Corporate Transparency Act: What You Need To Know To Comply

On January 1, 2024, the federal Corporate Transparency Act (CTA) took effect. This is a new law intended to combat the use of shell companies for laundering money, financing terrorism, and other bad acts by requiring that certain businesses file specific reports with the Treasury Department identifying the businesses owners and management with particularity.

Below is an overview of the requirements to comply with the CTA, including which businesses are affected and what, when, and—importantly—why to file.

Filing Requirements

All businesses that do not qualify for one of the exemptions listed below are required to file a “Beneficial Ownership Information (BOI) Report” with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) via their Beneficial Ownership Secure System (BOSS). BOI Reports are filed electronically at FinCEN’s website: https://www.fincen.gov/boi.

→ FinCEN’s Small Entity Compliance Guide outlines CTA compliance requirements in greater detail: https://www.fincen.gov/boi/small-entity-compliance-guide.

WHO: Businesses Required to File

All corporations, LLCs, and any other business entity formed by filing a document with a secretary of state or similar office (except exempt businesses) and all other business entities formed under a law of a foreign country and registered to do business in any US state (each, a “Reporting Company”), must file a BOI Report, unless they are expressly exempt from the requirement.

The following are the 23 exempt business types:

• Securities reporting issuer

• Governmental authority

• Bank

• Credit union

• Depository institution holding company

• Money services business

• Broker or dealer in securities

• Securities exchange or clearing agency

• Other Exchange Act registered entity

• Investment company or investment adviser

• Venture capital fund adviser

• Insurance company

• State-licensed insurance producer

• Commodity Exchange Act registered entity

• Accounting firm

• Public utility

• Financial market utility

• Pooled investment vehicle

• Tax-exempt entity

• Entity assisting a tax-exempt entity

• Large operating company

• Subsidiary of certain exempt entities

• Inactive entity

Each of the foregoing categories is described in more detail in the CTA: https://www.fincen.gov/boi-faqs#C_2.

Two exemptions warrant further discussion:

→ A “Large Operating Company” is an entity that employs more than twenty (20) full-time employees in the U.S. Business owners are prohibited from consolidating their employee count across multiple entities for purposes of qualifying as a Large Operating Company under the CTA. Each business entity must be evaluated separately.

→ An “Inactive Entity” is one that:

- Was in existence on or before January 1, 2020;

- Is not engaged in active business;

- Is not owned by a foreign person, whether directly or indirectly, wholly or partially;

- “Foreign person” means a person who is not a U.S. person, which is defined in section 7701(a)(30) of the Internal Revenue Code of 1986 as a citizen or resident of the U.S., domestic partnership and corporation, and other estates and trusts

- Has not experienced any change in ownership in the preceding twelve-month (12) period;

- Has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month (12) period; and

- Does not otherwise hold any kind or type of assets, whether in the U.S. or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

WHAT: Required Information for BOI Report

Each Reporting Company’s BOI Report must include the following information:

(i) Legal name and any trade or DBA name(s);

(ii) Entity address (usually the principal place of business in the US or primary location in other cases);

(iii) Jurisdiction where the Company was formed or first registered; and

(iv) Taxpayer Identification Number (TIN) and/or Employer Identification Number (EIN).

Additionally, the CTA requires that a Reporting Company’s BOI Report identify all “Beneficial Owners”—defined as any individual who, directly or indirectly, exercises substantial control over the Reporting Company or who owns or controls at least 25% of the Reporting Company – and certain other individuals.

All persons meeting the definition of a Beneficial Owner must provide the following pieces of information:

- Full name;

- Date of birth;

- Address (usually home address);

- An identifying number from a driver’s license, passport, or other approved document; and

- An image of the approved identification document for each individual.

All persons or entities filing a BOI Report or application under the CTA must certify that it is true, correct, and complete. It is estimated that the BOI Report may take three (3) hours to complete.

FinCEN enables Beneficial Owners to apply for and receive a unique identification number associated with that person or entity (“FinCEN ID”). For Beneficial Owners who receive their own FinCEN ID, it can be used in lieu of resubmitting the same information, thereby saving the applicant time when submitting future BOI Reports.

Based on the complex corporate structures involved in many businesses, many Reporting Companies will need to file a number of BOI Reports to comply with the CTA. Therefore, entities and persons are advised to apply for their own FinCEN ID if they (or a Reporting Company with which they are associated) expect to file multiple BOI Reports in the future.

WHEN: Filing Deadlines, Updates and Corrections to BOI Report

Reporting Companies are required to file their initial BOI Report according to the chart below. There is no annual requirement to file a BOI Report, only the initial BOI report. After the initial BOI Report, Reporting Companies are only required to update or correct the report, as information changes.

| Deadlines | |||

| Initial Filing | Updates | Corrections | |

| Pre-2024 Companies | 1 year | 30 days | 30 days from Reporting Company becoming aware or having reason to know of inaccuracy regarding Reporting Company or Beneficial Owner |

| Companies formed in 2024 | 90 days | ||

| Companies formed after 2024 | 30 days | ||

WHY: Penalties(!)

Civil penalties for failing to comply with the CTA are significant and can include criminal penalties. These penalties are compounded where noncompliance is willful.

Reporting Companies who fail to comply with the CTA—willfully or not—face fines of up to $500 for each day that the violation continues. Violators also face criminal penalties, including imprisonment for up to two (2) years and/or a fine of up to $10,000, where there was a willful failure to file or to provide complete or updated information, or fraudulent conveyance of false information.

… Next Steps

1. Consider whether your business may be one of the exempt business categories described above.

2. Identify and evaluate who and what needs to be reported and begin collecting the information—including images of required IDs.

3. Pay attention to the deadlines listed above and exercise diligence when and where previously reported information needs to be updated or corrected. Reporting requirements are ongoing and the penalties for noncompliance are steep.

4. But keep in mind, the CTA is a new law just now taking effect and one which will have unforeseen impacts. The requirements, exemptions, and enforcement mechanisms are not fully tested—and the full impacts are not yet known.

At DP&F, we can advise on CTA requirements as they relate to your business. For more information about the CTA and its impact on your business—or if you plan to form a new business entity—please email Carol Kingery Ritter, John Trinidad, or Owen Dallmeyer.

DP&F Employment Law Group Presents: HR Workshops this April

Join us this spring for HR Workshops designed to help business owners and HR professionals navigate some of the most difficult situations faced by California employers today.

We will be holding two identical HR Workshops – one in Santa Rosa and one in Napa – each with a morning and afternoon session covering different topics in California employment law.

During the morning sessions, we will cover Wage and Hour topics including the importance of accurate timekeeping, tips for complying with meal and rest break requirements, and other risk management topics.

For the afternoon sessions, we will cover how to effectively provide and manage Reasonable Accommodations and Leaves of Absence.

During both sessions attendees will have the opportunity to work together to analyze hypotheticals and discuss strategies with the group. This is a great opportunity to practice your skills and expand your knowledge!

DETAILS and PRICING

Santa Rosa – Tuesday, April 16, 8:30 AM – 4:00 PM

Flamingo Resort & Spa, Santa Rosa

Full Day | Includes Lunch – $699

Half Day | AM or PM – $369

Morning Session: Wage & Hour

8:30 AM – 11:30 AM

Afternoon Session: Reasonable Accommodation & Leaves of Absence

1:00 PM – 4:00 PM

–

Napa – Thursday, April 18, 8:30 AM – 4:00 PM

Napa Valley Marriott, Napa

Full Day | Includes Lunch – $699

Half Day | AM or PM – $369

Morning Session: Wage & Hour

8:30 AM – 11:30 AM

Afternoon Session: Reasonable Accommodation & Leaves of Absence

1:00 PM – 4:00 PM

–

Attendees can choose to attend either the morning or afternoon session of either workshop, or attend the full day. All full-day attendees will also receive lunch included with the price of registration.

SHRM, HRCI & MCLE Credit Pending

Click to Register | Questions? Reach out to [email protected].

Southern Glazer’s Class Action Settlement a Reminder to Comply with Maximum Late Payment Penalties on Retailers

A recent $5.5 million settlement payment from one of the country’s largest alcoholic beverage wholesalers serves as a good reminder that California law restricts the amount of late fees and interest that can be charged in connection with the purchase and sale of alcoholic beverages to retailers.

Cal. Bus. & Prof. Code § 25509 provides that various alcoholic beverage manufacturers and wholesalers who sell and deliver alcoholic beverages to a retailer and who did not receive payment for such alcoholic beverages within 42 days of delivery shall charge the retailer 1% of the unpaid balance on the 43rd day and an additional 1% for each 30 days thereafter.

In 2014, a Los Angeles-based retailer, Wiseman Park, LLC (“Wiseman”), brought an action against Southern Glazer’s Wine and Spirits, LLC (“Southern”) in connection with Southern’s attempt to collect not only the Section 25509 statutory late payment penalty, but also a 1% per month “carrying charge” included in the parties’ written agreement. Wiseman alleged that Southern’s imposition of the separate carrying charge violated Cal. Bus. & Prof. Code § 17200.

In 2021, the action was changed to a class action lawsuit so that other retailers subject to Southern’s carrying charge could join the lawsuit. In early 2024, the court preliminarily approved the parties’ proposed settlement agreement whereby Southern would make a $5.5 million payment to resolve the class action lawsuit, write off $44.1 million carrying charges yet to be paid by the retailers, and agree not to impose the carrying charge going forward. The deadline for retailers to opt out of, or object to, the class action was March 1, 2024. The final approval hearing for the settlement is scheduled for April 16, 2024.

Industry members should take this opportunity to review their agreements with retailers, and ensure any interest or penalties imposed on retailers do not exceed the statutory limits imposed by the ABC Act.

For assistance with this or any other Alcohol Beverage Law & Compliance or Wine Law matters, email Bahaneh Hobel, John Trinidad, or Alexander Mau.

Key Legal Updates All California Employers Should Know for 2024

Employment laws in California are always changing, and it is important for employers in California to keep up with these changes to ensure their policies and practices are compliant. This blog post provides key updates to the California employment laws that all employers should know for this year.

Minimum Wage Increase

Beginning January 1, 2024, the state minimum wage for all employers has been increased to $16.00 per hour. This rate reflects a 3.5% increase from this year’s minimum wage based on the law’s provision that allows this increase if the national Consumer Price Index (“CPI”) is over 7%. All employers must post the current minimum wage rate in a common area where employees can easily view it.

With this new rate of $16.00/hour, the minimum salary for exempt employees in 2024 has also increased to $66,560.00/year. Note that the minimum salary is tied to the state minimum wage rate, not individual municipalities.

Employers should also check if there is a higher minimum wage in any city or municipality where they have employees working (typically 2 hours/week is the minimum). For example, the minimum wage in Santa Rosa has increased to $17.45/hour.

Increase in Paid Sick Leave Amount to 5 Days

As of January 1, 2024, the amount of paid sick leave that must be provided to employees under the Healthy Workplaces, Healthy Families Act increased to five (5) days, or 40 hours, per year. Employers can still choose to either provide paid sick leave in a lump sum each year or allow employees to accrue paid sick leave based on hours worked.

The minimum accrual rate is still one (1) hour for every 30 hours worked. If paid sick leave is accrued, employees must now be allowed to accrue up to a cap of at least ten (10) days, or 80 hours. However, employers can limit employees’ actual use of accrued sick leave to five (5) days, or 40 hours per year.

Reproductive Loss Leave Required for All Employers with 5 or More Employees

Beginning January 1, 2024, private employers with five (5) or more employees are required to provide all employees who have worked for the employer for at least 30 days with five (5) days of unpaid, protected leave following a reproductive loss event, which includes a failed adoption, failed surrogacy, miscarriage, stillbirth or an unsuccessful assisted reproduction.

The five days of leave do not have to be taken consecutively but must be completed within three months of the reproductive loss event. This new leave is available for each qualifying reproductive loss event; however, employers have the right to limit the maximum amount of leave under the policy to no more than 20 days in a 12-month period.

Off-Duty Cannabis Use Added as a Protected Class Under FEHA

Starting January 1, 2024, off-duty cannabis use was added as a protected class under the state’s Fair Employment and Housing Act law (“FEHA”). The law specifically prohibits any adverse employment actions taken against an employee for off-duty cannabis use and prohibits an employer from drug screening for cannabis. Employers may still prohibit on-duty possession, impairment, or use. Additionally, the law does not apply to employees in the building or construction trades, or employees that work in positions that require federal background investigations or security clearance under federal law.

Non-Compete Agreements With Employees Still Prohibited in California

Under existing law in California, non-compete agreements with employees are and have been void and unenforceable. Nonetheless, the state has passed two new laws regarding post-employment non-compete agreements that both went into effect on January 1, 2024.

The first law confirms existing case law and voids all unlawful noncompete agreements contained in employment contracts. Under this law, employers are required to individually notify all current employees, and former employees who were hired after January 1, 2022, whose employment contracts include a noncompete clause or who were required to sign a noncompete agreement that such clauses or agreements are void. The notice must be given in writing by no later than February 14, 2024. The notice can be by email, but it must be an individualized communication to each employee or former employee.

The second law confirms that all noncompete agreements are void and unenforceable regardless of where and when the contract was signed. Even if the contract was signed in another state with an employee who was working outside of California, it cannot be enforced in California. The law also makes it a civil violation for employers to enter into or try to enforce unlawful noncompete agreements. Further, the law gives employees the right to bring a civil action against an employer that attempts to enforce an unlawful noncompete agreement, which allows the employee to seek damages and attorneys’ fees and costs in addition to injunctive relief.

New Presumption of Retaliation for Adverse Actions Taken Within 90 Days of Protected Activity

Starting January 1, 2024, if an employer takes any adverse action against an employee within 90 days of the employee engaging in so called “protected activity,” it will create a rebuttable presumption of retaliation under the law. An employer who violates this provision will be liable for a civil penalty of up to $10,000 per employee to be awarded to the employee(s) that was retaliated against. “Protected activity” is defined broadly and includes, among other things, employees who make an internal complaint about working conditions, wages, harassment, etc., an employee who files a suit or complaint with an agency against the company and an employee who testifies in a proceeding against the employer.

NLRB Decision in Stericyle Requires Employers to Review Their Handbook Policies

In 2023, the National Labor Relations Board (“NLRB”) issued a decision in Stericycle, Inc. and Teamsters Local 628 regarding workplace policies and the effect they have on employee rights under the National Labor Relations Act (the “NLRA”). The decision states that workplace policies cannot infringe on employees’ rights under the NLRA, either directly or indirectly. This includes policies that could discourage employees from engaging in protected activities under the NLRA. Employees’ rights under the NLRA, which are protected, include: the right to form or join unions, the right to engage in protected, concerted activities to address or improve working conditions and the right to refrain from engaging in these activities.

Employers should review their handbook policies and make sure they are drafted so that their policies do not “chill” employees’ exercise of their rights under the NLRA.

Additional Updates and Reminders

Updated Wage Theft Notice (Required for all Non-Exempt Employees Upon Hire)

The Notice to Employee required under Labor Code Section 2810.5 – also referred to as a “Wage Theft Notice” – has been updated for 2024. All employers are required to use the new form. You can access the revised Wage Theft Notice here.

Updated Harassment Poster

The California Civil Rights Department (CRD) has updated their “California Law Prohibits Workplace Discrimination and Harassment” poster. Employers are required to display this poster in a common area where employees can easily view it. You can access the new updated poster here.

IRS Mileage Reimbursement Rate Increase

Starting January 1, 2024, the Internal Revenue Service (IRS) has increased the standard mileage rate by 1.5 cents per mile for 2024 to 67 cents per mile.

Overtime Change for Small Agricultural Employers

For employers with 25 or fewer employees, the phase in for overtime rules for agricultural workers continues in 2024 with daily overtime for any hours worked in excess of 8.5 hours in a day and 45 hours in a week.

Workplace Violence Prevention Plan Required by July 1, 2024

Starting July 1, 2024, all employers are required to establish and maintain a workplace violence prevention plan as part of their Illness Injury Prevention Plan (“IIPP”), which will include maintaining a violence incident log and providing effective training on the workplace violence prevention plan. We will be doing a more detailed blog post on the requirements for the new plan in the Spring.

Employers should reach out to their workers’ compensation carrier for assistance with updating their IIPP accordingly.

*

For more information reach out to the DP&F Employment Law partners Jennifer E. Douglas and Marissa E. Buck.

CalRecycle To Host Webinar for Small Wineries (Limited to 1,000 Attendees)

As mentioned in our recent blog post, Compliance With Bottle Bill Just One Month Away for Wine and Spirits, California law changed on January 1, 2024, to include wine and distilled spirits in California’s Beverage Container Recycling Program. California wineries and distilleries will now need to register with CalRecycle, submit monthly reports, pay certain fees, and make sure their labels include an appropriate recyclability message from July 1, 2025.

CalRecycle will host a 2-hour webinar on February 23, 2024 aimed at small wineries to explain how the changes will affect them. The webinar will also include a demonstration on how to use the Division of Recycling Integrated Information System (DORIIS) for monthly reporting and payment of fees. The webinar is limited to 1,000 attendees, so register as soon as possible at https://us02web.zoom.us/meeting/register/tZYkd-6upj4tEtCVEASeUimnDkRGDsY7glXV. The webinar will conclude with a Q&A session.

For questions about the webinar, please contact the CalRecycle Registration Units via email at [email protected] or via phone at 916-323-1835.

COVID-19 Updates for California Employers

On January 9, 2024, the California Department of Health (CDPH) issued an order changing COVID-19 related definitions. These revisions apply to the Cal/OSHA Non-Emergency Regulations, which are still in place until February 3, 2025 and must be followed by all employers in California.

The questions and answers below reflect the updated rules and definitions that currently apply in the workplace. You can read more about the changes on Cal/OSHA’s FAQ page here, which is updated regularly.

COVID-19 Updates for California Employers as of January 2024

What is the current definition of the “infectious period” for employees who test positive for COVID-19?

For COVID-19 cases with symptoms, the “infectious period” is a minimum of 24 hours from the day of symptom onset. Under the current regulations, there is no infectious period for COVID-19 cases with no symptoms.

If an employee tests positive, are they required to be excluded from the workplace?

If an employee tests positive for COVID-19 and has symptoms, they must be excluded from the workplace for a minimum of 24 hours from the day of symptom onset.

Symptomatic COVID-19 cases may return to work after 24 hours if:

- 24 hours have passed with no fever, without the use of fever-reducing medications and;

- Symptoms are mild and improving.

If an employee tests positive for COVID-19 and is asymptomatic, there is no infectious period for the purpose of isolation or exclusion, which means they are not required to be excluded from the workplace. If symptoms develop, the above criteria will apply.

All employees who test positive for COVID-19 must wear a mask around others for 10 days from the date of the positive test or symptom onset.

Are employees allowed to come to the workplace if they had a “close contact” with someone with COVID-19?

Yes – employees do not have to be excluded from the workplace unless they test positive.

If employees have had a “close contact,” they are no longer required to test; however, the CDPH still recommends testing for:

- All people with new COVID-19 symptoms; and

- Close contacts who are at higher risk of severe disease or who have contact with people who are at higher risk of severe disease.

Are masks still required in the workplace?

Masks are only required in the workplace in the following situations:

- Employees who test positive for COVID-19 must wear a mask while around others for 10 days from the positive test or symptom onset;

- In an outbreak or major outbreak all employees in the exposed group must wear a mask; and

- If a local ordinance requires it, such as places like healthcare facilities and skilled nursing facilities.

Close contacts are no longer required to wear masks; however, it is still recommended that close contacts wear masks around others for 10 days following the last contact.

What is a “close contact”?

The regulation defines a “close contact” as sharing the same indoor airspace as a COVID-19 case for a cumulative total of 15 minutes or more over a 24-hour period during a COVID-19 case’s infectious period. Spaces that are separated by floor-to-ceiling walls (e.g., offices, suites, rooms, waiting areas, bathrooms, or break or eating areas that are separated by floor-to-ceiling walls) are considered distinct indoor airspaces.

What is the current definition of an “outbreak”?

The new outbreak definition requires at least three COVID-19 cases within an exposed group during a 7-day period (previously it was a 14-day period).

Is an employee paid if they test positive and are unable to work?

Possibly. The COVID supplemental paid sick leave program has expired. However, an employee may be eligible for compensation if they have accrued sick time and/or vacation time, or through disability insurance.

Note that the Workers’ Compensation Presumption expired on January 1, 2024, which means the presumption that an employee’s work-related COVID-19 illness is an occupational injury and eligible for workers’ compensation is no longer available.

Does an employer still need to send a notification to employees when there is a workplace exposure?

If an employer becomes aware of a potential COVID-19 exposure in the workplace, they are still obligated to notify all employees who may have had close contact with a COVID-19 case in the workplace. The notice must be in writing and must be provided within one business day of discovering the potential exposure.

Is an Employer still required to maintain a COVID Prevention Plan (CPP)?

Yes. To comply with the Non-Emergency Regulations, an employer must either develop a written COVID-19 Prevention Program or ensure its elements are included in an existing Injury and Illness Prevention Program (IIPP).

Does an employer still need to provide COVID-19 testing to employees?

Regardless of CDPH recommendations, employers must continue to make COVID-19 testing available at no cost and during paid time to all employees who had a close contact at work with a person with COVID-19 during their infectious period, except for asymptomatic employees who recently recovered from COVID-19.

In workplace outbreaks or major outbreaks, the COVID-19 regulations still require testing of all close contacts in outbreaks, and everyone in the exposed group in major outbreaks. Employees who refuse to test and have symptoms must be excluded for at least 24 hours from symptom onset and can return to work only when they have been fever-free for at least 24 hours without the use of fever-reducing medications, and symptoms are mild and improving.

For more information reach out to the DP&F Employment Law partners Jennifer E. Douglas and Marissa E. Buck.

Deadline to Comment on Napa County’s New Draft Groundwater Sustainability Workplans is January 30, 2024

ATTENTION: The following proposed measures will impact existing groundwater pumpers in the Napa Valley Subbasin.

Napa County’s Groundwater Sustainability Plan (GSP) was approved by the California Department of Water Resources on January 26, 2023. The approved GSP identified the need to develop a Water Conservation Workplan and Groundwater Pumping Reduction Workplan. The GSP also identified data gaps in evaluating the depletion of interconnected surface waters and groundwater dependent ecosystems, and proposed the preparation of a workplan to address such data gaps. These three plans have now been prepared by Napa County’s Groundwater Sustainability Agency and are available for public review and comment. All public comments on these three plans are due by January 30, 2024.

General information on the scope of the three workplans is below:

- Groundwater Pumping Reduction Workplan:

- This plan identifies a goal to achieve a 10 percent reduction (about 15,000 acre feet) in pumping relative to the average annual historical pumping (as measured in the years 2005-2014).

- This plan also presents voluntary programs that will purportedly result in Subbasin sustainability benefits, and in addition, presents mandatory measures to reduce groundwater pumping (which could be implemented if the voluntary measures are insufficient).

- Water Conservation Workplan:

- This plan is a resource for stakeholders to learn about, consider, and adopt new or additional water conservation measures.

- Interconnected Surface Water and Groundwater Dependent Ecosystems Workplan:

- This plan addresses the data gaps that were identified in the originally adopted GSP and provides a structured approach to evaluating the effect of groundwater conditions on interconnected surface waters and groundwater-dependent ecosystems.

Public comments on these plans can be submitted using the Excel Comment Form on the County’s website (link below), submitted via email to: [email protected].

For more information, visit the County’s website here: https://www.countyofnapa.org/3219/County-of-Napa-Plans-Reports-Documents.

For more information about Napa County Groundwater Sustainability planning, email Joshua S. Devore, Thomas S. Adams or Elena Neigher.

Compliance With Bottle Bill Just One Month Away for Wine and Spirits

COMPLIANCE WITH BOTTLE BILL JUST ONE MONTH AWAY FOR WINE AND SPIRITS

On January 1, 2024, California’s container recycling deposit system (referred to often as the “Bottle Bill”) will expand to include wine, spirits, and wine and spirits coolers (regardless of ABV). Below is a brief overview of what wineries, distilleries, importers and wholesalers of wine and spirits need to do to comply!

Register with CalRecycle as a Beverage Manufacturer and/or Distributor

Register with CalRecycle as soon as possible to prepare for monthly payment and reporting requirements beginning January 1, 2024.

- California-Based: California wineries and distilleries, and importers of wine or spirits into California, will need to register as a “Beverage Manufacturer.” They will also need to register as a “Distributor” if they sell to retailers (whether on-sale or off-sale), restaurants, bars, or directly to consumers.

- Out-of-State: Out-of-state wineries and distilleries with a California Wine Direct Shippers Permit, and that sell directly to California consumers, will need to register as a “Beverage Manufacturer” and a “Distributor.”

Processing Fees and California Redemption Value (CRV)

- Beverage Manufacturers Pay Processing Fees: Beverage manufacturers (as defined above in bold) will need to pay CalRecycle processing fees for each wine or spirits beverage they sell to wholesalers or retailers (whether on-sale or off-sale) in California from January 1, 2024. These fees depend on the type of container material. The fee per glass bottle is $0.00576. Their first report for January 2024 will be due on March 10, 2024.

- Distributors Pay CRV: Distributors (as defined by CalRecycle and noted above) will need to pay CalRecycle a CRV for each wine or spirits beverage they sell to consumers, restaurants, or bars from January 1, 2024. There is an exemption for bottles opened at the winery or distillery for tasting purposes. These fees depend on the size of the container. For bottles smaller than 750 mL (less than 24 fluid ounces), the CRV is 5 cents/bottle. For bottles 750 mL or larger (24 fluid ounces or more), the CRV is 10 cents/bottle. For boxes, bladders, pouches, or similar containers (regardless of size), the CRV is 25 cents/container. Distributors don’t need to pay CRV for alcoholic beverages opened and poured for on-site consumption at CA ABC licensed tasting rooms. Distributors can keep 1.5% of the processing fees as an administrative fee, which CalRecycle will automatically calculate. Distributors’ first report for January 2024 will be due on February 29, 2024.

CRV Statements on Bottles

- CRV Statement: From July 1, 2025, all wines and spirits containers sold in California (except those containers filled and labeled before January 1, 2024) must be labeled with one of five CRV statements: “CA Redemption Value,” “California Redemption Value,” “CA Cash Refund,” “California Cash Refund,” or “CA CRV.”

- Exempt Containers: All wines and spirits containers sold in California that were filled and labeled before January 1, 2024 are exempt from and not subject to the labeling requirements of the Bottle Bill. No new labels or statements will have to be added to these products.

- Appearance of Statement: The CRV statement must be clearly, prominently, and indelibly marked and can be added on the actual label or by sticker (but not on aluminum cans), stamp, embossment, or other similar method. The Bottle Bill also has other, very prescriptive rules about the appearance of the CRV statement.

For more information about the Bottle Bill, see our previous blog post or email Bahaneh Hobel, Alexander Mau, or Theresa Barton Cray.

Updates to Products Subject To California’s Bottle Bill

On October 13, 2023, Governor Gavin Newsom signed California Senate Bill 353, which made a significant change to products that will be subject to the California Beverage Container Recycling and Litter Reduction Act (known as the Bottle Bill).

Now, only products filled and labeled after January 1, 2024 will be subject to the CRV labeling requirements of the Bottle Bill. Any products (whether domestic or imported) that were filled and labeled prior to that time will be exempt. This legislative fix did not make any changes to the change the reporting or payment requirements of the Bottle Bill.

Please see below for a full summary of the Bottle Bill and contact DP&F with any questions.

With the passage of Senate Bill No. 1013, beginning on January 1, 2024, wine and spirits will be included in California’s state container deposit system established by the California Beverage Container Recycling and Litter Reduction Act (known as the “Bottle Bill”). As such, wineries and distilleries will now be required to comply with the Bottle Bill’s CA Redemption Value (CRV) payment and reporting obligations beginning January 1, 2024, and CRV labeling requirements for all wine and spirits filled and labeled after January 1, 2024 and sold after July 1, 2025. Beer and certain other non-alcoholic beverages were already previously covered by the Bottle Bill.

Importantly, because all wines and spirits (that were not filled and labeled after January 1, 2024) sold in California after July 1, 2025 must be labeled with some type of approved CRV statement, producers should start including this information on their bottles and/or labels as soon as possible for all products to be offered for sale on or after January 1, 2025.

Below we have included a brief summary of the rules applicable to wines and spirits under Bottle Bill, the new registration and payment obligations, and labeling changes required to comply with the new laws.

TYPES OF BEVERAGES:

The Bottle Bill applies to beer, malt beverages, wine, spirits, wine and spirit coolers (regardless of ABV), and certain other non-alcoholic beverages intended for sale in California. Section 14504 and 14560.

CA REDEMPTION VALUES (CRV): Section 14560

- For bottles smaller than 750 mL (less than 24 fluid ounces), the CRV is 5 cents/bottle.

- For bottles 750 mL or larger (24 fluid ounces or more), the CRV is 10 cents/bottle.

- For boxes, bladders, pouches, or similar containers (regardless of size), the CRV is 25 cents/container.

REGISTRATION & PAYMENT OBLIGATIONS BEGINNING JANUARY 1, 2024:

- All wineries and distilleries should register with CalRecycle as soon as possible to prepare for payment and reporting requirements beginning 1/1/2024 (information regarding registration can be found here).

- All producers and importers of wine and distilled spirits should register as a Beverage Manufacturer. Brand owners that contract with producers for the manufacture of wine or distilled spirits are not considered Beverage Manufacturers.

- Any wineries and distilleries that sell wine or spirits in California Direct to Consumer or Direct to a Retailer (for wine) should also register as a Distributor.

2. Report and pay the applicable CRV to CalRecycle.

- CRV is due and payable for every beverage container (other than a refillable beverage container) sold or transferred to a dealer or consumer in CA. There is an exception for products served in a tasting rooms, discussed below. 1.5% holdback for administrative fee is permitted.

- Report due last day of month following the month of sales, even if no sales or transfers. First report for January 2024 is February 29, 2024.

- The winery or distillery may pass on the CRV cost to consumers (as the consumers can return the bottles to a recycling center for the redemption). Section 14560

3. Report and pay the applicable Processing Fee.

- The processing fee is paid on all containers a winery or distillery sells or transfers in CA, whether to wholesalers, retailers, or consumers. Section 14575(g)

- Report and payment due 10th day of 2nd month following the month of sales, even if no sales or transfers. First report and payment for January 2024 is due March 10, 2024.

- The processing fee is variable depending on container material (size does not matter) and changes each calendar year, but is currently 0.452 cents/glass bottle. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

LABELING OBLIGATIONS FOR ALL WINES AND SPIRITS SOLD AFTER JULY 1, 2025:

- All wines and distilled spirits containers sold in California that were filled and labeled before January 1, 2024 are exempt from and not subject to the labeling requirements of the Bottle Bill. No new labels or statements will have to be added to these products.

- All wines and distilled spirits containers sold in California after July 1, 2025 (except those containers filled and labeled before January 1, 2024) must be labeled with: “CA Redemption Value,” “California Redemption Value,” “CA Cash Refund,” “California Cash Refund,” or “CA CRV”.

- The CRV statement must be clearly, prominently, and indelibly marked and can be added on the actual label or by sticker (not on aluminum cans), stamp, embossment, or other similar method. Labeling size and location requirements are set forth below: CCR 2200(b).

- For glass and plastic, the CRV statement must be on the container body label or secondary label with:

- Option 1: Along the bottom edge of the container body label in minimum lettering size at least 3/16 inch in height.

- Option 2: On or in a secondary label minimum lettering size at least 3/16 inch in height.

- Option 3: On a container body label or secondary label with contrasting colors with legible lettering size at least 1/8 inch in height.

- For aluminum, the CRV statement must be on the top lid:

- for tops greater than 2 inches in diameter, the CRV statement must be 3/16” in height; and

- for tops 2 inches or less in diameter, the CRV statement must be 1/8” in height.

- Requirements for box, bladder, and pouch containers to be determined.

4. Senate Bill No. 1013 also revised Section 14561(d) of the Bottle Bill to allow for CRV labeling by the inclusion of a scan code or quick response (QR) code on the container. This new language is currently under review by CalRecycle.

EXCEPTION FOR TASTING ROOM SALES:

If any wines or spirits are sold for on-site consumption in a tasting room, then those products are exempt from the Bottle Bill’s requirements.

For more information regarding Bottle Bill compliance, please contact Bahaneh Hobel at [email protected] or Theresa Barton Cray at [email protected].

Deadline Is October 1, 2023 To Apply for Continuation Under Napa County’s Winery Waste Discharge Program

DEADLINE IS OCTOBER 1, 2023 TO APPLY FOR CONTINUATION UNDER NAPA COUNTY’S WINERY WASTE DISCHARGE PROGRAM

The deadline to apply for Napa County’s Winery Waste Discharge Program was recently extended. For wineries currently enrolled in Napa County’s Winery Waste Discharge Program, the deadline to apply for continuation under the program is coming up on Sunday, October 1, 2023. Below is additional information on how to apply for continuation and additional information for wineries that are not currently enrolled in the program.

As California winery operators are likely aware, the new California Statewide General Waste Discharge Requirements for Winery Process Water Order requires compliance for most existing wineries beginning January 20, 2024. However, Napa County has arranged to continue its existing Winery Waste Discharge Program for an additional three years. If you have not yet applied for continuation, you can submit the application here (the application page still references the prior August 1, 2023 deadline).

More information can be found on the County’s website here.

Wineries that do not have current enrollment in the County’s program are NOT eligible for apply for this continuation and will be required to enroll in the new Statewide General Winery Discharge Program by January 20, 2024, which can be found here.

For more information or for assistance with enrollment in either of the above, please contact Josh Devore or Elena Neigher.

Canadian Court Gives 👍 to Contract Accepted by Emoji

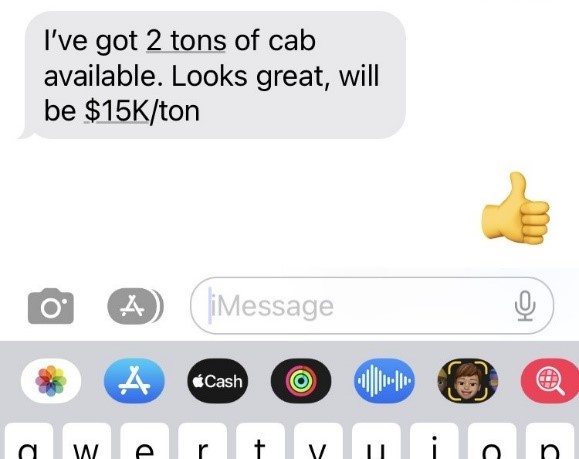

Harvest is underway in wine country. During this season there is increased demand for skilled labor, transportation, and crush facilities. Buyers and sellers of fruit have a short window to make deals. A busy harvest season also lends itself to casual communication about crops, like this:

Now, did you just tell your friend you are happy for him, or did you just commit to buying $30K worth of fruit?

According to at least one Canadian court, the thumbs-up 👍 emoji could qualify as acceptance of a contract. A recent decision from the Court of King’s Bench in Canada discussed the “new reality in Canadian society” facing courts as the forms of communication broaden.

The Canadian court examined a dispute between a farmer and grain buyer over an alleged contract for 87 metric tons of flax, to be delivered in November 2021. The grain buyer and farmer spoke by phone, and the buyer texted the farmer a photo of the contract signed by buyer for November delivery. The text message said “please confirm flax contract.” The farmer texted back a “thumbs-up” emoji.

Later, when November rolled around, the price of flax had gone up, and the farmer attempted to say that his “thumbs-up” in response to the buyer only signaled that he had received the contract, not that he had accepted it. The court also looked at the prior dealings between the farmer and buyer, noting that in prior contracts for durum wheat, the farmer had various formed agreements with the buyer employing similarly concise responses, including “looks good,” “ok,” or “yup.”

Here, the court ultimately found that yes, the “thumbs-up” was sufficient acceptance, and the farmer was ordered to pay C$82,000 for the unfulfilled contract.

Canadian law is not controlling in the United States. However, this case reminds us that as forms and methods of communication grow, U.S. courts may eventually find that an emoji can qualify as acceptance of an agreement.

So, during important business negotiations, consider the potential consequences of casually firing off that “thumbs-up” emoji to the other side. Finally, when in doubt, seek the advice of an attorney.

Deadline to Apply for Continuation Under Napa County’s Winery Waste Discharge Program

DEADLINE IS AUGUST 1, 2023 TO APPLY FOR CONTINUATION UNDER NAPA COUNTY’S WINERY WASTE DISCHARGE PROGRAM

As California winery operators are likely aware, the new California Statewide General Waste Discharge Requirements for Winery Process Water Order requires compliance for most existing wineries beginning January 20, 2024. However, Napa County has arranged to continue its existing Winery Waste Discharge Program for an additional three years. If your winery is currently enrolled in Napa County’s Winery Waste Discharge Program, the deadline to apply for continuation under the program is coming up on Tuesday, August 1, 2023. If you have not yet applied for continuation, you can submit the application here: Napa County Winery Waste Discharge Program Application.

More information can be found on the County’s website here: Winery Waste Discharge Requirements (WDRs).

Wineries that do not have current enrollment in the County’s program are NOT eligible for apply for this continuation and will be required to enroll in the new Statewide General Winery Discharge Program by January 20, 2024, which can be found here: General Waste Discharge Requirements for Winery Process Water.

For more information or for assistance with enrollment in either of the above, please contact Josh Devore.

Attention Online Content Creators…

Online content creators, bloggers, influencers — wineries producing content for digital distribution — it’s time to file copyright applications for your works. The U.S. Copyright Office now offers the Group Registration for Short Online Literary Works (GRTX) registration option for “short online literary works” such as articles, columns, essays, blog entries, short stories, poems and social media posts. The GRTX option allows applicants to register up to fifty (50) works with a single application and filing fee.

In order to use GRTX registration option, the literary work must contain between 50 and 17,500 words and must be published first as part of a website or online platform, including online newspapers, social media websites, and social networking platforms. Please note that emails, podcasts, audiobooks and computer programs cannot use the GRTX registration option, even if they contain 50 to 17,500 words and were first published online.

For assistance in getting your literary content registered with the U.S. Copyright Office under the economical GRTX registration option or otherwise, please contact Katja Loeffelholz.

Effective January 1, 2024, CA Wineries and Distilleries Will Have Reporting and Payment Obligations to CalRecycle Under the Bottle Bill

With the passage of Senate Bill No. 1013, beginning on January 1, 2024, wine and spirits will be included in California’s state container deposit system established by the California Beverage Container Recycling and Litter Reduction Act (known as the “Bottle Bill”). As such, wineries and distilleries will now be required to comply with the Bottle Bill’s CA Redemption Value (CRV) payment and reporting obligations beginning January 1, 2024, and CRV labeling requirements for all wine and spirits sold after July 1, 2025. Beer and certain other non-alcoholic beverages were already previously covered by the Bottle Bill.

Importantly, because all wines and spirits sold in California after July 1, 2025 must be labeled with some type of approved CRV statement, producers should start including this information on their bottles and/or labels as soon as possible for all products to be offered for sale on or after January 1, 2025.

Below we have included a brief summary of the rules applicable to wines and spirits under Bottle Bill, the new registration and payment obligations, and labeling changes required to comply with the new laws.

TYPES OF BEVERAGES:

The Bottle Bill applies to beer, malt beverages, wine, spirits, wine and spirit coolers (regardless of ABV), and certain other non-alcoholic beverages intended for sale in California. Section 14504 and 14560.

CA REDEMPTION VALUES (CRV): Section 14560

- For bottles smaller than 750 mL (less than 24 fluid ounces), the CRV is 5 cents/bottle.

- For bottles 750 mL or larger (24 fluid ounces or more), the CRV is 10 cents/bottle.

- For boxes, bladders, pouches, or similar containers (regardless of size), the CRV is 25 cents/container.

REGISTRATION & PAYMENT OBLIGATIONS BEGINNING JANUARY 1, 2024:

- All wineries and distilleries should register with CalRecycle as soon as possible to prepare for payment and reporting requirements beginning 1/1/2024 (information regarding registration can be found here).

- All producers and importers of wine and distilled spirits should register as a Beverage Manufacturer. Brand owners that contract with producers for the manufacture of wine or distilled spirits are not considered Beverage Manufacturers.

- Any wineries and distilleries that sell wine or spirits in California Direct to Consumer or Direct to a Retailer (for wine) should also register as a Distributor.

2. Report and pay the applicable CRV to CalReycle.

- The winery or distillery may pass on this cost to consumers (as the consumers can return the bottles to a recycling center for the redemption). Section 14560

- The processing fee is variable depending on container material (size does not matter) and changes each calendar year, but is currently 0.452 cents/glass bottle. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

3. Report and pay the applicable Processing Fee.

- The processing fee is paid on all containers a winery or distillery sells, whether to wholesalers, retailers, or consumers. Section 14575(g)

- The processing fee is variable, but is currently 0.426 cents/glass bottle or for new containers, 0.574 cents/container. The Wine Institute has noted that the hope is for the processing fee to be reduced to zero.

LABELING OBLIGATIONS FOR ALL WINES AND SPIRITS SOLD AFTER JULY 1, 2025:

- All wines and distilled spirits containers sold in California after July 1, 2025, except those containers filled and labeled before January 1, 2024, must be labeled with: “CA Redemption Value,” “California Redemption Value,” “CA Cash Refund,” “California Cash Refund,” or “CA CRV”.

- The CRV statement must be clearly, prominently, and indelibly marked and can be added on the actual label or by sticker (not on aluminum cans), stamp, embossment, or other similar method. Labeling size and location requirements are set forth below: CCR 2200(b).

- For glass and plastic, the CRV statement must be on the container body label or secondary label with:

- a text height of 3/16”, or

- a minimum text height of 1/8” and in a contrasting color to the background and nearby text.

- For aluminum, the CRV statement must be on the top lid:

- for tops greater than 2 inches in diameter, the CRV statement must be 3/16” in height; and

- for tops 2 inches or less in diameter, the CRV statement must be 1/8” in height.

- Requirements for box, bladder, and pouch containers to be determined.

3. Currently, there is no exemption for wines or spirits labeled before July 1, 2025. While the Wine Institute is working on legislation to create an exemption for wines labeled before January 1, 2024, wineries and distilleries should start including the required labeling on all applicable containers as soon as possible.

4. Senate Bill No. 1013 also revised Section 14561(d) of the Bottle Bill to allow for CRV labeling by the inclusion of a scan code or quick response (QR) code on the container. This new language is currently under review by CalRecycle.

EXCEPTION FOR TASTING ROOM SALES:

If any wines or spirits are sold for on-site consumption in a tasting room, then those products are exempt from the Bottle Bill’s requirements. Any products sold for offsite consumption are subject to the requirements of the Bottle Bill. Section 14510.

Post revised October 18, 2023 to reflect labeling exemption established under California Senate Bill 353.

For more information regarding Bottle Bill compliance, please contact Bahaneh Hobel at [email protected] or Theresa Barton Cray at [email protected].

The Caribbean is Calling

As of February 24, 2023, Belize has officially joined the Madrid Protocol, becoming the 113th member of the system. This marks the fourth Commonwealth Caribbean nation and the third in three years to join, with the other members being Antigua and Barbuda (2000), Jamaica (2022), and Trinidad & Tobago (2021). Cuba is also a member from the Caribbean, while Curacao, Sint Maarten, the Caribbean Netherlands, and the French Caribbean jurisdictions are part of Madrid due to their status within the Kingdom of Netherlands and France.

Trademark protection is essential for every wine brand name, fanciful name and vineyard designation. Trademarks secure a wineries’ brand identity and help avoid infringement issues. However, obtaining international trademark rights can be a daunting task.

The Madrid Protocol provides a simplified and cost-effective solution for wineries to secure their trademark rights across multiple countries. By filing a single application with the World Intellectual Property Organization (WIPO), they can secure their trademark rights in numerous countries that are members of the treaty. The process is easier, faster and more cost-effective compared to traditional routes of filing trademark applications individually in each country saving on filing, translation and legal fees.

The Madrid Protocol provides flexibility for businesses to add or remove countries as required, and ensures that trademark rights are enforced uniformly across all member countries. This is particularly helpful for wineries that are expanding into new markets gradually or need to remove countries where they no longer wish to operate. By leveraging the benefits of the protocol, businesses can maintain the integrity of their brands, avoid infringement issues and increase their brand value.

For assistance with Madrid Protocol trademark applications, or more information about international trademark protection, please contact Katja Loeffelholz at [email protected].

FTC Issues Proposed Non-Compete Ban To Spur Employee Mobility, Aligning with Existing California Law

Thursday, January 5, 2023, the FTC issued its proposal to prohibit non-compete clauses in employment agreements in an effort to boost wages and competition, citing worker mobility as essential to a thriving U.S. economy. California has long prohibited such clauses pursuant to Business and Professions Code Section 16600. The FTC’s proposed rule is shining a light on the issue, which makes it a good opportunity to focus California and non-California employers’ attention on what can be done to protect their businesses from unlawful competition.

The rule flows from President Biden’s 2021 Executive Order Promoting Competition, which directed the FTC to address unfair use of non-compete and similar agreements to stifle employee mobility and depress wages. Like California’s law, the proposed rule would invalidate existing non-compete agreements in place and would provide exception for the sale of certain types of businesses. If promulgated, the new FTC rule would supersede and preempt inconsistent state laws, and employers will be required to issue notice to employees, rescinding existing employment agreements to remove objectionable non-competition clauses.

Similar to California, under the proposed FTC rule, nondisclosure and non-solicitation agreements would also be scrutinized, e.g., as to whether such agreements are invalid in that they so broad as to effectively function as noncompete agreements.

The rule is currently open for public comment until March 6, 2023, and employers will be subject to enforcement 180 days after final publication.

For workers, the rule provides more flexibility to pursue future employment in a worker’s area of expertise, to market one’s talents and seek increased compensation. For employers, this rule is another wake-up call for the need to safeguard and secure trade secret assets of the business to which an individual has access.

Given the reality of increased mobility, employers should be ensuring that:

- Employees with access to sensitive information are covered by up-to-date confidentiality and lawful non-solicitation obligations; and

- Employers must redouble efforts to keep organized, diligent records of the existence, inventory and location of any employer assets or property, including devices and customer lists, so as to expediently secure such assets should an employee or contractor depart on short notice.

We continue to monitor developments and will make ourselves available to concerned clients to discuss what can be done to favorably address business impacts and requirements flowing from the new FTC rule and California’s existing non-compete prohibitions. For more information as to how this will impact IP rights, contact Chris Passarelli. For more information about how this will impact your employment agreements, contact Jennifer Douglas.

Ninth Circuit Rules Time Booting Up Computer Before Clocking In Is Compensable

The Ninth Circuit Court of Appeals issued a decision earlier this week holding that employees who worked at a call center were entitled to compensation for the time spent booting up their computers at the start of the work day prior to clocking in. The call center employees conducted the majority of their jobs using their computers, thus the Court determined that turning on and booting up the computers was “integral and indispensable” to the workers’ duties. Under the FLSA, duties that are “integral and indispensable” are considered principal activities and must be compensated.

For employers in California, this is another sign that both state and federal courts are moving towards requiring employers to compensate employees for time spent prior to clocking in where employees are completing tasks that are required by the employer or indispensable for their jobs. Some examples include: booting up computers, cleaning and preparing tools, and putting on a uniform or safety equipment.

Employers should review the tasks that non-exempt employees undertake prior to clocking in each day to determine if those duties are related to their jobs and should be compensated. If employees are completing tasks that are “integral and indispensable” to their jobs prior to clocking in, employers should determine the average amount of time the tasks take to complete each day and add that amount to employees’ paychecks.

For those who are interested in reading the full decision, the case is Cariene Cadena and Andrew Gonzales v. Customer Connexx, LLC and Janone, Inc., case number 21-16522.

If you have any questions about this or any other employment related matters, please contact Marissa Buck, Jennifer Douglas or any member of DP&F’s Employment Law team.

Flexible Workplace Options for Employers

As more employees return to the workplace, employers are searching for ways to retain existing employees and attract new talent in a changing landscape where remote work and shorter workweeks are becoming more common. This article looks at two options for employers who are seeking to give employees greater flexibility in their schedules and how to remain compliant with California labor laws in the process.

Alternative Workweek Schedule

One option for employers is to implement an alternative workweek schedule (“AWS”), which provides greater flexibility by allowing employees to work longer shifts on less workdays. The AWS also permits non-exempt employees to work more than 8 hours in a day without incurring daily overtime. The most common AWS is the 4/10, where employees work 4 days a week for 10 hours each day.

Under an AWS, no overtime is required for a regular schedule of not more than 10 hours per workday within a 40-hour workweek. If employees work longer than 10 hours a day on an AWS, they are entitled to overtime pay at one-and-one-half times their regular rate of pay for all time worked between 10 and 12 hours, and double their regular rate of pay for any hours worked over 12 hours. Additionally, employees are entitled to overtime for all hours worked on any day that is not included in the AWS at one-and-one-half times their regular rate for the first 8 hours and double their regular rate of pay for any hours worked over 8 hours.

An AWS can be used for an entire company, or any identifiable “work unit” including a department, a shift, or a particular location. The AWS must be approved by a secret ballot election of at least two-thirds of the affected employees in the work unit. Employers can propose one schedule for all employees in the work unit or provide a menu of schedule options that each employee can choose from.

Once the work unit and AWS is determined, employers should follow the steps below to implement the AWS.

- Notice. Send a notice to all employees in the work unit regarding the proposed schedule change and describe how the change will affect their hours, wages, and benefits.

- Pre-Election Meeting and Disclosure. Employers are required to hold a pre-election meeting at least 14 days before the secret ballot election to discuss the proposed alternative workweek schedule. Employers must also provide all employees with a written disclosure that includes the information discussed at the meeting. If at least 5% of the employees in the work unit speak a language other than English, employers must provide the disclosure in that language as well.

- Secret Ballot Election. Hold the election at the worksite during regular work hours. If some employees in the work unit are not present for the election, they can provide an absentee ballot upon their return.

- Notify DLSE. If the AWS is approved by the employees in the work unit, the election results must be mailed to the Department of Industrial Relations. Employers should follow the instructions on the DLSE website regarding where to send the notice and what information to include: https://www.dir.ca.gov/databases/oprl/dlsr-awe.html.

- Implement Schedule: Employers may not require employees to work the new AWS for at least 30 days after the final results of the election.

Employers must also make reasonable efforts to accommodate a schedule with 8-hour work days for employees who voted in the election but are unable to work the AWS, employees who have a religious belief or observance that conflict with the AWS, and employees who are hired after the date of the election and are unable to work the AWS.

Hybrid Work Schedule

While remote work has gained popularity amongst employees and employers, for many companies it is necessary to have employees physically present in the workplace. One option for employers is to create a hybrid remote work schedule that allows employees to work remotely part of the time. Employers can require a certain number of days at the workplace each week, or create set schedules designating the specific days of the week on which employees will work remotely.

Employers should have a written policy in place that describes which employees or groups of employees are eligible for remote work, how to request a remote work schedule and who needs to approve it, and the expectations for employees when working remotely.

If remote work is provided as a purely voluntary option for the benefit of the employee, and it is not a requirement of their job, employers are not obligated to reimburse employees for expenses incurred in working remotely.

We recommend working with counsel to implement either an AWS or a remote work policy to ensure compliance with all California labor laws.

If you have any questions about this or any other employment related matters, please contact Marissa Buck or any member of DP&F’s Employment Law team.

The Metaverse and Your Wine Brands

Every winery and wine brand will eventually need a Metaverse strategy.

During the pandemic, some wineries have become adept at conducting on-line tastings and enhancing customer experience by providing virtual vineyard, winery and cellar tours. Wineries were compelled to connect online with customers like never before. This is just the beginning. Wine businesses will need to adapt to an increasing technological sales process not only online but in the Metaverse.

The Metaverse is a virtual and immersive digital world that that reflects our real lives in many respects. The Metaverse is inhabited by digital representations of people, places and things (including brands). The Metaverse experience can provide experiences on par with the real world, while also offering experiences beyond those of the real world, for example, the sensation of human flight.

Of importance to brand owners, the Metaverse hosts a growing virtual marketplace that allows users to buy, sell and share digital assets like NFTs (non-fungible tokens), virtual real estate, experiences, information and virtual goods. It will be inhabited by users living second (or even third) lives – wholly digital lives. Just as the Metaverse parallels our real lives, where branding is used in the real world it will have a digital partner in the Metaverse.

Wineries should be interested in the Metaverse because retail will be one of the largest sectors in it, with social experiences, a close second. In addition, wineries should care about the Metaverse because it will have real world impact on their marketing and branding. Not only will the Metaverse be a new market for products and services, it will also be a new source of data collected from users of the Metaverse that can be leveraged by businesses in the real world. Just as real-world sales drive sales in the Metaverse, the Metaverse can drive sales in the real world.

There will be opportunities in the Metaverse for wine product placements (branded products in games or experiences), virtual events like cellar, winery and vineyard tours, virtual tastings, computer generated retail stores featuring wine, and virtual online education featuring branded content or sponsorship. The Metaverse can also offer wineries opportunities for sales of NFTs, for example, NFT Wine Club has more than three thousand real-life vines in Napa, California which are tied to a digital NFT. In addition, Wine Bottle Club will replicate its physical cellar in a virtual shop in the OVER (OVR) Metaverse.

The Metaverse is likely to become an important part of the wine industry marketing and sales. In addition to real world brands make sure your trademarks are registered for virtual goods, goods for use in online environments, virtual online environments and extended reality virtual environments, retail store services featuring virtual goods, etc. A trademark for a real-world brand may not protect you in the Metaverse. Ensure that your trademarks are registered for digital and virtual reality products. This is the key to protecting a brand in the Metaverse.

For assistance with branding protection in the Metaverse or the real world, contact Katja Loeffelholz.

Napa County Micro-Winery Ordinance Goes Into Effect May 5, 2022

On, April 5, 2022 the Napa County Board of Supervisors adopted a new “Micro-winery Ordinance”, allowing Napa Valley winegrape growers to produce and sell wine at their family farms. The Ordinance will go into effect May 5, 2022.

The Ordinance will amend the Napa County Code to allow farmers to obtain a use permit for a “micro-winery” via approval by the zoning administrator, instead of the planning commission. This change allows applicants under the Ordinance to avoid public hearings, potentially reducing costs of acquiring a use permit. Note however that a new winery application, even without a planning commission hearing, is still complex, requiring detailed materials from architects, engineers, and potentially other experts.

The Ordinance allows micro-wineries to produce small amounts of wine primarily made from estate-grown fruit, provide limited on-site tastings, and make direct consumer sales. Applicants must follow the below requirements to qualify:

Zoning

Micro-wineries are only permitted within the Agricultural Preserve (AP) and Agricultural Watershed (AW) zones. The parcel on which the winery is located must be at least 10 acres in size.

Production

Micro-wineries must produce at least 201 gallons of wine onsite annually, up to a maximum of 5000 gallons. At least 75 percent of the fruit must be estate grown either on the property or on contiguous parcels under the same ownership.

Square footage limits

Micro-winery facilities are limited to a maximum of 5,000 square feet, including storage, processing, tasting, and caves.

Trips, tours and tasting, and marketing events.

Micro-wineries can generate no more than 20 average daily trips—equivalent to 10 daily round trips—between visitors, employees, and deliveries. Note that the County assumes each visitor vehicle carries 2.6 visitors. For example, a micro-winery that produced 2,500 gallons pre year with one full-time and one part-time employee could host 19 visitors per day.

Tours, tastings, and retail sales are limited to 9:00 am to 6:00 pm. No marketing events outside of tours and tastings are allowed.

Sunsets in 3 years (May 5, 2025); Convert to Regular Winery Use Permit 2 years After Approval.

Importantly, applications will only be accepted for a 3-year period, at which point the County will evaluate whether to amend, extend, or re-adopt it. Further, any micro-wineries who have use permits approved under the Ordinance may not modify or amend their permit within 2-years after approval.

CEQA

All use permits are discretionary approvals subject to the California Environmental Quality Act. Micro-wineries should qualify for a Categorical Exemption unless special circumstances exist.

Dickenson, Peatman & Fogarty has represented a number of wine producers in the use permit process. For more information on the new micro-winery ordinance and the application process, please contact Thomas Adams or Joshua Devore.