrected. Reporting requirements are ongoing and the penalties for noncompliance are steep.

4. But keep in mind, the CTA is a new law just now taking effect and one which will have unforeseen impacts. The requirements, exemptions, and enforcement mechanisms are not fully tested—and the full impacts are not yet known.

At DP&F, we can advise on CTA requirements as they relate to your business. For more information about the CTA and its impact on your business—or if you plan to form a new business entity—please email Carol Kingery Ritter, John Trinidad, or Owen Dallmeyer.

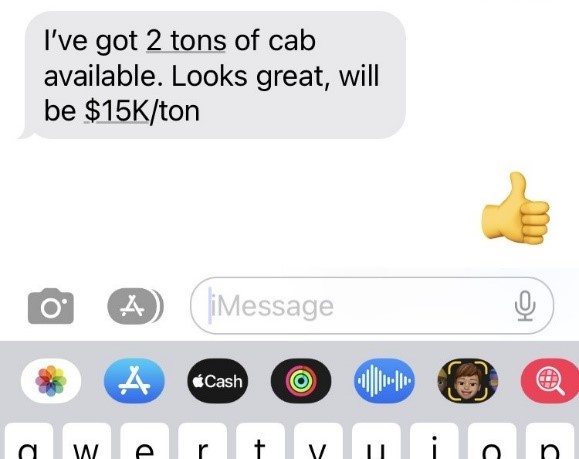

Canadian Court Gives 👍 to Contract Accepted by Emoji

Harvest is underway in wine country. During this season there is increased demand for skilled labor, transportation, and crush facilities. Buyers and sellers of fruit have a short window to make deals. A busy harvest season also lends itself to casual communication about crops, like this:

Now, did you just tell your friend you are happy for him, or did you just commit to buying $30K worth of fruit?

According to at least one Canadian court, the thumbs-up 👍 emoji could qualify as acceptance of a contract. A recent decision from the Court of King’s Bench in Canada discussed the “new reality in Canadian society” facing courts as the forms of communication broaden.

The Canadian court examined a dispute between a farmer and grain buyer over an alleged contract for 87 metric tons of flax, to be delivered in November 2021. The grain buyer and farmer spoke by phone, and the buyer texted the farmer a photo of the contract signed by buyer for November delivery. The text message said “please confirm flax contract.” The farmer texted back a “thumbs-up” emoji.

Later, when November rolled around, the price of flax had gone up, and the farmer attempted to say that his “thumbs-up” in response to the buyer only signaled that he had received the contract, not that he had accepted it. The court also looked at the prior dealings between the farmer and buyer, noting that in prior contracts for durum wheat, the farmer had various formed agreements with the buyer employing similarly concise responses, including “looks good,” “ok,” or “yup.”

Here, the court ultimately found that yes, the “thumbs-up” was sufficient acceptance, and the farmer was ordered to pay C$82,000 for the unfulfilled contract.

Canadian law is not controlling in the United States. However, this case reminds us that as forms and methods of communication grow, U.S. courts may eventually find that an emoji can qualify as acceptance of an agreement.

So, during important business negotiations, consider the potential consequences of casually firing off that “thumbs-up” emoji to the other side. Finally, when in doubt, seek the advice of an attorney.

End in Sight for Temporary Covid Relief Measures from CA ABC

The California Department of Alcoholic Beverage Control announced today end dates for the temporary relief measures announced in 2020 in response to the Covid-19 pandemic. Depending on the specific regulatory relief in question, the relief granted by ABC, and the expanded privileges granted to many licensees during Covid, will come to an end on either June 30 or December 31, 2021.

To assist licensees during the difficulties that arose from shut downs and restricted operations during Covid, the ABC issued various Notices of Regulatory Relief, advising the industry that certain practices would essentially be temporarily permitted With the end of Covid somewhat in sight here in California, the ABC has now provided the end dates for these measures.

The following Notices of Regulatory relief will be rescinded and no longer effective as of the close of business on June 30, 2021.

- Returns of Alcoholic Beverages

- Retail-to-Retail Transactions

- Extension of Credit

- Drive-Thru Windows for Off-Sale Transactions

- Hours of Operations for Retail Sales

- Delivery Hours Extended to Midnight

- Distilled Spirits Manufacturers Providing High-Proof Spirits for Disinfection Purposes

- Virtual Wine Tastings

- Extension of Regulatory Relief for Club Licenses: Type 50, 51 and 52

The ABC is allowing certain items of regulatory relief to remain in place until the end of the year. The following Notices of Regulatory Relief will thus temporarily remain in place until December 31, 2021 and rescinded immediately thereafter.

- On-Sale Retailers Exercising Off-Sale Privileges

- Sales of Alcoholic Beverages To-Go

- Deliveries to Consumers

- Free Delivery

- Expansion of Licensed Footprint

- On-Sale Licensees without Kitchen Facilities

- “Virtual” Meet the Winemaker or Brewer Dinners

- Renewal of Relief for Charitable Promotions and Sales

- Relief from Type-75 Requirement to Produce 100 Barrels of Beer Annually

These changes will have a big impact on industry members who have spent over a year incorporating some of these practices into their sales, marketing and distribution programs. For example, as of June 30, Virtual Wine Tastings with consumers (where samples of wine were shipped to the consumer for the tasting) will no longer be permitted, although Virtual Winemaker Dinners in conjunction with licensed retailers can continue until December 31.

Absent legislative changes to the ABC Act, none of the regulatory relief measures provided by ABC during Covid will become permanent, so licensees should start preparing now to make these shifts. It should be noted that proposals are already pending in the legislature to keep some of these measures in place for the long term. For example, a bill is currently pending that would allow certain licenses to donate a portion of their proceeds to charities, which was previously prohibited.

For more information on what each of the Notices of Regulatory Relief specifically provided, please visit https://www.abc.ca.gov/law-and-policy/coronavirus19/ or contact Bahaneh Hobel.

HOW THE PASSING OF PROPOSITION 24 WILL CHANGE THE CCPA

In 2018, California adopted the most extensive privacy provisions in the United States, the California Consumer Privacy Act of 2018 (CCPA.) Emulating provisions adopted in Europe’s General Data Protection Regulation (GDPR), the CCPA gives California consumers of certain, generally larger, businesses rights relating to the use and sale of personal information like names, addresses or internet purchasing history. In general, the CCPA provides consumers with the right to learn what categories of personal information are collected or sold; to request businesses delete their personal information or opt-out of the sale of their personal information; and creates liability for failing to reasonably protect consumers’ personal information.

California residents voted 56%-44% in the November 2020 election to amend and expand the CCPA through the passage of Proposition 24, the California Privacy Rights Act (CPRA). Proposition 24 imports more of the GDPR’s provisions, providing additional consumer privacy rights over sensitive information. It also expands penalties established through the CCPA, and creates a new agency in California to oversee and enforce consumer data privacy laws. Most of the provisions of CPRA go into effect on January 1, 2023, although the creation of the new state agency and requirements for developing new regulations will immediately go into effect. Businesses must comply with the regulatory provisions of the CCPA until those new regulations are in place.

Most notably, the proposition 1) creates a new administrative enforcement agency and eliminates the existing 30-day period to cure CCPA violations to avoid penalties; 2) slightly narrows which businesses are subject to the consumer data privacy requirements; and 3) provides customers with new data privacy rights, including limiting the sharing of personal data.

Changes to Administrative Enforcement Procedures and Penalties

Under the existing CCPA, a business can be penalized for violation of the regulations only if it does not cure any alleged noncompliance within 30 days after being formally notified by the California Attorney General’s office. Prop 24 creates a separate agency to enforce the CPRA – the California Privacy Protection Agency — and eliminates the existing 30 day opportunity to cure compliance oversights (but provides instead for discretion in whether to impose penalties or allow time to cure), effective January 2023. As a result, all businesses subject to the CPRA will need to be in compliance with the CPRA to avoid the potential issuance of administrative fines once the provisions go into effect in 2023. The new California Privacy Protection Agency will be responsible for investigating violations and assessing administrative penalties, although violations will still be subject to enforcement actions brought by the Attorney General as well. Among other changes, Prop 24 also increases the penalty up to $7,500 on businesses that violate the consumer privacy rights of minors.

Changes which Businesses Must Comply with Consumer Data Privacy Laws

Proposition 24 changes which type of businesses will be subject to California’s consumer data privacy requirements. To be subjected to the CPRA, a business must either:

- Derive at least 50% of its annual revenue from selling or sharing (as opposed to just selling under CCPA) the personal information of California consumers;

- Have gross revenue over $25 million (unchanged); or

- Buy, sell, or share the personal information of more than 100,000 (increased from 50,000 under CCPA) California consumers/households. (Helpfully, the standard now counts only California consumers or households; the CCPA also counted “devices.”)

Other notable changes include:

- Delays the applicability of the CCPA to personal information of a business’s own employees and other business-to-business communications until 2023.

- Requires rulemaking for the protection of trade secrets from disclosure as a result of a consumer request.

- Expands consumer “right to know” requests beyond the prior 12-months, beginning with data collected after January 1, 2022.

This is only a summary of notable changes. More information on Proposition 24 can be found here. The full text of the Proposition including all of the changes to the CCPA can be found here.

Napa County Moves to Orange Reopening Tier

On Tuesday, October 20, Napa County was approved to move to the Orange, Moderate Risk Level reopening tier under California’s Blueprint for a Safer Economy. As a result, effective Wednesday, October 21, many businesses will be able to expand their activities under the Orange Tier guidelines.

Wineries will begin to be allowed indoor tasting, with capacity limited to 25% or 100 people, whichever is less.

Restaurants will be allowed to increase their inside dining capacity to 50% or 200 people, whichever is less.

Bars, breweries and distilleries that have not previously been allowed to open without food service will be allowed to reopen, though only for outside activities.

Information on other businesses and their allowed activities under different tiers is available at https://www.countyofnapa.org/2739/Coronavirus-COVID-19

Napa County is expected to issue additional specific local guidance on reopening requirements in advance of the official change to Orange Tier operations. Additional information from the County and answers to Frequently Asked Questions can be found on the County website.

2020: The Year Testing Availability and Technology Failed Our Wine Industry Economy

Accurate, available and cost-effective diagnostic tools have never been more critical to economic survival than in 2020. While the world waits for a COVID-19 vaccine, large segments of our economy have been closed or hamstrung by government restrictions or voluntary measures implemented to slow the spread of the novel coronavirus. The lack of readily available, quick and accurate COVID-19 testing has been a primary contributor to the implementation of restrictions that have put millions out of work and slowed or recessed economic growth. Now, California and other west coast wine regions have been placed in another impossible situation as a result of the lack of testing resources and technologies available to make timely decisions about the quality of wine grapes.

The 2020 fires, the first round of which was caused by the lightning storms of August 16-19, occurred earlier in the harvest season than the fires and smoke exposure of previous years. The timing and breadth of these fires has caused an enormous demand for smoke taint testing at the go-to laboratory for smoke taint analysis- ETS Laboratories- although ETS and the Napa Valley Vintners have compiled a list of other testing resources available in state and abroad. Because of the enormous and unprecedented demand for ETS services, even with technicians working around the clock, some wineries and growers are shipping their samples overseas in hopes of getting results prior to the pick date.

Smoke taint tests primarily come in two forms: (a) whole berry testing where grape berries are analyzed for “free” guaiacol and 4-methylguaiacol (two of the primary indicators of smoke taint); and (b) wine tests where guaiacol and 4-methylguaiacol are measured in wine that has been fermented or micro-fermented. In the second test, where smoke taint is present, the guaiacol levels will be higher because some or most of the guaiacol that had been bound to sugars in the grapes will have released from the sugars through fermentation.

Whole berry testing was generally considered the most reliable testing option after the 2017 fires. However, it was known that smoke taint characteristics would increase after sugar bonds broke during fermentation and would continue to exacerbate through aging. In 2018, wineries started harvesting small batches of grape clusters to perform in-winery micro-fermentations to then test for smoke taint. Many growers objected to this process because of a lack of transparency regarding the micro-fermentation methodology or any uniformly recognized industry standard protocol. Some growers suspected that grape rejections were based on business factors, such as a wine supply glut, rather than actual smoke taint.

Now in 2020, the demand for testing is so intense that ETS is posting timing updates to receive test results on the landing page for their website. That is, please accept our condolences- ETS is currently reporting results from samples received on August 26 and samples received on September 10 will be reported by October 20.

This delay causes significant problems for wineries and growers. First, wineries cannot evaluate smoke impacts to grapes in real time to make informed grape harvest and acceptance decisions. Second, even if a winery will rely on an “old” test, the delay in receiving even dated information may result in grapes passing maturity and being subject to other defect liabilities. For growers, the problem is more severe and immediate. Growers across the state are watching grapes mature on the vines and many have no definitive answers from the wineries regarding a pick and delivery date or rejection.

In other cases, wineries are offering to process fruit but delay determination on quality until after fermentation. This risk for growers may payoff if smoke taint fears are worse than their reality, but if the fermented wine is ultimately rejected, some growers may be left without any compensation or insurance claim for an entire year of farming and nurturing the 2020 crop. Growers should be speaking regularly with their crop insurance agents and adjusters to determine whether they can maintain claim rights for rejections that occur in the winery, an option that had not previously been available.

In circumstances where pick decisions have not been made because of the lack of timely technical analysis, the delay will result in effective rejection and a much more complicated crop insurance claim process. For every fraction of increased Brix in grapes, the grapes also lose water, or desiccate, meaning that there will be lower tonnage, negatively impacting the purchase price for tonnage-based grape purchase agreements. Two extreme heat spikes over the past 30 days have further exacerbated the rate of desiccation. The delay in making informed pick or rejection decisions may also negatively impact growers’ ability to deliver sound and merchantable fruit and meet any contractual quality standards even if the grapes are shown not to be adversely impacted by smoke conditions.

For growers who have crop insurance, and want to make a claim for unharvested fruit, they need the winery to reject the crop, evidence of an independent analysis of the crop showing smoke taint, and the crop insurance adjuster to evaluate the tonnage of the crop in the vineyard. Any crop insurance payment will be based on either the contract price, or the average price set by the government-backed insurance program, multiplied by the crop tonnage and then reduced further by the policy coverage, which is based on the historic average yields on the vineyard, the amount of coverage purchased, the manner in which the farm units were defined by the policy and broken up by contract and less a deduction because the crop was not harvested. The longer that winery and grower are delayed in determining whether smoke taint is present, the lighter the tonnage and further reduced crop insurance claim. For growers who have recently planted vineyards, add to the insult the inability to show the progressive increase in crop yield on the vineyard for future crop insurance policies.

On top of all this, most Grape Purchase Agreements have provisions that allow for acceptance or rejection of grapes at the time of delivery, but while such a provision may be suitable to reject raisinated grapes or grapes that don’t meet the contractual Brix requirements, they are not well suited for rejection/acceptance based on smoke taint where meaningful inspection cannot occur on the crush pad at delivery. Even contracts that have specific smoke provisions, those provisions were predicated on the assumption that smoke taint test results could be obtained in a timely manner for a contract where time is of the essence in performance. With contracts that don’t adequately address the unexpected inundation of testing needs and a crop insurance program that doesn’t accommodate in-vineyard rejection without test results, wineries and growers are also challenged to consider contract amendments that attempt to mitigate the crop quality risks of this season.

I have always believed that strong relationships between wineries and growers are the cornerstone of this industry that I love and the basis for making beautiful wines that I love to drink. This harvest, like this year, is pushing many of us to the edge. And while testing resources are available and good people are doing their best, for a fire season that has cost lives and livelihoods, this 2020 harvest has shown that we do not have the testing and technology available to support the wine industry economy in the face of climate change.

The industry should demand and advocate for necessary and appropriate changes to crop insurance claim requirements that reflect the reality that smoke impacts are not like other grape defects that can be evaluated in the vineyard. For wineries that are partnering with their growers and taking the risk on grapes that they cannot adequately evaluate in the vineyard, a holistic approach is required to support these efforts and collaborations both on the production side and for the grower who has been left, in many cases, with no better option as a result of conditions they could not control. Much like the emergency relief put in place to allow businesses to adapt to the restrictions required to respond to the COVID-19 pandemic, state and local emergency action can support this industry now.

This year will end and that sounds great, but the challenges of climate change won’t go away on December 31. It is time to use our creativity and resources to prepare for the challenges of the future, at least so we can drink beautiful wine at the end of a long, hard-fought day trying to solve these problems.

Join DP&F’s Richard Mendelson for Free Webinar: Doing Business in the Time of COVID

DP&F’s Richard Mendelson will be the moderator for a star-studded panel of Napa business executives in a free Zoom webinar on Doing Business in the Time of COVID. Giving the perspective of the wine industry will be Jean-Charles Boisset, owner of Raymond Cellars and JCB Collection, and Emma Swain, CEO of St. Supery Estate Vineyards & Winery. They will be joined by Lindsey Gallagher, President and CEO of Visit Napa, who will address the tourism challenges of COVID on the Napa Valley. The webinar is being presented as part of the North Bay Business Journal’s Impact Napa conference and will take place on Wednesday, September 30, 2020 from 10:00-11:30 a.m. It is FREE for all to attend, just register at the following link:

https://zoom.us/webinar/register/WN_CpTOcRUOQA2HIberRQEbSA

PPP Forgiveness Terms Substantially Relaxed

The terms of the usage of PPP loans were just substantially relaxed by the Paycheck Protection Program Flexibility Act of 2020 – H.R. 7010. PPP recipients now have 24 weeks (the “covered period”), to use the loan proceeds instead of the original eight weeks and still receive forgiveness of the loan amounts. However, recipients of already issued loans can elect to still use the original 8 week period for purposes of their forgiveness application calculations if that is more favorable.

The PPP Flexibility Act also provides significant relief involving the provisions that reduce loan forgiveness amounts where staffing levels have declined. It adds additional time to cure cuts in staffing or compensation levels that reduce forgiveness amounts, extending the deadline from June 30 to December 31, 2020. It also adds a provision that allows two exceptions to the forgiveness penalties for staffing reduction. Where the loan recipient can document that it was unable to rehire staff because their prior employees, and similarly qualified employees, were not available, the forgiveness reduction will not apply. It also will not apply where the recipient is unable to return to the same level of business activity as before February 15, 2020 due to sanitation, social distancing or any other customer or worker safety requirements related to federal COVID-19 requirements or guidance.

It also eases the prior restriction developed through the regulatory process that 75% of PPP loan funds were required to be spent on payroll costs. The new PPP Flexibility Act provision requires only 60% of funds be used on payroll costs, allowing 40% to be spent on other specifically allowed costs of mortgage interest, rent and utility payments.

Further, it substantially extends the original PPP loan payment deferral terms. Originally, no payments of principal, interest or fees were required for six months. Now, no payments are required at all until a forgiveness determination is made, so long as the forgiveness application is filed within 10 months of the end of the “covered period.” That works out to a total of more than 15 months from when the loan is originated without any payments – the 10 months begin to run after the end of the extended 24 week period for using the funds. If the forgiveness application is not filed by the 10 month deadline, payments on the loans begin.

Finally, the PPP Flexibility Act removes a restriction on those that receive PPP loan forgiveness from also taking advantage of a delayed payment of employer payroll taxes. Now, PPP loan recipients who seek loan forgiveness will also be able to use the deferred payroll tax payment provisions of Section 2302 of the CARES Act. Those provisions allow for payment of 50 percent of specifically defined applicable employment taxes for 2020 to be paid by December 31, 2021, and the remainder by December 31, 2022.

Updated PPP Guidance Deems Smaller Loans ‘Necessary’

Today, May 13, 2020, the Treasury Department issued a major revision to its interpretation of the Payroll Protection Program’s requirement that loans under the program be “necessary.” On April 24, it had issued proposed rules regarding the required certification that the “current economic uncertainty makes this loan request necessary,” and provided a safe harbor for entities that may have certified this under a misapprehension of the standard to return funds that were obtained previously. It emphasized that borrowers must “certify in good faith that their PPP loan request is necessary,” under the threat of potential criminal prosecution for certifications made without sufficient need.

In a near-complete reversal, it has now said, effectively, never mind. With a newly provided FAQ answer, Treasury now says that all PPP loan recipients of amounts of less than $2 million “will be deemed to have made the required certification concerning the necessity of the loan request in good faith.” While this gives additional comfort to those that accepted and retained loans in the past, it is too late and highly disappointing for those that, in good faith, considered the prior interpretation and decided to return their loans out of fear of the risk it could later be found to be unnecessary.

The potential risk for those with loans above the $2 million threshold has also been substantially pared back. The updated guidance tempers the potential consequences to repaying the funds: “If SBA determines in the course of its review that a borrower lacked an adequate basis for the required certification concerning the necessity of the loan request, SBA will seek repayment of the outstanding PPP loan balance and will inform the lender that the borrower is not eligible for loan forgiveness. If the borrower repays the loan after receiving notification from SBA, SBA will not pursue administrative enforcement or referrals to other agencies based on its determination with respect to the certification concerning necessity of the loan request.”

Highlights of Napa County’s Updated Shelter in Place Order Including Cloth Face Covering Requirement

On May 7, 2020, Napa County issued an Order modifying the prior Shelter in Place Order that was issued on April 22, 2020. The full text of the Order can be found here, and the updated FAQs are here.

Here are the key changes in the new Order:

- The Order requires wearing cloth face coverings when inside places of business and in workplaces when interacting with any person where six feet of physical distancing cannot be maintained.

- A Face Covering is Not Required When: at home; in your car alone or solely with members of your household; exercising outdoors provided you are staying at least six feet apart from anyone who is not a member of your household (but it is recommended that you have a face covering with you and readily accessible); when eating or drinking.

- Who Should Not Wear a Face Covering: Children 6 years old or younger may not need a face covering and children under 2 should not wear one; anyone who has trouble breathing or is unable to easily remove a face covering without assistance; anyone who has been advised by a medical professional not to wear a face covering.

- Essential businesses must require their employees wear a face covering in any area where others may be present, even if there are no customers or members of the public present at the time. Essential businesses should inform customers about the requirement of wearing a face covering, including posting signs at the entrance to the store or facility.

- All workers operating public transportation, or operating other types of shared transportation are required to wear a face covering when at work in most settings.

- Workers doing minimum basic operations, like security or payroll, essential infrastructure work, or government functions should wear a face covering when six feet of physical distance cannot be maintained.

- For more information on cloth face coverings, including links to guidance on how to make your own mask, see the Napa County requirement here.

- The Order states that businesses will be permitted to reopen within the State of California’s framework that identifies four-stages to reopening.

- Non-essential businesses will be permitted to reopen according to the State’s four-stage framework. It is anticipated that Early Stage 2 non-essential businesses may be able to open as early as Friday, May 8, 2020. The list of those businesses, and how they will be allowed to operate, will be provided by the State.

- Counties may be able to move into Deep Stage 2, but only after the State Public Health Officer provides criteria and procedures for doing so, as well as the template for submitting a “readiness plan” that requires self-certification by the Public Health Officer and approval by the Board of Supervisors.

- Stage 3 non-essential businesses will not be able to reopen until the Governor determines, on a statewide basis, that counties can move into Stage 3. The Governor has also said this stage is months away.

- The Order allows drive-in activities that can comply with physical distancing requirements.

- All construction is now allowed but it must comply with Construction Site Requirements to maintain social distancing and sanitation (see Appendix B to the Order).

- The Order allows outdoor recreation sports that can comply with physical distancing requirements; however, person-to-person contact sports are still prohibited.

- The list of approved outdoor recreation activities can be found here.

- Golfing, use of tennis courts, and use of swimming pools (public and semi-private) are permitted as long as they are used in compliance with social distancing protocols. (The specific, detailed requirements for golf courses remain the same – see Appendix C of the Order).

- You can exercise outdoors if you will not be in close contact with other people or using equipment that other people outside your household have touched. Fitness centers, gyms, recreational centers, fitness equipment at parks, climbing walls, basketball courts, and other shared sports facilities remain closed.

- Comment on the Short-Term Lodging Industry

- The Napa County Public Health Officer has advised the lodging industry that reservations beginning on and after June 1, 2020 may be accepted. However, this is not a guarantee that the reservations can be honored, and short-term lodging businesses should inform customers that their reservations will be cancelled if the local and/or state Shelter-At-Home orders continue to prohibit short-term lodging at that time. Further, lodging businesses should consider how they will provide appropriate sanitation and enforce physical distancing protocols when they are allowed to reopen.

- The Compliance Task Force will not engage in enforcement activities for lodging businesses that are currently accepting reservations for dates beginning June 1, 2020 and beyond, but making new reservations for dates in May is still prohibited and subject to enforcement.

For more information please contact Marissa Buck.

Additional Paycheck Protection Program Funding Approved; Disaster Loan Program Expanded To Farmers

On April 24, H.R. 266, the Paycheck Protection Program and Health Care Enhancement Act, was signed into law. In addition to providing significant funding for health care providers ($75 billion) and testing ($25 billion), the stimulus package revives the CARES Act’s Paycheck Protection Program (PPP) with an additional $310 billion in funding for forgivable loans. This expanded stimulus and relief package sets aside a portion of that funding for smaller lenders. The additional funding does not change the limits on the availability of the PPP’s forgivable loans, nor change the priority of borrowers in obtaining those loans.

However, in reaction to various reports on public companies obtaining PPP loans, the Treasury Department updated its PPP FAQs and this morning, April 24, issued additional proposed rules regarding the required certification that the “current economic uncertainty makes this loan request necessary,” and provided a safe harbor for entities that may have certified this under a misapprehension of the standard to return funds that were obtained previously. Borrowers must “certify in good faith that their PPP loan request is necessary.”

The legislation also makes one significant change to the CARES Act, by now allowing agricultural enterprises (i.e., farmers) to seek Economic Injury Disaster Loans. The SBA’s EIDL Program is typically not available to agricultural enterprises, which would normally turn to the USDA’s FSA Emergency Farm Loan program in a natural disaster. However, that program covers actual damages to crops. With the change to the provision made in H.R. 266, agricultural enterprises can now seek EIDLs from the SBA for economic losses, including a $10,000 advance that does not need to be repaid. However, even with the additional funding whether new applicants will be able to obtain EIDLs is unclear. Applications are processed on a “first come, first served” basis, and reports indicate a very large volume of applications that have not been funded already. The SBA had paused accepting applications for EIDLs pending additional funding. Details on the EIDL program are available on the SBA’s website here.

Coronavirus (COVID-19) Resources

Updated August 2, 2021

In addition to our periodic blog posts on Coronavirus related news, DPF has compiled a list of Coronavirus resources, including those specifically aimed at the alcohol beverage and hospitality industries, that may be of interest to our clients.

CALIFORNIA STATE RESOURCES

CA Coronavirus Regional Stay Home Order: https://covid19.ca.gov/stay-home-except-for-essential-needs/

CA Coronavirus Safer Economy Guide: https://covid19.ca.gov/safer-economy/

CA Coronavirus Roadmap – Counties: https://covid19.ca.gov/roadmap-counties/

CA Coronavirus Roadmap Reopening Guidance: https://covid19.ca.gov/roadmap/#guidance

CA Coronavirus Industry Reopening Guidance: https://covid19.ca.gov/industry-guidance/

CA Coronavirus Portal: https://covid19.ca.gov/

03/19/2020 Governor’s Executive Order re Shelter in Place Order: https://covid19.ca.gov/img/N-33-20.pdf

03/20/2020 List of Designated Essential Workforce under Executive Order: https://covid19.ca.gov/img/EssentialCriticalInfrastructureWorkers.pdf

COUNTY RESOURCES

Napa County

Face Covering Mandate: https://www.countyofnapa.org/DocumentCenter/View/17329/Napa-County-Health-Officer-Recommendations-For-Wearing-Face-Coverings?bidId

County Coronavirus Site: https://www.countyofnapa.org/2739/Coronavirus-COVID-19

COVID-19 Exposure Guidance: https://www.countyofnapa.org/DocumentCenter/View/18019/Guidance-for-Employers-and-the-Community_Positive-or-Exposed-Employees

Social Distancing Protocol: https://www.countyofnapa.org/DocumentCenter/View/17123/Appendix-A-Social-Distancing-Protocol?bidId=

Industry Guidance: https://www.countyofnapa.org/2840/Industry-Guidance

Dine In: https://www.countyofnapa.org/DocumentCenter/View/17584/Restaurant-Sector-Reopening-Guidelines

Retail: https://www.countyofnapa.org/DocumentCenter/View/17585/Retail-Sector-Reopening-Guidelines-

Professional Services (offices): https://www.countyofnapa.org/DocumentCenter/View/17586/Professional-Services-Sector-Reopening-Guidelines

Restaurant Specific Facts: https://www.countyofnapa.org/DocumentCenter/View/17712/Restaurant-Specific-FAQs-ENG

Health Notice for Public Pool and Spa Operation: https://www.countyofnapa.org/DocumentCenter/View/17696/Health-Notice-for-Public-Pools-and-Spas-in-Napa-County-5-19-2020

Social Distancing and Sanitation Protocol – Public Swimming Pools:https://www.countyofnapa.org/DocumentCenter/View/17695/Swimming-Pool-Social-Distancing-and-Sanitizing-in-Napa-County-5-19-202

Updates to Napa County Shelter at Home Orders (Updated May 6, 2020): https://www.countyofnapa.org/2813/Shelter-at-Home-Order

04/02/2020 Shelter at Home Order Extension: https://www.countyofnapa.org/DocumentCenter/View/17112/Shelter-at-Home-Order-4-3-2020–?bidId=

03/20/2020 Shelter at Home Order (Updated 03/22/2020): https://www.countyofnapa.org/DocumentCenter/View/16684/Shelter-at-Home-FAQ_ENGLISH

Sonoma County

Face Covering Order Effective 08.03.21: https://socoemergency.org/order-of-the-health-officer-of-the-county-of-sonoma-c19-25

Face Covering Order 05.24.21: https://socoemergency.org/face-covering-order

County Coronavirus site:https://socoemergency.org/emergency/novel-coronavirus/

https://socoemergency.org/emergency/novel-coronavirus/soco-covid-19-check/

Santa Rosa City Temporary Sick Leave Ordinance for COVID-19:https://srcity.org/3348/Temporary-Sick-Leave-Ordinance

Outdoor Dining Guidance:https://socoemergency.org/wp- content/uploads/2020/05/COVID-19-Guidance-Outdoor- Dining-ENG-05232020.pdf

Covid-19 Check App FAQs:https://sonomacounty.ca.gov/Health/Disease-Control/Coronavirus/FAQ-COVID-app/

https://sonomacounty.ca.gov/Health/Disease-Control/Coronavirus/SoCo-COVID19-Check-App/

Economic Development Board – COVID – 19 App/Strategies to Help Reopen Local Businesses:http://sonomaedb.org/Business-Assistance/Coronavirus/Business-Management-Plans/

04/01/20 Extension of Shelter in Place Order: https://socoemergency.org/order-of-the-health-officer-shelter-in-place-extended/

Original Shelter in Place Order: https://socoemergency.org/order-of-the-health-officer-shelter-in-place/

Marin County

Mask Mandate Effective 08.02.21: https://coronavirus.marinhhs.org/masks

County Coronavirus site:https://coronavirus.marinhhs.org/

Specific Protection Plan:https://storage.googleapis.com/proudcity/marinrecoversca/uploads/2020/05/COVID-19-Site-Specific-Protection-Plan-SPP-Fillable-accessible.pdf

Guidelines for Businesses: https://marinrecovers.com/agencies/guidelines-for-businesses/

Golf Courses and Racket Clubs: https://marinrecovers.com/parks-outdoor-recreation/

Outdoor Recreational Activity Businesses: https://marinrecovers.com/parks-outdoor-recreation/

Recreational Equipment Rentals: https://marinrecovers.com/parks-outdoor-recreation/

Pet Groomers: https://marinrecovers.com/personal-services/

Summer/Sports Camps and Child Care:https://marinrecovers.com/summer-camps-youth-activities/

Shelter in Place Order: https://coronavirus.marinhhs.org/marin-public-health-order-may-15-2020

Other County Shelter in Place Orders and county-specific COVID-19 sites Information:

https://covid19.ca.gov/state-local-resources/#top

Mendocino County (Red Tier): https://www.mendocinocounty.org/community/novel-coronavirus

Contra Costa County Order 08.02.21: https://813dcad3-2b07-4f3f-a25e-23c48c566922.filesusr.com/ugd/84606e_8a1ea8e1a6cd4e33a3509521f661237d.pdf

Contra Costa County (Red Tier):https://www.coronavirus.cchealth.org/

Alameda County Order 08.02.21: https://covid-19.acgov.org/covid19-assets/docs/press/joint-release-2021.08.02.pdf

San Francisco County Mask and Face Coverings effective 08.03.21: https://sf.gov/information/masks-and-face-coverings-added-protection-coronavirus

San Francisco County Order 08.02.21: https://covid-19.acgov.org/covid19-assets/docs/press/joint-release-2021.08.02.pdf

Solano County (Red Tier):https://www.solanocounty.com/depts/ph/ncov.asp

ALCOHOL BEVERAGE INDUSTRY RESOURCES

U.S. Department of Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB) Coronavirus Specific Information (updated 3/30/2020): https://www.ttb.gov/coronavirus

03/31/2020 TTB Industry Circular re Postponement of Tax Payment and Filing Due Dates: https://www.ttb.gov/industry-circulars/ttb-industry-circulars-2020-2

California Department of Alcoholic Beverage Control COVID-19 Updates: https://www.abc.ca.gov/law-and-policy/coronavirus19/

05/20/2020 Fifth Notice re Regulatory Relief: https://www.abc.ca.gov/fifth-notice-of-regulatory-relief/

05/15/2020 Fourth Notice re Regulatory Relief: https://www.abc.ca.gov/fourth-notice-of-regulatory-relief/

04/21/2020 Third Notice re Regulatory Relief: https://www.abc.ca.gov/third-notice-of-regulatory-relief/

04/01/2020 Second Notice re Regulatory Relief: https://www.abc.ca.gov/second-notice-of-regulatory-relief/

03/19/2020 First Notice re Regulatory Relief: https://www.abc.ca.gov/notice-of-regulatory-relief/

03/21/2020 FAQ re Regulatory Relief: https://www.abc.ca.gov/law-and-policy/coronavirus19/frequently-asked-questions/

California Wine Institute COVID-19 Resources Page: https://wineinstitute.org/news-alerts/coronavirus-covid-19-update

California Wine Institute “Winery Tasting Rooms Reopening Protocols” (posted 5/13/2020):

https://wineinstitute.org/our-work/compliance/covid-19-updates/tasting-room-guidance/

California Craft Breweries COVID-19 Resources Page: http://californiacraftbeer.com/covid-19-resources-for-craft-breweries-ongoing-list/

Brewers Association Coronavirus Resource Center: https://www.brewersassociation.org/brewing-industry-updates/coronavirus-resource-center/

Distilled Spirits Council of the U.S. COVID-19 Page: https://www.distilledspirits.org/news/discus-monitoring-covid-19-industry-news/

California Artisanal Distillers Guild Updates: https://twitter.com/CADISTILLERS

Note that regional trade associations are also providing their members with significant helpful information regarding the Coronavirus outbreak and regulatory response.

HOSPITALITY, TOURISM AND TRAVEL INDUSTRY RESOURCES

California Restaurant Association Coronavirus Resources: https://www.calrest.org/coronavirus-resources

National Restaurant Association COVID-19 Resources: https://restaurant.org/covid19

California Hotel & Lodging Association: https://calodging.com/coronavirus-information-resources

U.S. Travel Association: https://www.ustravel.org/toolkit/emergency-preparedness-and-response-coronavirus-covid-19

Napa County Tourism (Visit Napa Valley): https://www.visitnapavalley.com/

Sonoma County Tourism: https://www.sonomacounty.com/

EMPLOYER RESOURCES: FEDERAL

EEOC Question and Answer Page (added 05/06/20): https://www.eeoc.gov/eeoc/newsroom/wysk/wysk_ada_rehabilitaion_act_coronavirus.cfm

PPP Loan Forgiveness Guidance (added 05/20/20)

The U.S. Department of the Treasury – SBA Form PPP Forgiveness Application: https://home.treasury.gov/system/files/136/3245-0407-SBA-Form-3508-PPP-Forgiveness-Application.pdf

The U.S Department of the Treasury PPP Loan Resource page: https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Frequently-Asked-Questions.pdf

Cares Act Resource (added 04/01/20)

The U.S. Department of the Treasury CARES Act Resource page: https://home.treasury.gov/cares

The SBA CARES Act Resource page: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

IRS – CORONAVIRUS TAX RELIEF: https://www.irs.gov/coronavirus

The following were added on 04/01/20

The IRS FAQs regarding tax credits for paid leave under the FFCRA: https://www.irs.gov/newsroom/covid-19-related-tax-credits-for-required-paid-leave-provided-by-small-and-midsize-businesses-faqs

The IRS FAQs regarding CARES Act: https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act

IRS new tax form, Form 7200, that can be used to request the advance tax credits under both the FFCRA and the CARES Act. The form and the draft instructions (final instructions are expected shortly), can be found here: https://www.irs.gov/forms-pubs/about-form-7200

CYBERSECURITY AND INFRASTRUCTURE SECURITY AGENCY (CISA) GUIDANCE ON ESSENTIAL CRITICAL INFRASTRUCTURE WORKERS: https://www.cisa.gov/sites/default/files/publications/CISA-Guidance-on-Essential-Critical-Infrastructure-Workers-1-20-508c.pdf

FEDERAL MOTOR CARRIER SAFETY ADMINISTRATION: https://www.fmcsa.dot.gov/newsroom/us-department-transportation-issues-national-emergency-declaration-commercial-vehicles

U.S. SMALL BUSINESS ADMINISTRATION: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

U.S. OFFICE OF PERSONNEL MANAGEMENT TELEWORK GUIDANCE: https://www.telework.gov/guidance-legislation/telework-guidance/emergency-telework/

DEPARTMENT OF LABOR RESOURCES

COBRA Premium Subsidy: https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/cobra/premium-subsidy

Families First Coronavirus Response Act (FFCRA) requirements and questions:

Poster/notice:https://www.dol.gov/sites/dolgov/files/WHD/posters/FFCRA_Poster_WH1422_Non-Federal.pdf

https://www.dol.gov/sites/dolgov/files/WHD/Pandemic/1422-spanish.pdf

Questions about Coverage and the Poster:

Poster Questions: https://www.dol.gov/agencies/whd/pandemic/ffcra-poster-questions

Coverage Questions: https://www.dol.gov/agencies/whd/pandemic/ffcra-employer-paid-leave

https://www.dol.gov/agencies/whd/pandemic/ffcra-questions

EMPLOYER RESOURCES: STATE AND COUNTY

STATE OF CALIFORNIA EMPLOYMENT DEVELOPMENT DEPARTMENT

COVID-19: https://www.edd.ca.gov/about_edd/coronavirus-2019.htm

COVID-19 FAQ: https://www.edd.ca.gov/about_edd/coronavirus-2019/faqs.htm

Work Sharing Program: https://www.edd.ca.gov/unemployment/Work_Sharing_Program.htm

Disaster Unemployment Assistance: https://edd.ca.gov/about_edd/disaster_related_services.htm

Emergency and Disaster Payroll Tax Extension: https://edd.ca.gov/Payroll_Taxes/Emergency_and_Disaster_Assistance_for_Employers.htm

DEPARTMENT OF INDUSTRIAL RELATIONS (DIR):

COVID-19 Cal/Osha Regulations: https://www.dir.ca.gov/dosh/coronavirus/Revisions-FAQ.html

COVID- 19 6.9.2021 Press Release: https://www.dir.ca.gov/DIRNews/2021/2021-60.html

COVID- 19 6.3.21 Press Release: https://www.dir.ca.gov/DIRNews/2021/2021-58.html

COVID-19 Recent Proposed Changes from ETS: https://www.dir.ca.gov/oshsb/documents/Jun032021-COVID-19-Prevention-Emergency-txtcourtesy-Readoption.pdf

COVID-19 Proposed Changes From ETS: https://www.dir.ca.gov/OSHSB/documents/COVID-19-Prevention-Emergency-txtcourtesy-Readoption.pdf

COVID-19 2021 Resources: https://www.dir.ca.gov/dlse/COVID19Resources/FAQ-for-SPSL-2021.html

COVID-19 2021 Supplemental Paid Sick Leave Poster: https://www.dir.ca.gov/dlse/2021-COVID-19-Supplemental-Paid-Sick-Leave.pd

Cal/OSHA webinars: https://www.dir.ca.gov/dosh/coronavirus/webinars.html

Cal/OSHA regulations: https://www.dir.ca.gov/OSHSB/documents/COVID-19-Prevention-Emergency-apprvdtxt.pdf

Cal/OSHA requirements: https://www.dir.ca.gov/dosh/coronavirus/Health-Care-General-Industry.html

COVID-19 AB 685 FAQ: https://www.dir.ca.gov/dosh/coronavirus/AB6852020FAQs.html

COVID-19 Emergency Temporary Standards – Fact Sheets – Model Written Program: https://www.dir.ca.gov/dosh/coronavirus/ETS.html

COVID-19 Emergency Temporary Standards FAQ: https://www.dir.ca.gov/dosh/coronavirus/COVID19FAQs.html

COVID-19 FAQ: https://www.dir.ca.gov/dlse/2019-Novel-Coronavirus.htm

Workers’ Comp. Notice Requirement – SB 1159: https://www.dir.ca.gov/dwc/Covid-19/FAQ-SB-1159.html

Expansion of CA COVID-19 Supplemental Paid Sick Leave – AB 1867: https://www.dir.ca.gov/dlse/FAQ-for-PSL.html

Poster for non-food sector employers with 500 or more employees can be accessed here: https://www.dir.ca.gov/dlse/COVID-19-Non-Food-Sector-Employees-poster.pdf

Worker Safety in Wildfire Regions: https://www.dir.ca.gov/dosh/Worker-Health-and-Safety-in-Wildfire-Regions.html

Heat Illness Prevention and High Heat Requirements: https://www.dir.ca.gov/DOSH/HeatIllnessInfo.html

Cal/OSHA Guidance on Face Coverings: https://www.dir.ca.gov/dosh/coronavirus/Face-coverings-poster.pdf

Cal/OSHA Guidance on Requirements to Protect Workers from Coronavirus: https://www.dir.ca.gov/dosh/coronavirus/Health-Care-General-Industry.html

Cal/OSHA Guidance on Protecting Workers During a Pandemic: https://www.osha.gov/Publications/OSHAFS-3747.pdf

Cal/OSHA Guidance on Developing an Emergency Action Plan: https://www.dir.ca.gov/dosh/dosh_publications/iipp.html

https://www.dir.ca.gov/dosh/etools/09-031/index.htm

GOVERNOR’S ORDERS:

Exception to Cal WARN Act 60-day notice requirement for layoffs: https://www.gov.ca.gov/wp-content/uploads/2020/03/3.17.20-EO-motor.pdf

Waiver of one-week waiting period for UI benefits and SDI: https://www.gov.ca.gov/wp-content/uploads/2020/03/3.12.20-EO-N-25-20-COVID-19.pdf

The latest orders can be found on the Governor’s website here: https://www.gov.ca.gov/newsroom/#:~:text

LABOR AND WORKFORCE DEVELOPMENT AGENCY: https://www.labor.ca.gov/coronavirus2019/

CALIFORNIA GOVERNOR’S OFFICE OF BUSINESS AND ECONOMIC DEVELOPMENT: https://business.ca.gov/coronavirus-2019/

STATE OF CALIFORNIA FRANCHISE TAX BOARD: https://www.ftb.ca.gov/about-ftb/newsroom/news-releases/2020-2-more-time-to-file-pay-for-california-taxpayers-affected-by-the-covid-19-pandemic.html

NAPA/SONOMA SMALL BUSINESS DEVELOPMENT CENTER (Includes Coronavirus-specific Business Assistance Webinars and Small business “survival guide”): https://www.napasonomasbdc.org/covid-19

HEALTH SERVICES RESOURCES

For the latest information about the coronavirus in Sonoma County and advice from health experts on prevention and care, call 2-1-1, text your zip code to 898-211 or visit (copy/paste) https://socoemergency.org/

For the latest information about the coronavirus in Napa County visit https://www.countyofnapa.org/2739/Coronavirus. You may also call Napa County’s information line at (707) 253-4540 (Monday – Friday, from 9am to 12pm and 1pm to 5pm).

CA Dept. of Public Health Resource Page:

https://www.cdph.ca.gov/Programs/CID/DCDC/Pages/COVID-19/guidance-for-face-coverings.aspx

https://www.cdph.ca.gov/Programs/CID/DCDC/Pages/COVID-19/Workplace-Outbreak-Employer-Guidance.aspx

https://www.cdph.ca.gov/Programs/CID/DCDC/Pages/Immunization/ncov2019.aspx

https://www.cdph.ca.gov/Pages/LocalHealthServicesAndOffices.aspx

California Correctional Health Care Services: https://cchcs.ca.gov/covid-19-interim-guidance/

CDC – Covid Data Tracker: https://covid.cdc.gov/covid-data-tracker/#county-view

CDC – Centers for Disease Control & Prevention: https://www.cdc.gov/coronavirus/2019-ncov/community/organizations/businesses-employers.html

Coronavirus – How to Protect Yourself/If You Think You Are Sick:

https://www.cdc.gov/coronavirus/2019-ncov/community/disinfecting-building-facility.html

https://www.cdc.gov/coronavirus/2019-ncov/prepare/prevention.html

https://www.cdc.gov/coronavirus/2019-ncov/if-you-are-sick/steps-when-sick.html

EPA EXPANDS COVID-19 DISINFECTANT LIST: https://www.epa.gov/newsreleases/epa-expands-covid-19-disinfectant-list

CA ABC Loosens Regulations for Alcohol Beverage Retailers and Delivery

The California Department of Alcoholic Beverage Control issued a notice on March 19, 2020 temporarily loosening certain regulations during the current state of affairs. While primarily focused on retailers, there are some potentially helpful provisions that impact alcohol beverage producers, too.

A few things to keep in mind. First, local regulations and restrictions may also govern and restrict the ability of licensees to engage in these activities. Second, this move by the ABC is temporary. ABC plans to notify the industry 10 days before these guidelines terminate.

Below is a summary of ABC’s March 19 notice.

3/21/2020 Update: CA ABC has issued a FAQ for it’s 3/19/2020 Notice of Regulatory Relief

For a full list Coronavirus-related links and resources compiled by DPF attorneys, please click here.

ON-PREMISE RETAILERS SELLING ALCOHOL “TO GO”

ALCOHOL IN MANUFACTURER PRE-PACKAGED CONTAINERS: If you hold an on-premise retail license that allows you to sell beer and wine or beer wine and spirits, you can sell that beer and wine to go for off-premise consumption in the original container/bottle (barring any condition on your license). That was true prior to the ABC notice, and still holds. However, if you hold an on-premise retail license that allows you to sell beer, wine and spirits, you can now sell all those beverages (beer, wine and spirits) in the original container/bottle.

ALCOHOL IN RETAILER PACKAGED CONTAINER: Under ABC’s new notice, if you operate a restaurant / “bona fide eating place”, you can now package whatever alcohol your license allows you to sell (beer and wine only for a Type 41; beer, wine, and premixed cocktails/drinks if you are a Type 47) in a container with a “secure lid or cap” so long as that cap does not have a sipping hole or opening for a straw, or could otherwise be consumed without removing the lid/cap. However, that container must be sold in conjunction with a meal prepared for pick-up or delivery.

Retailers that want engage in this type of activity must have a prominent posting (either on the premise, online, or in any way possible to alert consumers or the person transporting the beverage) that states, “Alcoholic beverages that are packaged by this establishment are open containers and may not be transported in a motor vehicle except in the vehicle’s trunk; or, if there is no trunk, the container may be kept in some other area of the vehicle that is not normally occupied by the driver or passengers (which does not include a utility compartment or glove compartment (Vehicle Code section 23225)). Further, such beverages may not be consumed in public or in any other area where open containers are prohibited by law.” UPDATE 3/24/2020: ABC has created a PDF of that notice so that retailers can easily print and post.

TAKE OUT WINDOWS: Some licensees have conditions on their license that prohibit the sale / delivery of alcohol to persons in cars or to consumers outside of the licensed premises through a take-out window or slide-out tray. Those prohibitions are temporarily lifted.

DELIVERY TO CONSUMERS: Even before the emergency notice, most business that hold a license that permits them to sell alcohol to consumers for off-premise consumption can also deliver those beverages to the consumer, so long as the sales transaction (other than the delivery) takes place at the licensed premise. In other words, the order must be received at the licensed premise, and payment is processed there. You can’t just show up at someone’s door and swipe a credit card there.

The temporary notice now allows for the following:

- If you are allowed to sell to consumers for off-premise consumption, you can accept payment, including cash, at the point of delivery.

- Although the CA ABC Act is silent as to whether Craft Distillers have the right to make deliveries away from the premises, the notice now allows Type 74 craft distillers can also deliver to consumers, but must limit sales to 2.25 liters per consumer per day.

- These delivery privileges are not limited to delivery to a consumer’s residence, but also allow for curbside delivery to consumers immediately outside the licensed premises.

HOURS OF OPERATION: State law prohibits the retail sale of alcohol between 2:00am and 6:00am. Some licensees have even more restrictive hours through conditions placed on their license. However, those license conditions are now lifted for off-premise sales, though the 2am-6am state law is still in place.

RETURNS: Generally, there are restrictions on the ability of producers and wholesalers from accepting returns from retailers. Those restrictions are temporarily lifted. It doesn’t mean that wholesalers and producers are required to accept all returns from retailers, just that they can if they choose to. However, producers/wholesalers cannot condition the acceptance of a return on a requirement to purchase in the future. This is consistent with TTB latest guidance on returns as well.

RETAILER-TO-RETAILER SALES: Under California law, retailers cannot purchase alcohol from other retailers. Under the temporary guidance, an off-premise retailer (grocery store, bottle shop, etc.) can now buy inventory from on-premise retailers (such as bars and restaurants).

EXTENSION OF CREDIT: Normally, California law imposes a maximum 30 day credit on the purchase of alcohol by a retailer from a wholesaler or producer. That 30 day limit is temporarily lifted. Note, however, once the temporary guidance is revoked, the extended credit term will also terminate (i.e., the retailer will have to pay the amount due at that time).

For a list of Coronavirus related resources, please see our Resources Page.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

Resources for Addressing Economic Losses due to the Public Health Emergency

The ongoing COVID-19 public health emergency, including the directive to close winery tasting rooms, is causing significant disruption to California’s businesses. Businesses that have, or are unsure whether they may have, insurance coverage for losses caused by this situation should contact their carriers promptly to inquire into their potential claims.

In addition, because there is a declared disaster including many counties in the San Francisco Bay area and other wine regions, affected wineries and other businesses typically are eligible to borrow up to $2 million under the U.S. Small Business Administration (SBA) Economic Injury Disaster Loans (EIDLs) program. Major employers may be able to borrow more than the typical $2 million limit.

These low-interest loans can provide working capital to cover ordinary and necessary financial obligations that cannot be met due to the ongoing public health emergency. Rates are set by a formula that is capped at 4%. Loans can be obtained to cover the actual economic injury, as determined by the SBA. The loans are intended to help businesses through the disaster and recovery period.

The approval of a loan is not guaranteed and loans must go through an underwriting process. Approved loans generally require collateral. The available amounts may be reduced or offset by the availability of business interruption or other insurance that covers the same losses. The SBA also assesses ability to repay as well as other potential contributions to cover the losses from business owners and affiliates in considering whether to approve the loans. To learn more or apply for a loan, go to https://disasterloan.sba.gov/ela.

Whether or not you are interested in an SBA loan, be sure to contact your insurer to confirm whether you may already have coverage for the ongoing interruption. For more information on the current declared disaster allowing for SBA EIDLs in California, including eligible counties and other terms, a fact sheet is available at https://disasterloan.sba.gov/ela/Declarations/ViewDisasterDocument/3429. Those in other states can visit https://disasterloan.sba.gov/ela/Declarations/Index to determine if they are in an eligible location.

For a list of Coronavirus related resources, please see our Resources Page.

Additional Guidance For Wineries in Light of Recent Government Actions

Since the Governor’s announcement on Sunday recommending the temporary suspension of on-premise alcoholic beverage businesses, including winery tasting rooms, certain cities and counties have instituted “Shelter-in-Place” ordinances, and both the California ABC and the California Wine Institute have issued additional guidance on the operation of alcohol beverage licensed premises, including wineries.

Given the various orders and guidance currently in place, we have provided below a brief summary of the current state of play for wineries. Please note that things are rapidly changing and while we will do our best to issue updates, we highly recommend that all licensees sign up for the California ABC email updates, and also keep an eye on orders from their local governments.

GOVERNOR’S DIRECTIVE – Statewide Recommendations

- On Sunday, March 15, 2020, Governor Gavin Newsom announced that he was directing the closure of “all bars, nightclubs, wineries, brewpubs, and the like.”

- The California ABC has since clarified that the directive is aimed at suspending on-premise retail privileges (that is, the service of alcohol for consumption at the licensed premises). For wineries, the directive applies to their tasting room and event operations in pouring wine and serving customers for on-premise consumption. It has no impact on their production operations, and wineries can continue to have consumers purchase and pick up wine for off-premise consumption, subject to any further local restrictions such as the shelter-in-place orders discussed below.

- After discussing the directive with the Governor’s office, Wine Institute has recommended that wineries take the following steps:

- Ensure visitor and employee safety by intensify cleaning and sanitation procedures;

- Operate the facility in compliance with social distancing guidance (such as instituting procedures to keep individuals 6 feet apart);

- Implement recommendations from the CDC and California Department of Public Health re washing hands, avoiding close interpersonal contact, encouraging employees to remain at home when sick, and instituting additional precautions for older employees and customers.

For other operational recommendations, please see our Employer Guide to Navigating COVID-19 from earlier this week.

LOCAL GOVERNMENT “SHELTER-IN-PLACE” ORDERS – Enforceable Restrictions

- As of March 18, 2020, a number of counties in Northern California (including Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Santa Cruz, and Sonoma) have issued shelter-in-place orders.

- Wineries that have operations in any jurisdiction that have implemented such an order have legal obligations to alter their current operations to comply with their specific county’s order.

- In its recent guidance, issued prior to the Sonoma County order, Wine Institute concluded that winery businesses meet the definition of “essential businesses” because they constitute “businesses that supply other essential businesses (grocery stores and other food outlets) with the support or supplies necessary to operate.” According to Wine Institute, wineries can engage in the following activities in those Shelter in Place jurisdictions: “vineyard management, wine production operations, bottling, warehousing, sales, delivery and shipping.” However, this “does not include wine tasting and events ….”

- The Sonoma County order includes a provision that more directly addresses winery operations. Specifically, the following activities are deemed “essential” under the Sonoma County Ordinance: “Agriculture, food, and beverage cultivation, processing, and distribution, including but not limited to, farming, ranching, fishing, dairies, creameries, wineries and breweries in order to preserve inventory and production (not for retail business).” It is unclear whether, by excluding “retail business,” Sonoma County is restricting wineries and tasting rooms from engaging in the sale of wine in sealed containers for off-premise consumption, or whether the language is only meant to address retail sales for on-premise consumption.

- Napa County’s order goes into effect at 12:01am on Friday March 20. It includes a provision that deems the following businesses as “essential”: “Any form of cultivation of products for personal consumption or use, including farming, ranching, livestock, and fishing, and associated activities including but not limited to activities or businesses associated with planting, growing, harvesting, processing, cooling, storing, packaging, and transporting such products, or the wholesale or retail sale of such products, provided that, to the extent possible, such businesses comply with Social Distancing Requirements set forth in subsection (j) of this Section 10 and otherwise provide for the health and safety of their employees.”

Please note that this is a rapidly evolving situation, and many more cities and counties may implement Shelter-in-Place measures over the next days and weeks ahead. It is also possible that the ordinances on which this blog post, and Wine Institute’s guidance are based, may be revised.

ADDITIONAL ABC GUIDANCE

- ABC has issued additional guidance regarding the Governor’s directive on steps licensees can take to minimize risk.

- ABC has stated that retail licensees that comply with the Governor’s directive or local government restrictions will not have their licenses suspended.

- ABC offices in shelter in place jurisdictions are closed to the public. ABC Staff will be available to answer questions over the phone, and you can still mail applications to those local offices. Other ABC local office closures will be posted here.

- ABC is not currently accepting, processing, or approving special event or daily licenses in light of guidance on gatherings.

ADDITIONAL WINE INSTITUTE INFORMATION

- Wine Institute has been in direct communication with ABC and has shared the following information:

- ABC will not enforce state regulations that limit the extension of credit to 30 days.

- ABC is looking at additional relaxation of regulations in light of the current situation.

- For more information, go to https://wineinstitute.org/news-alerts/ca-abc-suspends-ca-credit-regulations-enforcement-clarifies-wine-take-out-sales-in-restaurants

- In addition, TTB has informed Wine Institute that “it does not expect any service interruptions but urges all wineries to register and utilize COLAs Online and Permits Online immediately since most of its staff is now teleworking.” For more information, go to https://wineinstitute.org/news-alerts/ttb-relaxes-consignment-sale-restrictions-urges-online-colas-and-permit-submissions

Wine Institute has a helpful resource page dedicated to Coronavirus related updates, which can be accessed here.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

Governor Issues Guidance / Directive on Closure of CA Bars, Clubs, Winery Tasting Rooms, On-Premise Retailers

On Sunday, March 15, 2020, Governor Gavin Newsom announced that due to efforts to reduce the potential spread of the novel coronavirus, he was directing the closure of “all bars, nightclubs, wineries, brewpubs, and the like.” Restaurants, however, are not directed to close at this time, but are subject to reduction of occupancy and social distancing guidelines. Although the Governor did not explicitly state as much, the closure directive appears aimed at suspending on-premise retail privileges (i.e., the service of alcohol for consumption at the licensed premises), whether those privileges are exercised at stand-alone premises or at locations tied to alcohol beverage production facilities, such as tasting rooms.

The directive is not an order, but has the same force as the Governor’s guidance last week regarding non-essential social functions over 250 attendees.

While the Governor announced that the directive would apply to “wineries,” it appears that this may only apply to a winery’s tasting room operations, and does not impact production operations. A number of on-premise licensees may also have off-premise retail privileges. It is unclear whether the Governor’s directive allows these licensees to sell sealed bottles for consumption off the licensed premises during the closure period.

We have been in contact with representatives of the California Department of Alcoholic Beverage Control and expect further guidance on Monday, March 16. We will update this post with any additional information.

If you have any questions regarding alcohol beverage licensing, please contact John Trinidad or Bahaneh Hobel.

For a list of Coronavirus related resources, please see our Resources Page.

Proposed CCPA Regulations Zig-Zag On Logo, Personal Information

Remember a few weeks ago when we said to be on the lookout for a new “Do Not Sell My Information” button that looked like this?

Never mind.

The latest version of the proposed California Consumer Privacy Act (CCPA) regulations, released for comment on March 11, 2020, has struck the prior version’s proposed opt-out button. But it hasn’t replaced it with a new one. The latest version of the regulations thus only creates more uncertainty as to how the “Do Not Sell My Information” provisions of the CCPA are to be implemented. With enforcement scheduled to begin July 1, 2020, time is growing short for clarity on the regulations.

The latest revision has also undone the significant provision added in the prior version that IP addresses not linked to a particular identifiable consumer are not considered “personal information.” Without that clarification, one is left to wonder whether that suggests that IP addresses unlinked to a particular consumer are nevertheless personal information.

The new version of the proposed regulations does provide some minor further clarification on the content of privacy policies, requiring that both the source and business or commercial purpose for information collected or sold be described in a “manner that provides consumers a meaningful understanding of the information being collected” and why the information is collected or sold.

Other minor modifications have been made to regulations addressing the sale of data of minors; responses to requests to delete; requirements of “service providers;” opt-out control functions; and how data can be valued.

The text of the revised regulations can be found here.

A further comment period is open until March 27, 2020.

Napa County Winery Permitting in State of Flux

The Napa County Board of Supervisors has undertaken a series of major regulatory moves involving winery and vineyard permitting over the course of the past year. Critics of the various regulatory changes abound on all sides of the issues, with the board navigating a difficult path between wine industry, agricultural, environmental and anti-growth interests.